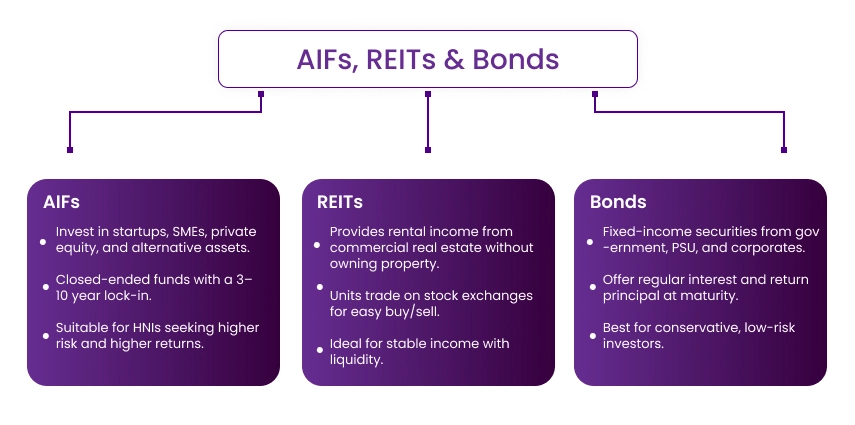

Do you know, apart from traditional investment options like mutual funds, fixed deposits, there are other advanced investment options also available for NRIs and residents in India? These are AIFs, REITs & Bonds. Although traditional investment options are not bad, they come with certain limits. For instance, equity mutual funds are good for generating long-term wealth. However, these come with volatility, which is why NRIs look for other alternatives.

Want to know about these advanced investment options in detail? This blog breaks down all the information about Alternative Investment Funds (AIFs), Real Estate Investment Trusts (REITs), and Bonds. So, read on and know about them.

- Apart from real estate, mutual funds, and FD, there are other investments such as AIFs, REITs, and bonds available for residents, NRIs, and foreign nationals.

- These advanced investment options, along with generating a return, also safeguard the capital.

- AIFs let you get access to venture capital, hedge funds, private equity, and real estate funds- investment options not available in mutual funds.

- REITs provide commercial real estate returns (malls, office buildings, and more) without owning property.

- Bonds without any unique risk profiles, like FDs, provide predictable, fixed income.

What Are AIFs, REITs & Bonds?

For 2026, will AIFs, REITs, and bonds continue to be safe investment options for NRIs? Moving further, I'd like to find out about them.

Alternative Investment Funds (AIFs): The Investment Option Beyond Mutual Funds

AIFs, or alternative investment funds for NRI investors who look beyond the regular options available in the market, serve as a unique investment. Unlike mutual funds, AIFs invest in assets that you do not find in any traditional financial markets.

These investments are structured as closed-ended funds with a 3-10 year term. Further, this extended timeline helps the fund managers to generate returns and let their strategies mature. AIFs are generally established in the form of a company, LLP, or trust. Additionally, AIFs are categorized into three categories:

- Category I: Investors in SMEs, startups, and socially useful sectors.

- Category II: Private debt and equity funds.

- Category III: For high returns, uses sophisticated strategies such as hedge funds.

Generally, these funds target Foreign Institutional Investors (FIIs), HNIs, and Ultra HNIs. Additionally, they are not traded on a stock exchange. Also, it has a longer lock-in period, making it an ideal option for experienced investors who can handle higher risk.

Real Estate Investment Trusts (REITs): Without Issue Own Prime Commercial Property in India

A REIT is a firm or company that owns and manages real estate, intending to generate income. NRI investment in REIT allows them to earn income dividends from real estate investment. For this, they do not need to purchase, manage, or finance any property themselves.

Like shares, you purchase units in REITs. From tenants, REITs generate rental income, which this further distributed as dividends to you. REITs function like mutual funds; however, instead of investing in bonds or stocks, they invest in real assets. Here, the key difference is that these are listed on stock exchanges, and you can sell and purchase them anytime.

Bonds: For Conservative Sophisticated Fixed Source of Income

Bonds are fixed-income securities issued by entities and governments to finance their operations, expenses, and other activities. In this, generally, investors who buy bond issues provide money to the issuing entity. In return for it, at periodic intervals, the entity pays interest to them.

Further, on the maturity date of the bonds, the principal is paid to the bondholder. So, for bond issuers, bondholders can be considered creditors.

This was all about these three investment options. Moving on, let's look at the eligibility criteria and how NRIs can invest in them.

Eligibility & How NRIs Can Invest In?

Here are the following eligibility criteria that NRIs need to follow to invest in AIFs, REITs, and bonds.

AIFS

NRIs, Indian residents, and foreign nationals can invest in SEBI-registered AIFs; however, for this, they need to follow banking routes and compliance steps. Considering this, through proper banking channels, like an NRE or NRO account, funds should be routed. Additionally, the guidelines of FEMA and RBI should be followed during investments along with the own subscription documents of AIFs.

Further, some AIFs allow NRIs for investment on a non-repatriable basis, while others allow repatriation, which calls for thorough verification of the AIF's terms.

REITs

Being an NRI, to invest in REITs in India, you should be:

- Have a Permanent Account Number (PAN) card and are classified as an NRI.

- Should have a Non-Resident Ordinary (NRO) or Non-Resident External (NRE) bank account.

- With a registered bank or broker, have a trading and demat account.

- To make transfers in secondary markets, you should have an NRE PINS account.

- Fulfill the applicable Know Your Customer (KYC) regulations.

Bonds

To invest in Indian bonds, NRIs should have:

- Should have NRI status as per FEMA guidelines.

- Active NRE/ NRO bank account in India

- Have valid documentation like NRI status proof, visa, passport, and more.

This was all about the eligibility criteria for advanced investment options for NRIs. Moving ahead, let's know the minimum investment requirements for these.

Connect with Savetaxs and plan your finances simply with expert guidance.

Minimum Investment Requirement

Here is the minimum investment requirement that you need to fulfill to invest in AIFs, REITs, and bonds.

- AIFs: For most investors, the AIFs' minimum investment requirement is INR 1 crore. For fund managers, employees, or directors associated with AIF, the price drops to INR 25,00,000. This high barrier investment requirement certifies HNIs, Ultra HNIs, and the participation of institutional investors.

- REITs: In REITs, the minimum investment requirement is INR 10,000 - INR 15,000 per lot in the secondary market. So, depending on the unit price of the REIT, your actual minimum investment closer is INR 10,000 - INR 30,000.

- Bonds: Depending on the bond type, the minimum investment requirement varies:

- Government Securities: INR 10,000 via RBI retail direct

- PSU Bonds: Depending on issue INR 10,000 - INR 1,00,000

- Tax-Free Bonds: INR 10,000 (Secondary market)

- Bharat Bond ETF: 1 unit (~INR 1,000)

So, these were the minimum investment requirements of AIFs, REITs, and bonds. Moving further, now let's know the tax obligations of these investments on NRIs.

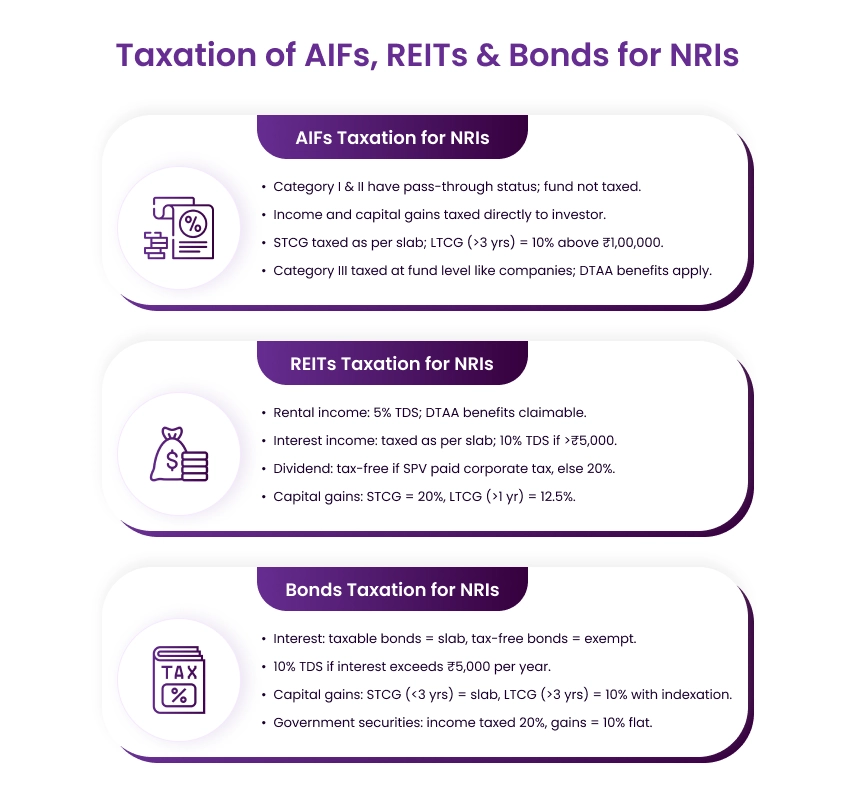

Taxation for NRIs

Depending on the type of investment, the tax implications differ for NRIs. So, let's know about it according to the investment type.

AIFs Taxation for NRIs

The categories I and II of AIFs have pass-through status. This states:

- The fund does not pay tax

- Capital gains and income are directly passed to you

- If the investments are made directly, then they are taxable.

It further helps in avoiding double taxation. In a company structure, corporate tax (~25%) is paid, and then you pay dividend tax on it. Here, pass-through denotes single-level taxation. Moreover, for NRIs, this is:

- Short-term capital gains are taxable as per your Indian tax slab rate.

- Long-term capital gains if holding is more than three years 10% on capital gains more than INR 1,00,000.

- If applicable, can claim DTAA (Double Taxation Avoidance Agreement) benefits.

Moreover, Category III of AIFs is taxed at the fund level. These are treated like companies, not like pass-through vehicles.

REITs Taxation for NRIs

According to the income type and Special Purchase Vehicle (SPV), which pays the corporate tax, taxation on REITs varies. Further, to understand, let's break down the REITs taxation for NRIs:

- Rental Income (Distributed by REIT)

- Under most DTAAs, for NRIs, subject to 5% withholding tax (TDS)

- When filing taxes, you can claim DTAA benefits

- Interest Income (Debt REIT Investment)

- According to your income tax slab rate, interest income is taxed.

- If the interest is more than INR 5,000, 10% TDS is imposed.

- Dividend Income

- If the corporate tax is paid by SPV, then the dividend is tax-free for you.

- If SPV does not pay corporate tax, then the dividend is taxed at 20%.

- Capital Gains (when REIT units are sold)

- Short-term capital gain (if held for less than one year): 20% tax

- Long-term capital gain (if held for more than one year): 12.5% tax on gain more than INR 1,25,000.

Further, depending on the residence country, NRIs can claim DTAA benefits.

Easily navigate your NRI tax complications with Savetax.

Taxation on Bonds for NRIs

The taxation on bonds depends on the type of it and its holding period.

- Interest Income

- Taxable Bonds: According to your income slab rate, interest is taxed (generally on special investment income; it is 20% for NRIs).

- Tax-free Bonds: Under Section 10(15) (IV) (h), interest is fully exempt.

- TDS: If the interest is more than INR 5,000 a year, 10% TDS is imposed.

- Capital Gains (if the bonds are sold before their maturity date)

- Short-term Capital Gain (held for less than three years for most bonds): As per your income slab rate.

- Long-term Capital Gain (held for more than three years): With indexation benefits, 10% tax is imposed.

- Special case for government securities: A flat 20% tax rate is charged on investment income generated from government securities acquired in foreign currency. Further, capital gains are taxed at a 10% flat rate.

This is how NRIs pay tax on AIFs, REITs, and bonds. Moving ahead, let's know the risks associated with these investments for NRIs.

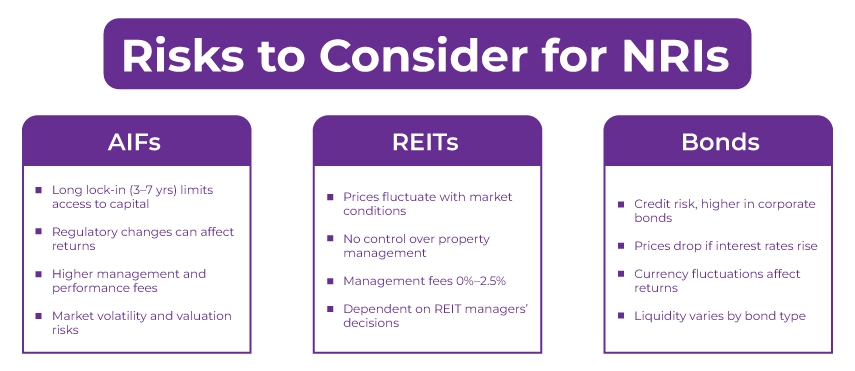

Risk to Consider

Here are the risks that NRIs need to consider while investing in AIFs, REITs, and bonds in India:

- AIFs Investments

- Most of the AIFs have a long lock-in period, i.e., 3 to 7 years or more, which restricts your access to the capital for the entire duration.

- Changes in SEBI regulations and government policies directly impact investment strategies, fund operations, and potentially change the expected returns.

- Generally, compared to mutual funds, the fees of performance and fund management for AIFs are higher, which further affects the net returns of investors.

- AIFs invest in real estate, unlisted companies, and other assets, which, in accurate valuation, face uncertainty and high market volatility.

- Further, in AIFs, there is a risk of the product being mis-sold if, with due diligence, investors do not perform well.

- REITs Investments

- Since REITs are traded on stock exchanges, based on the economic cycles and market conditions, their prices change. This market volatility, unlike direct real estate, impacts short-term returns.

- Unlike direct real estate investments, REIT investors do not have direct influence over leasing decisions, property operations, or tenant selection.

- The management fees charged by REITs vary but generally range between 0.% to 2.5% annually of assets under management (AMU). Further, investors cannot make decisions directly, which makes them dependent on REIT managers.

- Bonds Investments

- The credit risk the issuer might default on payments. Compared to government bonds it is higher in corporate bonds.

- With interest rates, the prices of bonds have an inverse relationship. Considering this, if the interest rates of bonds rise, the market value of them decreases.

- For NRIs who have foreign bonds, currency fluctuation can affect the returns.

- Some bonds, specifically, government bonds, are highly liquid. However, municipal bonds and other corporate bonds have lower liquidity, which further creates hurdles at the time of selling them.

These were the risks associated with AIFs, REITs, and bonds that NRIs need to consider before investing.

Final Thoughts

Lastly, while AIFs, REITs, and bonds have their own investment advantages for NRIs, with varying features, they are quite different from traditional investment options. This was all about the advanced investment options available for NRIs in India. Additionally, before investing, consider thea return potential of the investment, liquidity, and safety of the capital.

Further, if you are still confused about choosing the right investment option, connect with Savetaxs. We have a team of financial experts who can guide you in choosing the right investment as per your financial goals. Additionally, they can also assist you with fulfilling your cross-border tax obligations.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Understanding Alternative Investment Funds (AIFs) in India for NRIs

- Top 8 NRI Investment Myths Got Busted

- Things NRIs Should Consider While Investing in India

- RBI Rules For NRI Investment : A Guide For NRIs

- NRI Guide to Choosing Between REITs and Mutual Funds

- Impact of FEMA Rules on NRI Mutual Fund Investments

- Difference Between Repatriable Vs. Non-Repatriable Investments for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766492717.png)

_1766559165.png)

-plan_1761282887.webp)

_1752921287.webp)