A tax credit is an amount that you can directly subtract from your owed taxes. Here, the amount value depends on your credit nature. Considering this, different types of tax credits are provided to businesses and individuals. Well, in simple words, you can say that it is a “dollar-for-dollar reduction” from the bill of the taxpayer.

Want to know everything about the tax credit? Then, you are on the correct destination. This blog consists of all the information about it. So read on and clear all your doubts.

Key Takeaways

- A tax credit is an amount directly subtracted from the owed taxes of taxpayers. In simple words, it is a dollar-for-dollar tax reduction.

- Compared to tax deductions, tax credits are more favorable. It is because it reduces the due tax amount, not the taxable income.

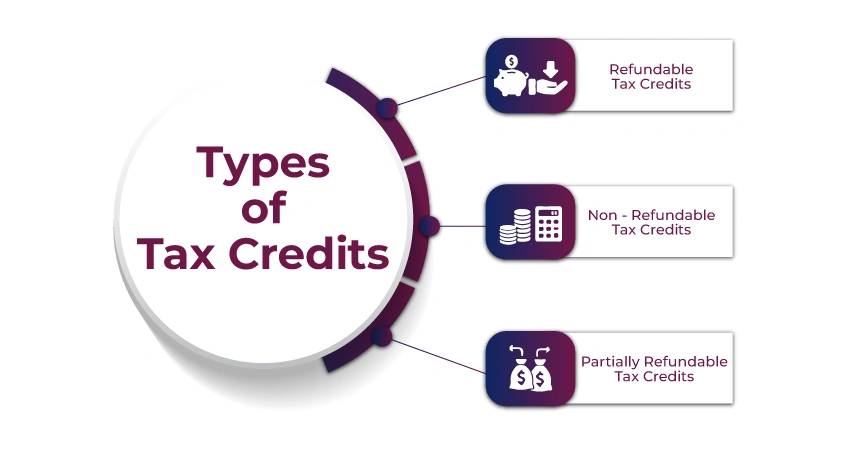

- Tax credits are of three types, i,e, refundable, non-refundable, and partially refundable. Generally, in most cases, nonrefundable tax credits are offered to taxpayers.

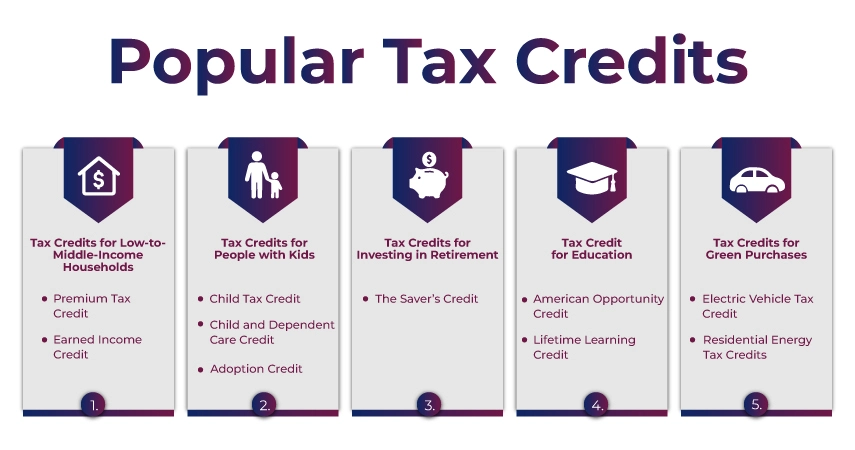

- There are several popular tax credits available as per the tax situation and needs of the taxpayers. It includes tax credits for low-to middle-income households, people with kids, education, green purchases, and investing in retirement plans.

What is a Tax Credit?

As you read earlier, a tax credit is an amount that is deducted from the owed taxes of a taxpayer. Considering this, in some scenarios, it also helps in increasing your tax refund.

These are generally granted by the state and federal governments to promote some initiative that benefits the economy. For instance, offering tax credits to individuals who install solar panels in their homes. Additionally, to others who spend their income on education, adoption, and more.

You can also say that, compared to tax-deductible expenses, tax credits are more favorable for taxpayers. It is because tax deduction reduces the tax liability, considering the marginal tax rate of the individual. Whereas tax credits reduce the tax liability of the taxpayer dollar for dollar. In simple words, a tax deduction lowers your taxable income, whereas a tax credit reduces the taxes you owe.

For instance, Mr. A is a taxpayer with a 22% tax bracket. On tax deduction, he saves $0.22 for every marginal tax dollar deducted. However, while a tax credit reduces his tax liability to directly $1.

So, this is what a tax credit is. Now, let’s know the different types of tax credits taxpayers can claim.

The eligibility for an NRA for a U.S. tax credit is very limited and depends on whether the income is “effectively connected" with a. trade or business in the United States. Several common credits available for resident taxpayers are not available for NRAs, such as the lifetime learning and earned income.

What Are the Different Types of Tax Credits

Tax credits are of three types: refundable, nonrefundable, and partially refundable tax credits. Let’s know about them in detail.

Refundable Tax Credits

As its name states, a refundable tax credit is paid back to the taxpayer regardless of their tax liability if the credit is more than their taxable income. In simple terms, compared to the credit amount, if you owe lower taxes when filing your returns, you receive the extra amount as a refund.

For instance, if you owe $700 and get a refundable credit of $900, when filing your tax return, you will get the extra $200 refund.

Nonrefundable Tax Credits

Nonrefundable tax credits only reduce the tax amount you owe. Additionally, it does not create or increase your tax credit when you already have one. A nonrefundable tax credit is directly deducted from your tax liability until the due taxes equal zero.

For instance, if you get a $500 nonrefundable tax credit, you can reduce your owed taxes by $500. Additionally, if you do not owe any taxes, you would not get any credit, even though you qualify for it.

Partially Refundable Tax Credits

A partially refundable tax credit reduces your tax liability by the associated credit amount. Additionally, if you owe a lower tax liability than your credit amount, you may receive a partial refund of it. However, here you only get up to a certain amount.

For instance, if you have a credit amount of $1000, but you only refund $500 or lower your tax liability to $500, if the credit is more than what you owe in taxes. Here, you cannot claim both things.

These were the different types of tax credits available for taxpayers. Generally, nonrefundable tax credits are received by the majority of people. Now, moving ahead, let’s know the popular tax credits for 2025.

Popular Tax Credits for 2025

The popular tax credits are divided into five categories. According to your tax liability and situation, you can apply for the one for which you qualify.

Tax Credits for Low-to-Middle-Income Households

To help low-to middle-income households, there are two types of taxes available that reduce their tax liability and offer them more refunds. These are as follows:

Premium Tax Credit

This tax credit, using the qualified health insurance marketplace plans, helps taxpayers reduce the cost of their health insurance premiums. The premium tax credit is also considered unique as taxpayers can take its amount in advance.

In simple words, through it, you can manage your premium payments effectively throughout the tax year. Additionally, you can also wait to claim the tax credit when filing your tax return.

Earned Income Credit

Depending on your filing status and how much you qualify for through the earned income credit, you can get up to $8,046 refund. Further, let’s know about the conditions of it:

- Generally, to qualify for the earned income tax credit, you do not need to have children by your side. However, if you have one or more children, you qualify for a higher tax credit.

- Additionally, if your adjusted gross income (AGI) is $68,675 or less in 2025, you may qualify for this credit. However, if you have invested income, capital gains, dividends, or other things of more than $11,950. Then, in this scenario, you do not qualify for the earned income tax credit.

Tax Credits for People with Kids

Do you know there are tax credits available for people with kids in the US? Read the next section and know about them.

Child Tax Credit

Under the child tax credit, per kid, you can get up to $2,200. Additionally, with the additional child tax credit, you receive a potentially $1700 refundable amount. However, you can only qualify for this tax credit when your AGI is under:

- For married couples filing jointly, it is $400,000, and for other filers, it is $200,000.

- The higher your adjusted gross income, the less you qualify for this tax credit.

Child and Dependent Care Credit

This tax credit is worth 20% - 35% of up to $3000 for one dependent or $6000 for two or more dependents. Here, the dependents include a child under 13, a parent, or a spouse who is not able to take care of themselves.

- For higher-income earners, the allowable expenses decrease. Hence, it also outcome in decreasing the value of the child and dependent care credit.

- Also, the credit amount decreases when you make payments using your dependent-care flexible spending account (FSA). Additionally, it also decreases when you take advantage of other tax programs.

Adoption Credit

With up to $5000 refundable amount, using adoption credits, you can claim up to $17,280 per child adoption cost. However, to qualify for this tax credit, you need to fulfill the following conditions:

- You cannot claim this tax credit if you are adopting a child of your spouse.

- The tax credit is available if your modified adjusted gross income is up to $259,190 or adjusted gross income is up to $299,190. Further, this tax credit is not available for taxpayers having income above the mentioned one.

- Additionally, people who adopt children with special needs get the complete adoption credit amount, even if the expenses were fewer.

Tax Credits for Investing in Retirement

The tax credits available for investing in a retirement plan are as follows:

The Saver’s Credit

Before talking about the available credit limit, let’s first know what a saver’s credit is. In simple words, a saver’s credit is your contribution credit that you made to your retirement savings. This credit is worth up to $1000 for single filers and $2000 for married filing taxes jointly.

This tax credit is calculated based on your traditional or Roth IRA, 401(k), 403(b) plan, or other retirement plans. Further, depending on your tax filing status and AGI, you can qualify for 50%, 20% or 10% of the contribution amount.

Generally, for married filing, the AGI should be up to $79,000, for singles $39,500, and for heads of households it is $59,250.

Tax Credit for Education

The tax credits for education available for taxpayers are the American Opportunity Tax Credit and the lifetime learning credit. Under the tax credit for education, you can claim both of these credits when filing your tax return. However, both credits cannot be claimed for the same student. Further, let’s know about them in detail.

American Opportunity Credit

Under the American Opportunity Tax Credit, you can claim up to $2500 per student. It includes books, activities, tuition fees, equipment, and supplies during the college years. This tax credit is partially refundable. Considering this, if your tax liability is lowered by the credit, you can get the 40% amount as a refund.

Further, to qualify for this tax credit, you need to fulfill the following conditions:

- Students need to enroll at least half-time to claim this credit. Additionally, they should not have drug convictions.

- Parents or qualified guardians can take this credit if they mention the students on their returns as dependents.

Lifetime Learning Credit

With a lifetime learning credit, you can claim up to $2000 on education expenses. It includes books, tuition, activity fees, equipment, and supplies for undergraduate and graduate students. Additionally, this tax credit is also available for nondegree courses from qualified institutions. Here is what you need to know about this credit:

- There is no workload requirement you need to fulfill to claim this credit.

- The $2000 tax credit limit is per tax return, not per student. Considering this, regardless of how many students you pay, you only receive $2000 on your returns.

Tax Credits for Green Purchases (Limited Time)

Tax credits for green purchases are an initiative from the government to promote the use of alternative energy sources among the people. Moving further, let’s know about them in detail.

Electric Vehicle Tax Credit

The electric vehicle tax credit (EV tax credit) is also known as the clean vehicle credit. Under this, you can claim up to $7,500 for purchasing a new electric vehicle. Additionally, can also claim up to $4000 for using a used electric vehicle.

However, the tax credit available for used EVs is only when the service is done by September 30, 2025. Additionally, ev tax credit is no longer available for vehicles purchased after this date.

Residential Energy Tax Credits

Through the residential energy tax credits, you can claim up to $3000 on your energy-efficient home upgrades. It includes heat pumps, windows, and doors. Additionally, under the solar panel tax credit, you can claim up to 30% of the cost of expenses related to solar energy systems. It includes solar panels, battery storage technology, and more.

However, to claim this tax credit, the purchase should be made by December 31, 2025. As it is no longer available in 2026.

So, these are the popular tax credits that you can claim according to your tax situation and needs.

Final Thoughts

Lastly, a tax credit is a financial benefit offered by the US government to reduce the tax liability of a taxpayer. The above blog was all about it and the different types of tax credits available under this for taxpayers. Hope after reading it, you get all the information about it.

Further, if you need any kind of assistance in claiming the tax credit, consider connecting with Savetaxs. We have a team of professionals who provide you with proper guidance and solve any tax-related queries.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- Understanding Itemized Tax Deductions

- 2025 Roth IRA Income and Contribution Limits

- The Full List Of 20 Tax Deductions For Self-Employed People

- State And Local Tax (SALT) Deductions

- Understanding Standard Tax Deduction

- Tax-Deductible Donations: Rules for Charitable Contributions

- All You Need to Know About Mortgage Interest Deduction

- IRS Capital Gains Tax: Short and Long-Term Rates for 2024-2025

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766059659.webp)

_1756816946.webp)

_1756729655.webp)