Yes, medical expenses are tax-deductible in the US. The IRS allows taxpayers to deduct medical expenses. However, for this, the medical costs should exceed 7.5% of your adjusted gross income (AGI), and if you itemize them on your tax return. The medical expenses tax deductible includes the hospital stays, dentist and doctor bills, and more.

Want to know more about it and how you can claim the medical expenses? Then, you are on the right page. Here we have provided you with a complete overview of how the medical expenses tax deduction works. Additionally, how can you claim it? So, read on and gather all information about it, and reduce your tax liability.

Key Takeaways

- To all the taxpayers in the US, the IRS allows them to claim qualified medical expenses that exceed 7.5% of their adjusted gross income.

- In order to deduct your medical expenses, instead of applying for the Standard Deduction on IRS Schedule A, you should itemize your tax deductions.

- The IRS allows taxpayers to deduct unreimbursed payments. It includes surgeries, preventive care, vision care, dental care, and treatment. Additionally, it also includes visits to psychiatrists and psychologists, medical prescriptions, and appliances that you pay for. Here, the medical appliances include contacts, hearing aids, glasses, false teeth, and more.

- Payment of medical expenses from a health savings account and a flexible spending account is not tax-deductible under medical expenses. It is because the money from these accounts has already come under tax benefits.

Can Medical Expenses Be Tax Deductible?

As mentioned above, yes, medical expenses are tax-deductible. However, for this, you need to fulfill some specific requirements. To deduct the medical expenses, on Schedule A, you need to itemize your tax deduction.

The IRS allows taxpayers to deduct unreimbursed payments. It includes treatment, preventative care, dental, surgeries, and vision care. It also includes your visits to psychiatrists and psychologists, medical prescriptions, and appliances. The medical appliances include hearing aids, false teeth, and other expenses that qualify for medical care.

So, from the above information, yes, medical expenses are tax-deductible in the US. Moving ahead, let's know which medical expenses are tax-deductible.

Which Medical Expenses Are Tax Deductible?

In Publication 502, the IRS has mentioned the complete list of tax-deductible medical expenses. Considering this, to provide you with an idea, we have stated the common ones.

Medical Payments and Insurance Premiums

Payments made to dentists, doctors, psychiatrists, surgeons, and other medical practitioners are tax-deductible. Additionally, long-term care insurance or medical insurance is also tax-deductible. However, it should be paid by you after filing your return and not by your employer.

Reproductive Care

Reproductive care includes the cost of breast pumps, pregnancy tests, and birth control. It also includes lactation supplies and procedures. For instance, in vitro fertilization, legal abortions, and vasectomies. However, the cost of surrogacy treatment is not included in medical expenses and is not deductible.

Prescription Drugs, Medicines, and Other Medically Vital Items

It includes medical prescriptions like insulin, dentures, wheelchairs, contacts, eyeglasses, and more. So, after paying for these medical expenses, you can claim a tax deduction on them.

Transportation

The cost of transportation to and from the medical care typically counts as a deductible. It also counts the transportation and admission to medical conferences about diseases that you or your family members have. However, it does not include lodging and meals-related expenses.

Certain Health Programs and Services

Certain health programs and services cover addiction programs. For instance, weight-loss and quitting smoking programs for doctor-diagnosed diseases. However, it does not count the costs of the health and food club.

Hospitals and Nursing Home Care

If you pay for the hospital and nursing care for yourself, your spouse, or your dependent, it is tax-deductible. So, you can claim these medical expenses when filing for your tax return in the US.

Service Animals

You can deduct the price of purchasing, training, and maintaining a guide dog or other service animal that assists someone who is deaf. In addition, face difficulty in hearing, are visually impaired, or someone with physical disability. This usually involves any cost that you pay to maintain the vitality or health of the service animal. It includes grooming, food, and veterinary care so it can do its duties.

These are some of the key medical expenses that are tax-deductible in the US. Moving further, let's know the medical expenses that are not counted as tax-deductible.

Which Medical Expenses Aren't Tax Deductible?

The list of medical expenses that aren't tax-deductible in the US is also stated in the IRS Publication 502. Further, the following expenses are also not counted as tax-deductible under medical expenses.

- Over-the-counter medicines

- Funeral expenses

- Cosmetics, toothpaste, and toiletries

- Controlled substances

- Patches and nicotine gum that do not require a medical prescription

- Most cosmetic treatments and surgeries. For instance, hair transplants, electrolysis, teeth whitening, and more.

These are some of the key medical expenses that are not tax-deductible in the US. Moving ahead, let's know the value of the tax deduction for medical expenses.

What Is the Deduction Value for Medical Expenses?

Under medical expenses, the deduction value varies. It is because, based on your income, the amount changes. Considering this, the IRS allows taxpayers to subtract their total qualified unreimbursed medical care costs that are more than 7.5% of their AGI (adjusted gross income). However, for this, the taxpayer needs to use Schedule A of the IRS to itemize their deductions.

Here, your AGI is your total earned income subject to tax from your income tax return, minus any available adjustments to income. It includes deductible interest on student loans, a traditional IRA, or more. Confused, let's better understand this with an example.

For instance, your AGI is $45,000, and you have spent $5,475 on your medical expenses. Here to find out your expenses exceeding 7.5% you need to multiply $45,000 by 0.075%. This will provide you with $3,375 that you can include in your itemized deduction. It provides you with $2100 ($5,475 - $3,375) medical expense deduction. Further, you can include this amount on Schedule A of the IRS as itemized deductions.

This was all about the deduction value for medical expenses. Moving further, let's know how to claim the medical expenses tax deduction.

How to Claim the Medical Expenses Tax Deduction?

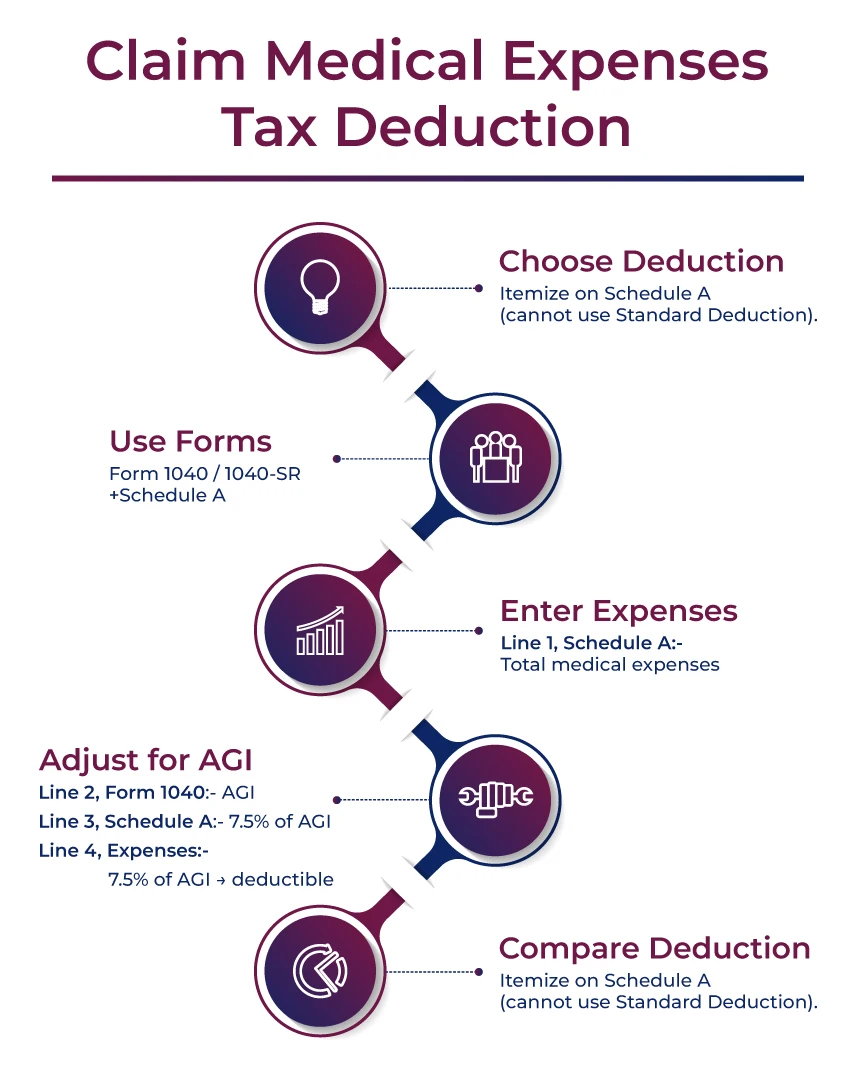

To claim the medical expenses tax deduction as stated above, you need to itemize your deductions on Schedule A, IRS Form 1040 or 1040-SR. It should be done when filing your federal tax return. However, if you itemize your tax deductions, you would not be able to claim the Standard Deduction.

Furthermore, this is how using Form 1040 and attaching Schedule A, you can claim medical expenses as tax-deductible:

- On Schedule A, mention your total paid medical expenses during the year on line 1. Additionally, from your Form 1040, on line 2, report your adjusted gross income.

- On line 3, mention 7.5% of your AGI.

- Write the difference between your medical expenses and 7.5% of your AGI on line 4.

- The amount mentioned on line 4 will be added to your itemized deductions. Additionally, to decrease your taxable income for the year, it will be subtracted from your AGI.

Here, if this amount and any other itemized tax deductions you claim are not more than your Standard deduction, you do not need to itemize.

So, this is how using Schedule A and Form 1040 you can claim medical expenses tax deductible in the US.

If you are an NRI, you can claim the medical expense tax deduction in India under Section 80D of the Income Tax Act, provided you have taxable income in India and file an ITR. You can claim a deduction for health insurance premiums paid, and also for special medical expenses in some cases.

Final Thoughts

Lastly, having an understanding of whether medical expenses tax deductible or not in the US is vital. It helps you in reducing your tax liability. However, for this, you need to fulfill specific conditions. For instance, itemize your deduction and can only claim it if your medical expenses in more than 7.5% of your AGI.

Here, the complete blog was all about it. Hope after reading it, you get answers to all your questions. Furthermore, if you need more information on medical expenses or are facing issues in claiming them, connect with Savetaxs. We have a team of experts who can provide you with all the details and help you claim your deductible tax on medical expenses.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- Tax Credit: What It Is, How to Claim It, and Types

- Understanding Itemized Tax Deductions

- IRS Capital Gains Tax: Short and Long-Term Rates for 2024-2025

- Tax-Deductible Donations: Rules for Charitable Contributions

- 2025 Roth IRA Income and Contribution Limits

- IRA vs 401k : A Clear Difference

- All You Need to Know About Mortgage Interest Deduction

- Are Medical Expenses Tax Deductible in the US?

- Understanding Standard Tax Deduction

- State And Local Tax (SALT) Deductions

Want to read more? Explore Blogs

(i)-Of-The-Income-Tax-Act_1756812791.webp)

_1767080655.webp)

_1758631896.webp)