- Key Takeaways

- What is the SALT Deduction?

- What is the Purpose of SALT Deduction?

- How Does the SALT Deduction Work?

- What is the History of SALT Deduction?

- Which Taxes and Fees are Not Covered Under the SALT Deduction?

- What is the SALT Deduction Cap?

- Why Was the SALT Deduction Capped?

- Who Gets the Benefits of the SALT Deduction?

- What is the SALT Cap Workaround?

- Should I Claim the SALT Deduction?

- Did the SALT Deduction Cap Expire?

- To Conclude

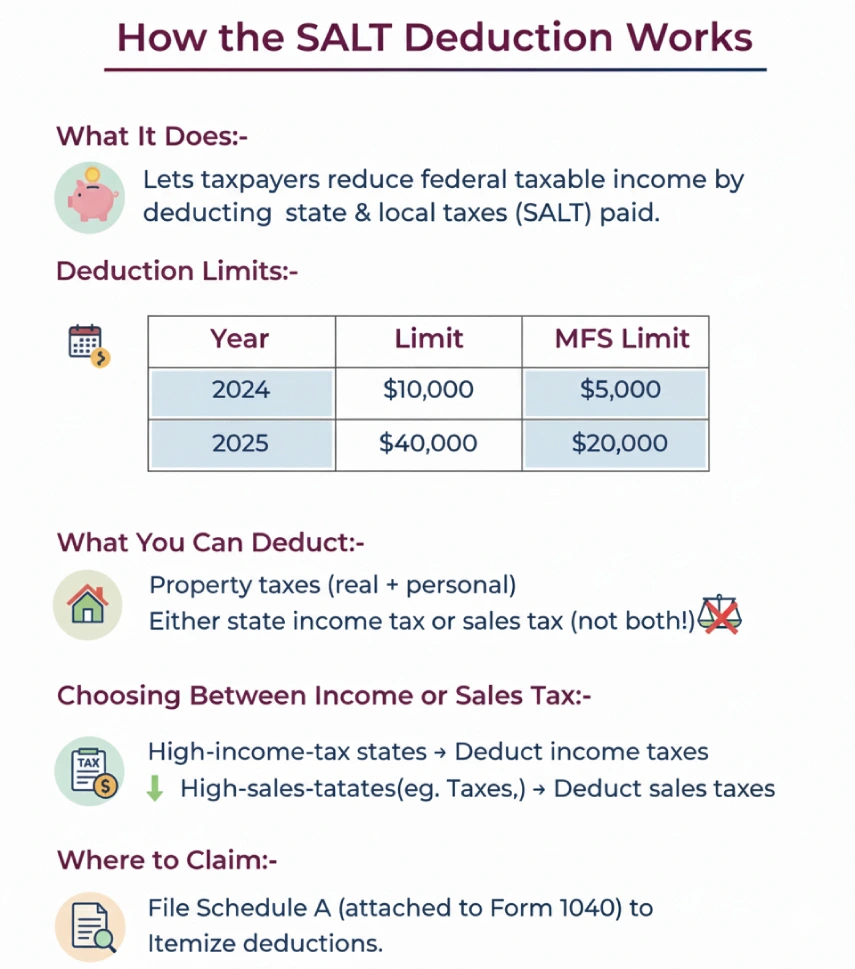

SALT deduction stands for State and Local Tax deduction. It is for those taxpayer who itemize their deductions to lower their federally taxable income. Such taxpayers are eligible to deduct nearly $10,000 for 2024. Otherwise, $40,000 for 2025 for property, sales, or income taxes that you have already paid to state and local governments.

This specified limit is known as the SALT cap, which was originally set at $10,000 by the Tax Cuts and Jobs Act (TCJA). Later, the One Big Beautiful Bill Act (OBBBA) increased this cap to $40,000 for 2025, subject to a phasedown.

If you are a taxpayer in a high-tax state or a high-income filer, the SALT deduction can be helpful for you as it avoids double taxation. Continue reading the blog to know more about the SALT deduction.

Key Takeaways

- The state and local tax deduction is an itemized deduction. A taxpayer can use the SALT deduction when they file their annual tax returns.

- When they claim the SALT deduction, taxpayers are allowed to deduct up to $10,000 in property, income, or sales taxes that they have paid to their state and local governments.

- Taxpayers who claim the SALT deduction are not allowed to claim the standard deduction.

- The Tax Cuts and Jobs Act enforced the $10,000 limit when it was enacted into law in 2017.

- The $10,000 cap might change when the TCJA expires at the end of 2025.

What is the SALT Deduction?

Taxpayers who itemize their deductions instead of claiming a standard deduction are allowed to subtract certain state and local taxes that they have already paid from their federally taxable income under the SALT deduction.

The SALT deduction can offer a certain tax relief to those who don't bother doing some additional work while preparing their returns. It has been an arguable topic, but the rules for claiming it stay the same throughout the tax year 2025.

The Tax Cuts and Jobs Act (TCJA), approved in December 2017, limited the itemized deduction for state and local taxes. The limit was up to $5,000 for a married person filing separately and $10,000 for all other tax filers. However, the One Big Beautiful Act (OBBBA) increased the SALT cap to $40,000 - $20,000 for married filing separately for 2025. Also, $40,000 for 2026.

For tax years starting after 2026 and before 2030, the cap will increase by 1% every year. Additionally, the cap will come back to $10,000 or $5,000 for married filing separately for tax years starting in 2030.

Furthermore, the increased SALT cap is subject to a phase-down when the modified adjusted gross income (MAGI) surpasses $500,000 for 2025 and $505,000 for 2026. The threshold for MAGI will increase by 1% after 2026. Also, taxpayers who are fully phased down will be capped at $10,000.

What is the Purpose of SALT Deduction?

The SALT deduction avoids double taxation by preventing some federal taxpayer liability. This is done by excluding income that is already taxed for state and local government services.

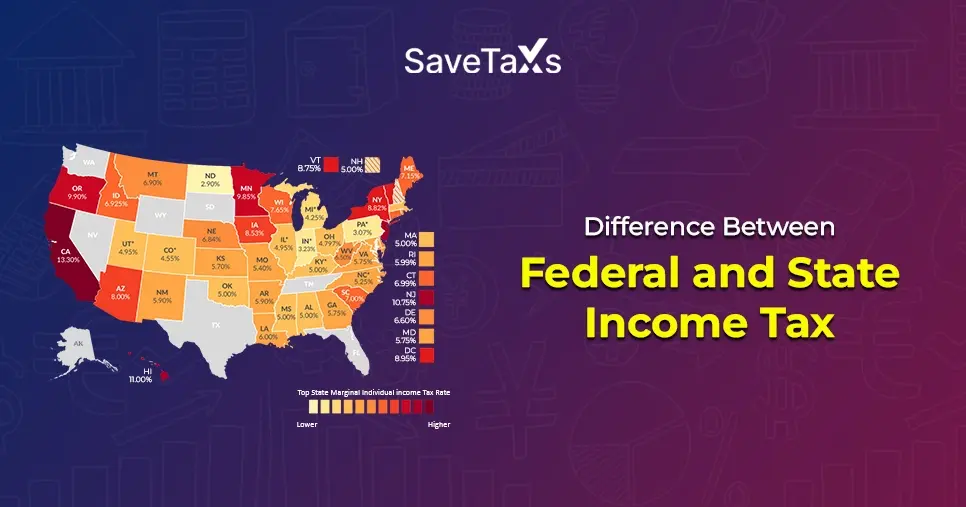

States with high state and local tax rates, providing more government services, usually see a large number of taxpayers claiming the SALT deduction. Such places often include high-income states like New York, Connecticut, New Jersey, and California.

How Does the SALT Deduction Work?

The SALT deduction allows certain taxpayers to lower their federally taxable income based on the amount of state and local taxes they have paid that year. For 2024, the limit is up to $10,000 or $5,000 for married filing separately. For 2025, the limit is $40,000 or $20,000 for married filing separately.

Property taxes include those paid on both real and personal property. However, you can't claim the sales tax you paid and the income taxes you paid. So, you need to choose one or the other. Hence, taxpayers who itemize must decide between deducting their income taxes or sales taxes.

Taxpayers who itemize mostly choose to deduct their state and local income taxes. This happens often when they live in a state that has high-income taxes. On the contrary, taxpayers who stay in states that have higher sales taxes, but low or no-income taxes, such as Texas or Louisiana, may find it more advantageous to deduct sales tax in case they itemize.

Taxpayers have the option to claim the itemized deductions on Schedule A. You can find it attached to Form 1040.

The SALT deduction works differently for non-resident (NR) based on the type of income they receive. They can only deduct SALT on income that is considered "effectively connected" with U.S. trade or business and not claim a deduction for other income types.

An Example of SALT Deduction

Let's understand how the SALT deduction works in detail with the help of an example:

The taxpayer has to choose between itemizing their deduction or claiming a standard deduction while filing their 2025 tax return. In annual property taxes, they paid $20,000, and in state income taxes, $25,000.

For example, let's say the income tax rate for the taxpayer is 24%. So, the taxpayer paid an overall amount of $45,000 in eligible state and local taxes. The maximum limit of SALT deduction for 2025 under the current law is $40,000.

As mentioned, with their 24% tax rate, the taxpayer's deduction would lower their income tax liability for 2025 by $9,600 - $40,000 times the 24% tax rate.

What is the History of SALT Deduction?

Since 1913, the idea of deducting state and local income taxes from income has been part of the federal tax code. Initially, there was no dollar limit to the paid tax amount that you could subtract. However, this changed when President Donald Trump signed the Tax Cuts and Jobs Act (TCJA) into law late in 2017 during his first term.

Under the TCJA, the SALT deduction remained accessible. Nevertheless, the act imposed a cap of $10,000 on it throughout its term. The TCJA will expire at the end of 2025.

Which Taxes and Fees are Not Covered Under the SALT Deduction?

As per the IRS, the taxes and fees that taxpayers are not eligible to claim as the SALT deductions include, but are not limited to:

- Stamp taxes

- Federal income taxes

- Social Security taxes

- Homeowner's association fees

- Estate and inheritance taxes

- Service charges for water, sewer, or trash collection

- Transfer taxes, such as taxes imposed on the sale of a property.

If you understand which taxes and fees can or cannot be deducted. Then, you can lower individual state and local taxes, specifically in states with higher tax rates.

Certain pass-through entities can also lower their federal tax liabilities by using a tax-reduction tool available for businesses.

What is the SALT Deduction Cap?

The SALT deduction cap limits the itemized deduction for both state and local taxes. For 2024, it caps $10,000- $5,000 for married filing separately. Otherwise, $40,000 - $20,000 for married filing separately for 2025.

The SALT cap was set up with the passage of the Tax Cuts and Jobs Act in 2017. Later, it was modified by the One Big Beautiful Bill Act in 2015. There was no cap on the SALT deduction before the TCJA. Hence, taxpayers were allowed to deduct 100% of their state and local taxes paid.

The SALT deduction led to significant debates, particularly within the high-tax states. It happened because the opponents claimed that the SALT deduction cap was unconstitutional. In 2018, a lawsuit was filed against the Treasury Department and IRS by the governments of New York, New Jersey, Connecticut, and Maryland.

Ultimately, the SALT cap was ruled to be constitutional. Also, the Supreme Court denied review of the Second Circuit's decision in New York in 2022, which stated that the SALT cap is constitutional. Now, since the SALT cap is higher for 2025-2029, taxpayers staying in high-tax states might get some relief on their federal income tax returns.

Why Was the SALT Deduction Capped?

The main motive behind imposing the SALT deduction cap was to aid in increasing federal revenues by limiting deductions. One of the largest federal tax expenditures was the pre-cap SALT deduction. It costs the U.S. Treasury an estimated $100 billion a year.

Moreover, in 2017, the SALT deduction was the fifth-largest tax expenditure, the year before the cap was imposed. In the same year, the federal government lost around $70 million in tax revenues.

Who Gets the Benefits of the SALT Deduction?

Taxpayers who have higher tax liabilities in jurisdictions with higher state and local tax rates might enjoy the maximum benefits after claiming the SALT deduction. Generally, they face higher income tax bills and own property with property taxes to deduct.

Additionally, before the implementation of the SALT cap, taxpayers with income of more than $100,000 accounted for the overwhelming majority of 91% of those claiming SALT deductions. Such taxpayers were mainly concentrated in six states. It includes New York, Pennsylvania, New Jersey, California, Texas, and Illinois.

What is the SALT Cap Workaround?

The SALT cap workaround is an elective pass-through entity tax (PTET) that several states have approved after the SALT deduction cap was implemented. This workaround can be a beneficial tax-reduction tool for certain pass-through entity (PTET) business owners. It allows them to avoid the cap on deducting state and local taxes on federal individual tax returns.

Several states have implemented and analyzed the workaround to the cap since the passage of the TCJA. Also, more than 30 states have approved SALT cap workarounds for some PTEs to date. Businesses' owners may still obtain the benefits of a PTET election, even though the OBBBA significantly increased the SALT cap for 2025-2029. For instance, conducting a PTET election may assist in lowering a partner's self-employment tax.

Additionally, business owners can take advantage of the high-standard deduction and the charitable deduction for non-itemizers. The specifics might differ by state; however, for some PTE owners, the SALT cap workaround may allow them to indirectly deduct state and local taxes that they have paid more than the SALT cap. It includes S corporations, some limited-liability companies (LLCs), and partnerships.

The SALT cap workaround can benefit some PTE owners in several ways, including:

- A greater net advantage than an itemized deduction, which the net investment income tax and alternative minimum tax might offset.

- Some individual PTE owners may enjoy the benefits of taxes paid by the PTE. It might be mentioned in the reduction of their shares of PTE income. They would have been liable to the SALT cap, provided they paid state and local taxes directly.

You must remember that in some situations, the SALT cap workaround can lead to other tax-related issues for PTEs, such as the valuation of a business property.

Should I Claim the SALT Deduction?

You need to fill out and submit Schedule A with your tax return to itemize your deduction instead of claiming the standard deduction. The schedule will sum up all your tax-deductible expenses for the year. In case the total of all your itemized deductions is below the standard deduction you are liable to claim for your filing status. Then, you might end up paying tax on more income than you are actually liable to.

As of 2025, the SALT deduction stays capped at $10,000. However, the standard deduction for a single filer is $15,000, increasing to $30,000 for married taxpayers filing jointly.

Did the SALT Deduction Cap Expire?

No, because the passage of the OBBBA made the SALT cap permanent. However, the cap amount is scheduled to change every year. The cap for 2025 and 2026 is $40,000 and $40,400, respectively. The cap will be increased by 1% every year, for tax years starting after 2026 and before 2030.

Also, the cap will come back to $10,000 or $5,000 for married filing separately for tax years starting in 2030.

To Conclude

The TCJA will expire at the end of December 2025 if Congress doesn't decide to extend it. As a result, the $10,000 cap beginning in 2026 will be removed. Set to increase by 1% every year, the expanded cap will then come back to its original level in 2030.

The SALT deduction substantially lowers your federal tax liabilities. However, you must know what's deductible and what the SALT cap is. Also, there is the existence of workarounds as well, hence it is crucial to seek guidance from experienced experts like Savetaxs.

Our expert team understands your taxability and specific situation. Although we prioritize compliance, we ensure to identify tax-saving opportunities for you. We will guide and assist you throughout the process to ensure we deliver the highest-quality service to you. Reach out to us right away and get assistance with your tax planning needs.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- Understanding Itemized Tax Deductions

- Understanding Standard Tax Deduction

- Tax-Deductible Donations: Rules for Charitable Contributions

- IRS Capital Gains Tax: Short and Long-Term Rates for 2024-2025

- The Full List Of 20 Tax Deductions For Self-Employed People

- All You Need to Know About Mortgage Interest Deduction

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

You can deduct the following under the SALT deduction:

- Property taxes paid to state or local governments

- State and local income taxes, or state and local sales taxes, any one.

Taxes that don't qualify under the SALT deduction include federal income tax, Social Security tax, inheritance/estate taxes, HOA fees, etc.

The cap for SALT deduction is as follows:

- For the tax year 2024: $10,000 for all filers ($5,000 for married filing separately).

- For 2025: the cap rises to $40,000 ($20,000 married filing separately).

- After 2026, the cap will continue to increase gradually, which is about 1% every year until 2029. Then, in 2030, it returns to the lower amounts ($10,000/$5,000) unless new legislation makes changes to that.

Assume in the tax year 2025, you paid:

- $20,000 in property tax

- $25,000 in state income tax

The total eligible SALT would be $45,000.

However, since the 2025 cap is $40,000, you can only deduct $40,000. If your federal tax rate is 24% then this $40,000 deduction will reduce your federal tax liability by about $9,600 (i.e., 24 *$40,000).

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)

-plan_1761282887.webp)

_1758631896.webp)