- What is a Defective Return?

- What is the Reason for the Defective Notice u/s 139(9) of the Income Tax Act?

- What Should You Do After Receiving a Notice Under Section 139(9)?

- What Happens if You Don't Respond After Receiving a Notice for a Defective Return Under Section 139(9)?

- How Will You Receive a Notice Under Section 139(9)?

- How to Respond to a Notice u/s 139 (9)?

- What is the Time Limit to Respond to Defective Notice?

- Can You Withdraw Your Response to a Defective Notice Under Section 139 (9)?

- How to Revise Your Income Tax Return in Response to the Notice?

- Defective Tax Return Notice is Not a Cause to Worry

Generally, it happens that we might miss out on details and make some errors while filing income tax returns. These errors make your return "defective.". This is when you are issued a notice of defective return under section 139(9).

Section 139(9) of the Income Tax Act, 1961, explains that when your return is found defective, the assessing officer grants you a period of 15 days to rectify such errors. It is like a warning to taxpayers, allowing them to rectify errors and ensure accurate reporting. You need to respond to such notices quickly to avoid penalties, interest, or issues with refunds.

In this blog, we will understand the different reasons why you might get a defective return notice. Also, we will walk you through how to respond to a defective return under Section 139 (9).

- The notice is sent under Section 139 (9) through registered email.

- A defective return in income tax is flagged when the IT department finds mistakes in your Income Tax Returns.

- The most common reasons for defects include incomplete ITR, mismatched TDS, unreported income, or wrong information.

- The taxpayer must respond to the notice within 15 days.

- Taking prompt action on the notice will help avoid penalties, interest, and delays in receiving refunds.

What is a Defective Return?

An income tax defective return notice is issued when the Income Tax Department finds errors or inconsistencies in your ITR. The main aim behind issuing this notice is to ensure that your ITR contains accurate and complete information. Some common errors could include:

- Wrong basic details, like name, PAN, or address.

- Filing the wrong ITR form for your type of income.

- Missing or incomplete details in the Income Tax Returns.

- Errors in tax computation or reporting of income and deductions.

- Discrepancy in details compared to the data available with the department (from employers, banks, mutual funds, TDS/TCS deductors, etc.)

In any of the above-mentioned cases, the income tax department will issue an income tax defective return notice u/s 139(9) to the taxpayers. The notice will inform them about the same and ask them to rectify the errors made in the return.

The notice will be sent to your registered email ID and can also be accessed through the Income Tax e-filing portal. After receiving the notice, you need to make the necessary corrections in the return within 15 days. In case you fail to rectify the errors on the ITR on time, you might face some consequences in the future.

Let's now discuss the reasons for receiving a defective notice 139 (9) in detail.

Section 139(9) of the Income Tax Act helps NRIs understand when their income tax return (ITR) may be considered defective due to errors or omissions. It explains common causes such as mismatches in income and tax details, missing audit reports, or incomplete disclosure of income. NRIs get a 15-day window to correct these defects after receiving the notice, allowing them to avoid penalties and ensure accurate tax compliance in India. This knowledge empowers NRIs to promptly address errors in their tax returns and safeguard their refunds and benefits.

What is the Reason for the Defective Notice u/s 139(9) of the Income Tax Act?

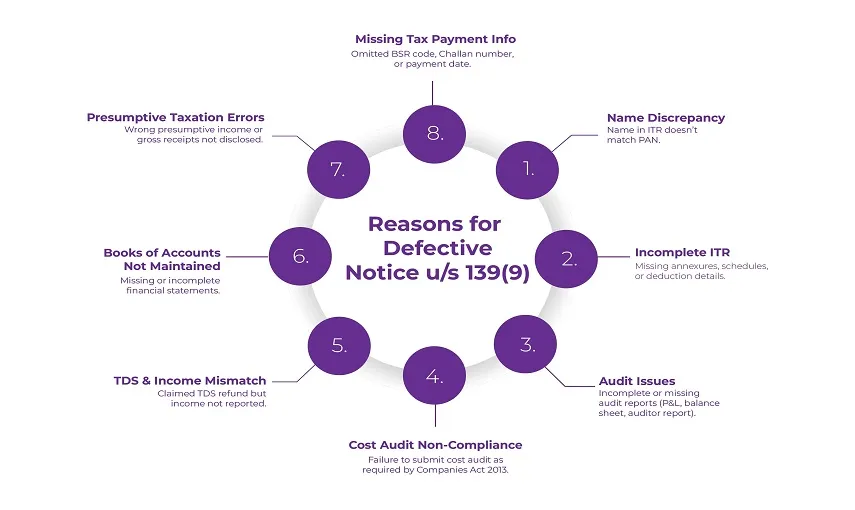

The assessing officer may consider the following reasons, mistakes, or omissions while issuing an income tax defective return notice under Section 139(9):

- Discrepancy in Name: When your name stated in the ITR doesn't match the name on the PAN card.

- Incomplete ITR: You must file the annexure, statements, and columns in the ITR. The ITR must be duly filed whenever needed. For instance, when you claim deductions u/s 80G. You are required to file the details in the relevant schedule correctly.

- Income Tax Audit: Suppose an audit is required from your side under Section 44AB. Then, the entire audit report, including profit and loss account, balance sheet, and auditors' report, must be provided. When these documents are not submitted or if you submit an incomplete audit report, you may receive a defective return notice.

- Not Complying with Cost-Audit: If you fail to submit the "Cost Audit" as required by the Companies Act 2013. Then, you might receive a defective return notice.

- TDS and Income Mismatch: You have claimed the TDS as a refund. However, the corresponding income is not offered for tax in the return.

- Not Maintaining Books of Accounts: You need to maintain regular books of account. It includes balance sheets, trading accounts, profit and loss accounts, etc. However, incomplete or non-submission of these may incur a defective return notice.

- Inaccuracies in the Presumptive Taxation Scheme: In case of presumptive taxation, furnishing a wrong calculation of presumptive income, not disclosing accurate details, or a discrepancy in gross receipts can lead to a defective return notice. For instance, if gross receipts are not stated in the profit and loss account, or the mentioned amount exceeds Rs. 2 crore in ITR 4, it may trigger a defective return notice.

- Missing Tax Information: It means that if taxes have been paid along with interest before filing the return. Also, if the details related to it are omitted in the ITR. It includes the BSR code, the Date of the Challan, and the Challan serial number.

What Should You Do After Receiving a Notice Under Section 139(9)?

Upon receiving a notice of an income tax defective return notice u/s 139(9), you need to revise your return within 15 days of the notice's receipt by the Income Tax Department. Alternatively, you can request an extension by submitting a written application to the Assessing Officer (A.O.). You can ask for more time to file a revised return.

It is often observed that even if a taxpayer rectifies the defect after the 15-day duration, the AO may still condone the delay and treat the return as valid. It applies if it is done before the assessment is finalized.

However, if you don't respond within 15 days, you can request an additional extension to make the revisions. If your extension request is denied, the original return will be considered invalid. This situation could lead to consequences like accruing interest, not being able to carry forward losses, facing penalties, and losing specific exemptions.

What Happens if You Don't Respond After Receiving a Notice for a Defective Return Under Section 139(9)?

If you fail to respond to a defective return notice under Section 139(9) or to revise your income tax return (ITR) within the specified timeframe. Then, it will result in your defective return being classified as a non-filed or invalid return. The Income Tax Department will view this as if you have not submitted a return for that year. Consequently, it means that any potential refund you are due will not be processed.

If your original ITR is deemed invalid, you can still file a belated return. However, this will incur a penalty fee to minimize further repercussions.

How Will You Receive a Notice Under Section 139(9)?

You will get the notice u/s139(9) from the Income Tax Department via the email address you provided while filing your ITR. These notices typically come from the CPC. Also, the subject line will read "Communication u/s 139(9) for PAN AWZXXXXXXX for the A.Y. 2024-25".

The notice is attached to the email and is password-protected. To open it, the password is your PAN in lower case, and your birth date in the format DD/MM/YYYY.

For example,

If your PAN is ABCDE1234F and your birth date is 01/01/2001, then the password to open the defective return notice will be abcde1234f01012001.

How to Respond to a Notice u/s 139 (9)?

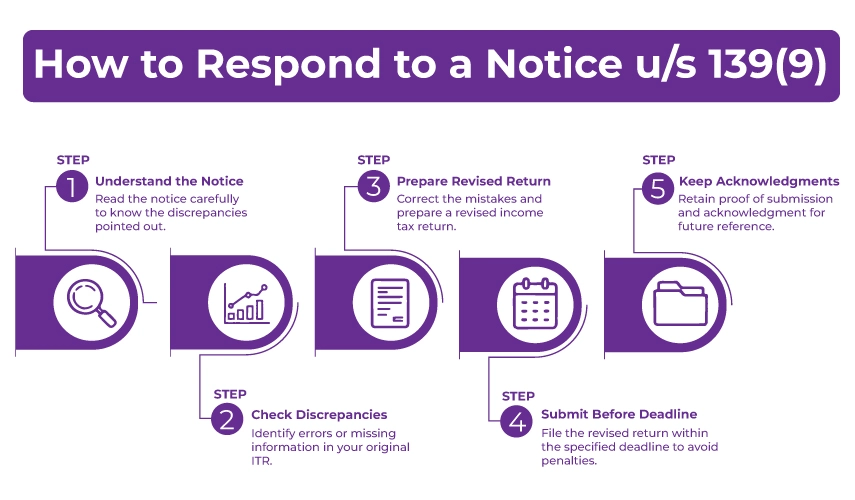

To respond to an income tax notice, you can visit the income tax department's website and log in using your credentials. Here is a quick guide on how to address Income Tax Notices:

- Step 1: On the dashboard, click on pending actions and then on e-proceedings.

- Step 2: In case you have not received any notice, you won't see any e-proceedings records.

- Step 3: In case there is any proceeding, it will be visible in your pending actions. To check that, click on "For your action and view notices".

- Step 4: Now, click on "Notice/Letter PDF" to check the notice.

- (A): Once you have checked your notice, click on Submit a response.

- Step 5: Upon clicking on submit a response, the screen will display a response page. On this page, you will either have to agree or disagree with the notice.

- Step 6: If you agree with the notice, you will have to respond to the said defect on the visible screen.

- (A): In case you disagree with the notice, choose disagree in the given column. Also, provide reasons related to the disagreement in the provided text box.

- Step 7: Lastly, if you chose the agree-on option and offline utility response mode. Submit the attachment file to correct the defect.

What is the Time Limit to Respond to Defective Notice?

When you receive a defective notice, you have 15 days from the date of receipt. Also, you have the time frame specified in the notice to rectify the mistakes in the return you have filed.

Can You Withdraw Your Response to a Defective Notice Under Section 139 (9)?

Previously, it was possible to withdraw a response submitted for a defective notice under Section 139(9). However, this option is no longer available. Now, you cannot withdraw your response; however, you can either update or view it.

It is essential to respond promptly and accurately to a defective return notice. You can seek advice from an expert regarding the same.

How to Revise Your Income Tax Return in Response to the Notice?

According to Section 139(9) of the IT Act, taxpayers have the right to revise their ITRs. This provision allows for the rectification of unintentional errors or omissions, even after a notice under Section 139(9 of the Income Tax Act) has been issued.

Revisions can take place before the one-year mark from the end of the relevant assessment year or before the completion of the assessment year, whichever comes first. This flexibility enables taxpayers to address discrepancies and ensure accuracy in their tax filings.

Defective Tax Return Notice is Not a Cause to Worry

You need to understand that receiving a tax notice is not a cause to panic or worry. Instead, you must see it as an opportunity to correct any errors made in your original income tax return. Taking action on time can protect you from facing potential penalties, loss of benefits, and scrutiny.

However, if you are someone who finds tax and tax-related issues complicated, seek assistance from a professional like Savetaxs. At Savetaxs, we have a team of experienced CAs and tax professionals carrying years of experience. They actively work 24*7 across all time zones to ensure timely and satisfactory assistance.

Our team ensures to provide you with personalized assistance as per your situation. No matter which country you are in and what tax issues you are facing, contact us right away.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Intimation Under Section 143(1) of Income Tax Act – ITR Intimation Password

- How Much Gold NRI Can Bring to India in 2025?

- Income Tax Surcharge Rate & Marginal Relief for AY 2025-26

- Section 115F: Unlocking Tax Benefits for NRIs in India

- Short Term Capital Gain on Shares (Section 111A of Income Tax Act) - STCG Tax Rate and Calculation

- How to Respond to Notice Under Section 143(2)?

- 5 Common Mistakes NRIs Make The Lead To Tax Notices

- Understanding your NRI status and Its impact

- Understanding Section 10 of the Income Tax Act

- All You Need to Know About Section 22 of the Income Tax Act

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

Some common mistakes that can lead to a defective return are:

- Claiming TDS (Tax Deducted at Source) without stating the corresponding income in the Income Tax Returns (ITR).

- The aggregate of gross receipts in Form 26AS, on which you have claimed the credit, is more than the income you have reported in ITR.

- Mentioning "Gross Total Income" and all income categories as "nil" or "0", while still computing and paying the tax you owe.

- Discrepancy between the name stated in the ITR and the name mentioned on the PAN card.