- What is a UK Certificate Of Residence (CoR)?

- Why Do NRIs Need a UK Certificate Of Residency?

- Eligibility Criteria For Obtaining A UK Certificate Of Residence

- How to Apply For A UK Certificate Of Residence

- What are the documents required for a Certificate of Residence (UK)?

- Processing Time & Validity Of UK Certificate Of Residence

- Benefits of Having A UK Certificate Of Residence (CoR)

- Tax Relief Under the India-UK DTAA

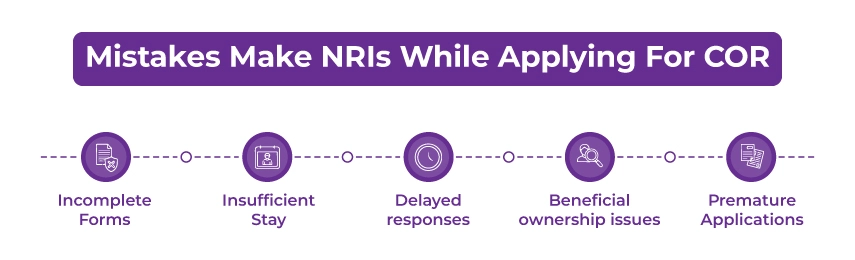

- Common Mistakes NRIs Make While Applying For CoR

- How Can You Submit The UK CoR To Indian Tax Authorities?

- The Bottom Line

A UK certificate of residence is an authorized document issued by the HMRC confirming that you are a resident of the UK. Primarily, this certificate is used to avoid double taxation and claim tax relief.

The UK has double taxation treaties (DTTs) with over 157 countries; therefore, a certificate of residence is a non-negotiable requirement to avoid double taxation on the same income.

In this blog, we will discuss the key aspects of the UK certificate of residence (CoR), including its eligibility criteria, benefits for NRIs living in the UK, the application process, processing time, and other compliance requirements.

- The UK certificate of residence serves as official evidence from HM Revenue & Customs that an individual or a company holding it is a UK tax resident.

- The main benefit of the CoR for NRIs living in the UK is that it allows the taxpayer to claim DTAA benefits under the India-UK Tax Treaty. This means you will not be taxed twice on the same income source.

- Having a CoR is mandatory again because financial institutions and foreign tax authorities often require it for various cross-border activities. Such activities include remittances, opening bank accounts, and more.

- The UK certificate of residency is valid for 12 months and must be renewed for individuals to continue receiving the India-UK DTAA benefit.

- Ensure that the UK certificate of residency certifies only the tax residence for the past and current periods, and not future periods, as the circumstances may change.

What is a UK Certificate Of Residence (CoR)?

As aforementioned, CoR is an official document issued by HM Revenue & Customs, the UK's tax authority. This certificate serves as proof that the holder, whether an individual or a company, is based in the United Kingdom for tax purposes. In a nutshell, CoR also acts as your tax residency certificate.

CoR is primarily used to avoid double taxation and to claim tax exemptions or reliefs on income earned in India. This document is mandatory for NRIs living in the UK and being tax residents there who also earn revenue from India. The certificate proves that they are obliged to pay taxes in the United Kingdom. This acknowledgment prevents double taxation of the same income source.

Please ensure that CoR is not mandatory for all Non-Resident Indian (NRIs). It is only needed if you are claiming benefits of double taxation treaties in Indian Income. Having the CoR alone does not prevent double taxation. You must also meet the DTAA conditions set in India and file all the required forms as an NRI, such as Form 10F and TRC.

Why Do NRIs Need a UK Certificate Of Residency?

There are several reasons why a UK tax residence certificate from HMRC is important for NRIs.

To Avoid Double Taxation: The primary benefit of having a UK certificate of residency is the ability to use the DTAA tax treaty provisions. This ensures that income earned in one country is not taxed in another.

To Claim Tax Benefits in India: As per the Income Tax Act of 1961, a tax residency certificate (CoR) is mandatory to claim any benefits, tax rates, or relief under a DTAA on income earned in India.

Lower withholding tax (TDS) rates: If an NRI does not have a certificate of residency, then he/she will be subject to higher TDS rates. However, with a valid Indian residency certificate, NRIs can claim lower TDS rates as mandated by the India-UK Double Taxation Avoidance Agreement.

Fund Repatriation: Many Indian banks often require a tax residency certificate to process the repatriation of funds, such as the proceeds from the sale of property in your NRO account to the UK. Having a tax residency certificate simplifies the entire process and ensures compliance.

Eligibility Criteria For Obtaining A UK Certificate Of Residence

To get a UK Certificate of Tax Residency, you need to meet certain rules set by HMRC. Such rules are:

- To be considered as a UK tax resident under the Statutory Residence Test.

- To have a tax agreement or tax treaty with the country where you want tax relief. For NRIs living in the UK, the tax agreement is between the UK and Indian.

- Generally, you must have spent at least 183 days in the United Kingdom during the financial year that is April 6 to April 5.

- You must either have your only or your primary home in the United Kingdom.

Please note that the HMRC will not issue the CoR if you did not meet the tax treatment benefits.

How to Apply For A UK Certificate Of Residence

Non-resident Indians living in the United Kingdom can apply for a Certificate of Residency through the HMRC's online portal or by post.

The Online Application

- Log in to His Majesty's Revenue and Customs government gateway account.

- Go to the Certificate of Residence Request section.

- Enter the required details and upload all the required documents.

- Apply, then wait for a response from HMRC.

Postal Application

- Download and complete the certificate of residence application forms. Please ensure you download the form from HMRC's official website.

- Attached all the required and necessary documents, including tax returns and all the details about income.

- Upon completion, double-check everything you have mentioned or attached, then send the application to the HMRC address listed on the form.

Please note that HMRC may ask you for clarification, such as proof of address. Hence, please respond to such requests promptly, as any delay will prolong your processing time.

Issuance Of Certificate

- Upon arrival, HMRC will email you a PDF certificate. Additionally, they will post the signed hardcopy of the certificate.

- Please keep the signed and hard copies for tax submissions with India and for the designated authorities.

What are the documents required for a Certificate of Residence (UK)?

As an NRI, to get a tax residence certificate or certificate of residence from the UK, please keep the following documents in order.

- Filled out TRC1/2 Form.

- Self-assessment tax return for the recently filed year.

- Unique Tax Reference Number or Corporation Tax Reference.

- National Insurance Number if you are an individual, or the company registration Number.

- Proof of residence that is dated within the tax year. Proof of residence can be your utility bills, council tax statement, tenancy agreement, or mortgage statement.

- Evidence of business can include recent pay slips, the employment contract, or the company's house certificate.

- For expatriates who become residents of the United Kingdom mid-year, they must have a copy of their passport.

- Please ensure you have all the documents handy before applying for the CoR, as document gaps are the major reason for delays.

Processing Time & Validity Of UK Certificate Of Residence

The processing time of the UK certificate of residency is as follows.

Online Application: The processing time for online applications is generally four to six weeks, given that all the documents you have provided are correct.

Postal Application: The processing time for a postal application is generally around 6 to 8 weeks (plus additional time that might be expected from the postal service).

Complex Cases: Companies with sophisticated structures or dual registration holders may take around eight to twelve weeks to process.

Hence, to avoid all last-minute complications, please apply well in advance.

Validity Of The UK Certificate Of Residence

Generally, a certificate of residence is valid for a financial year from the date of issue. HMRC cannot provide you with a CoR for the future period.

Hence, you will have to apply for a certificate of residence every year if you are eligible under DTAA.

Benefits of Having A UK Certificate Of Residence (CoR)

With the help of CoR, Non-resident Indians can reduce the tax liability on different types of Income earned in India. Such income can be

- Rental income generated from properties in India.

- Divided received from Infian companies.

- Interest income from the Indian bank accounts.

- Capital gains from the sale of investment proceeds in India.

Tax Relief Under the India-UK DTAA

The DTAA treaty benefits apply to different types of taxes in both countries.

So, the taxes in the United Kingdom under DTAA are:

- The Income Tax

- Corporate Taxes

- Capital Gain Taxes

- Petroleum Revenue Taxes

Taxes under the Indian Tax Category Are:

- Income tax, along with surcharge or cess.

Apart from these taxes, other taxes are either the same or similar types included in the DTAA.

Common Mistakes NRIs Make While Applying For CoR

Here is a list of a few common mistakes that NRIs make, which you must avoid if you don't want to delay the processing time of your certificate of residency.

- Incomplete Forms: Applicants sometimes leave fields blank on TRC1/2 Forms, or enter incorrect UTR numbers or make typos.

- Insufficient Stay: Not staying in the UK enough to qualify under the Statutory Residence Test.

- Delayed responses: People ignore HMRC's clarification requests, causing unnecessary delays and resulting in the application being spent.

- Beneficial ownership issues: When the officials cannot confirm that you actually own the income you are claiming, the tax treaty benefits for.

- Premature Applications: When the applicant applies before establishing a clear residency status for the relevant period.

How Can You Submit The UK CoR To Indian Tax Authorities?

As a non-resident Indian (NRI) earning income in India and wanting to claim the Double Taxation Avoidance Agreement (DTAA) benefits, you must first submit your UK certificate of Residence to the Indian tax authorities along with the required documents.

Here is a step-by-step process for doing it.

Step 1: Get a certificate of residence from the HMRC. Please ensure that the Cor should clearly method the following details.

- Your name and address.

- Tax identification number.

- Country of residence.

- Financial years for which the certificate of residency is valid.

Step 2: Get a Form 10F. Download Form 10F from the Incoe tax e-filing portal. And fill in all the requested details, such as his name, address, nationality, TIN, residential status period, and more.

Step 3: Provide Certificate of Residence and Form 10F to the Indian Payer. Meaning that you must submit both Form 10F and CoR to the entity that receives your income in India, such as a bank or employer, or the buyer.

Doing so allows the payer to deduct TDS at DTAA rates rather than the higher standard rates.

Step 4: Submit CoR to the Indian Tax Department. Whenever you're filing your income tax return in India, attach Form 10F and a Copy of the certificate of Residence to it.

The Bottom Line

The UK Certificate of Science is important for UK residents involved in international tax matters. This certification ensures that you avoid duplicate taxation easily and can manage your business operations in India smoothly.

The CoR for NRI is also known as the NRI tax residency certificate in the UK. Please ensure this document is mandatory for NRIs in the UK seeking to claim tax treaty benefits under the India-UK DTAA.

By utilizing Savetaxs high-end, expert-backed services, you can ensure an easy, secure UK Certificate for the tax-residence application process.

Our experts bring more than 30 years of experience in NRI taxation and cross-border tax planning, so you can be assured that we provide each client with a tailored approach to their taxation needs.

The experts will provide end-to-end guidance on how to apply for the UK certificate of residency efficiently and then claim benefits under the India-UK DTAA.

Connect with Savetaxs today—we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with current regulations and can help you make accurate decisions and maintain accuracy throughout the process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- Section 89A - Tax Relief on Income from Foreign Retirement Funds

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- TDS on Sale of Property by NRIs in India

- What is a Tax Residency Certificate (TRC) and How to Get It?

- NRI Selling Property in India

- How to Claim TDS Refund for an NRI?

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

The UK certificate of Residence is an official document issued by the HMRC that confirms an individual or a business as a tax resident of the United Kingdom.

It is important for NRIs who earned income in India that a UK CoR is mandatory to claim benefits under the India-UK Double Tax Avoidance Agreement.

_1753429421.webp)

(i)-Of-The-Income-Tax-Act_1756812791.webp)