Sending money to India from any foreign country can be a task for most NRIs. There are so many methods, and each method has its own pros and cons. Different options and a lack of knowledge make the remittance process very complicated for them.

In this article, we will explore the various methods for remitting money to India and help you find the best way to send money to India. We have also mentioned the RBI and FEMA guidelines, as well as the documents you may require, so you can comply with the process.

- Reasons for sending money to India can include family maintenance, investment, medical, or self-transfer.

- Different methods for remittance include online transfers, cross-border UPI, money orders, wire transfers, and FCC/FCDD

- Always comply with RBI and FEMA (Foreign Exchange Management Act) guidelines while transferring money to India.

- There will be tax implications for the recipient of funds from a foreign country.

Why NRIs Send Money to India?

There are many reasons why the foreign nationals, Non-Resident Indians (NRIs), Overseas Citizens of India (OCIs), and Persons of Indian Origin (PIOs) send money to India. These reasons can be family maintenance, investment purposes, or self-transfers to their own Indian account for saving. The process of sending money from a foreign country to India is known as an Inward Remittance.

How Can NRIs Send Money to India?

There are various options by which the NRIs can send money to India:

1. Online Money Transfer Services

Many banks and fintech companies offer platforms for instant fund transfers worldwide. You can easily transfer money to the recipient bank that provides these services. Account holders at all banks can use these digital platforms.

2. Wire Transfers

- Online wire transfers: You can start the transfer process via net banking. You have to submit the required documents, check exchange rates, and then track your transaction status online. There is no upper limit on funds while using wire transfers.

- Wire Transfers through a branch: You can visit any overseas bank branch to send money to Indian from abroad.

3. International Money Order

An international money order is a money transfer service offered by the Indian Postal Network. It is an easy and reliable way to send and receive money across borders. The recipient can redeem the money order at cheque-cashing facilities or deposit it into their bank account.

4. Cross-border transaction under Unified Payments Interface (UPI)

The NPCI (National Payments Corporation of India) and NIPL (NPCI International Payments Limited) now offer international payments by using the Cross-border UPI. The NRIs can use these facilities to send money to India. Currently, it is available in the India-Singapore corridor and is soon to be expanded to other countries. NRIs can send money to any Indian bank account or UPI, which a local remittance service provider handles.

We file Income Tax Returns for NRIs with 100% accuracy.

5. Foreign Currency Demand Draft (FCDD)/ Foreign Currency Cheque

An NRI can send FCC/FCDD from an overseas bank in India to an Indian recipient. The beneficiary can deposit FCC/FCDD into their account or take it to the bank and receive the remittance. There may be service changes applicable at the time of the FCDD enhancement. These charges can vary for different banks depending on the amount of the transfer.

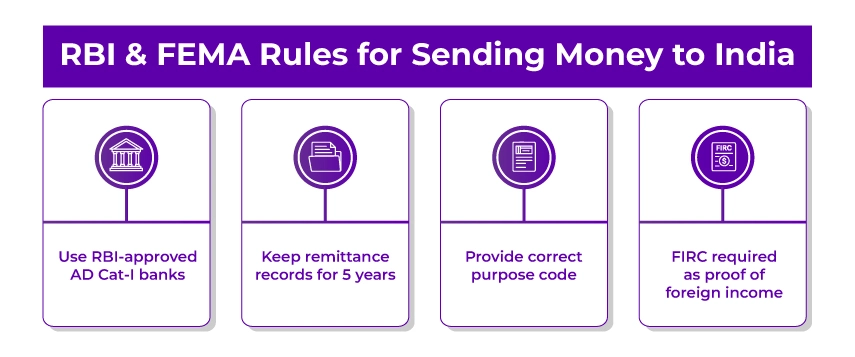

RBI & FEMA Guidelines for Sending Money to India

Here are the most important guidelines that come under the FEMA rules for foreign transfer:

- Using Authorised Banks: You should always receive foreign remittances via an Authorised Dealer Category I bank. Not every financial institution in India needs to deal in foreign currency. Only major banks licensed by the RBI, such as AD Cat-I banks, are eligible to handle inward remittances.

- Maintaining Transaction records: According to FEMA rules, everyone should retain records of their foreign transactions for at least 5 years. These receipts include invoices, FIRA, bank advices, contracts, etc. These are important for queries or audits from tax/RBI authorities. By following the above guidelines, you will make your inward remittances smooth and legally correct.

- Requirement of Purpose Codes: Purpose codes define the purpose of the remittance. To identify the purpose of your foreign transaction, consult the purpose code list on the RBI website. After identifying, you must provide the purpose code to your bank. It is important to use the correct code, as an incorrect one can cause compliance issues. It can lead to the cancellation of the transaction or even legal actions against you.

- Foreign Inward Remittance Certificate (FIRC): FIRC serves as proof of inward remittance. It is an important document for Indian companies offering services abroad, exporters, and freelancers, as they must prove that their income is derived from a foreign client. The FIRC contains crucial information, such as the amount, the remitter's details, and the purpose of the remittance. The exporters need to claim export-related incentives and GST refunds with the help of FIRC.

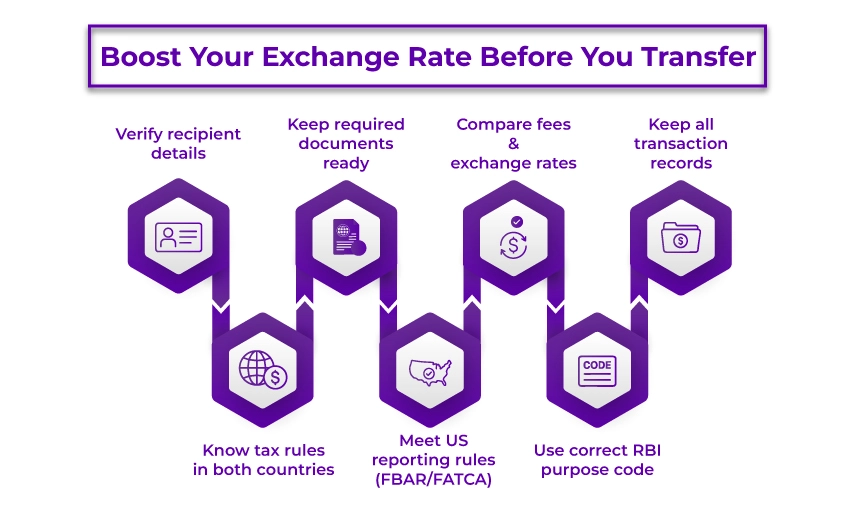

How to Get the Best Exchange Rates?

To get the best exchange rates, it is important to properly prepare before sending money to India. It will help in avoiding delays and complications. Here is the list of things that you need to verify and prepare:

- Verify recipient details: Check the details of the recipient carefully, like full name, account number, IFSC code, and SWIFT/BIC code of the bank. It prevents funds from being misdirected. The smallest error can cause financial losses or major delays.

- Know tax implications: You should understand the taxation in both countries. The amount of transfer is not taxed in the US. You have to file Form 709 for gifts valued at more than USD 19,000 per person per year. In India, gifts to non-relatives valued at more than Rs 50,000 per year become taxable for the recipient.

- Maintain proper documents: You must keep your passport and all other required documents ready. They are based on the transfer purpose, such as medical bills for treatment, property documents for investment, etc.

- Fulfill the reporting requirements: If the foreign accounts exceed US$10,000 at any time of the year, then US residents have to file FBAR (FinCEN 114) and FATCA (Form 8938) for foreign assets above threshold limits.

- Compare fees and exchange rates: You should compare the fees and exchange rates across all the providers. To maximize the amount your family receives in India, choose services with transparent rates and no hidden charges.

- Choose the correct purpose code: As per the RBI guidelines for NRI remittance, you should mention the correct purpose code according to your purpose of transfer, such as medical expenses, investment, education, etc

- Keep transaction records: You should keep the proof of all your transfers, such as receipts, confirmation emails, tax filing, and for solving potential disputes.

Documents You May Need

The remitter must submit these documents to the authorised service provider or to their overseas bank. Here is the list of all the documents required for an inward remittance.

- Remitter's full name and address

- Beneficiary's name

- Beneficiary bank account details along with the SWIFT code

- Amount of Remittance

- Purpose of transfer

Get accurate ITRs filed and carry forward your losses by consulting our experts.

Understanding the tax implications of sending money to India

For NRIs, the amount they send to India is not taxable. However, there will be tax implications for the recipient who is a resident of India. Taxation will depend on the purpose of the amount transfer, such as:

- If the money is received for supporting family members or family maintenance, then it is not taxable in India.

- If it is a gift to a non-relative and its value is more than Rs 50,000, then it will be taxable for the recipient as per Section 56(2) of the Income Tax Act, 1961.

NOTE: There may be Standard Goods and Services Tax (GST) applied to the service charges (not on the transferred amount), which are payable on remittances.

Conclusion

There are various options by which the NRIs/PIOs/OCIs and foreign nationals can send money to India. These methods are wire transfers, money transfer services, cross-border UPI, IMO, and FCC/FCDD. You can choose your preferred method as per your needs, depending on cost, speed, and comfort. There will be tax implications for the Indian recipient of money. You should also comply with the FEMA guidelines and notify your authorised dealer/bank about the transfers.

Furthermore, if you find this process complicated, getting expert assistance is the best solution. Savetaxs is one such platform for NRI taxation. We have a team of professionals with years of experience to help you feel confident about the tax implications of sending money to India.

**Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with current regulations and can help you make accurate decisions and maintain accuracy throughout the process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- Registering a Will in India: Key Tips for NRIs

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- A Complete Guide to Investing in Gold for NRI in India

- NRI Investment in SGrBs Through IFSC

- Top 5 Problems NRI Face While Investing In India

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766742512.webp)

_1767080655.webp)