- Do NRIs Need to Disclose Their Foreign Assets in India?

- Why Do NRIs Receive Foreign Asset Disclosure Notices?

- What Should NRIs Need to Do After Receiving the Foreign Asset Disclosure Notice?

- What is the Deadline to Report Foreign Assets in the ITR?

- What Happens if NRIs Ignore Reporting Foreign Assets in Their ITR?

- How to Declare Foreign Assets in Income Tax?

- Final Thoughts

For many NRIs, the foreign asset reporting rules create confusion, which is why they sometimes receive an NRI Foreign Asset Disclosure Notice from Indian tax officials. Considering this, the eligibility for reporting foreign assets depends on your residency status, specific threshold, and forms.

Being an NRI, are you also confused about when you need to report your foreign assets or income in India? Then this blog is for you. Read it and know when, as an NRI, your disclosures are needed, what to do when you receive the notice, and how to stay compliant.

- Generally, NRIs do not need to disclose their foreign assets or income when filing ITR in India. Considering this, NRIs do not need to file Schedule FA (Foreign Assets).

- If an NRI is claiming a tax refund without an Indian bank account, or if income from an Indian source is credited directly to foreign accounts. In these situations, NRIs need to report their foreign income in their ITR.

- Reporting for foreign assets or income in Schedule FA depends on the threshold limit, residential status, and forms.

- Further, sometimes due to an income mismatch, underreporting of foreign income, etc. NRIs receive a tax notice from Indian tax officials.

- In case NRIs get the tax notice, using the e-filing portal, they can reply to the notice with the requested documents or an explanation.

Do NRIs Need to Disclose Their Foreign Assets in India?

Generally, NRIs do not need to disclose their foreign assets or income in India when filing the ITR. However, in two specific situations, they need to disclose their foreign assets or income in India. These are as follows:

- When Income from India is Received in Foreign Accounts: Being an NRI, if you have taxable income in India, such as rental income from property, and this income is directly deposited into your foreign account. In this scenario, you need to mention that account when filing the ITR in India.

- Claiming Tax Refunds Without an Indian Bank Account: Expecting a tax refund, but did not maintain an Indian bank account. In this scenario, you need to provide the details of your foreign bank account so the refund can be credited directly to it.

These are the two situations in which NRIs must disclose their foreign assets in India. Further, with a change in your residential status, the disclosure requirements for your ITR change. After returning to India, if your residential status changes from NRI to ordinary tax resident, you need to disclose all foreign assets and income. This involves:

- Overseas properties

- Interests in foreign trusts

- Foreign bank accounts

- Foreign securities and stocks

- Any other foreign assets

It is well known that NRIs are liable to pay tax on income accrued or earned in India. However, Indian residents are liable to pay tax on their global income. Considering this, based on your residential status, you need to fulfill your foreign asset reporting obligations. In short, reporting of foreign assets or income in Schedule FA depends on the taxpayer's residential status, the threshold limit, and the forms used.

After returning to India, if your NRI status changes to an Indian resident, you need to complete Schedule FA (Foreign Assets) in your tax return. It's not optional, but it is vital to do so.

So, this is when NRIs need to disclose their foreign assets when filing ITR in India. Moving ahead, let's know why NRIs receive a foreign assets disclosure notice.

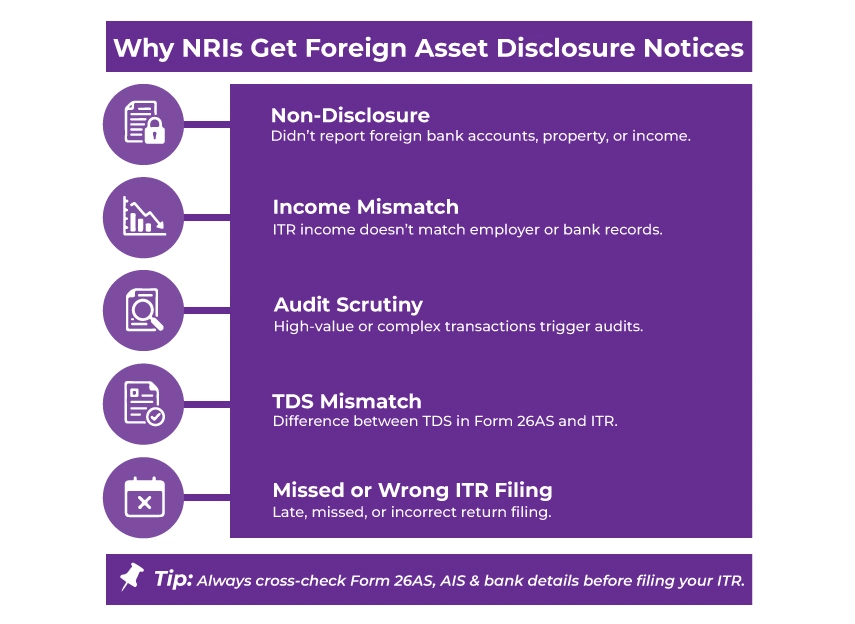

Why Do NRIs Receive Foreign Asset Disclosure Notices?

NRIs receive the foreign asset disclosure notice for several reasons. Here to help you out, we have mentioned the common reasons for it:

- Non-Disclosure of Foreign Assets: The Income Tax Act 1961 of India has made the disclosure of foreign income and assets for NRIs mandatory when filing ITR. If they fail to disclose their foreign investments, properties, or bank accounts, they can get an ITR notice.

- Income Mismatch: The difference between the reported income in the ITR and the income mentioned by your employer or your financial institution also triggers the ITR notice.

- Audit Notices: NRIs who are involved in high-value transactions or engaged in financial activities can be subject to a tax audit. If the ITR is chosen for scrutiny, in this scenario, an NRI receives an ITR notice. Further, they also need to submit additional documents.

- TDS Mismatch: If there is a difference between the amount stated in the Tax Deducted at Source (TDS) shown in Form 26AS and the amount mentioned in the ITR. In this scenario also you can also receive the tax notice from the officials.

- Failure to File ITR: If an NRI files the ITR incorrectly or fails to file the ITR on time, then it also triggers the tax notice.

These were some of the common reasons that NRIs cited, which further triggered the Tax Notices. Moving further, let's know what NRIs need to do after receiving the notice from the IT department.

Contact Savetaxs, and resolve your tax notice on time with expert guidance.

What Should NRIs Need to Do After Receiving the Foreign Asset Disclosure Notice?

If NRIs receive the foreign asset disclosure notice from the income tax officials, here is what they need to do:

- Keep your reply to the notice short, simple, and to the point.

- As evidence, include all the vital documents.

- Mention any NRI-specific tax deductions or exemptions that you have claimed as an NRI.

- If applicable, refer to the tax agreements signed between India and your country.

This is what NRIs need to do when they receive the foreign asset disclosure notice from the income tax department. Moving ahead, let's know the deadline to report the foreign assets in the ITR.

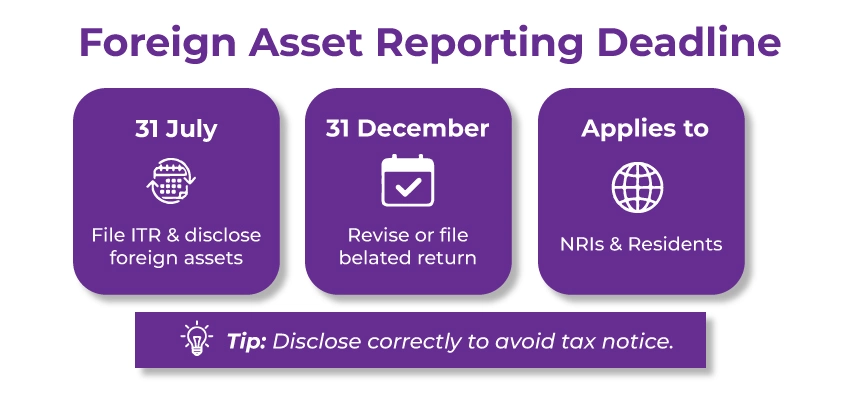

What is the Deadline to Report Foreign Assets in the ITR?

Generally, the deadline to disclose their foreign assets in their ITR is 31 July of the assessment year. Here, the date is aligned with the due date of the income tax filing.

However, in case you wrongly declared your foreign assets or forgot to mention them, then you get a second chance to respond to them. Considering this, till 31 December of the assessment year, you can revise or file your belated return without paying any penalties.

This was all about the deadline to report foreign assets in the ITR. These dates remain the same for both the Indian residents and NRIs. Moving further, let's know what happens if NRIs ignore reporting their foreign assets in their ITR.

Connect with Savetaxs and ask any tax-related query to our tax experts. We are available 24*7 to guide you.

What Happens if NRIs Ignore Reporting Foreign Assets in Their ITR?

If NRIs ignore reporting foreign assets in their ITR, they face several penalties. Considering this, the penalties stated in Schedule FA of the ITR for misrepresenting or failing to disclose are as follows:

- For every year when NRIs forget to mention their foreign assets, they could face an INR 10,00,000 penalty.

- When filing the ITR, not mentioning the foreign assets is stated as willful tax evasion. Considering this, NRIs can face imprisonment of six months to 7 years.

- Non-declaration of foreign assets also revokes the rights of NRIs to claim the Double Taxation Avoidance Agreement for the income they have already paid tax in a foreign country.

So, this is what happens when NRIs ignore reporting of foreign assets in their ITR. Moving ahead, let's know how to declare foreign assets in income tax.

How to Declare Foreign Assets in Income Tax?

To declare the foreign assets and income in your income tax return, you need to fill in the details of them in Schedule FA (Foreign Assets). To help you out, here is how you can do so:

- Step 1: First, you need to determine the different types of foreign assets you have overseas. It includes stocks, bank accounts, real estate, and other financial instruments.

- Step 2: Fill out the requested details in the Schedule FA. In this, you need to mention the name of your residence country, currency code, zip code, name, and address of the foreign institution, account number, and more.

- Step 3: In the next step, you need to mention the details of the initial value of the investment, opening, and closing balance. Additionally, a high balance during an accounting year is required in both Indian and foreign currency.

- Step 4: After that, if you have earned any revenue/ income from the redemption/ sale of the investment during the accounting year should be stated in both INR and foreign currency.

These are the steps that you need to follow to declare your foreign assets on your income tax return. Additionally, do not forget to have detailed records and documentation of all foreign assets. It further helps in supporting your disclosure you made in your ITR.

Final Thoughts

Lastly, being an NRI, having information about when you need to report your foreign assets in India, simplifies your tax compliance. Additionally, it saves you from getting an NRI Foreign Asset Disclosure Notice. Generally, NRIs do not did not need to disclose their foreign. However, there are some exceptions, such as when getting Indian income in foreign accounts.

Further, this was all about when NRIs need to disclose their foreign assets in India. Furher, if you still have any confusion about this, connect with Savetaxs. We have a team of professionals who can guide you on this and help you stay compliant with the right approach.

*Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Income Tax Act Section 148: Assessment or Reassessment

- What are the 5 Heads of Income Tax?

- NRI Income Tax Refund Delayed Because Of PAN Name Mismatch? Know What To Do

- 5 Common Mistakes NRIs Make The Lead To Tax Notices

- How to Respond to Notice Under Section 143(2)?

- Intimation Under Section 143(1) of Income Tax Act – ITR Intimation Password

- Can NRI Hold a Savings Account in India?

- How Much Gold NRI Can Bring to India in 2025?

- Advance Tax Planning For NRIs (Non-Resident Indians)

- Taxation of Foreign Source of Income in India for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766644785.png)

_1766561286.webp)

(i)-Of-The-Income-Tax-Act_1756812791.webp)

_1763555884.webp)