Cryptocurrencies are emerging as a financial and prominent innovation. It is stated as a Virtual Digital Asset. It offers borderless and decentralised transactions to individuals. For many NRIs, it is a good way to increase their wealth overseas. However, the taxation for Returning NRIs in India often makes them feel a maze. Generally, it is imposed on the gains that an NRI earns from transferring or selling these assets.

Are you also an NRI planning to return to India and thinking about how the new tax laws impact your cryptocurrency investments? Then you are on the right page. In this blog, we have mentioned everything about crypto taxation for returning NRIs post-budget 2025. So, read on and gather all the information.

- The cryptocurrency taxation rate is a flat 30%. It is imposed on capital gain earned from the transfer and sale of the asset.

- If the cryptocurrency is acquired without purchase, tax is charged at slab rates.

- 1% TDS is charged on the transaction more than INR 10,000 for salaried individuals and INR 50,000 for business owners.

- In case any person undisclosed crypto assets, a 60% tax is charged.

- It is vital for returning NRIs who hold cryptocurrency to mention them in Schedule VDA of ITR 2 or ITR 3.

What are Cryptocurrencies and How They Are Treated in India?

In simple words, similar to other currencies, cryptocurrencies are digital assets that are designed to purchase goods and services. Today, around 1500+ virtual currencies are available in the Indian market. This includes Dogecoin, Bitcoin, Matic, Ethereum, Ripple, and more. Additionally, with time, the trading and investment volume of these has increased.

Considering this, NFTs and Crypto are stated as 'Virtual Digital Assets', and to define this term, section 2(47A) was added to the Income Tax Act.

So, this was all about cryptocurrencies. Further, let's know how these currencies are treated in India.

Treatment of Cryptocurrencies in India

As mentioned above, cryptocurrencies are treated as Virtual Digital Assets (VDA) in India. Like other assets, these also hold market value and are transferred electronically. Additionally, a Section 115BBH stated a flat 30% tax is charged on the capital gain from VDA sales or transfer with applicable surcharge and cess, irrespective of the period an individual holds it. This removes the short-term vs. long-term split that happens for real estate or stocks.

Apart from this, under section 194S, 1% TDS (Tax Deducted at Source) is applied:

- Salaried Individuals: In a financial year, TDS is applicable if the total transaction made by the person is more than INR 10,000.

- Business Traders and Owners: If transactions are more than INR 50,000 annually, TDS is charged.

Further, let's know the key points of the Virtual Digital Assets Regime:

- You can only deduct the purchase price of the assets. Considering this, transaction fees, gas fees, and storage prices cannot be claimed.

- Additionally, you cannot offset your losses of cryptocurrencies with other income. Also, you can not do it even against the capital gains you earned from other crypto tokens.

- Without purchase consideration, for acquisitions, instead of 30%, the income is taxed as per the slab rate of the individual.

This was all about cryptocurrency and how they treated in India. Moving ahead, let's know the tax rate and rules of crypto taxation for returning NRIs in India.

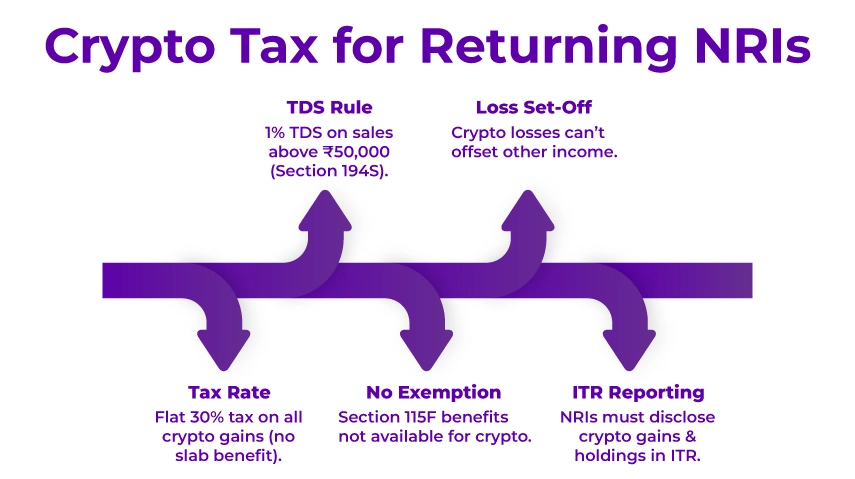

Crypto Taxation for Returning NRIs: Tax Rate and Rules

Like the Indian residents, the NRIs also face the same 30% flat tax rate on the VDA capital gains. However, there are specific rules for NRIs holding cryptocurrencies in India. These are as follows:

- As per section 194S, 1% TDS is imposed on the crypto sales if it is above the stated threshold. If a sale is INR 50,000, the exchange should withhold 1% and pay it to the income tax department.

- Unlike Indian residents, NRIs cannot claim the tax exemption under section 115F. It is a provision that provides tax relief to individuals when capital gains are included in specific shares, bonds, and more. In this eligible asset list, crypto is explicitly excluded.

- Additionally, the flat tax rate of 30% is applied even when the global income of the NRI is in a lower slab.

- Further, like residents, NRIs also cannot offset the losses of cryptocurrency against other cryptocurrencies or other sources of income.

- For NRIs, reporting of cryptocurrency is mandatory. Considering this, they should disclose their VDS holding and capital gains when filing their ITR.

This was all about the tax rate and rules of crypto taxation for returning NRIs. Further, let's know the tax exemptions that are missing in these investments.

Tax Exemptions Missing in the VDA Investments

Unlike traditional NRI investments, VDA does not provide the following tax-friendly ways to NRIs:

- Under section 115F, reinvestment of foreign-exchange assets capital gains.

- On long-term securities, getting the benefits of capital gain indexation.

- Sovereign gold bonds and tax-holiday bonds for tax-free interest.

None of the benefits are available for cryptocurrencies. Considering this, against the final tax liability, the returning NRIs in India can only claim 1% TDS credit on VDA on the purchase cost.

Additionally, in Budget 2025, a key amendment was introduced. It talks about the classification of undisclosed virtual digital assets under Section 158B. Under this, if the authorities find unreported crypto holdings from an NRI, a 60% tax with no tax exemptions and deductions will be imposed on them.

So, this was all about the tax exemption missing in the VDA investments. Now, let's know the residency rule change for NRIs in 2026.

Residency Rule Change in 2026 for NRIs

Being an NRI, if you earn more than INR 15,00,000 in India, from April 1, 2026, the 120-day rule may impact your residential status. If this happens, then, along with a flat 30% tax rate on your Indian crypto holding, you need to pay tax on your global crypto holding. Additionally, it increases the tax bill of NRIs with large holding positions on foreign exchanges.

Confused? Let's better understand with an example.

For instance, Mr. A is an Indian tech professional who works overseas. From a consulting contract, he earns INR 20,00,000 and returns to India for 130 days a year. Here, as per the new rule, Mr. A became an Indian resident as he earns more than INR 15,00,000 and stays in India for 120 days.

Considering this, he is liable to pay tax on all his crypto gains. It includes those he earned on a foreign exchange if the transaction routes were done through an Indian exchange.

So, when returning to India, it is advisable to plan your travel days. It will keep our Indian-source crypto activity minimum. Additionally, restructure your portfolio to take advantage of tax treaties.

This was all about the residency rule change for NRIs. Moving further, let's know about the compliance requirements and filing tips for crypto taxation for returning NRIs.

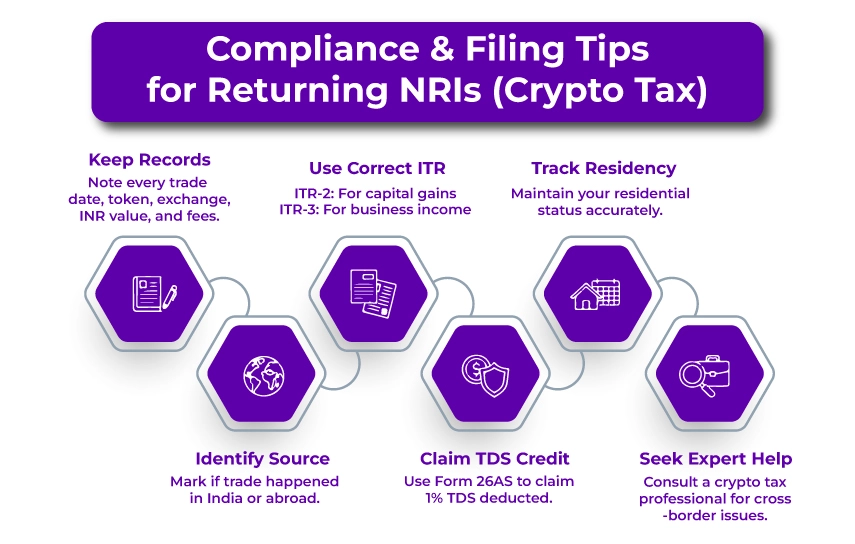

Compliance Requirements and Filing Tips for Returning NRIs

Here are the compliance requirements and filing tips for crypto taxation for returning NRIs in India:

- Have a record of every transaction. It includes noting down the date, quantity, token, used exchanged, value in INR, and fees. Even though you cannot deduct the fees during your ITR filing, at the time of audit you need to mention it.

- Identify your source, i.e., whether the trade happened abroad or on the Indian exchange.

- Fill out the correct ITR form on time. Considering this, use ITR-2 if you have only income from capital gain or ITR-3 if you have business income.

- Using the Form 26AS, when filing the ITR, do not forget to claim your 1% TDS credit.

- Maintain your residential status while staying in India.

- If you have any confusion about cross-border crypto, consider taking the help of a professional who is familiar with it. It further assists you in avoiding unnecessary penalties.

This was all about compliance requirements and filing tips for returning NRIs in India. Moving ahead, let's know about the tax risks and penalties associated with cryptocurrencies.

Tax Risks and Penalties

Non-compliance with cryptocurrency tax rules can lead NRIs to:

- Receiving notice from the income tax official asking for a detailed explanation and documentation.

- Underreporting of VDA or failing to pay dues taxes can result in heavy interest and penalties.

- For willful evasion, under sections 271C and 276B, can lead to fines and imprisonment.

These are the tax risks and penalties linked with non-compliance with cryptocurrency tax rules that NRIs can face.

Final Thoughts

Lastly, the crypto taxation for returning NRIs in India is the same as that for Indian residents. These VDA investments are the financial and prominent innovation that provide borderless transactions to individuals. However, there are some rules set for NRIs who hold these VDA investments. Also, several strict compliance and new penalties are imposed on disclosed income. So, NRIs planning to move back to India should reassess their investment strategies for cryptocurrencies.

Further, if you need expert guidance on NRI tax planning or crypto taxation for returning NRIs in India, connect with Savetaxs. We have a team of professionals who can solve all your queries and assist you in better tax planning.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Section 80C of Income Tax Act - 80C Deduction List

- How to Save Tax in India: Tips of Indian Residents and NRIs

- Complete Guide for Income Tax Audit Under Section 44AB

- Rules for Tax on Gifting in India for NRI: Everything You Need to Know

- Tax Rules for Selling Property in India as an NRI & US Tax Resident

- How Much Gold NRI Can Bring to India in 2025?

- How Should NRIs Manage US Tax On Capital Gains From India?

- All You Need to Know About NRI Home Loans in India

- Your Complete Guide on EPF Withdrawal for NRIs

- A Guide for NRI Buying Agricultural Land in India

- Tax Guide for Working from India for a US Company After Expire of H-1B Visa

- Complete Checklist for NRIs Before and After Leaving India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

-in-the-USA_1762862398.webp)