Tax-free investment options are exceptionally preferred among NRI individuals seeking to maximize their tax returns. Additionally, such options help you reduce your overall tax liability while efficiently building your wealth.

Tax-free investment options are quite advantageous for people in higher income tax brackets and investors with a low-risk appetite who wish to invest in government-backed securities.

In this blog, we explore seven tax-free investments for NRIs to help you make an informed decision.

- NRIs' investments in India offer strong economic growth potential.

- Tax-free investment options offer all three to NRI security, wealth, and compliance with the Indian taxation system.

- As an NRI investing in tax-free investment options in India, it is essential to keep yourself updated with the changing rules.

- Many tax-free investment options in India fall under the EEE (Exempt-Exempt-Exempt) category. This means that the initial investment, interest/returns, and maturity/ withdrawals are all exempt from taxes.

What Attracts NRIs To Invest In Tax-Free Investments In India

As one of the fastest-growing economies in the world, India has attracted significant foreign direct investment over the last few years. From high-potential returns and emotional connection to portfolio diversification and a growing investment landscape, to tax-free investment options, India is the clear choice for NRIs.

NRIs are primarily interested in investing in tax-free options, as they offer an excellent combination of wealth maximization through tax exemptions.

Additionally, given the high TDS rates on NRI income, these tax-free investment options help NRI individuals diversify their portfolios without worrying about high taxation rates.

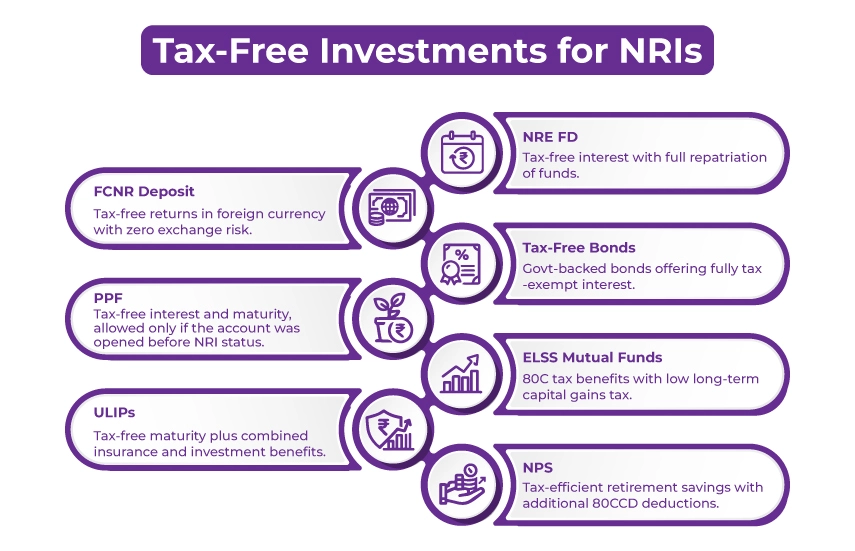

7 Tax-Free Investments For NRIs In India

The following are the seven tax-free investments for NRIs.

1. NRE Fixed Deposits

Non-Resident External (NRE) Fixed Deposits are one of the best tax-free investment options for NRIs in India. These fixed deposits allow NRIs to park their foreign earnings in India and earn tax-free interest.

Key Highlight

- Tax-Free Interest: The significant NRE fixed deposit tax benefit is that the interest earned on these fixed deposits is exempt from tax in India.

- Easy Repatriability: In an NRE fixed deposit, the principal and interest amounts are easily and entirely repatriable. This means there is no limit or restriction on NRIs transferring funds back to their country of residence.

- Flexible Time Limit: NRE fixed deposits have no fixed tenure, unlike standard FDs, hence you can choose a tenure ranging from 1 to 10 years depending on yur financial goal.

2. FCNR Deposits

For NRIs seeking tax-free returns while avoiding currency exchange risks, the Foreign Currency Non-Resident (FCNR) deposit is the solution.

Key Highlights

- Tax-Free Interest: Interest earned on FCNR deposits is tax-free in India.

- Zero Currency Risk: As FCNR is a foreign currency-denominated account, the funds you deposit here are held in foreign currencies such as USD, GBP, EUR, etc. Meaning, there's no currency conversion of funds into INR, which eliminates the risk of currency fluctuations.

- Repatriable: Similar to the NRE account, the funds here are also easily repatriable.

If you are an NRI earning in foreign currency and want to safeguard your foreign earnings from exchange rate fluctuations and get tax-free returns in India, then FCNR deposits must be your first choice.

Get expert assistance for smooth and error-free NRI tax filing.

3. Tax-Free Bonds

As a non-resident Indian, another tax-saving scheme for NRIs is the bonds issued by government-backed organizations, such as NHAI (National Highways Authority of India) or IRFC (Indian Railways Finance Corporation).

If you are a risk-averse investor who is seeking steady and long-term income, then these tax-free bonds are an excellent option for you.

Key Benefits

- Tax-Free Interest: The interest you earn from these government-backed bonds is entirely tax-free from Indian income tax.

- Low Risk: As mentioned, these bonds are backed by the government of India, making them a low-risk, safe investment choice.

- Long-Term: The average tenure of these bonds is 10-20 years, making them an ideal investment option for NRIs looking for long-term, low-risk investments in India.

4. Public Provident Fund (PPF)

Another tax-efficient option for NRIs to invest in India is the Public Provident Fund (PPF). This investment option is quite popular among Indian residents.

However, please note that NRIs are not allowed to open a new PPF account; they can, however, continue contributing to the account they opened before becoming an NRI until maturity.

Key Highlights

- Tax Free Returns: As per section 10(11) of the Income Tax Act, PPF offers tax-free returns on both the interest earned and the maturity proceeds.

- Fixed Rate of Interest: The government sets the PPF rate of interest quarterly, providing stability for investors.

- Maturity Period: Public provident funds have a 15-year lock-in period, but partial withdrawals are allowed after the 6th year.

5. Mutual Funds Through NRE Accounts

In India, some specific mutual funds for NRIs offer tax-free returns. However, they are not completely tax-free; investments made through an Equity Linked Savings Scheme (ELSS) qualify for certain tax deductions under Section 80C.

Key Highlights

- Low Tax Rate: As dividends are no longer tax-exempt in India, capital gains from a mutual fund held for more than 1 year are taxed at a relatively low rate of 10% on gains exceeding Rs 1 lakh.

- High Returns: Such funds are expected to provide market-linked returns that can be much higher than those of fixed-income options.

Stay Compliant with Indian Tax Laws, Claim Deductions, and Avoid Penalties.

6. Unit-Lined Insurance Plans (ULIPs)

ULIPs offer a profitable combination of investment and insurance benefits, making them a dual-purpose option for NRIs. The premiums you paid for ULIPs are eligible for a deduction under Section 80C of the Income Tax Act. Then, the maturity proceeds are tax-free under Section 10(10D) of the IT Act, provided the person has met certain conditions.

Key Highlights

- Zero Tax Maturity Proceeds: You are obligated to pay zero tax on the maturity proceeds if your annual premium does not exceed 10% of the sum assured.

- Flexible: ULIPs combine both debt and equity investments.

- Dual Benefits: This type of investment offers NRIs with life insurance coverage alongside investment returns.

7. National Pension Scheme (NPS)

The NPS (National Pension Scheme) enables NRIs to save for retirement in a tax-efficient manner.

Key Highlights

- Tax Deductions: NRI contributions made to NPS of up to Rs 1.5 lakh are deductible under Section 80C. Moreover, an additional NPS tax benefit for NRIs is the deduction of up to Rs 50,000 under Section 80CCD (1B) of the Income Tax Act.

- Partial Tax Exemption on Maturity: As an NRI, when you withdraw 60% of the corpus at maturity, it is free from taxes.

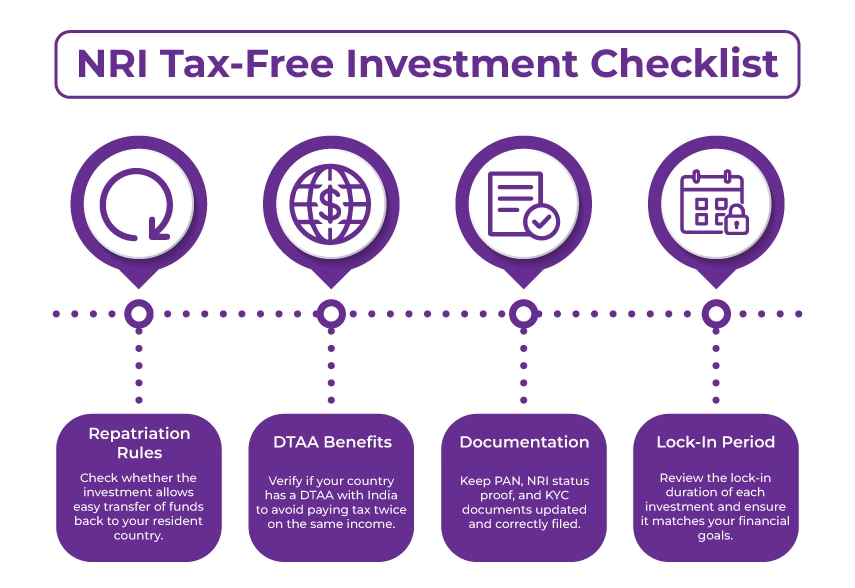

Key Points To Consider While Making Tax-Free Investments In India, As an NRI

The following are a few points to consider when investing in any tax-free option.

- Repatriation Rules: Before investing in any options, be vigilant and ensure the option allows repatriation if needed.

- DTAA (Double Taxation Avoidance Agreement): Before investing, check if your country of residence has a DTAA with India, so that you don't get taxed twice on the same income source.

- Documentation: Please maintain proper documentation, including your PAN, proof of NRI status, and KYC compliance, in the correct order.

- Lock-In Periods: Several tax-free options have lock-in periods, so before investing, check each product's lock-in period and ensure it aligns with your financial goals.

The Bottom Line

Tax-free investment in India for NRIs provides an appropriate balance of growth, security, and compliance with the Indian tax system. Be it your NRE fixed deposits, tax-free bonds, PPF, or any other NRI investment options in India, these products offer NRIs a lucrative opportunity to maximize their wealth without worrying about tax implications.

However, NRIs still face confusion around tax-free investment options in India. To resolve it, you can seek professional NRI taxation expert advice. One such expert for you is Savetaxs. We have been helping NRIs from 90+ countries with their investment options by providing personalized investment strategies based on their financial goals.

Connect with us as we serve our clients 24/7 across all time zones.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Difference Between Repatriable Vs. Non-Repatriable Investments for NRIs

- NRI Purchasing Property In India From The USA - A Complete Guide

- Impact of FEMA Rules on NRI Mutual Fund Investments

- Advance Investment Options for NRIs: AIFs, REITs & Bonds

- Mistakes NRIs Make While Investing in India

- Things NRIs Should Consider While Investing in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1764918370.webp)