An NRI fixed deposit is a type of savings account that Non-resident Indians open in India. It is one of the popular investment choices among NRIs seeking a secure and safe way to increase their savings. The fixed deposits in India provide high returns to NRIs. Additionally, with the fastest-developing economies among the NRIs, India has become a favorable option for investment for fixed deposits.

However, NRIs often make mistakes when investing in fixed deposits. This further impacts their financial planning and returns. Considering this, to help you better understand NRI fixed deposits in India, we will provide you with a comprehensive overview in this blog. So read on and gather all the details.

- NRI fixed deposits are one of the most favorable investment options for NRIs in India.

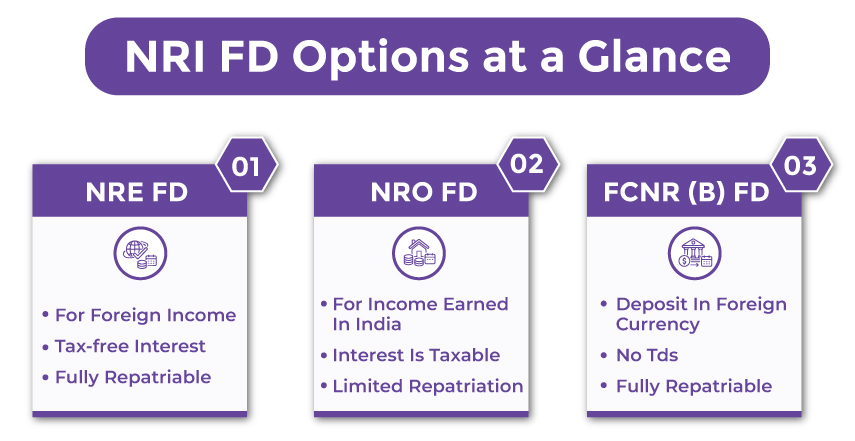

- There are three types of NRI fixed deposit accounts in India, i.e., NRE, NRO, and FCNR (B) accounts.

- The interest earned on NRE and FCNR (B) FDs is tax-free in India. However, the interest earned on NRO accounts is taxable in India.

- Funds of NRE and FCNR (B) accounts are fully repatriable. On the other hand, in a financial year, USD 1 million can be repatriated from the NRO account.

- To open an NRI fixed deposit account in India, first, you need to have either an NRE or an NRO account.

Why NRIs Prefer Fixed Deposits in India- Key Benefits

NRI fixed deposits are an attractive investment option in India and offer several benefits. Here are some of the key advantages of these accounts to NRIs:

- NRI fixed deposits are a safe investment option in India as banks back them. Considering this, in case something goes wrong with the bank, up to a certain amount, the government of India insures deposits. For many NRI investors, this safety net offers peace of mind.

- Another benefit of FDs is that they provide guaranteed returns. Unlike other investment options, which go up and down, in this, you get interest at a fixed rate. During the deposits, you have the idea of how much you will earn from this deposit. Further, for financial planning, this predictability is very useful.

- In terms of how long you want your investments, FDs provide flexibility to you. In this, you get the option to choose the investment period, i.e., from a few months to several years. Usually, longer terms provide higher interest rates. Considering this, if you keep your money for a longer time, you get maximum returns.

- Additionally, one of the key benefits of NRI fixed deposits is the tax benefits. So, being an NRI, the interest you earn from your Indian FDs is tax-free. However, it is vital to note that, on this interest, you might need to pay taxes in your current residence country.

- Further, FDs are simple to understand. In this investment, you do not need to track down the market changes or make complex decisions. This makes them accessible to people who do not have expertise or time to manage the complex investments.

These were some of the key benefits of NRI fixed deposits in India. Moving ahead, let's know the different types of these.

Types of NRI Fixed Deposits

There are three different types of NRI fixed deposits you can choose from:

- NRE FD: NRE or Non-Resident External Fixed Deposits help NRIs to earn interest on their foreign earnings. These deposits are completely repatriable. It means that you can transfer the principal and interest back to your current resident country. Additionally, the interest you earn from your NRE Deposits is tax-free.

- NRO FD: NRO or Non-Resident Ordinary Fixed Deposits, NRIs can earn interest on the income they earned in India. You can open this account jointly with an NRI or a resident Indian. However, the interest earned by you on these deposits is taxable in India.

- FCNR (B) FD: FCNR (B) or Foreign Currency Non-Resident (B) Deposits allow you to open and hold a fixed deposit in one of the permitted foreign currencies. In India, FCNR (B) deposits are exempt from TDS. Additionally, the principal and interest are freely repatriable.

These were the different NRI fixed deposit accounts that you can opt for as per your financial goals. Moving further, let's know the interest rates on NRI fixed deposits offered by the best banks for NRI fixed deposits in India.

Connect with Savetaxs and simply open your NRE/ NRO account without issues in a few steps.

Interest Rates on NRI Fixed Deposits

The table below shows the interest rates on NRI fixed deposits by account type and the best banks for NRI fixed deposits in India.

| Account Type | Bank | Tenure | Rate of Return (p.a.) |

|---|---|---|---|

| NRE Fixed Deposits Rates | HDFC Bank | 1 year to 10 years | 6.60% - 7.20% |

| SBI Bank | 1 year to 10 years | 6.80% - 7.10% | |

| Axix Bank | 1 year to 10 years | 6.70% - 7.10% | |

| Federal Bank | 1 year to above 5 years | 6.80% - 7.40% | |

| NRO Fixed Deposits Rates | HDFC Bank | 7 days to 10 years | 3.00% - 7.20% |

| SBI Bank | 7 days to 10 years | 3.00% - 7.10% | |

| Axis Bank | 7 days to 10 years | 3.00% - 7.10% | |

| Federal Bank | 7 days to above 5 years | 3.00% - 7.40% | |

| FCNR (B) Fixed Deposit Rates in US Dollar | HDFC Bank | 1 year to 5 years | 3.90% - 5.50% |

| SBI Bank | 1 year to 5 years | 3.80% - 5.00% | |

| Axis Bank | 1 year to 5 years | 4.10% - 5.60% | |

| Federal Bank | 1 year to 5 years | 3.90% to 5.25% |

These were the best banks for NRI fixed deposits in India, and the interest rate they offer on the investment. Moving ahead, let's know the taxation rules for NRI fixed deposits in India.

Taxation Rules for NRI Fixed Deposits in India- NRE vs NRO vs FCNR (B)

When it comes to taxation, NRO and NRE FDs are treated differently. The interest earned from the NRE and FCNR (B) FDs is tax-free in India. Considering this, as mentioned above, this makes them an attractive option for NRIs seeking to increase their returns.

On the other hand, tax at source (TDS) is deducted by your bank on the interest you earn from your NRO FDs. The current rate of TDS for NRIs is 30%. However, the TDS rate can be lower if your residency country has signed a tax treaty, i.e., DTAA (Double Taxation Avoidance Agreement) with India. It helps you avoid paying taxes twice on the same income.

Further, it is vital to note that, even if your interest income is tax-free in India, you might be required to pay taxes on it in the country where you currently reside. So, to avoid any tax obligations and legal issues, it is advisable to consult a tax advisor who can help you understand the tax laws of India and other countries.

Now, let's know the NRI FD repatriation rules.

NRI FD Repatriation Rules- What NRIs Should Know

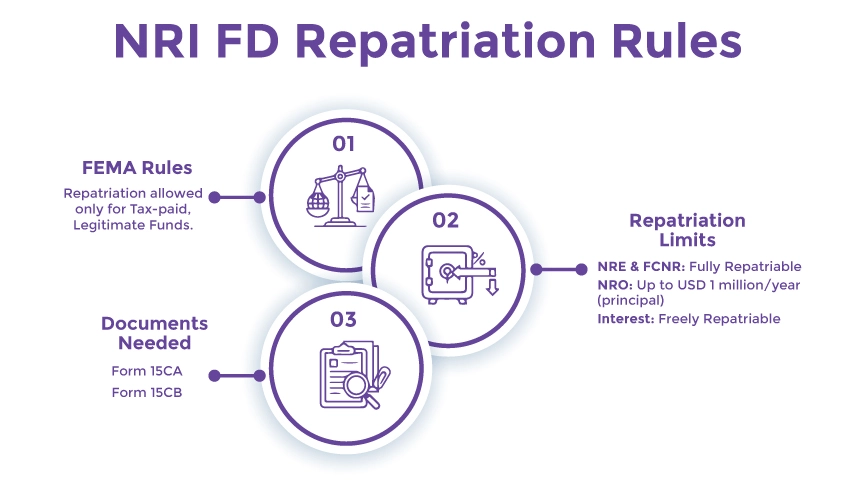

The NRI FD repatriation rules are primarily governed by the Foreign Exchange Management Act (FEMA). These rules are introduced to safeguard both the tax and legal status of funds moving in and out of India. Further, let's know the NRI FD repatriation rules that NRIs should know.

- FEMA Guidelines: As mentioned above, the NRI repatriation process is governed by FEMA. It ensures that only taxed and legitimate funds are allowed out of India. Considering this, FEMA establishes strict rules on when and how funds can be transferred from India to an NRI's overseas account.

- Repatriation Limit: NRE and FCNR (B) FDs are fully repatriable without any limit restrictions. However, from the NRO accounts, you can repatriate up to USD 1 million per financial year. Here, the amount limit applies to the principal amount, not including your earned interest. Considering this, you can repatriate your earned interest separately. Further, the USD 1 million limit covers income from salary, rent, dividends, pensions, and profits from the sale of immovable property.

- Procedural Requirements: To repatriate funds from your NRO account, you need to submit several documents and follow a proper procedure. It also includes tax clearances. Considering this, NRIs should complete forms such as Form 15CA and Form 15CB. These forms confirm the payment of imposed taxes.

So, this was all about the NRI FD repatriation rules. Moving ahead, let's know the documents NRIs need to submit to open a fixed deposit account in India.

Take control of your investment options with Savetaxs and unlock the full potential of your returns.

Documents Required to Open an NRI Fixed Deposit

Here is the list of documents required to open an NRI fixed deposit account in India:

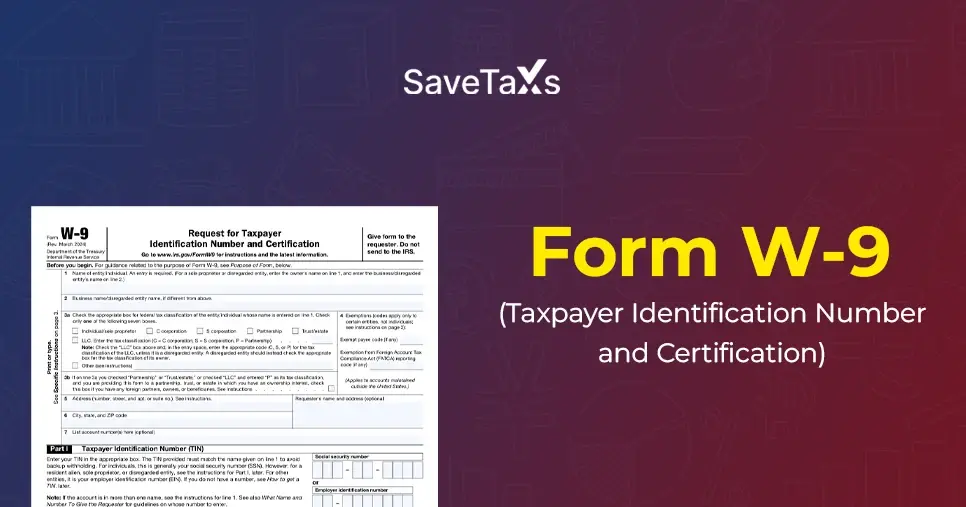

- PAN card or Form 60

- Proof of NRI status (Residence/ employment visa or residence/work permit)

- Valid passport copy

- Indian and abroad address proof

- Recent passport-size colored photograph

- Overseas bank statement

- Cancelled cheque/ passbook

These were the documents that you generally required to open an NRI fixed deposit account in India. Moving on, let's see how you can open this account in India.

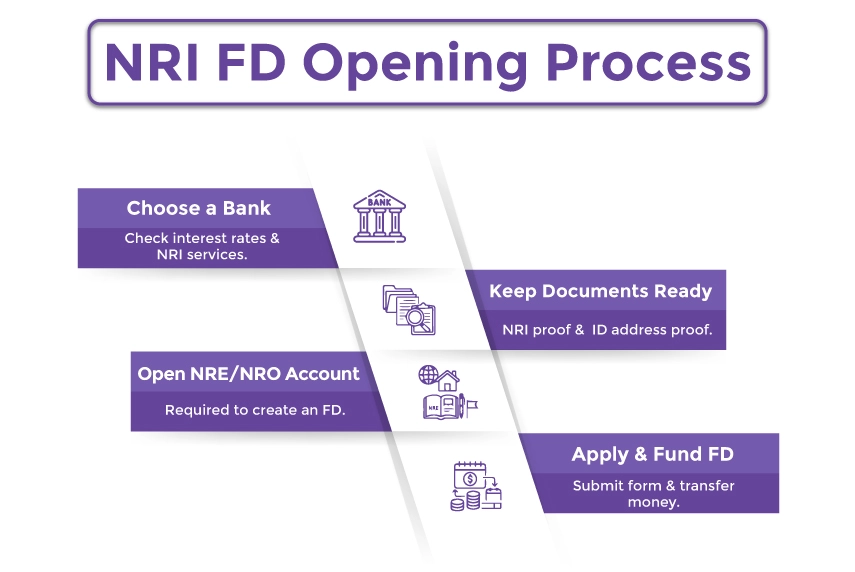

How to Open an NRI Fixed Deposit in India?

Opening an NRI fixed deposit account in India is straightforward. Here is how you can do so:

- Step 1: Choose a bank account where you want to open your fixed deposit account. While choosing a bank, consider its interest rate and reputation. Additionally, several banks in India offer special NRI services, further simplifying the process.

- Step 2: After that, gather the requested documents. It includes proof of your NRI status, address proof in India, and the country where you currently reside, as well as other documents. Further, for better clarification, it is advisable to check the document requirements of your chosen bank.

- Step 3: Before you open a fixed deposit account, you need to have an NRE or NRO savings account, as per your fund source. If you do not have any of these accounts, you need to open one first for a fixed deposit.

- Step 4: Once you open a savings account, you are eligible to fill out the fixed deposit application form. Further, you can do so online; several banks in India offer online banking. Once your application is approved, you can open your FD account by transferring funds from your NRO or NRE account.

This is how you can open an NRI fixed deposit account in India by following the account mentioned earlier.

Final Thoughts

Lastly, NRI fixed deposits are a great way for NRIs to grow and save their money in India. These investments offer guaranteed returns, safety, and tax benefits to NRI investors. However, like any financial decision, it is vital to consider your financial situation and goals.

Further, if you are still confused and seeking a liable financial planner who has experience in NRI investments, connect with Savetaxs. We have a team of professionals who can help you make the right investment choices in India to deliver higher returns.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Vikram brings in more than ten years of experience in US Taxation. He is also an EA mentor and instructor. The expertise of Mr. Agrawal includes accounting, bookkeeping, Tax preparation, small business tax, personal tax planning, income tax, financial advisory services, and retirement planning.

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- Everything You Need to Know About FCNR (B) Account

- A Guide to NRO (Non-Resident Ordinary) Accounts

- Overseas Bank Account for NRIs

- How To Transfer Money From NRO Account to NRE Account

- Why Should an NRI Convert Their Resident Savings Account to an NRO Account?

- Top 5 NRI Banks for NRE account in India for 2025

- When Does an NRIs NRE Account Lose Tax-Free Status in India?

- Everything You Need to Know About UPI for NRI

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

-plan_1761282887.webp)

(i)-Of-The-Income-Tax-Act_1756812791.webp)

_1767333184.png)