- Introduction to REIT Investment for NRIs

- Benefits of Investing in REITs for NRIs

- Different Types of REITs to Invest in India

- Things NRIs Should Consider Before Investing in REITs in India

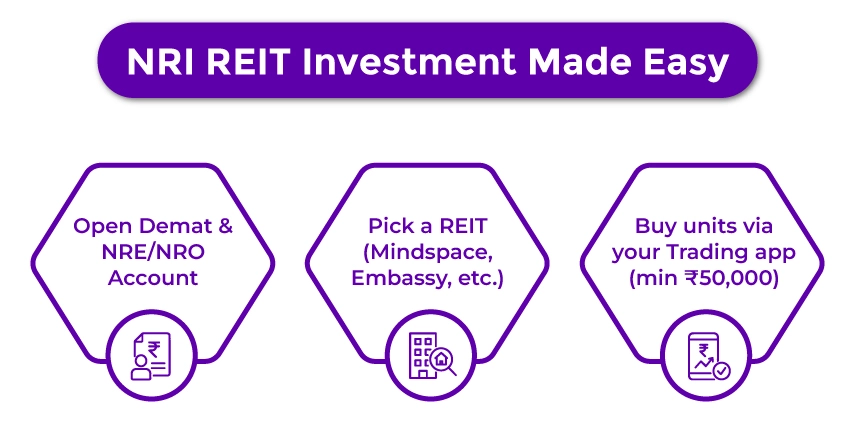

- How NRIs Can Invest in REITs in India?

- Taxation of REITs for NRIs- Dividend, Interest & Capital Gains

- Final Thoughts

For NRIs who wish to invest in India's real estate market, navigating the process is quite complex. It is because of property management, legalities, and market changes. In this, Real Estate Investment Trusts (REITs) offer a lucrative and straightforward option for investing in residential and commercial real estate with minimal issues.

REITs provide an effective way to capitalize on India's booming real estate market. Further, NRIs can avoid the obstacles of direct property ownership while still using it to increase their wealth. Read on for your complete guide to investing in REITs as an NRI in India.

- Investing in REITs as an NRI offers you easy, low-risk real investment in India, with currency benefits, and without your physical presence.

- Indian REITs are regulated by the Securities and Exchange Board of India (SEBI).

- Returns are provided through capital appreciation of underlying assets and rental income distributed as dividends.

- To fund their investments, NRIs should use an NRE or NRO account.

- REITs are taxable as per the income type received by the NRI.

Introduction to REIT Investment for NRIs

Real Estate Investment Trusts (REITs) are companies that own, manage, acquire, or finance income-generating real estate across several sectors. It includes industrial, commercial, and residential properties. Investing in REITs as an NRI provides you with the benefits of enjoying the ownership of real estate without the requirement of buying physical properties.

Still confused? Here is why REITs are an attractive investment option for NRIs in India:

- Unlike direct real estate investment, in REITs, you need less capital. This makes it simple for NRIs to gain exposure to the thriving real estate sector of India. Further, it offers access to high-value properties without the requirement for a large upfront investment. This makes the real estate more accessible to NRI retail investors.

- REITs are traded on the stock exchanges. This further provides liquidity to the investors that is not present in traditional real estate investments. Considering this, you can simply sell or buy REIT stocks. Furher, compared to physical real estate, this makes them a more flexible investment option.

- REITs offer a diversified portfolio to investors across several properties and regions. It reduces the risk associated with the investment in a single property.

- Securities and Exchange Board of India (SEBI) regulates the REITs in India, certifying protection and transparency to investors.

- Additionally, REITs need to distribute a minimum of 90% of their net distributable cash flow to shareholders. This certifies that from the rental income produced by the underlying properties of real estate, investors get regular dividends.

This was all about REITs and why these are the best investment options for NRIs in India. Moving ahead, let's look at the benefits of investing in REITS for NRIs in India.

Benefits of Investing in REITs for NRIs

Here is the list of key benefits of investing in REITs as an NRI:

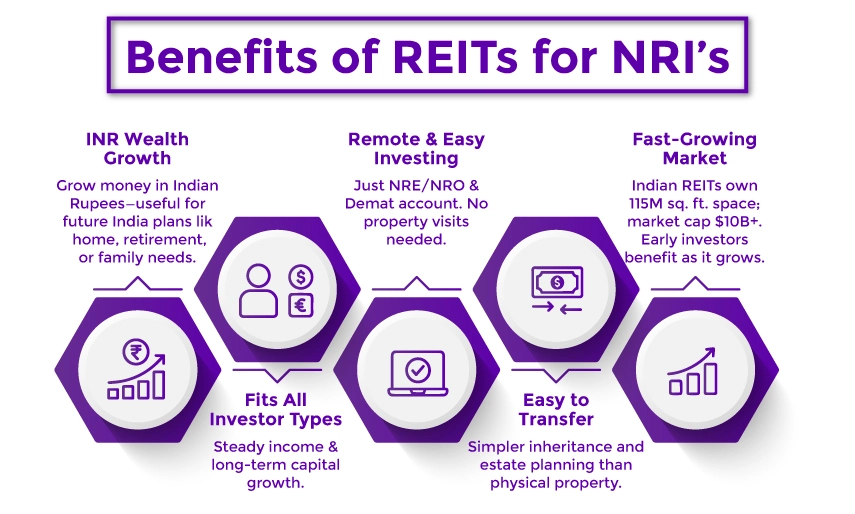

- Currency Benefits for Long-Term Objectives: As mentioned, REITs help you to grow and build your wealth in Indian rupees. It is immensely beneficial if you plan to move back to India. Additionally, if you have future expenditures in the country, like property purchase, family assistance, or retirement.

- Perfect for All Types of Investors: REITs are perfect for all types of investors. Considering this, for NRIs looking for consistent returns, a steady income stream is a good option. Further, for growth-oriented investors who are seeking long-term capital gains, capital appreciation is the right choice.

- No Need for Physical Presence: NRIs, with the comfort of their home, can simply open an NRO/NRE and a demat account to invest in REITs. This makes REITs a convenient investment option for NRIs as they do not need to visit India or do a physical inspection of the property.

- Simplicity and Estate Planning: In comparison to physical property, REITs can be transferred with inherited, ease or included in a will. This further provides legacy planning and clarity.

- Evolving Market: In India, the REIT market is still developing, and assets are coming onto the market. Considering this, as the market matures and expands, early investors might receive benefits from long-term growth. For instance, now Indian REITs own 115 million sq.

- feet of retail space and commercial space. Further, combining the market capitalization, this exceeds $10 billion.

Hence, investing in REITs as an NRI provides you with a blend of real estate benefits with convenient stock market investing options. This makes it a perfect option for NRIs looking for income-fetching, safe, and professional exposure to the real estate market of India.

Moving further, let's look at the different types of REITs to invest in India.

Connect with Savetaxs and simplify your NRI tax journey.

Different Types of REITs to Invest in India

In India, there are three main types of REIT investments, each of which fulfills different investment preferences.

Equity REITs

- It is the most common type of REIT.

- These are owned and manage income-generating real estate, such as shopping malls, office buildings, and hotels.

- Generally, the revenue rather than property sales is derived from rental income.

Mortgage REITs (mREITs)

- Primarily, rather than owning physical properties, it offers financing for real estate projects.

- Income is earned through interest payments on loans and mortgages.

- Sensitive towards market fluctuations and interest rate changes.

Hybrid REITs

- It is a combination of both mortgage and equity REITs.

- Diversified income sources from interest earnings and rental yields.

- Between financing and property ownership, there is a balance of risk exposure.

These were the different types of REIT investments available for NRIs in India. Further, let's know the key players in the REIT market in India.

Key Investment Players in the REIT Market in India

With significant growth in the REIT market in India, several key investment players have established their names. These are as follows:

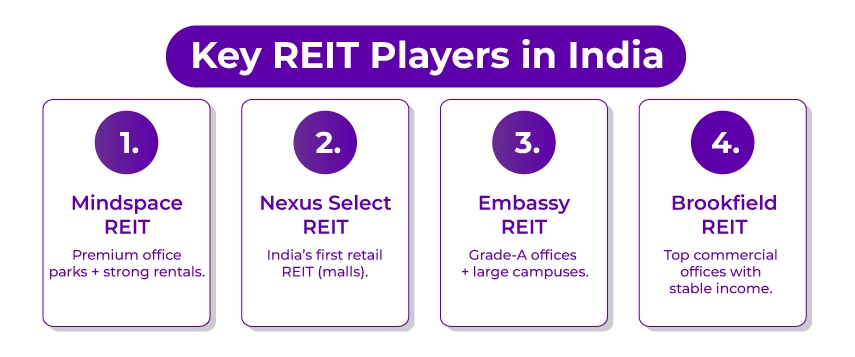

- Mindspace Business Parks REIT: This REIT develops and owns premium commercial office assets and integrated business parks in the main markets of India. Mindspace Business Parks focuses on high-quality office space. It offers modern amenities and infrastructure to domestic and global corporations. Additionally, certifies robust rental income streams.

- Nexus Select REIT: It is the first retail-focused REIT in India. Across prime urban locations, it invests in high-quality real estate assets. It operates and owns mixed-use retail spaces, shopping malls, targeting steady rental income from a wide range of rental tenants and consumers.

- Embassy Office Parks REIT: Embassy Office Parks REIT is the first listed REIT in India. It specializes in commercial real estate and premium office parks. It manages and owns Grade-A office spaces, large-scale business campuses, and caters to blue-chip and multinational tenants in big Indian cities.

- Brookfield India REIT: It is a publicly listed REIT focused on operating and owning top-quality, income-generating commercial office space across the main cities of India. The main targets of it are Grade-A office assets, providing opportunities for long-term capital gains and stable cash flow.

These were the key investment players in the India REIT market. Now, moving ahead, let's know what the things you should consider are while investing in REITs as an NRI in India.

Plan your taxes today with Savetaxs and maximize your tax refunds.

Things NRIs Should Consider Before Investing in REITs in India

Here are the following things that NRIs should consider before investing in REITs in India:

- Evaluate the real estate and economic conditions to know the potential rewards and risks of REIT investment.

- Assess the property types in which the REIT invests, such as industrial, retail, office, and specialised sectors like hospitality or healthcare. Additionally, consider their stability and growth prospects.

- Analyse the financial performance of the REIT. It includes dividends, revenue, funds from operations (FFO), liquidity, and debt levels to assess the growth potential, ability, and stability to get consistent returns.

- To mitigate risks and ensure diversification linked with fluctuations of the local market or regional economic downturns, understand the geographic sites of the properties owned by REITs.

- Have information about the tax implications of REIT investments. It includes the potential tax benefits of REITs, a pass-through tax structure, and any tax consequences associated with Capital Gains and dividends.

- To determine the income sustainability and potential, consider the payout ratio and dividend yield of the REIT. Additionally, also know about its consistency and dividend growth.

- To know whether REITs match your income-generation goals and portfolio diversification, understand your investment objectives and risk tolerance. Further, consider the volatility in REIT dividends and prices.

These were some of the things that, while investing in REITs as an NRI, you should consider. Moving further, let's know how you can invest in REITs in India.

How NRIs Can Invest in REITs in India?

NRIs can simply invest in REITs via an Initial Public Offering (IPO) and get exposure to real estate without holding physical property. Here is how you can do so:

- To open a Demat account, choose a SEBI-registered broker and link this account with an NRE or NRO account.

- According to your financial goals and preferences, select your REIT from the list, such as Mindspace, Brookfield, or Embassy.

- From your trading platform, buy the REIT units. Further, according to the new investment rules, you can invest a minimum of INR 50,000 in REITs.

This is how NRIs can invest in REITs in India. Moving ahead, let's know the taxation of REITs for NRIs.

Taxation of REITs for NRIs- Dividend, Interest & Capital Gains

Income from REITs includes dividends, interest, and other distributions. Each of them has different tax treatments. Additionally, capital gains earned from the sale of REITs are taxed as on the holding period. Now, let's know how NRIs are taxed on REITs in India.

| Income Distribution | Applicable Tax Rates |

|---|---|

| Interest Income | Taxed at 5% with TDS applied |

| Qualified Dividend Income | Not taxable |

| Disqualified Dividend Income | Taxed at individual rates with TDS applied |

| Other Income Taxable in the Scheme | Not taxable |

| Other Distributions | Amounts more than the issue price are taxable |

| Capital Gains Earned from Sale of Units |

|

This is how NRIs are taxed on their REIT investments in India.

Final Thoughts

Lastly, investing in REITs as an NRI provides you with a high-reward, low-risk entry into the real estate market of India without the issue of acquiring a physical property. Also, the ease of entry and exit of REITs is flexible. This makes them a perfect option for individuals who are looking for a safe real estate investment.

Further, if you are looking for someone to help you navigate the complexities of cross-border investment, connect with Savetaxs. Our experts will help you make informed financial decisions while taking into account your tax obligations in India.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Vikram brings in more than ten years of experience in US Taxation. He is also an EA mentor and instructor. The expertise of Mr. Agrawal includes accounting, bookkeeping, Tax preparation, small business tax, personal tax planning, income tax, financial advisory services, and retirement planning.

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- Registering a Will in India: Key Tips for NRIs

- NRI Succession Certificate: A Guide to Inheriting Property

- Top 5 Problems NRI Face While Investing In India

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- NRI Investment in SGrBs Through IFSC

- A Complete Guide to Investing in Gold for NRI in India

- Sending Money to India from Abroad: A Complete Guide for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1754392689.webp)