After your income tax return has been successfully filed, the Income Tax Department generates an ITR-V acknowledgment. This document confirms your ITR filing. However, the ITR-V acknowledgment is a password-protected PDF, which confuses many first-time ITR filers about how to open it and what the password is.

In this blog, we will be telling you exactly how you can open your ITR-V PDF file through the ITR PDF password.

- The password to open the ITR acknowledgment verification documents is the combination of your PAN number in lowercase and your date of birth in DDMMYYYY format.

- To verify your income tax return, you must either e-verify or physically verify it within 30 days of filing your return.

- Taxpayers have two options to verify their return: either electronically or offline by dispatching a manually signed copy of the verification form to the central processing center (CPC Bengaluru).

- You can download your ITR V acknowledgment PDF from the official income tax e-filing website.

What Is The ITR PDF Password And Its Format?

A password ensures that no one other than you can access your information; hence, a strong password is the first line of defense against unauthorized or illegal access. Important financial government documents such as PAN, Form 16, ITR, etc., are protected with a strong password, ensuring your core information isn't accessible to unauthorized users.

Once you have filed your ITR return in India, you can download the acknowledgment form (ITR-V) as a PDF. The downloaded PDF is protected by a password, ensuring only its authorized user can access the information it holds.

The PDF password format for the ITR V acknowledgment PDF is the combination of your PAN number in lowercase and your date of birth in DDMMYYYY format. Additionally, you will need Adobe Reader 8.0 to open this PDF file.

ITR PDF Password Format Example

If you are still diabolical about the PDF password format, here is how it is.

Suppose your PAN is BLOFS0000A and your DOB is January 19, 1995. With this information, your password to open the ITR V PDF document file will be blofs0000a19011995.

How To Open The ITR V Acknowledgment PDF File With a Password.

The ITR V acknowledgment PDF file is sent by the Income Tax department via email and can be opened by entering a password. You also have the option to download this file from the official website of the Income Tax Department. The following are ways to open the PDF file with a password.

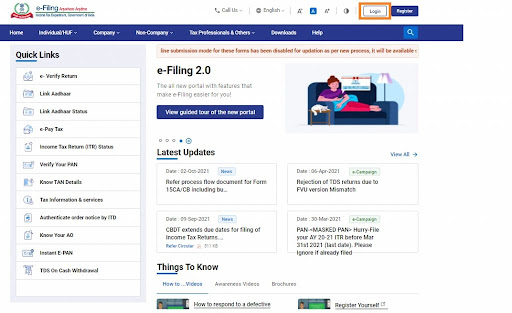

Step 1: Log in to the income tax e-filing website.

Step 2: Click on the "e-file" tab. From there, select the "Income tax returns" and "view filed returns" option to see your e-filed tax return.

_1768297850.png)

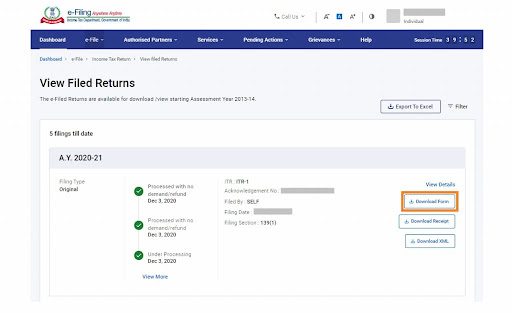

Step 3: To download the acknowledgment ITR-V file, click the "Download ITR V Form" button for the relevant assessment year.

Step 4: The acknowledgment form will then be downloaded. However, the information contained in the document is confidential, so it is password-protected.

Step 5: To open this PDF, enter the password in the exact format discussed above. Ensure that there are no spaces while entering your PDF password combination. The PDF file will open.

What Is an ITR V Acknowledgement Form?

The ITR V is the "income tax return verification". It is a verification document rolled out by the Indian Income Tax Department that confirms your ITR filing. When an individual files their ITR online without a digital signature, the ITR department issues an ITR V form as proof that the return was submitted successfully.

One thing to ensure is that this document needs to be verified either electronically (e-verification) or physically (by posting it to the CPC Bangalore (Centered Processing Center). Your return will be marked incomplete if verification isn't completed. The ITR V document has all your personal administrative information, such as your PAN, name, assessment year, ITR submission date, and more.

In case of offline mode, you need to send a copy of your ITR-V form, signed, to the concerned center. For an online e-verification method, there are five ways to verify the return successfully. Those five e-verification methods include

- Aadhaar-based OTP

- Net Banking

- Via Bank Account

- By Visiting Your Bank ATMs

- Through Your Demat Account

Key Things To Consider Before Sending the ITR V Acknowledgment Form.

Once you have downloaded the ITR-V, you can send it to the CPC Bangalore within 30 days of filing your ITR return to verify it offline. But before doing so, there are a few things to consider to ensure everything is in compliance.

- Do not print any watermarks in the ITR acknowledgment form. Also, the form must be printed in black ink.

- You must get the form printed on A4-sized paper,

- The form must be signed in blue ink.

- In a case where an individual is submitting both their original and revised returns for verification, please ensure that you do not print them back-to-back on one paper. Print the ITR acknowledgment form on two separate A4 sheets of paper.

- Please do not write anything on the back of the form.

- Do not send any additional documents, forms, annexures, or cover letters along with the verification form.

- In case of excess TDS deduction or if you have paid advance tax in that financial year, the amount that needs to be refunded to you must be mentioned on your ITR-V form.

NRIs, your ITR filing process in India has been simplified than ever with Savetaxs.

The Bottom Line

Using the information above and the clear steps, you can easily download your ITR PDF document and open it. Just ensure you verify your ITR return on time, or else it will be marked incomplete.

Additionally, if you need any professional guidance on downloading your ITR V PDF in compliance, Savetaxs can help you with it. Our experts will ensure that your NRI ITR is verified successfully and in compliance with the Income Tax Department rules and regulations.

Connect with us as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- What is Form 16 and Form 16 Password?

- Understanding Power Of Attorney & Tax Compliance For NRIs

- Income Tax Return (ITR) Processing Time

- Income Tax Act 2025: Key Changes, Features, Provisions & Objectives Explained

- Income Tax Act 1961: Chapters, Objectives, Features, Provisions

- Understanding your NRI status and Its impact

- How Should NRIs Report Crypto in Indian ITR?

- What is the Procedure of TDS Challan Correction?

- Income Tax Helpline: Customer Care Number and Email ID

- Cost Inflation Index for FY 2025-26: Index Table, Meaning, Calculation

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768304909.webp)

_1766644785.png)

_1764137986.webp)

_1759750925.webp)