- Myth 1: NRIs cannot invest in Indian Mutual Funds

- Myth 2: NRIs Cannot Buy Real Estate in India

- Myth 3: NRE Accounts Offer Tax-Free Returns Forever

- Myth 4: NRIs Can Invest In Any Investment Option In India

- Myth 5: NRIs Cannot Invest in Indian Stocks

- Myth 6: Best Investment For NRIs Is Real Estate

- Myth 7: NRIs Cannot Invest in Indian FDs

- Myth 8: NRIs Pay Taxes Twice

- The Bottom Line

NRIs' investment to your money is what meditation is to your mind. Both ensure discipline, fitness, and endurance in longer runs.

Starting from the basics, we know that investing essentially means keeping a chunk of money in a financial instrument, and over time, either your money will grow or you'll be at a loss. Now, as an NRI, investing in India comes with many complications and hurdles, leaving you with a sense of uncertainty and many questions.

So, in this blog, we will debunk common NRI investment myths that might give you some relief.

- As an NRI, you have access to a lot of investment policies in India, such as mutual funds, stocks, FDs, real estate, and bonds.

- There are only a few areas where NRIs cannot invest, such as agricultural land, plantations, a few small savings schemes, and new SGB issues.

- Almost every investment process for NRIs has been digitized. Be it mutual funds KYC, opening of a PIS account for stuck, or even buying a property using a Power of Attorney, everything can be done online without you being physically present.

- Misunderstandings about NRI tax filing, real estate rules, and mutual fund access stem from sheer ignorance, leading to compliance issues. Hence, NRIs need to stay updated with FEMA and RBI rules to ensure smooth investing.

Myth 1: NRIs cannot invest in Indian Mutual Funds

Non-resident Indians are allowed to invest in Indian mutual funds in accordance with the Foreign Account Tax Compliance Act and the Common Reporting Standards (CRS). This means that as long as you are complying with the regulations set by these authorities, you can diversify your NRI investment portfolio in India with mutual funds.

Hence, the myth is debunked. As an NRI, you can easily invest in an Indian mutual fund through your NRE or NRO accounts. Additionally, the entire process of uploading documents, KYC verification, bank linking, and starting SIPs can now be completed online, which makes investing even easier.

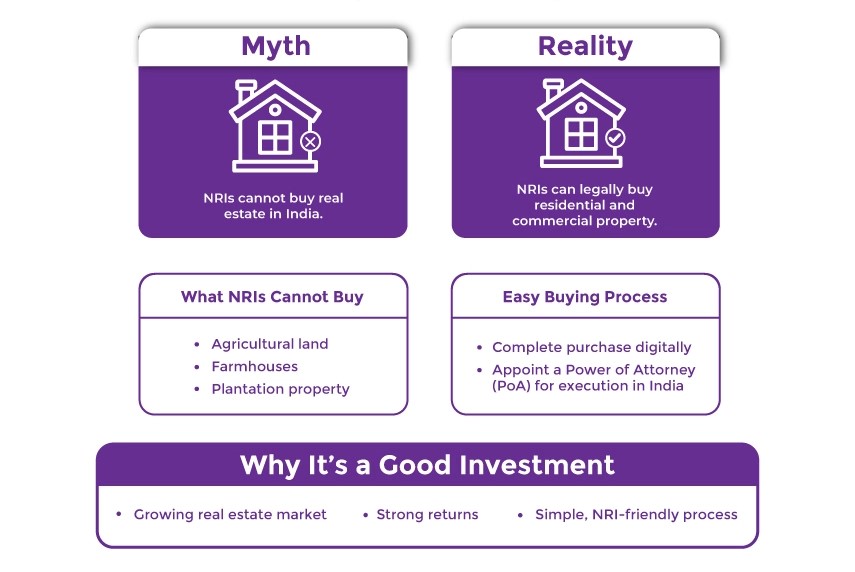

Myth 2: NRIs Cannot Buy Real Estate in India

The truth is, NRIs are legally permitted to buy residential and commercial property in India. However, the only thing to keep in mind is that as an NRI, you cannot purchase agricultural land, farmhouses, or plantations.

In fact, these days the entire buying process has become much easier, as NRIs can complete the process digitally, and you can even appoint a Power of Attorney to execute the sale in India on your behalf.

In a nutshell, investing in the Indian real estate market is a viable and lucrative option for NRIs.

You got all three and a lot more here at Savetaxs. File your NRI ITR with the top CAs in India.

Myth 3: NRE Accounts Offer Tax-Free Returns Forever

This is one of the most common NRI investment myths. Your NRE account returns in India only remain tax-free as long as you maintain your NRI residential status. Once you spend enough days in India to be classified as a resident, the NRE account that you have been using as an NRI must be re-designated to a resident account, and then the interest you earn becomes taxable.

Many NRIs keep on using their NRE account unknowingly even after returning to India, which raises compliance issues and penalties.

Additionally, please note that NRE accounts offer tax-free returns only in India. It is essential to check the taxation laws of your country of residence as well, because some countries tax the global income of their residents. Meaning, although you might not be paying taxes on NRE account returns in India, you could still be obligated to pay taxes on those returns in your country of residence.

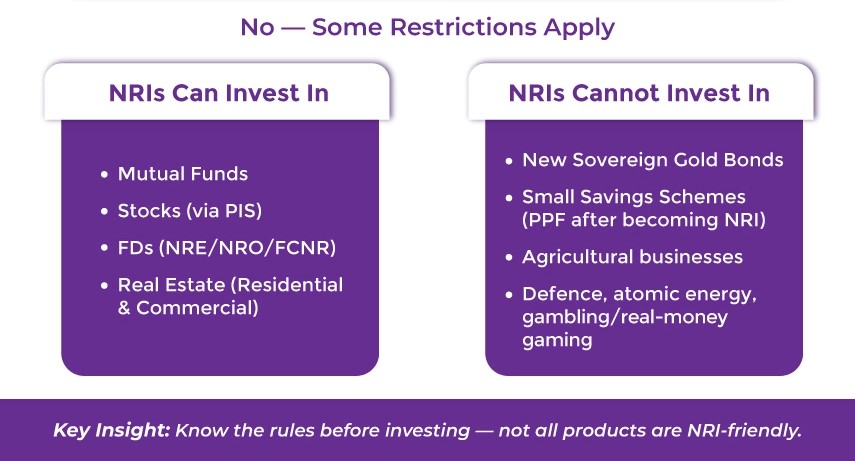

Myth 4: NRIs Can Invest In Any Investment Option In India

Well, that's entirely true. India offers a wide range of investment options for NRIs, but not all investment products are accessible to them.

NRIs cannot invest in new Sovereign Gold Bond issues and specific government savings schemes. Additionally, they cannot invest in particular sectors, such as defense, atomic energy, real-money gaming, or agricultural businesses.

Henceforth, understanding the regulations governing NRI investment options is important for making informed investment decisions.

Myth 5: NRIs Cannot Invest in Indian Stocks

A lot of NRIs have this misconception that they cannot trade in the Indian stock market unless they are physically present in India. This is entirely incorrect. Non-resident Indians are allowed to invest in Indian stocks directly via using their NRE/NRO Demat + Trading account.

Once you have opened a trading or NRI Demat account with a SEBI-registered broker, you can conveniently sell or buy shares listed on the Indian stock exchange.

But please ensure that certain investment restrictions do exist, as NRIs are not allowed to engage in intraday trading, commodity trading, and so on.

Additionally, as an NRI, a PIS-enabled account is mandatory only when you trade listed equity shares on a repatriable basis.

Myth 6: Best Investment For NRIs Is Real Estate

Investing in real estate is not the best option for everyone; it comes down to two things: your financial goals and personal preferences.

Although real estate is a lucrative investment for NRIs, it is crucial not to blindly follow what other NRI investors are doing. You should evaluate the legal checks, return on investment, tax compliance, liquidity, maintenance costs, and other related factors before making any real estate investment decision.

If we compare the real estate market with diversified assets like FDs, mutual funds, and global equities, diversified assets offer better diversification, liquidity, and clarity to individuals.

Myth 7: NRIs Cannot Invest in Indian FDs

Fixed deposit schemes such as NRE Fixed Deposit, NRO Fixed Deposit, and FCNR Fixed Deposit are available for NRIs.

These fixed deposits offer relatively reasonable interest rates and are also a safe investment option for NRIs with a low risk appetite. However, you must understand the features and benefits of these fixed deposits before investing in one.

Savetax's financial planning services include cash flow analysis, wealth & insurance planning.

Myth 8: NRIs Pay Taxes Twice

The double taxation avoidance agreement (DTAA) provides NRIs with relief and ensures they are not taxed twice on the same income source.

For example, if you are paying income tax in India on income generated here, you can claim relief for that in your country of residence, or vice versa.

Where you will be liable to pay the taxes depends entirely on the tax treaty between India and your country of residence.

The Bottom Line

These are the most common NRI investment myths about investing in India. We believe this information has debunked your myths and have answered your investment-related questions.

However, if you have any other questions or are struggling to find the best investment route in India that suits your financial goals, then Savetaxs is here for you.

For years, we have been consulting NRIs on their tax and investment-related queries and providing tailored solutions to their investment goal.

Our experts bring in a combined experience of more than 30 years in cross-border investment. We will help you craft personalized investment strategies and will recommend the best investment options, tailored to your financial goals.

Connect with us and let us hop on an inevitable journey that turns your investment portfolio green.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Everything You Need to Know About Hybrid Mutual Funds for NRIs

- Why NRIs Must Invest in Child Plans in India for Best Returns?

- How can NRIs Invest in Alternative Investment Funds in India?

- Pravasi Pension Scheme for NRIs: Eligibility and Application Procedure

- NRI Purchasing Property In USA: Process & Tax Implication

- Sending Money to India from Abroad: A Complete Guide for NRIs

- NRI Investment in SGrBs Through IFSC

- Registering a Will in India: Key Tips for NRIs

- NRI Succession Certificate: A Guide to Inheriting Property

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- Investing in REITs as an NRI in India- Complete Guide

- Top 5 Problems NRI Face While Investing In India

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- A Complete Guide to Investing in Gold for NRI in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

-plan_1761282887.webp)