Tax deductions for self-employed people are nothing less than a boon, saving self-employed individuals from a hefty tax bill. As a self-employed individual, you will come through a lot of business-related expenses that otherwise would have been covered by your employer.

However, the IRS has rolled out various tax deductions to help self-employed individuals and small business owners cover some of these business-related costs.

In this blog, we will talk about 20 tax deductions for self-employed people and sole proprietors.

Key Takeaways

- If you use a portion of your residential space for exclusive or even regular business use, then you can claim the home office deduction. This deduction is based on the square footage of your office area.

- Self-employed people can deduct the costs related to vehicle use for business. This is done by calculating the standard mileage rate methods or by tracking the expenses related to the vehicles when used for business purposes.

- Contributions that are made to SEP IRA, SIMPLE IRA, and various other retirement plans that are exclusively made for small business owners are deductible. The deductible range is up to the annual contribution limit of that plan. Hence, making contributions to such plans has two benefits: one is that it will help you save for retirement, while reducing your current taxable income.

- As a self-employed individual, you can deduct 100% of the health premiums you have paid for yourself, your family, your spouse, and your children. You can do so for as long as they are not eligible for an employee-sponsored health plan coverage.

Tax Deductions for the Self-Employed

As a self-employed individual, know that the business taxes are going to gulp a big chunk of money. So to save yourself from this panic, start managing your business tax liability proactively to ensure it is as low as possible.

To do so, the IRS has ruled out several tax deductions for self-employed individuals and people operating a sole proprietorship. If understood carefully, these deductions can reduce your overall tax liability.

Below is a list of 20 common tax deductions for self-employed people and sole proprietors.

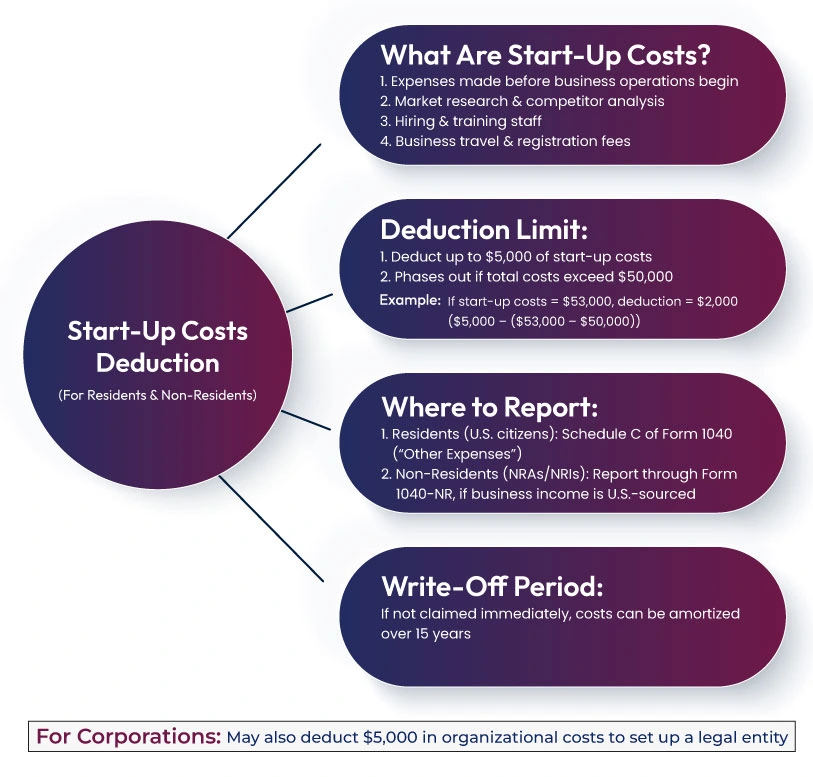

1. Start-up Costs Deduction

Costs that a business incurs before starting its operations are known as start-up costs. For example, as a business owner, you are paying for competitor analysis, product and market research, hiring and training employees, traveling to gather business insights, license registration fees, and more to establish your business.

These expenses are labeled as business start-up costs, which are deductible for the tax year in which you start the operations.

If you are a sole proprietor, you are allowed to deduct up to $5000 of the business startup costs. However, please ensure that the $ 5,000 limit is reduced on a dollar-for-dollar basis if the costs exceed the $50,000 threshold.

An Example

Say you have $53,000 as your start-up costs. Now, from the $ 5,000 reduction, you can only deduct $ 2,000 because ($ 5,000 - ($53,000 - $50,000 = $2,000).

You can claim the start-up costs deduction on Schedule C of your Form 1040 as "other expenses".

Start-up costs are not deductible in the tax year where your business starts operating and can be written off for a period of 15 years.

Note: if you are a corporation, you can also deduct $5000 of "organizational costs" to set up your business as a legal entity.

2. Home Office Deduction

As a self-employed individual, the chances are you will be working from your home for most of the time. Perhaps you might have an extra bedroom, or a den converted into your home office. If yes, then you can claim the home office deduction on Schedule C of your 1040 tax form.

This deduction covers expenses associated with that part of your home which is used as your place of business. If qualified for this deduction, you can deduct the cost of insurance, rent, mortgage interest, utilities, maintenance, and other such expenses from your overall tax liability.

Please ensure that any expenses that are related to the business use of your home are deductible.

Calculate home office deduction

You can calculate the home office deduction in two ways.

First method: Calculate your total home expenses and multiply it by the percentage of your home used for business.

For example, if your house office space takes up to 10% of your house, then just deduct 10% from your total home expenses. In case you go for this method, please use Form 8829 to calculate the deduction.

Second method: The next method is known as a simplified method. Here, you don't have to calculate the entire home expenses. Just multiply the square footage of your home used for business purposes by $5.

So, for example, if your home office space takes up to 100 square feet, you can deduct $500 ($5 * 100 = $500).

3. Rent Expense Deduction

If you do not have space in your home for an office or want to keep your personal and professional spaces separate, then, as per the rent expense deduction, you can deduct the cost of renting the office space.

However, there are certain restrictions and conditions in place.

Firstly, you cannot deduct the rent expenses if you have or in the future will have an ownership interest in the rented property. This means having an equity interest or title to the property.

For example, you cannot deduct the end as an expense and end a position as a client or contact.

Furthermore, you cannot deduct "unreasonable rent". Rent is unreasonable if it is higher than the market value.

Now, if you pay rent in advance, you can only deduct the amount that is applied to the current tax year. To deduct the advance amount, you have to wait until the next tax year.

You can cancel the deduction for rent on Schedule C of your 1040 tax form.

4. Health Insurance Deduction

As a self-employed person, you can deduct the health insurance premiums paid for you and your family. The self-employed health insurance deduction is claimed on Form 1040 Schedule 1.

The insurance must be for your business, but if you are filing Schedule C, the insurance policy can be either under the business name or your name.

Please make sure that you cannot claim the deduction for health insurance premiums paid for any month in which you were eligible for a health insurance plan through your or a family member's employer.

The amount of deduction is capped at an amount that is based on your age at the end of the year.

2025 Health Insurance Deduction Amount Limit

The deduction amount based on your age for the tax year 2025 is likewise.

- $480 if you are 40 years or younger

- $900 if you are between the ages of 41 and 50.

- $1,800 if you are between the ages of 51 and 60.

- $4,810 if you are between the ages of 61 and 70.

- $5,880 if you are 72 years or older.

If you are using the amount paid for a long-term care insurance plan to claim the deduction, you must file Form 7206.

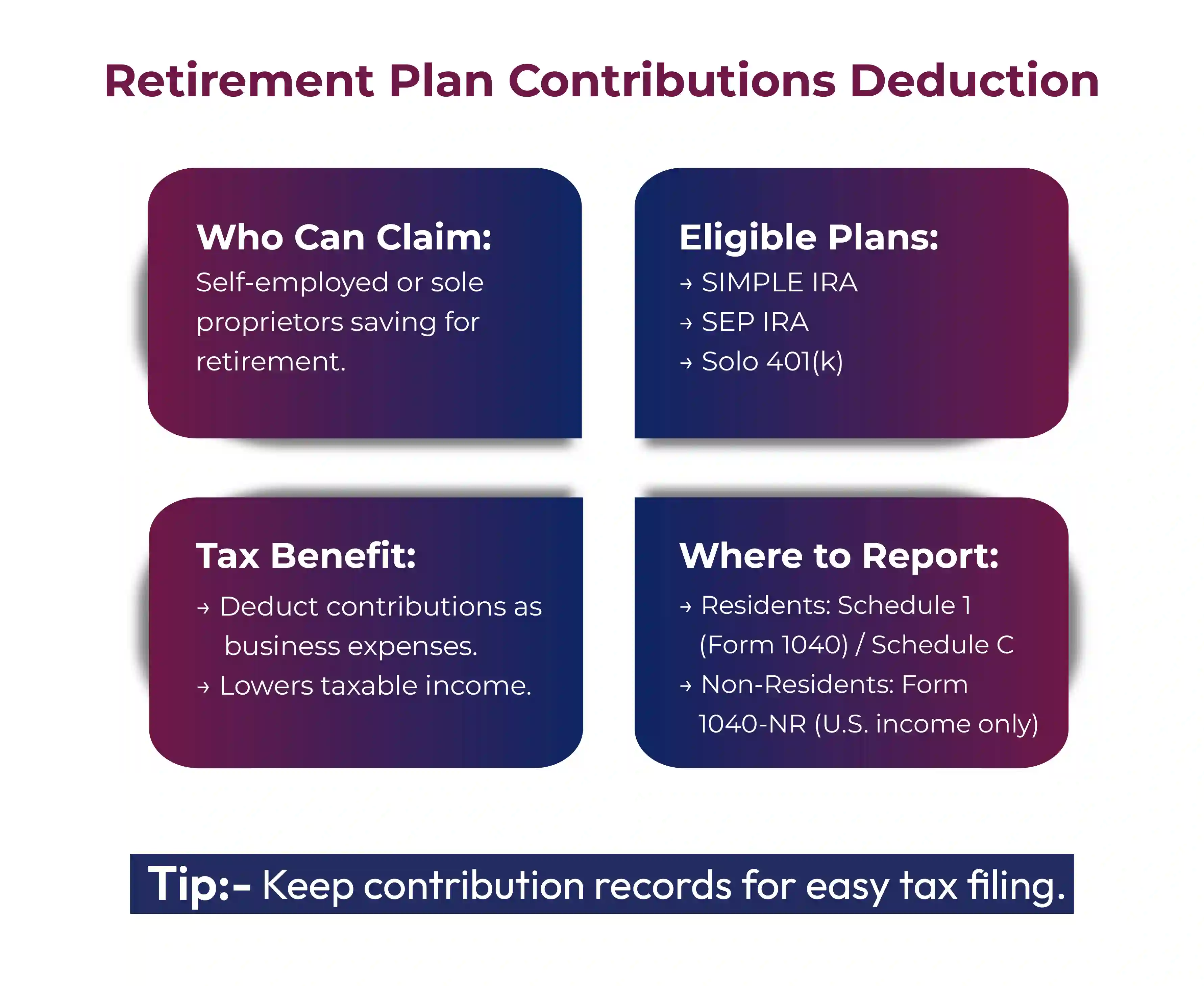

5. Retirement Plan Contributions Deduction

This Schedule 1 tax deduction is allowed to self-employed people and sole proprietors who have made contributions to retirement plans.

The contributions can be made in the following retirement accounts for themselves.

- Savings Incentive Match Plan For Employees (SIMPLE) IRAs.

- Simplified Employee Pension (SEP) IRAs

- Solo 401(k) Plans.

Funds contributed to retirement plans by an employee can be deducted as a business expense on Schedule C.

This deduction is claimed on Schedule 1 of Form 1040.

6. Car Expense Deduction

If you're using your personal car, van, truck, or any other vehicle for business use, then the expense incurred is deductible under Section C. This includes instances such as driving your car to the client's office for a meeting or to pick up supplies for business purposes.

Now, to calculate the deduction amount, you can either use the standard mileage rate or the actual expenses.

The standard mileage rate for each mile is $0.70 for the 2025 tax year. You can also add up the parking or toll fees, if any.

Please make sure that if you use five more vehicles for business purposes, you cannot use the standard illegal rate.

Now, for the actual expense methods, you may deduct the actual amount paid for oil, gas, tires, repairs, insurance, or other expenses for operating a car. Now, if you use both the truck, van, or the car for both personal and professional work, then you have to keep track of the mileage and expenses incurred while using it for business and deduct them.

7. Business Travel Deduction

Self-employed people who travel away from home for business purposes can write off travel expenses. For the cost to be deductible, it must be ordinary, meaning common and accepted in your business.

Deductible Travel Expenses

- Such everyday deductible travel expenses include:

- Car, bus, train, and airfare expenses.

- Taxi, limousine fees, or commuter bus expenses.

- Expenses related to a motel or hotel.

- Meal expenses.

- Fees and tips for baggage carriers, porters, hotel staff, and other related people. Now, please ensure that you can deduct $5 per day instead of your actual tips and fees if you did not claim a deduction for meals that particular day.

- Laundry, phone calls, dry cleaning expenses.

Please ensure that you cannot deduct travel expenses of the people travelling with you unless they are your business employees.

The business expenses are reported on Schedule C.

8. Business Meals Deduction

IRS states that you can deduct 50% of your meal costs that are related to business or happen during a business trip.

Please make sure the following points are met for the meal to be deductible:

- The expense of the meal must be ordinary and necessary for your business.

- The meal must not be too lavish or extravagant.

- You or your employees must be represented there to have the meal.

- The meal must be provided to you or the current or potential business's clients, customers, or consultants. Make sure that it is a business contact.

- The meal cost must be mentioned separately on bills, receipts, or invoices.

If your purpose of traveling is business, then you are permitted to deduct 50% of either your actual meal expense or the standard meal allowance.

The 50% meal expense deduction limit does not apply in the following cases:

- If you have the meal expenses as an independent contractor.

- Your client or the customer reimburses your travel expenses.

- You have the records of the meal expense for either your client or customer.

Along with this, the 50% limit is waived under two more conditions.

- If the meal expenses are related to social, recreational, or other related activities.

- If you sell the meals to the public, you can show a sense of goodwill in the community for your business by providing free beverages or food.

9. Self-Employment Tax Deduction

As an employee, it is the employer's responsibility to withhold your share of the Social Security and Medicare Taxes (FICA taxes) from each paycheck. The employer then sends the deducted amount to the IRS on your behalf.

But if you are self-employed, you have to pay these taxes all by yourself, both the employer's share and the employee's share. This tax is often referred to as the self-employment tax.

15.3% is the self-employment tax rate. Under this rate, 12.3% is for the social security taxes and 2.9% for the Medicare taxes.

Apart from this, please make sure that you have to pay an additional 0.9% in the medicare taxes if your self-employment income for the current tax year exceeds:

- $250,000 as a joint filer.

- $125,000 for married people filing separate returns.

- $200,000 for all the other people.

However, the good news is that, according to the IRS, you can deduct 50% of the self-employment taxes that you pay. The detention is first reported in schedule SE. And then the deduction is claimed on Form 1040 Schedule 1.

10. Qualified Business Income Deduction

This deduction lets the qualified employee write off at least 20% of their business expenses and losses from their combined total of the business's taxable income. This includes everything from losses, deductions, income, and gains. At times, this deduction is referred to as the Section 199A deduction.

There are certain limitations to it.

Say, for example, your business income exceeds a certain amount, then the qualified business income deduction (QBI) is reduced for specific business owners like accountants, lawyers, and doctors.

The deduction can be limited to certain other businesses based on their W-2 wages for their employees, depending on the type of organization they own.

Such a limitation makes it difficult and tricky to calculate QBI deduction.

To calculate the QBI deduction, you need to use either Form 8995 or Form 8995-A. After calculating the deduction amount, it is claimed directly on Form 1040. As it is not reported on Schedule 1 or Schedule C.

11. Work-Related Education Deduction

As a self-employed person, if you want to pursue your education further, then you can deduct the cost of books, tuition, or other eligible expenses as a business expense on Schedule C.

Please ensure that to deduct the education expenses, the course you take must be either of the following.

- Required to keep your essential salary, job, or status.

- The course is needed to either improve or manage the skills needed in your present work.

Additionally, if your course meets the requirements mentioned below, then you can deduct.

- Tuition, books, supplies, lab fees, and similar items.

- Certain transportation and travel costs are related to your classes.

- Other related expenses include the costs of going in for writing a research paper.

Please ensure that personal expenses are not deducted. For example, you are not permitted to deduct the dollar value of vacation time taken to attend classes.

Under this deduction, you can also deduct any necessary or ordinary costs incurred in educating and training your employees. This must also be reported in Schedule C.

Now, if you are planning to take your studies further, then you might be qualified for the Lifetime Learning Credit or the American Opportunity Tax Credit. But here the catch is, you cannot claim any of these tax credits if you have already deducted them as business expense on Schedule C, and vice versa.

12. Cost of Goods Sold Deduction

The cost of goods sold is deducted from the business to account for the expenses related to the production or purchase of any products they sell.

The cost of goods sold deduction is calculated and reported in the Schedule C.

This deduction is calculated by adding the cost of inventory from the start of the tax year to the cost of any inventory production or purchase cost during the year, and then subtracting the ending inventory at the end of the tax year.

In most cases, you will have to take an inventory at the beginning and end of the tax year to deduct the cost of goods sold. However, if you are considered a "small business taxpayer," then you are required to maintain the entire inventory.

13. Bad Debts Deduction

The bad debt deduction means that if someone owes you money and won't pay it, then in that case, you will be able to deduct the amount owed to you as bad debt.

Please make sure that the deduction is available only if you incorporate the amount you are owed in your current or previous tax year's gross income.

To deduct the debt as a business expense on Schedule C, ensure that the debt is considered a business bad debt.

Now, for the debt to be treated as a business bad debt, the debt must either be

- acquired or created in your business.

- closely related to your businesses, when it became totally worthless or partially worthless.

Additionally, the debt is closely tied to the business if the primary reason for incurring it was business-related.

A few examples of business sbad debut are credited to customers. Moreover, a loan is given to suppliers, clients, employees, or other entities.

14. Depreciation and Section 179 expense deduction

Let us say you acquire a business property that is anticipated to last more than one year, now you cannot deduct the entire cost as a business expense. Instead, you must deduct it little by little over the entire course of the business property's expected life.

This method of deducting the cost of a business property over time is known as depreciation. Now, there are two rules that can result in either a full deduction or a greater depreciation of the cost of property acquired during the tax year.

For the tax year 2024, the first rule, dubbed "bonus depreciation," means that 60% of the property cost can be deducted if the property is acquired in the 2024 tax year. The standard depreciation deductions is permitted from the remaining cost.

The second special rule is the section 179 expensing (the name hails from the tax code section that establishes the rule). As per this rule, you are permitted to deduct a part of all the costs of the property you buy in the year for use in your business. And yes, the remaining cost is decreased at the usual pace.

Under section 179, the maximum you can deduct is generally $2,500,000 for the year 2025. However, please ensure that this limit will be reduced on a dollar-for-dollar basis to the extent that the cost of the organization exceeds $4,000,00 for the year 2025.

You must use Form 4562 to calculate your deduction. The sole proprietor must report the deduction on the Schedule C.

15. Charitable Gifts Deduction

As a self-employed individual, you must indulge yourself in making charitable contributions or volunteer your time in social welfare agencies. Doing so is suitable for both your business and your taxes, too.

Because, under the charitable gifts deduction, you might be able to claim a charitable deduction for your generosity. However, ensure that if you are operating a business as a sole proprietor, you must claim the deduction in the same way as any other person would. Meaning that as a sole proprietor, you must claim it as an itemized deduction on Schedule A for Form 1040.

Please note that cash construction contributions in the name of charity cannot exceed 60% of your adjusted gross income. Business hotel expenses are also limited to 15% of your net business income on a limited basis.

Other than this, if you have incurred any travel expenses for any charitable purpose, then any out-of-pocket unreimbursed expenses made during that time are deductible. For example, if you have to bake a cake for a fundraiser, then you are allowed to eat the cake.

Additionally, you are also permitted to deduct the travel expenses, too, meaning if you drive your car for a business purpose. Please ensure that you can deduct either of:

- Your actual expenses for gas, oil, and more.

- 14 cents per mile, which is the standard mileage rate for charitable expenses.

The parking and toll fees are also deductible, but make sure you have the receipt or bills to prove it, just in case.

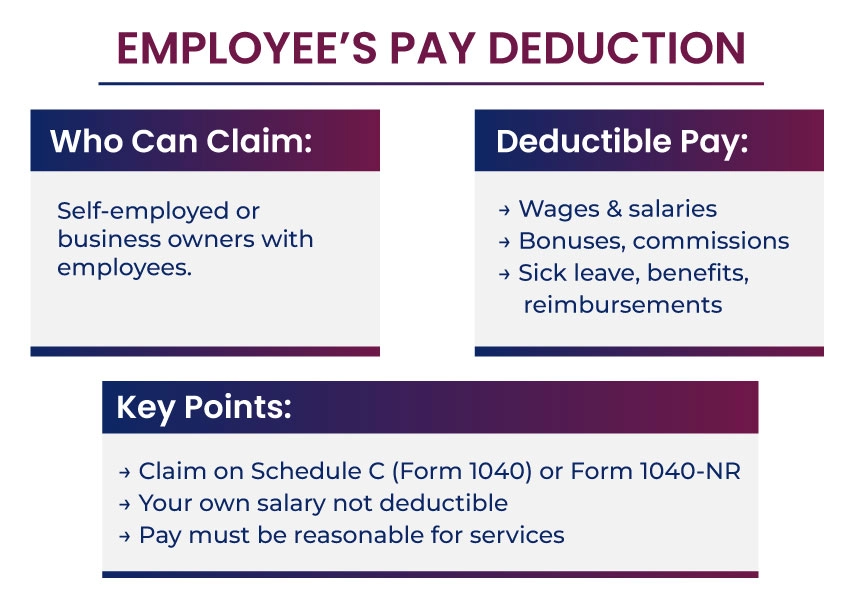

16. Employee's Pay Deduction

Now, under this deduction, if you hire employees, you are allowed to deduct their salaries or wages as business expenses on Schedule C. But please make sure that, as a sole proprietor, you cannot deduct your own salary because you are not an employee of your business.

To be considered deductible, the wages must be reasonable for the performance and services rendered by the employees. The pay can be in cash or services.

The pay that can be deducted includes sick leave, bonuses, vacation, commissions, education expenses, reimbursements, and fringe benefits for employees.

However, please make sure you cannot deduct the wages and salaries that are deducted elsewhere on your tax return. Apart from this, you are responsible for subtracting the amount of any employment-related tax credits you claimed, like the work opportunity tax credit or more, while computing the deductions.

17. Business Insurance Deduction

There are different types of insurance that owners buy to protect their businesses. However, the premiums you pay for most of the business insurance policies are deductible. Such premiums are deductible on Schedule C.

The insurance premium paid for the following type of business-related insurance sis deductible.

- Flood, theft, fire, and similar insurance.

- Credit insurance is taken to cover the business's bad debts and losses.

- Medical insurance and group hospitalization for employees.

- Liability insurance.

- Malpractice insurance.

- Workers' compensation insurance.

- Coverage for insurance taken to cover the business expenses if you are disabled.

- Car or vehicle insurance to cover the vehicles used in your business.

- Life insurance covering your employees.

- Business interruption insurance.

As noted earlier, self-employed individuals can deduct their medical health insurance premiums.

Please make sure that you are not permitted to deduct the payments for the insurance reserve funds, policies covering the last earnings due to sickness, or disability.

18. Supplies and Materials Deduction

Materials or any supplies that are used in the manufacturing or processing are included in the calculation of the cost of goods sold. Apart from these, other supplies and materials used in your business are also deducted from the Schedule C as business expenses. No, this includes general office supplies, such as printers, paper clips, pens, envelopes, and more.

Under the supplies and materials deduction, you r permitted to deduct the cost of supplies and materials if you use them for your business purpose during the tax year.

Ensure that if the use of supplies and materials extends well beyond a year, then you have to take the depreciation deduction for them.

19. Interest Expense Deduction

Self-employed individuals are allowed to deduct the interest paid during the tax year on the business-related debts. If the loan proceeds are used as a business expense, then the interest relates to your business.

You can deduct the interests as a business expense on Form 1040 Schedule C if all the following criteria are met.

- You are legally responsible for the debt payment.

- Both you and the lender intend for the debt to be repaid.

- You and the lender have a genuine debtor-creditor relationship.

20. Taxes and License Fees Deduction.

The taxes a business paid might be deductible. As mentioned earlier, on Schedule 1, you are allowed to deduct 50% of your federal self-employment tax. Additionally, the write-offs are also available on the Schedule C for the self-employed sole proprietors who are paying.

State taxes on the gross income, which is opposed to net income, are imposed directly.

Sales taxes are imposed on sellers of goods and services.

Personal property and real estate taxes paid to business assets.

Social Security and Medicare taxes are withheld from your employees' earnings and then paid to the IRS.

The unemployment taxes paid to either the state unemployment insurance funds, the IRS, or the disability benefit fund only if they are considered taxes under state law.

The federal highway use taxes.

Along with this, the state and local licenses and regulatory fees that are paid by your business are generally deductible, too. However, licenses such as those for liquor or other substances may need to be amortized and deducted over a span of years.

Please make sure that you are not permitted to exceed the licensing fee or tax payment as a business expense. You cannot deduct the following:

- Income taxes

- Estate and gift taxes

- The property taxes are imposed on your home or personal property.

- Sales taxes on property purchases for business use.

- Fuel taxes such as the motor fuel, gasoline, diesel fuel, and more that are used in your business operations.

- Other taxes and the license fees that are not business-related.

- Sales taxes that are imposed on the buyer and are required to be paid.

Other Business Expenses Deductions

The deductible business expenses we have talked about above can save a lot on your total income tax bill. But that is not an all-inclusive list. Apart from the ones mentioned above, there are other expenses as well that are incurred by an individual or a sole proprietor and can be deducted.

There are common business-related expenses that you can write off.

- Advertising

- Bank fees

- Commissions and fees.

- Contract labor.

- Depletion

- Employee benefit programs.

- Legal and professional services.

- Pension and profit-sharing plans.

- Remove barriers to individuals who are elderly and disabled.

- Repair and maintenance.

- Research and experimentation

- Trademark or trade names.

- Utilities.

The Bottom Line

If understood correctly, deductions are an innovative way for self-employed individuals and sole proprietors to reduce their overall taxable income. However, one should be aware of what business expenses they can deduct, as some costs get depreciated or amortized.

Lastly, if you are unsure whether a particular business expense is deductible or not, connect with a tax professional in the US so that you don't run yourself into any trouble. One such Tax Professional is Savetaxs, which has been helping thousands of U.S. citizens and residents with tax consultancy and filing services. Our satisfied clientele base speaks for itself in terms of the services we offer.

Savetaxs serves its clients 24/7 across all time zones, so connect with us right away and get your business taxes started.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767696432.webp)

_1767077669.webp)

_1764137986.webp)

_1753429421.webp)