- Key Takeaways

- What is Married Filing Jointly?

- Benefits of Married Filing Jointly

- What is Married Filing Separately?

- When Should Married Couples File Taxes Separately?

- Tax Deduction Rules when You File Taxes Separately

- Who Files Taxes Jointly or Separately?

- Which Is Better: Married Filing Jointly or Separately?

- Final Thoughts

For every person, marriage is an important life event. It often brings changes in the lives of people, including how you file your income taxes. Further deciding between married filing jointly vs separately is a tricky question for married couples. Both options have their own benefits and drawbacks.

Understanding the difference between them can assist couples in making an informed decision that meets their family's needs. As a married couple, are you also facing the same situation? Here in this blog, for each tax filing status is complete information on the tax implications. Knowing the pros and cons will surely help you in choosing the right option. So, let's begin reading.

Key Takeaways

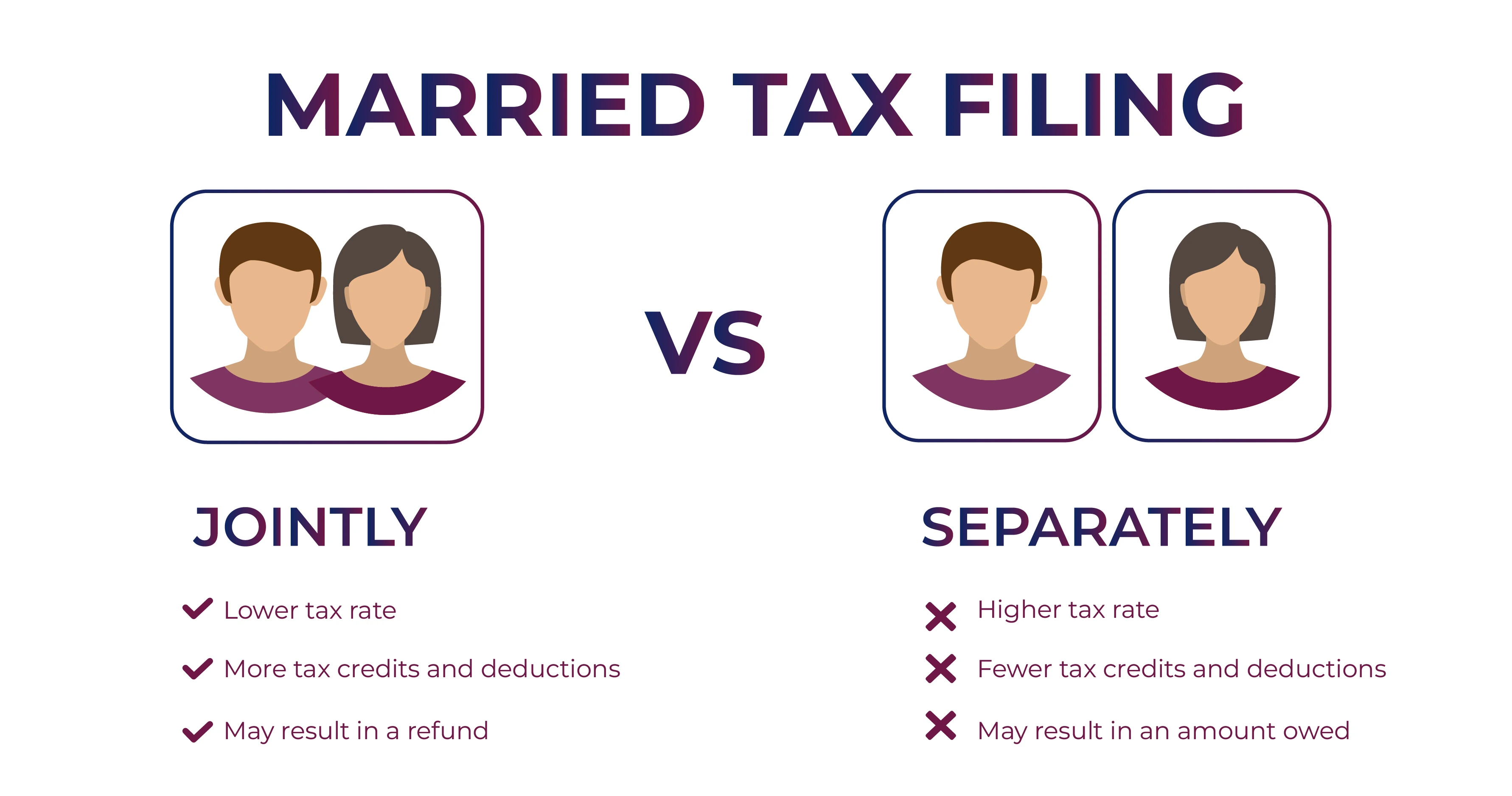

- When you are married, you get two options: to file your taxes jointly or separately.

- Filing taxes jointly provides you with benefits like access to certain tax credits and lower tax rates.

- If you file separately, you might face higher taxation than on a joint return. It especially applies when only one partner has taxable income.

- Filing separately can be helpful in special circumstances. Helps you save on your income tax on medical bills or repayment of student loans.

What is Married Filing Jointly?

Married filing jointly in the US is a tax filing option given to couples who are legally married in the country. It allows them to combine their income, tax credits, and deductions on a single tax return. It means you share all your refunds and are jointly accountable for any owed taxes.

Further, for married couples, it is a popular financial option. It is because it eases their filing process and reduces their tax burden. However, both spouses need to be liable equally for any omissions or errors on their tax return. It is also applicable when even one spouse has prepared the tax return.

In 2024, if you filed taxes jointly, you get the Standard Deduction $29,200 compared to separate filing, i.e., $14,600. For 2025, these amounts increase to $31,5000 and $15,750, respectively. Moreover, when filing taxes jointly, the spouse with more income can use the Standard Deduction of the other spouse as well.

This was all about married filing jointly. Moving ahead, let's know the benefits of it.

Benefits of Married Filing Jointly

There are several benefits of filing taxes jointly with your spouse. As mentioned above, joint filers get one of the biggest Standard Deductions. When calculating taxable income, this further helps them in deducting a specific amount. Moreover, couples who file jointly qualify for several tax credits, such as:

- Exclusion or credit for adoption expenses

- Earned Income Tax Credit

- Child and Dependent Care Credit

- American Opportunity and Lifetime Learning Education Tax Credits

Apart from this, the threshold limit of joint filers is generally higher for certain deductions and taxes. This means while earning more income, they can get certain tax breaks.

These are some of the benefits of filing taxes jointly in the US. Moving further, let's know what married filing separately means.

What is Married Filing Separately?

Choosing married filing separately means you and your spouse file your individual income tax returns. While this option is not so common but can in some situation it can be helpful. For instance, when one of you has medical expenses or wants financial independence. Filing taxes separately might qualify you for certain tax deductions as well.

However, filing the taxes separately also has some limitations. These are as follows:

- If you file taxes separately from your spouse, you are no longer eligible for several tax credits and deductions stated earlier.

- Couples who file tax returns separately cannot deduct the interest on student loans.

- Generally, separate tax filers get a smaller IRA contribution deduction from the government.

- For separate filing, the limit of capital deduction is $1500, while on a joint tax return, it is $3000.

This was all about married filing separately. Moving ahead, let's know in what circumstances couples should file taxes separately.

When Should Married Couples File Taxes Separately?

Despite having several benefits of filing the taxes jointly, there are several situations where filing taxes separately is good. It serves your financial needs better and offers you tax perks. These are as follows:

- Payment of Student Loan: In circumstances where repayment of your student loan is determined by your ITR. In this situation, filing the taxes separately helps you manage your payments.

- Medical Expenses: Out of your medical bills, if you or your spouse has a bigger amount. In this scenario, filing the taxes separately assists you in surpassing the threshold to deduct these amounts. It is because the percentage of your adjusted total income decides your threshold limit. Here, if calculated separately, one would have a lower income.

- Separated Finances: In circumstances where both partners want to handle their financial matters on their own. For instance, when filing for divorce, filing taxes separately offers financial division.

Further, filing the taxes separately also limits your tax liability from the tax matters of your spouse. For instance, suppose you have earned $50,000 from your job and have $10,000 of medical expenses. Here, you would get a 7.5% threshold limit, i.e., $10,000 / $50000 = 20% of your earned income.

However, if you filed taxes jointly with your spouse, your total income will be $135000. In this scenario, you are no longer eligible to claim medical expenses on your income, i.e., $10,000 / $135000 = 7.4% of your income.

These are some situations where filing taxes separately benefits married couples. Now, moving ahead, let's know the deduction rules when you file taxes separately.

Tax Deduction Rules when You File Taxes Separately

When married couples, instead of choosing to file taxes jointly, opt for the separate option, they must know the tax deduction rules. From both spouses, the IRS needs uniformity. It means if one of them itemizes tax deductions, then both should do so. It significantly impacts the tax deduction amount each spouse can claim. Moving ahead, let's know some specifics when it comes to tax deductions for separate filing.

- Both or None: The other spouse cannot claim the standard tax deduction if one decides to itemize. For 2024, if the couple does not itemize, each would get $14,600 standard deduction. Additionally, if one of them intemize, then the other also needs to do so.

- Shared Deduction Restrictions: In case both spouses have paid property taxes or interest on a mortgage. In this scenario, they must split the deduction amount while filing their separate returns. Here, the combined tax deduction amount should not be more than the allowable joint tax return.

- Capital Loss Deductions: The capital loss deduction for joint tax filers is $3000, while for separate filers is $1500 each.

Based on your tax situation, it is vital to consider the perks of itemizing against the standard tax deduction benefits. While itemizing may provide you higher tax deduction, the limitations for separate filers might take this benefit.

This was all about the tax deduction rules when you file you and your spouse file taxes separately. Moving further, let's know who files the taxes jointly or separately.

Who Files Taxes Jointly or Separately?

As stated at the start of the blog, married couples filing taxes jointly or separately is totally their choice. However, both filing jointly and separately have some eligibility requirements and require an understanding of the tax rules. During the tax season, both things play a key role in the tax life of married couples. Furthermore, let's know about them.

- Getting Married by the End of the Year: The IRS uses the December 31 date to consider your marital status. Confused? If you get married on 31 December, then you have the option to choose your tax filing status for the entire year.

- Living Apart but Not Separated Legally: In case you are living apart from your spouse in this scenario, you are eligible for married tax filing status. If you are separated legally under a maintenance decree or divorce by the end of the year. In this scenario, you qualify for married filing separately status.

- Spouse Passed Away: During the financial year, if your spouse passes away, you can file taxes jointly for that year. However, if you should not remarry at that time.

- Common-law Marriages: A couple entered into a legally recognized common-law marriage in a state that allows it. Here, they are eligible to choose their filing status from jointly or separately.

These are some of the scenarios where you can opt for joint or separate filing of taxes as per married couple. Moving ahead, let's know which is the better tax filing option for married couples.

Which Is Better: Married Filing Jointly or Separately?

Between married filing jointly vs separately, opting for one depends on your financial situation. One way by which you can know which tax filing option is good for you is to prepare your taxes. Once you write them down, compare them with both the tax filing options.

While it will take both your effort and time, through this, you get a clear idea of your tax refunds and due balance under each tax option. To provide you with an idea of this, the table below shows with 2024 tax rates and income brackets for married couples. It consists of both options, i.e., separately and jointly, which may assist you in running the numbers.

| Tax Rate | Married Couples Filing Taxes Jointly | Married Couples Filing Taxes Separately |

|---|---|---|

| 10% | $23,200 or less | $11,600 or less |

| 12% | $23,201 to $94,300 | $11,601 to $47,150 |

| 22% | $89,451 to $201,050 | $47,151 to $100,525 |

| 24% | $201,051 to $ 383,900 | $100,526 to $191,950 |

| 32% | $383,901 to $487,450 | $191,951 to $243,725 |

| $35% | $487,451 to $731,200 | $243,726 to $365,600 |

| 37% | $731,201 or more | $365,601 or more |

While the tax brackets are the same, for married couples filing separately, the income threshold for each tax bracket is lower. This showcases how tax filing status can impact your owed taxes. It specifically matters when you and your spouse have a big difference in income.

Final Thoughts

Lastly, whether to file married filing jointly or separately depends on your needs and financial situation. Both the tax filing options have their own pros and cons. So, it is advisable to first understand your financial needs and then choose the tax filing options.

Furthermore, if you still face difficulty in choosing the right tax filing option, connect with Savetaxs. Our experts will help you make an informed decision that matches your financial needs. Also, if you need, they can guide you in filing your tax returns. So, contact us, and let us make your tax filing journey simple.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!