Re-KYC for NRIs is a process of re-verifying and updating your KYC details periodically. This is done in accordance with the regulatory requirements set by the Reserve Bank of India, which require financial institutions and banks to conduct periodic updates of their customers.

In this blog post, we will cover the key aspects of Re-KYC for NRI, including why it is essential, how to update KYC for NRI, the required documents, and more.

- Re-KYC is a periodic, mandatory process for non-resident Indians, as required by the Reserve Bank of India, to update customer details and prevent financial crimes.

- Failure to re-KYC can result in NRI accounts being frozen or transactions being blocked.

- As an NRI, if you open a new NRI account with the same bank where you had your resident bank account or convert your resident savings account to an NRO account, you will need a fresh KYC for doing so.

What is Re-KYC For NRI Accounts

As aforementioned, Re-KYC means updating your Know Your Customer (KYC) details again. Financial institutions and banks are required to periodically update their customers' information in accordance with RBI rules. Doing so eliminates the chances of malpractices, money laundering, or misuse.

For non-resident Indians (NRIs), this is important, especially because your information, such as phone numbers, residency status, and address, might often change.

Hence, Re-KYC helps in:

- Keeping your NRI accounts active.

- Avoid any transaction issues.

- Stay compliant with the RBI's regulatory framework.

In a nutshell, Re-KYC ensures that your bank or financial institution has your correct and latest information, so your NRI banking operations are secure.

Reasons Why Re-KYC Is Important For NRI Accounts?

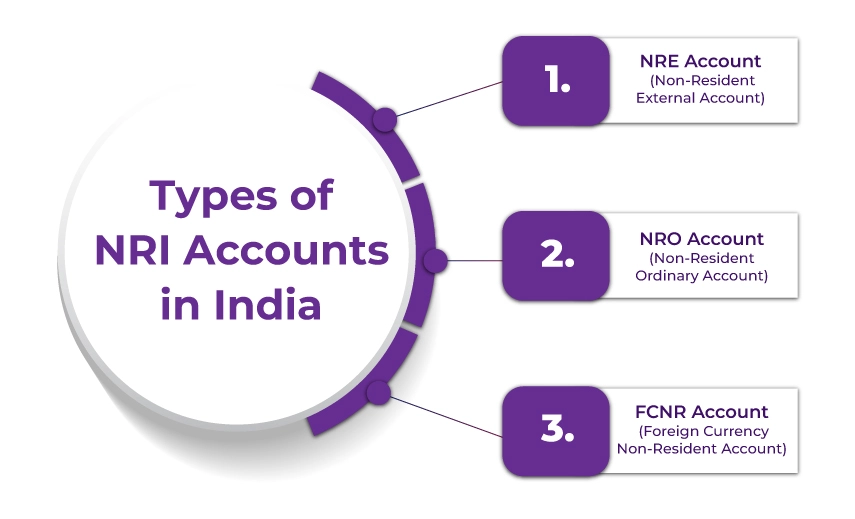

Be it any NRI bank Account, Re-KYC is required for multiple reasons.

NRE Account (Non-Resident External): As we know, for NRIs, interest on NRE accounts is tax-free, and funds are fully repatriable without any limits. Re-KYC ensures that the account holder is a valid NRI.

NRO Account (Non-Resident Ordinary): NRO accounts are used to manage Indian income. Re-KYC ensures correct TDS and tax compliance.

FCNR Account (Foreign Currency Non-Resident).: As an FCNR account handles foreign currency deposits of NRIs in India, a Re-KYC ensures that the account holder's foreign status is up to date.

However, here are a few reasons why Re-KYC is important for NRI accounts.

| Reasons | Importance of NRI Accounts |

|---|---|

| Regulatory Compliance | This ensures compliance with the Reserve Bank of India's (RBI) guidelines. |

| Account Security | Prevents illegitimate use of dormant or outdated accounts. |

| Updated Communication | It ensures that OTPs are delivered on time, account alerts are sent, and bank communication is smooth. |

| Continued Transactions | Eliminate account freeze due to outdated KYC. |

| Global Movements |

For NRIs, changes in overseas address, phone numbers, or employment are effectively tracked. |

When is Re-KYC for NRI Accounts Required?

Under the following conditions, Re-KYC for NRI Accounts is required.

| Circumstance | Re-KYC Requirement |

|---|---|

| Period Review (every 2-10 years, depending on the risk category) | This is mandatory |

| Change in the contact number or the overseas address. | Required |

| Change in visa or passport information. | Required |

| Change in the residential status (For example: NRI to resident) | Required |

| Upon the bank's request due to compliance-related issues. | This is mandatory |

Tax filing deadline is near; file now before it's too late!

Documents Required For NRI Re-KYC?

The final document checklist might vary depending on bank to bank. However, the following are the NRI KYC documents you need for the NRI KYC update process.

| Document Type | Examples | Verification |

|---|---|---|

| The Proof Identity | PAN Card, or a Valid Passport | Self-attested copies of identity proof are required. |

| Address Proof | Foreign bank account statement, rental agreement, or overseas utility bill. | A recent copy of the address proof (maximum three months old) |

| Residency Proof | Valid visa, OCI Card, residence, or work permit. | The document must be valid at the time of submission. |

| Financial Proof (if required) | Investment proofs, tax returns, or a salary slip. | - |

Along with these documents, you might also require a Foreign Account Tax Compliance Act (FATCA) declaration, as it applies to the US, or a CRS (Common Reporting Standards) declaration for Canada, the UK, or other 100+ countries that have adopted the CRS.

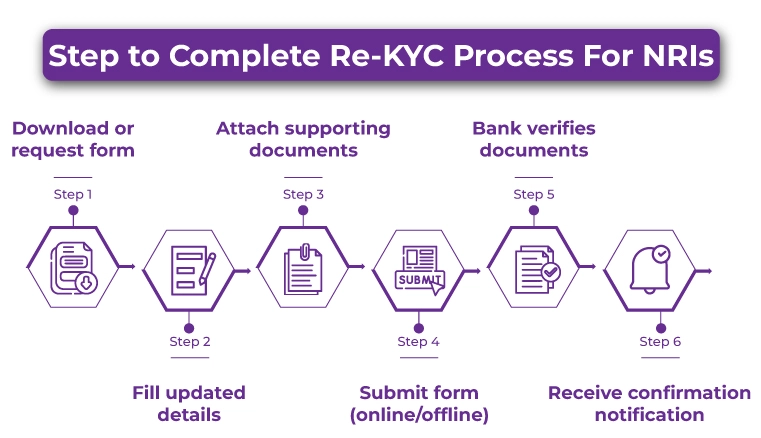

Step To Complete The Re-KYC Process For NRIs

Using the physical and digital banking channels of your bank, you can easily complete the periodic updation of KYC for your NRE/NRO/FCNR bank accounts.

However, the following are the general steps for NRI KYC update:

Step 1: Download or request the NRI Re-KYC Form from your bank's website or the nearest branch.

Step 2: Fill in the Re-KYC Form by entering the updated details. Include the overseas address, phone number, email ID, and updated visa or passport details. Additionally, if required, please include the occupation or employment details.

Step 3: Attach the supporting documents by providing the proof of updated information. This includes the self-attested copies of the visa, passport, address proof, etc. In a few cases, embassy attestation or notarization might also be required.

Step 4: Double-check all the filled-in information and submit the Re-KYC Form. You can do it online or offline, whichever is convenient for you.

- For the offline mode, either courier or post the form to the bank's branch in India or submit it at the overseas branch (if available).

- For online Re-KYC for NRIs, upload the accredited copies via internet banking or through the bank's mobile application.

Step 5: Upon submission, the bank will review all the submitted documents and verify them. The bank may require additional details for validation.

Step 6: Once the Re-KYC for NRI Bank Accounts is successfully updated, you will receive confirmation through SMS or via email.

What Will Happen If NRIs Do Not Complete Re-KYC?

As an NRI, if you fail to update the Re-KYC within the given time frame, the consequences and impact for the same will be as follows.

| Consequences | Impact |

|---|---|

| Account Freeze | The debit and credit transactions will be restricted. |

| Online banking will be blocked. | Inability to use net banking or mobile banking apps. |

| Delay in remittances. | Money transfers might be rejected. |

| Breach of compliance | Possible regulatory penalties |

Get expert-backed NRI consultation in one call!

The Bottom Line

For NRIs, Re-KYC is mandatory for the security of their NRI bank account and compliance. Re-KYC ensures compliance and security by monitoring your NRI accounts and keeping their records up to date.

Lastly, it helps the bank provide better services by maintaining accurate details. Hence, it is advised to complete the Re-KYC at the earliest to avoid last-minute disruptions to services such as account access, banking transactions, or receiving updated OTPs.

So, if you need expert-backed assistance with the Re-KYC or KYC for NRIs in India process, or anything related to this matter, reach out to Savetaxs for real-time guidance and results.

Connect with us today as we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- Top 5 NRI Banks for NRE account in India for 2025

- PoA For NRIs To Manage Indian Banking Needs

- Why Should an NRI Convert Their Resident Savings Account to an NRO Account?

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- Everything You Need to Know About FCNR (B) Account

- When Does an NRIs NRE Account Lose Tax-Free Status in India?

- Everything You Need to Know About UPI for NRI

- Overseas Bank Account for NRIs

- A Guide to NRO (Non-Resident Ordinary) Accounts

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767429506.webp)

_1766644785.png)

_1756729655.webp)