- What Does a Notice Under Section 143(2) Mean?

- Why a Notice Under Section 143(2) is Issued

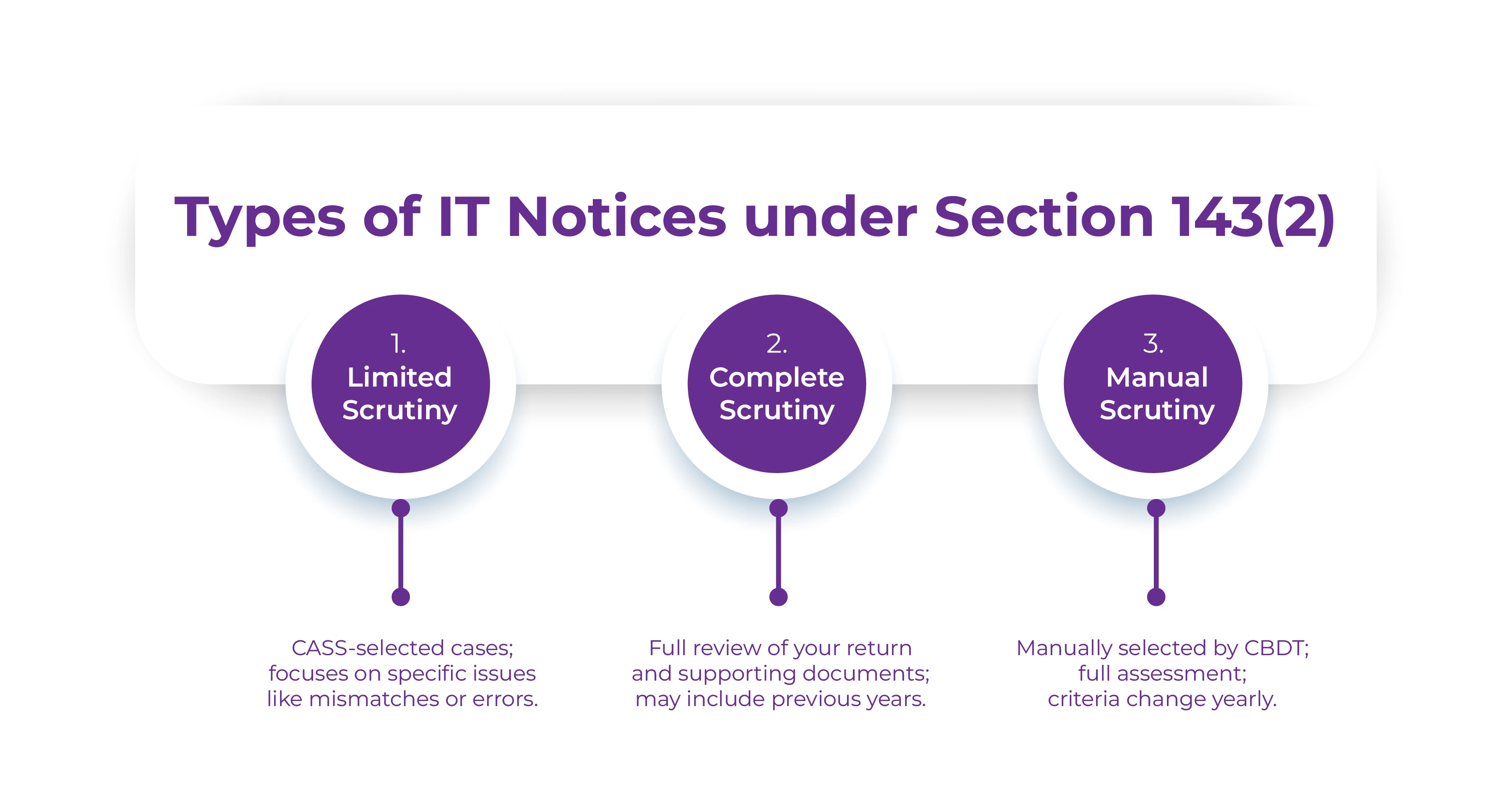

- Types of Notices u/s 143(2)

- Time Limit to Issue the Notice

- What is Faceless Assessment Under Section 144B?

- What You Should Know About Section 143(2) Notice?

- What Should I Do After Receiving Notice Under Section 143(2)?

- What Will Happen If You Fail To Respond

- What Is The Time Limit To Issue The Final Assessment Order

- Let The Experts Handle Your Section 143(2) Notice

Getting a scrutiny notice under section 143(2) means the Income Tax Department has selected your IT return for a detailed investigation. This notice is ruled out when the assessing officer has either not received any documents or is not satisfied with those received.

However, the notice does not directly mean you have avoided the taxes; it means that the department wants some explanation and clarification over what you have filed.

In simpler terms, the notice under Section 143(2) is a scrutiny assessment notice. This means the income tax department has identified issues in your IT and is asking you for further explanation to resolve them.

In this blog, we will understand the basics of the notice and how to respond to it when received.

What Does a Notice Under Section 143(2) Mean?

A notice under section 143(2) means a scrutiny notice. This is issued when the tax department finds an inconsistency and a mismatch in your ITR.

However, before issuing a scrutiny notice under section 143(2), the IT department sends an intimation under section 142(1). If the response to that intimation is not sent, or is not satisfactory, then the assessing officer issues the final notice under section 143(2).

The inconsistencies and discrepancies found in one's ITR can stem from any of the following: over-reporting losses, under-reporting income, or claiming deductions to which you are not eligible.

Keep in mind that receiving a scrutiny notice does not necessarily mean you are guilty; it is issued only to ensure you have not underpaid your taxes.

Why a Notice Under Section 143(2) is Issued

As mentioned, Income Tax Notice under Section 143(2) of the Income Tax Act 1961 is issued when the assessing officer identifies a mismatch or discrepancy in your ITR. The following are some situations in which the notice can be issued.

- A major inconsistency between Form 26AS (or) AIS.

- The turnover calculated as per the tax audit report does not match the turnover as per the GST records.

- Given the income earned, the claimed tax deduction is not appropriate.

- The income tax return includes high-value transactions as per Form 26AS.

- As per the registrar's records, property sale transactions are not disclosed in the ITR.

Types of Notices u/s 143(2)

Below is a rundown of the types of notices you can receive under section 143(2) of the Income Tax Act, 1961.

The Limited Scrutiny

These types of notices come under the Computer-Assisted Scrutiny Selection (CASS). These cases to which such notice is sent are selected on predefined parameters.

These cases have inaccurate income tax returns, mismatches, or incorrect information. The assessment or survey here will be done only in the area of return mentioned in the notice. Let us say a scrutiny claiming a foreign tax credit or assessment on the sale of property, and so on.

The Complete Scrutiny

As the name suggests, you will undergo a complete review of the income tax return filed and all the other supporting documents. The cases here will be flagged based on the CASS. Ensure that, under this scrutiny, the assessing officer may check the returns from previous years.

Manual Scrutiny

Here, the security criteria are defined by the Central Board of Direct Taxes. The requirements here are subject to change every year, and the cases selected under this are scrutinized thoroughly.

Time Limit to Issue the Notice

A scrutiny or assessment notice under section 143(2) can be issued within three months. This period starts from the end of the financial year in which the income tax return was filed.

For example, Mr Mukesh filed his income tax return on 31 July 2025 for the FY 2024-25. As per this, the assessing officer can issue the notice u/s 143(2) only till 30 June 2026. This is because the IT department allows issuance of such notices only within three years from the end of the academic year in which the return was filed.

What is Faceless Assessment Under Section 144B?

Faceless assessment is a system via which the Income Tax Department conducts tax scrutiny assessment electronically. Through this system, the notices are directly uploaded to the Income Tax portal. If you wish to view the notices, log in to your account on the portal.

However, the taxpayer against whom the notice is issued received it via email or SMS. Response to such a notice can be given online through your income tax portal.

The Faceless Assessment system ensures that the tax assessments are conducted online without you having to visit the Income Tax Department in person.

What You Should Know About Section 143(2) Notice?

Here are a few things that you must know about a notice issued under section 143(2)

- The income tax notice can be received in PDF format via email or via SMS.

- If no ITR is filed, you will not receive any income tax notice under section 143(2). But the assessing will issue a notice under section 142(1) in which he/she will ask you to file the returns.

- As per the Faceless Assessment Scheme, the income tax notice is uploaded on the income tax portal. You can log into Portal and check the notices. You will also receive an email or SMS regarding the issuance of such notices, along with us.

- You have to provide poof of all the income sources.

- You will have to undergo a detailed enquiry.

What Should I Do After Receiving Notice Under Section 143(2)?

The notice was received in the form of a PDF at your email address. The notice is also sent to the taxpayer's postal address.

Response Process of Notice Under Section 143(2)

- Log in to the Income Tax portal

- Go to the Worklist and then E proceedings.

- Choose the notice you want to respond to, and click on the "View Notice.

- Click on the "Submit Response"

- Now you can select any one "Agree" or "Disagree".

- If you select Agree, upload the JSON file of the ITR generated by the offline utility, then submit it.

- In case of disagreement, choose the reason to disagree and submit.

- After doing so, you will receive a successful dialog box displaying the transaction number.

What Will Happen If You Fail To Respond

Know that you cannot take this notice lightly or ignore it, as the consequences are severe. Here is what you will have to undergo if the notice is not responded to within the time period.

- A penalty of Rs 10,000 will be imposed under Section 272A.

- If the notice is not responded to within the timeline, the assessment office will close the assessment case with the information they have. This is known as closing the assessment with he best judgment under section 144.

- A higher taxable income can be considered, which will result in a higher tax and a similar higher penalty payable by the taxpayer.

- No response to the notice can lead to prosecution, and if found guilty, it will result in imprisonment.

What Is The Time Limit To Issue The Final Assessment Order

|

Assessment Year |

Time limit from the end of the assessment year |

|---|---|

|

2017-18 or before |

21 months |

|

2018-19 |

18 Months |

|

2019-20 |

12 Months |

Let The Experts Handle Your Section 143(2) Notice

Responding to the notice under section 143(2) within the timeline and accurately is essential. Because if you did not respond within the time frame, the consequences and penalties might be heavy.

Now, as they say, one should avoid the root cause of the problem. Hence, NRI taxpayers must consider seeking the assistance of a tax professional when filing their ITR to avoid such an income tax notice. However, if you have still managed to get one, look for someone with both technical and legal expertise in Indian Law.

One such expert we can discuss is Savetaxs. Savetaxs has been helping NRIs with their ITRs in India and other tax-related services for a decade.

The experts here bring over 30 years of combined experience, ensuring your taxes are sorted and that you receive a 100% guarantee of maximizing your assets.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Complete Guide On What is ITR, Documents Required, ITR Forms & Why To File

- NRI Income Tax Refund Delayed Because Of PAN Name Mismatch? Know What To Do

- NRI Selling Property in India

- Income Tax Act 2025: Key Changes, Features, Provisions & Objectives Explained

- Section 80TTA of Income Tax Act – All about Claiming Deduction on Interest

- How Much Gold NRI Can Bring to India in 2025?

- A Guide for NRI Buying Agricultural Land in India

- Intimation Under Section 143(1) of Income Tax Act – ITR Intimation Password

- 5 Common Mistakes NRIs Make The Lead To Tax Notices

- Your Complete Guide on EPF Withdrawal for NRIs

- Complete Checklist for NRIs Before and After Leaving India

- Understanding Defective Tax Return u/s 139(9)

- How to Respond to Notice Under Section 143(2)?

- Tax Guide for Working from India for a US Company After Expire of H-1B Visa

- How Should NRIs Manage US Tax On Capital Gains From India?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756467732.webp)