- Retirement Taxation in the US

- Indian Taxation of Foreign Retirement Income

- How Does DTAA Help in Claiming Tax Benefits on Retirement Funds?

- Role of Section 89A in Foreign Retirement Funds

- How Section 89A Works: Role of Rule 21AAA

- Tax Strategy for NRIs Returning to India with US Retirement Funds

- Final Thoughts

When returning to India, generally, many NRIs have retirement savings in the US. It includes Traditional IRAs, Roth IRAs, or 401(k) accounts. These accounts are taxed in the US only when the withdrawal is made. However, once the status of NRI changes to Resident and Ordinarily Resident (ROR) in India, these accounts also become taxable in India.

Hence, the taxation in relation to these retirement funds always tickles in their mind while returning to India. Are you also someone who is looking for guidance in this? This blog will help you know how to handle the US and Indian taxation, along with the DTAA provision. Additionally, also assist you in managing your retirement funds in India.

- It is vital for NRIs returning to India with US retirement plans to plan their taxation carefully.

- The retirement account taxation in India is different from that in the US.

- To avoid double taxation and claim DTAA, it is vital to optimize the withdrawals.

- Section 89A with Rule 21AAA and Form 10EE helps NRIs align India with US tax rules. Additionally, it prevents the annual accrual of Indian taxation.

- Further, under the DTAA between the USA and India, to claim Foreign Tax Credit, use Form 67.

Retirement Taxation in the US

In the U.S., there are three popular retirement plans for both US citizens and non-resident aliens. These are a Traditional IRA, Roth IRA, or 401(k) plan. During their work life cycle, NRIs contribute according to the prevailing retirement schemes and social benefits.

As per the US retirement accounts, an individual can withdraw the amount either upon reaching a specific age, i.e., 59½, or due to an incident. Further, in the US, retirement funds are taxed based on the account type, contribution, and withdrawal. Also, some tax exemptions are offered to individuals on these retirement schemes.

However, once you, as an NRI, return to India and your status changes to ROR, your global income becomes taxable here, as per Indian income tax laws. It also includes the interest income you received from your US retirement funds.

Considering this, the US-India treaty consists of certain specific articles that help individuals know how to tax the retirement payments. In this Article 19 is for government pensions, and Article 20 deals with private pensions. Article 19 states that government pensions are subject to taxation in the country where they are issued. Article 20 generally imposes taxes on the pension in the country where the individual lives.

Further, if both countries (India & US) impose tax on the same pension. In this scenario, through the foreign tax credit (FTC), you have the right to claim taxes on your US returns for taxes paid in India.

So, this was all about the retirement account taxation in the US. Moving ahead, now let's know how India imposes tax on foreign retirement income.

Indian Taxation of Foreign Retirement Income

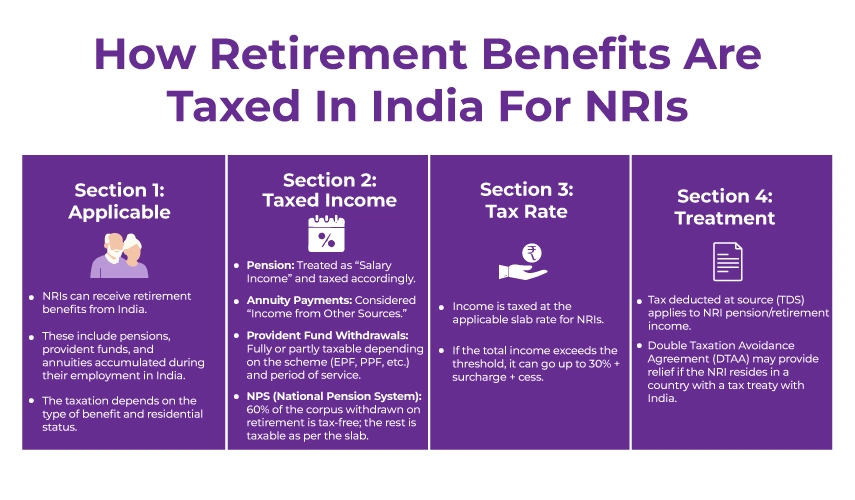

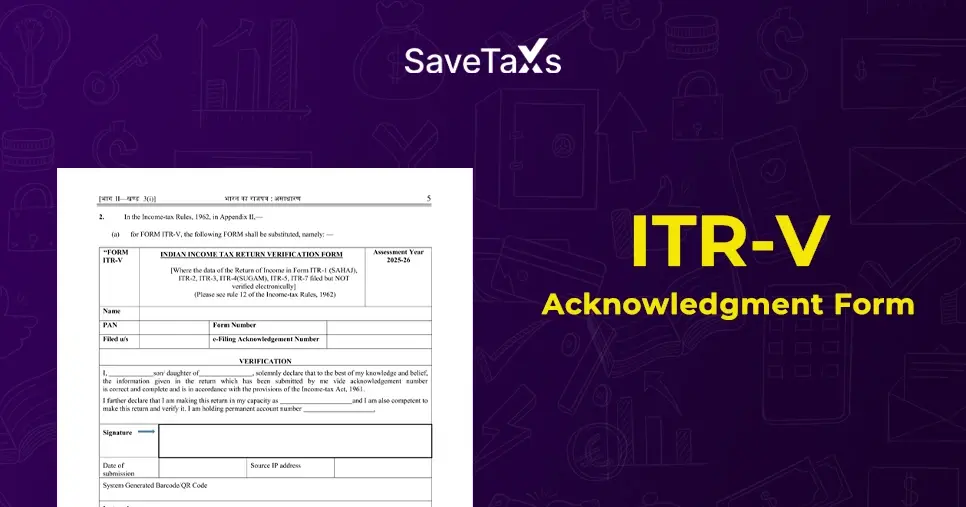

As mentioned above, once the status of NRIs changes to ROR, their global income becomes taxable in India. These also include the income earned from the foreign retirement funds. They need to mention their foreign retirement funds and the income they earn from these funds in Schedule FA of the income tax return.

However, whether you make a withdrawal or not from the US retirement accounts, every year in India, you need to pay taxes on these accounts. This led to double taxation on the same income.

Further, to address this issue, the government of India introduced Section 89A of the Income Tax Act 1961 with Rule 21AAA of the Income Tax Rules. Section 89A was introduced by the Finance Act, 2021. It provides relief to NRIs who have opened retirement accounts in the US or other foreign countries.

Considering these, by filing Form 10EE, NRIs can align US taxation with Indian taxation. Additionally, pay taxes on the retirement funds only when they make a withdrawal. This relief provision is optional for NRIs. It helps them claim the tax credit on the taxes they paid in the US on the retirement funds during the withdrawal.

This was all about the Indian taxation of foreign retirement income. Moving further, let's know how DTAA helps NRIs in avoiding paying double tax on the same retirement funds.

How Does DTAA Help in Claiming Tax Benefits on Retirement Funds?

The taxes on the retirement funds depend on the nature of the funds and the tax benefits available under Double Taxation Avoidance Agreements (DTAA). In this, pension income from employer-funded plans is taxed as salary income. Additionally, pension income from the social security authorities is taxed as other income sources in India. The tax rates are applied as per their applicable slab rates.

In case of double taxation, an NRI can claim the tax benefits under the DTAA between India and the USA in two ways, depending on their residential status. First, exempting the Indian tax. Second, claiming the FTC for the paid taxes in the US.

For instance, the US retirement funds are taxable in both India and the US. Considering this, through the DTAA agreement signed between the USA and India, you can be exempt from paying taxes on the same funds in India by claiming FTC.

Once you have claimed the tax exemption under the DTAA, you need to fill out Form 10F online. Additionally, along with the form, you need to submit your tax residency certificate given by the tax officials of your country. Further, if you claim the foreign tax credit, in India, you also need to fill out Form 67 along with the proof of taxes paid outside India.

So, this is how you use the DTAA agreement: you avoid paying double taxation on the retirement funds in the USA and India.

However, as stated above, in the US, taxes on the retirement funds are charged on the basis of withdrawal. This creates an issue in claiming the foreign tax credit. In India, when income accrues, taxes are charged, regardless of whether the taxes are imposed by the US on retirement funds. This potentially results in double taxation of the income in both India and the USA. To address this issue, section 89A and Rule 21AAA help the NRIs. Moving ahead, let's know about this in the next section.

Role of Section 89A in Foreign Retirement Funds

Introduced by the Finance Act 2021, Section 89A provides tax relief to Indian residents who, as NRIs, opened retirement accounts in the US. This section is for those individuals working in the US who have retirement funds like an IRA, 401(k), and more. Additionally, at present, they are tax residents in India (ROR).

According to section 89A, the central government stated how and when the income of a particular person from a designated retirement account will be taxed. Here, the specified person is an Indian resident who opened a specified account in a notified country while living or working there.

Further, to register for section 89A, you need to consider Rule 21AAA and fill out Form 10EE. Confused? Read the next section, and all your doubts will be clear.

Key Benefits of Section 89A for Returning NRIs

These are the following key benefits section 89A offers to NRIs returning to India with foreign retirement funds:

- This section is currently available for specified countries. It includes the US, UK, and Canada.

- Under this section, in India, income from a foreign retirement account is only taxable upon its withdrawal.

- Tax relief is only available if the NRI files Form 10EE in the first year when they become ROR.

How Section 89A Works: Role of Rule 21AAA

To impose section 89A, the Central Board of Direct Taxes (CBDT) stated Rule 21AAA. This provides:

- Contain the detailed procedure to claim the tax relief.

- Tell about the requirements to fill out Form 10EE online.

- Provides Indian taxation alignment with the tax rules of the US.

So, in simple words:

- Section 89A is right to claim taxation.

- Rule 21AAA provides the procedure to do so.

- Form 10EE works as a declaration form to the Indian tax department about your foreign retirement funds.

This was all about section 89A and how it helps returning NRIs in claiming tax relief on their foreign retirement funds. Additionally, by filing Form 10EE, NRIs can claim tax relief under the DTAA. Also, it syncs the Indian taxation with the US taxes and assists NRIs in claiming FTC for retirement taxes they already paid in the US.

Moving further, the tax strategies NRIs can implement when returning to India.

Tax Strategy for NRIs Returning to India with US Retirement Funds

Here are some strategies for NRIs returning to India with the US retirement funds:

- Know Your Residential Status in India: If you are a resident but not ordinarily resident (RNOR), your global income will not be taxed in India. However, once you become ROR, you need to pay tax on your foreign retirement funds. So, plan accordingly.

- Fill Out Form 10EE: Once your NRI/ RNOR status changes to ROR, in the first year, fill out the Form 10EE. Considering this, when filing out the form, as per section 89A, choose deferred taxation.

- Withdrawals in the US: In the US, on your retirement funds, you will be taxed in the year you make a withdrawal.

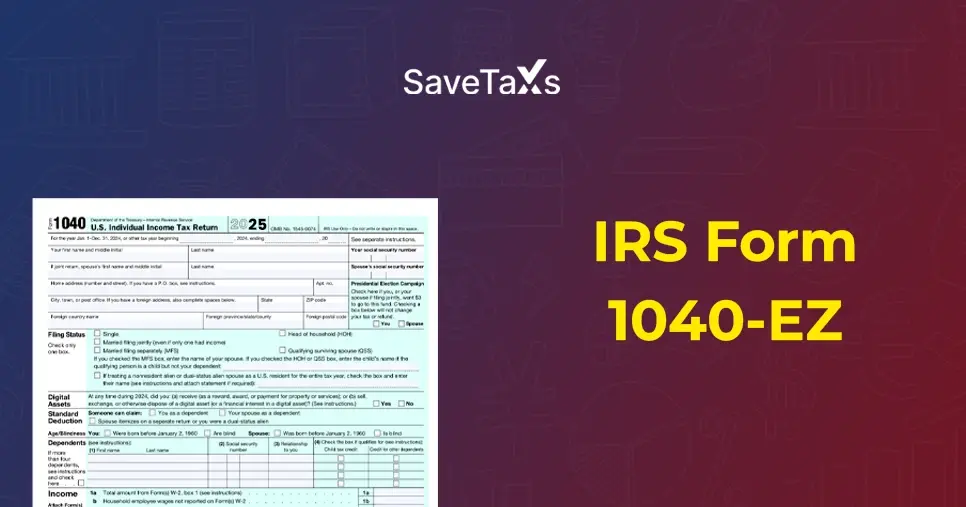

- Indian Taxation: Some taxes will be imposed in India in the year you make a withdrawal. Further, to claim the FTC on your paid taxes under the DTAA between the USA and India, file Form 67.

Using this tax strategy will surely help NRIs with cross-border taxation and claiming tax relief on their US retirement funds.

Final Thoughts

Lastly, Section 89A of the Income Tax Act plays a key role for NRIs returning to India with foreign retirement accounts. It helps them avoid paying double taxes on retirement funds. Additionally, provide tax relief with accrued income from the retirement accounts.

Here, the complete blog was about how NRIs can maintain their foreign retirement accounts in India after gaining ROR status. Further, if you are still confused, connect with Savetaxs. Our experts will help you out with this and clear all your doubts about the foreign retirement funds in India. Also, they can assist you with tax planning.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the content. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and can help you make accurate decisions throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- Complete Guide On What is ITR, Documents Required, ITR Forms & Why To File

- Section 80C of Income Tax Act - 80C Deduction List

- Your Complete Guide on TCS on Foreign Remittance

- NRI Selling Property in India

- Section 89A - Tax Relief on Income from Foreign Retirement Funds

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- Form 27Q Simplified For NRIs- TDS Return on Payments

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1760618042.webp)

_1759750925.webp)