Being an NRI, handling the US tax laws can be difficult, specifically when you are eligible for dual tax residency status. It happens when, in the same tax year, you are considered both a resident and a non-resident. Dual tax residency for US NRIs generally happens in the first year of their leaving or moving to the US.

Considering this, it is vital to understand your tax obligations in the US as per your tax residency status. It is because dual tax residency comes with certain limitations. In this, you cannot claim the standard tax deduction, which further impacts your tax amount.

Confused? To help you out, this blog consists of all the information about dual tax residency for US NRIs. So read on and gather all the details.

- Dual tax residency means being a resident and a non-resident in the same tax year in the US.

- You qualify as a resident in the US if you have stayed a minimum of 31 days in the current tax year in the US. Additionally, stayed in the country 183 days over three years.

- Dual status taxpayers cannot claim for standard tax deduction in the US.

- The DTAA signed between India and the US helps NRIs reduce their double taxation, claim foreign tax credit, and lower tax rates.

- The tie-breaker test of DTAA helps in determining the resident country of NRI for tax purposes in case of dual tax residency.

What Is Dual Tax Residency Status?

The dual tax residency status applies when, in the same tax year, you are considered both a resident and a non-resident alien in the US. The dual tax residency generally happens in two situations, i.e., in mid-year, obtain a green card, or spend a part of the tax year in the country.

Definition and Qualification Criteria

The dual tax residency status occurs when you enter the US as an NRI and your status changes to resident status. This same applies when you leave the country and your tax status changes from resident to non-resident. Based on your resident status, your tax obligations vary:

- Resident Period: You pay taxes in the US on your global income.

- Non-Resident Period: Only your U.S.-source income is taxable.

- Documentation Requirements: For each period, you need separate records.

Substantial Presence Test Requirements

For substantial presence test (SPT) has two main criteria:

- In the current year, you should physically present in the US for a minimum of 31 days.

- Over three years, you have stayed in the country for 183 days. The days can be calculated as:

- All days of the current tax year.

- One-third of the days in the first preceding year.

- One-sixth of the days in the second preceding year.

Green Card vs Non-Green Card Considerations

In the US, for tax purposes, the green card holders automatically become permanent residents. Until you officially give up your green card or the official terminates it, your US residency status continues. Compared to the substantial presence test, a green card holder faced different tax rules. These are:

- In the US, your first day as a lawful permanent resident marks your start date of residency.

- No matter how much time you spend outside the US, your residential status does not change.

- Further, compared to non-green card holders, you might get different tax benefits.

So, this was all about dual tax residency status for US NRIs. Moving ahead, let's know how dual tax residency affects NRIs.

File your tax returns with CA-powered expertise and maximize your returns.

How Does Dual Tax Residency Affect NRIs?

The tax residency status determines how your income in the US will be treated by the IRS. Considering this, according to the IRS NRI tax rules, dual taxpayers need to track and report their income.

Resident Period Tax Treatment

During your resident periods, your global income is taxable in the US. It also includes the income you earned outside the country. With some limits on tax credits and deductions, your tax obligations line up with the requirements of US citizens.

Non-Resident Period Taxation

During your non-resident period, only the income that you earned in the US is taxable by the IRS. Under this, your income falls into two categories:

- Fixed or Determinable Income: A flat 30% tax rate is imposed.

- Effectively Connected Income: Like US citizens, tax is applied at graduated rates.

Documentation and Record-Keeping Requirements

To accurately file your tax returns in the US, you need proper records. These records should include:

- During the resident period, your global income

- U.S. source income for non-resident periods

- Document proof that supports your tax deductions.

Further, at the end of the year, your residential status decides which tax return you will file. If you are a resident on the last day of the tax year, you need to fill out Form 1040, or as a non-resident, you need to fill out Form 1040NR. Additionally, attach a statement that represents how your income is divided between the resident periods.

Considering this, there are two IRS deadlines for dual-status taxpayers to file taxes. If you are receiving wages with withholding, April 15th is the tax filing date. However, if you do not get any such wages, then the date is extended to June 15 of the next tax year.

This is how dual tax residency for US NRIs impacts their tax obligations in the country. Moving further, let's know how DTAA helps NRIs in this.

How the India-USA DTAA Helps?

The main problem with dual tax residency is that both India and the US have different tax calendars. India follows a financial year, i.e., April 1 to March 31, whereas the US follows January 1 to December 31 as a tax year. Considering this, in case you leave the US and return to India in October to qualify as a resident in both countries for tax purposes, you have spent enough days.

This is where the Double Taxation Avoidance Agreement (DTAA) signed between India and the US comes to your rescue. It is a formal treaty, precisely designed for these types of circumstances. It certifies that a person does not pay tax on the same income twice. DTAA provides a hierarchical set of rules to determine which country has the right to tax your income. This further helps in effectively solving the conflict of dual tax residency for US NRIs.

Further, for claiming non-resident status under DTAA, there are two ways:

- Tie-Breaker Rule: The India-USA DTAA, by providing the "tie breaker" rules, helps in resolving the issue of dual tax residency for NRIs.

- Green Card Holders: The green card holders living in India under the DTAA can apply for treated as non-resident for US tax purposes by filing IRS Form 8333. The Form 8333 is a Treaty-Based Return Position Disclosure.

So, this is how the India-USA DTAA helps NRIs in paying tax on the same income twice. Moving ahead, let's know the DTAA tie-breaker rules for deciding residency.

DTAA Tie-Breaker Rules: Deciding Residency

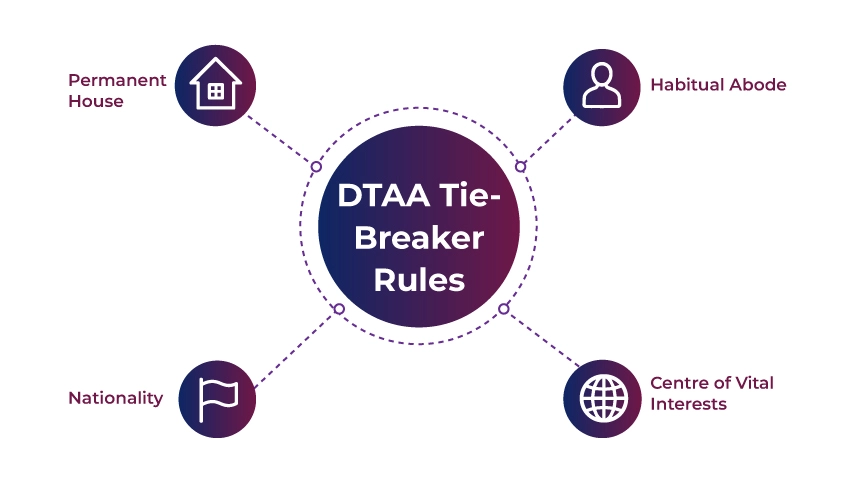

When you are considered a resident by both countries, Article 4 of the India-US DTAA, for tax purposes, to know your resident country provides a series of "tie-breaker" tests. Here are the key criteria for these rules:

- Permanent House: Country where you have a permanent residence.

- Habitual Abode: Country in which you have spent more time.

- Centre of Vital Interests: Location of the strongest economic and personal ties.

- Nationality: If all the above test fails to decide the residency, then your nationality is generally considered your resident country for tax purposes.

This is how the DTAA tie-breaker rules help in determining the residency status. Moving further, let's know how to avoid double taxation.

How to Avoid Double Taxation?

To avoid double taxation, you can implement the following strategies:

- To eliminate or reduce your tax obligations in one country, use the India-USA DTAA. You can do so by:

- Obtaining a Tax Residency Certificate (TRC) from the IRS.

- Declaring foreign income on both tax returns.

- File Form 10F and self-declaration in India.

- Through the tax credit method, claim tax relief

- In the US, to claim the foreign tax credit for paid taxes in India, fill out Form 1116. Additionally, to claim the credit on the paid taxes in the US, fill out Form 67.

- Smartly plan your overseas income. Such as:

This is how you can avoid double taxation. Additionally, for optimal tax planning, plan your return to India strategically.

Connect with Savetaxs and begin your stress-free tax journey in India with our taxation experts.

Final Thoughts

Lastly, the dual tax residency for US NRIs is significant but a manageable issue. You can stay compliant with the IRS regulations and your tax obligations by filing tax requirements, tracking residency periods, and the substantial presence test. Additionally, you need a clear understanding of the tax rules stated by the DTAA, a proactive approach, and proper documentation.

Further, if you are facing issues in filing dual-status tax returns, connect with Savetaxs. We offer specialized NRI tax services with expertise in Indian & US tax laws, along with personalized tax strategies and maximized tax savings.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- What Is State Income Tax - Overview, How It Works And More

- What is Adjusted Gross Income (AGI)?

- What Is Earned Income & the Earned Income Credit?

- Difference Between Residents And Non-Residents Aliens And Their Taxes

- What is modified Adjusted Gross Income (MAGI)

- New Tax Laws 2025: Tax Brackets and Deductions

- Difference Between Federal and State Income Taxes

- Self Employment Tax: Meaning & How To File It

- US States With Highest And Lowest Income Taxes

- 9 US States With No Income Tax

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1764918370.webp)

-plan_1761282887.webp)

_1766129179.png)

_1766644785.png)

_1763555884.webp)

_1766561286.webp)

_1768221427.webp)

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)