- Key Takeaways

- What are Itemized Deductions?

- Types Of Itemized Deductions

- The Itemizing Requirements

- Should I Itemize My Deductions Or Not?

- What are the implications of the Alternative Minimum Tax?

- What Is The Drawback Of Itemizing?

- How To Itemize Non-Cash Charitable Contributions?

- Get Expert Guidance On Itemized Deduction Calculation

An itemized deduction lets taxpayers subtract a few expenses from their annual gross income (AGI). This can potentially reduce the overall taxable income.

In simpler words, the itemized deductions are the eligible expenses that allow taxpayers to claim on their federal income tax returns. Unlike the standard deduction, the amount of itemized deduction is not pre-determined by the IRS. However, you need to follow specific criteria while itemizing the deductions.

In this blog, we will talk about everything related to itemized tax deductions, types of itemized deductions, and the requirements.

Key Takeaways

- The taxpayer must choose between the standard deduction and the itemized deduction.

- If you pay mortgage interest, property taxes, medical and dental expenses, or state and local income or sales taxes that exceed 7.5% of your adjusted gross income, then in this case, your itemized deduction amount will be greater than your standard deduction amount.

- Itemized Tax deductions help the taxpayer lower their annual income tax bill.

- The common itemized deduction includes medical expenses, state taxes, mortgage interest, charitable donations, and more.

- To claim the itemized deduction, a taxpayer must file the IRS tax form 1040 and list their itemized deductions on Schedule A.

- If a taxpayer is subject to the Alternative Minimum Tax (AMT), some or all of the itemized deductions they claim can either be eliminated or reduced.

What are Itemized Deductions?

The itemized tax deduction allows taxpayers to subtract a particular kind of expense from their adjusted gross income (AGI), which helps reduce the overall income of the taxpayer.

Standard deduction is a flat amount based on the filing status of the taxpayer, but the itemized deduction lets you deduct specified expenses as allowed by the IRS.

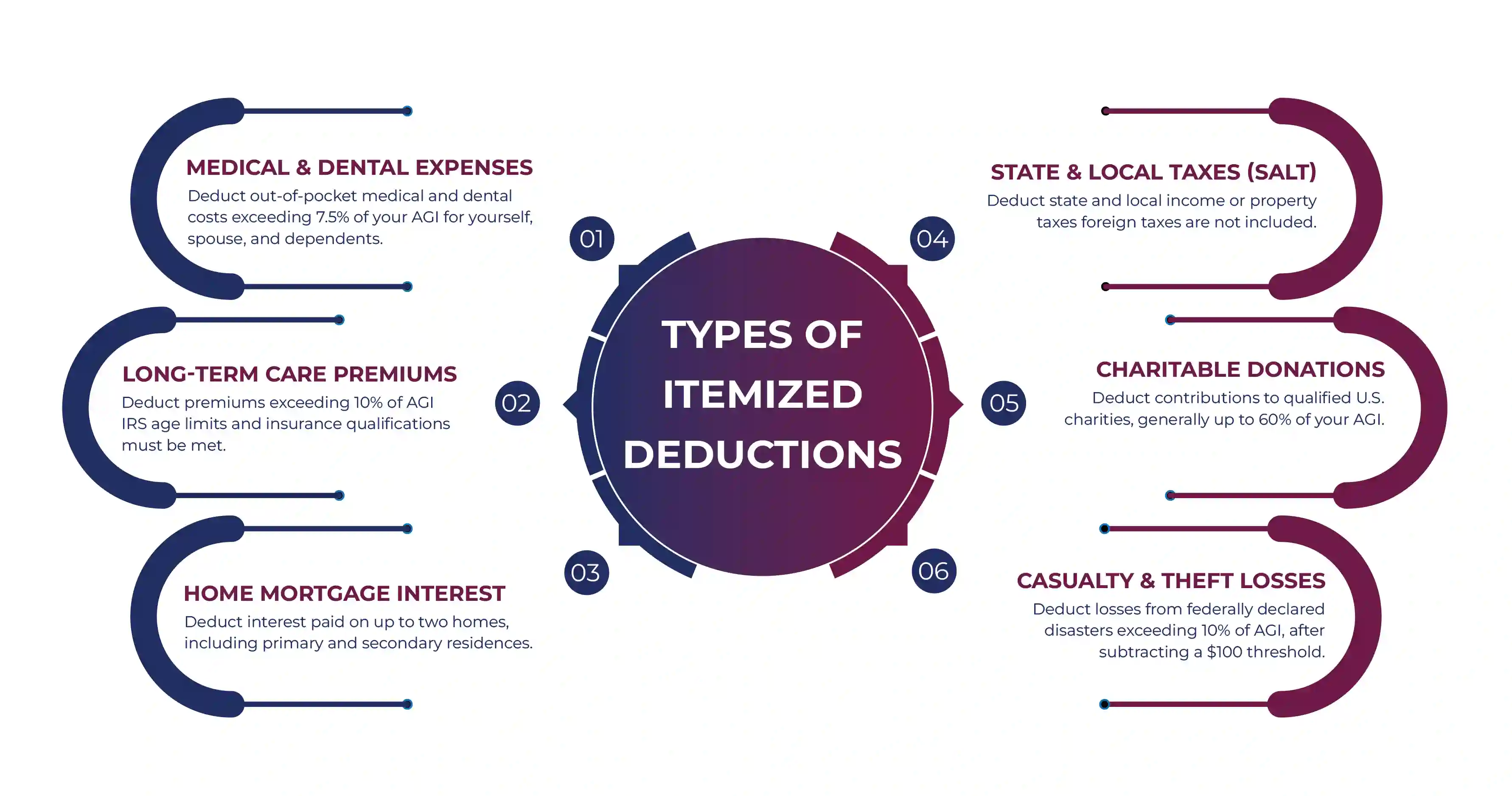

Types Of Itemized Deductions

Itemized deduction includes an IRS-permitted list of expenses that are only deductible when you choose to itemize.

Common itemized deductions that a taxpayer can deduct from their overall taxable income include:

Medical and Dental Expenses: The IRS allows you to deduct the dental and medical expenses that surpass 7.5% of your AGI. This includes the costs that you incur for yourself, your dependents, and your spouse. Please ensure that these deductions only apply to the out-of-pocket expenses and are not covered by the insurance.

Long-term Care Premiums: If you have long-term care insurance, you are allowed to deduct the premiums. However, this is allowed only if the premium exceeds 10% of your AGI. To do so, the IRS has set the limits based on age, and the insurance must meet the qualifications set by the IRS.

Home Mortgage Interest: The mortgage interest you pay on up to two homes.

State and Local Taxes (SALT): As a taxpayer who has itemized, you can deduct state and local taxes on your Schedule A. Personal or other taxes, such as the real estate taxes, are deductible with the state and local taxes that were evaluated from the last year.

Moreover, the refund received by the taxpayer from the state in the last year is considered income if the taxpayer has itemized their deductions in the last year. Please ensure that the foregin real estate taxes are not deductible.

Charitable Donations: If a taxpayer has made a charitable donation to a qualified charity, then that is deductible. The limit set on the charitable contribution is 60% of your AGI. However, this limit varies depending on the type of donation and the organization receiving the donation.

Casualty and Theft Loss: Losses that are the result of a federally declared disaster are deductible. However, it is only deductible if the loss limit is more than 10% of your AGI, which is after subtracting a $100 threshold. Now, in case you have received the reimbursement for the loss in the latter part of the year, it must be reported as income.

Before 2018, the itemized deduction examples list included miscellaneous deductions, such as work-related travel and union dues. From the start of 2018, such expenses were eliminated and were no longer deductible for federal tax. However, specific states in the US still allow these deductions.

The Itemizing Requirements

To claim itemized deductions, the taxpayer must file their income taxes using Form 1040 and list the itemized tax deductions on Schedule A.

- Enter the expenses on the right line of Schedule A.

- Add those expenses up.

- Copy the total amount to the second page of your IRS income tax form 1040.

- This calculated amount is subtracted from your income to compute the final taxable number.

Should I Itemize My Deductions Or Not?

See, whenever you are deciding to itemize your deduction, know that the cost of this is giving up on your standard deduction amount. So, just to be safe, after adding up your itemized deductions, make sure you cross-check that with the standard deduction amount as per your filing status.

Go for itemized tax deductions only when it is greater than the amount of your standard deductions. Because if it's not, you will end up paying more tax if you itemize.

What are the implications of the Alternative Minimum Tax?

As per the Internal Revenue Service (IRS), if you are subject to Alternative Minimum Tax (AMT), either some or all of your itemized deductions you claimed will be eliminated or reduced.

For example, the AMT does not allow deductions for.

- Interest on home equity loans

- State and local income or sales taxes.

What Is The Drawback Of Itemizing?

When you itemize deductions, it tends to feel overwhelming. This is because itemizing the deductions requires accurate calculations and recordkeeping of the expenses. In certain cases, the IRS even asks for documents such as statements or receipts to verify the deductions you have claimed.

The Internal Revenue Service (IRS) is more likely to audit those returns that are itemized, especially those in which the deduction amount happens to be high compared to the annual income of the taxpayer.

To successfully claim the right itemized tax deductions as a taxpayer, it is your responsibility to maintain and keep the records for the entire year.

How To Itemize Non-Cash Charitable Contributions?

When you donate non-cash items to the charity, such as household goods or vehicles, these items are not itemized. However, if you manage to obtain a written acknowledgment from the charitable organization, it must include the donation's name, date, and value. In that case, you can have the non-cash donation itemized.

Additionally, if your non-cash charitable contributions are above $500, then you must file Form 8283. This form provides a detailed breakdown of the items that have been donated.

Get Expert Guidance On Itemized Deduction Calculation

Itemized tax deductions can bring in great tax savings only if done with careful documents and understanding of the IRS rules about them.

It is highly advisable that if you are unsure about how to perform the calculations regarding itemization or whether it is the right choice, you must consult a tax professional.

One such tax professional leading the US taxation market is Savetaxs. Savetaxs offers the best taxation services in the US. By now, we have services for over a thousand satisfied U.S. citizens and residents, including taxation services and more.

Hence, if you need help regarding the itemized deductions and anything beyond it, experts are here to offer you end-to-end assistance. We service our clients 24/7; connect with us and let us help you secure significant tax deductions.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1763555884.webp)

-in-the-USA_1762862398.webp)