NRI selling property in India from the USA has always been a source of considerable confusion. Be it tax implications, adherence to FEMA regulations, documentation, or repatriating the sale proceeds, everything has been vaguely discussed till now.

But not anymore, as this blog is your final pit stop and answer to any confusion related to selling property in India as an NRI while living in the USA.

We will discuss all aspects of the process, including how NRIs sell property in India, the Power of Attorney, TDS deductions, capital gains taxation, required documentation, and more.

- NRIs cannot sell agricultural lands, plantations, or farmhouses in India unless they have an approved special permission from the Reserve Bank of India.

- The entire timeline of selling a property in India as an NRI, on average, is for about two to six months. However, if legal disputes arise, the timeline might be extended.

- Ensure that NRIs can repatriate up to USD 1 million in sale proceeds through their NRO accounts in a financial year. However, to ensure the successful repatriation of sale proceeds, the property sold must be acquired in accordance with FEMA, and the tax liabilities on the sale proceeds must be cleared.

- NRIs can reduce their capital gains tax liability through certain capital gains exemptions for NRIs under the Income Tax Act, 1961, such as Sections 54, 54EC, and 54F.

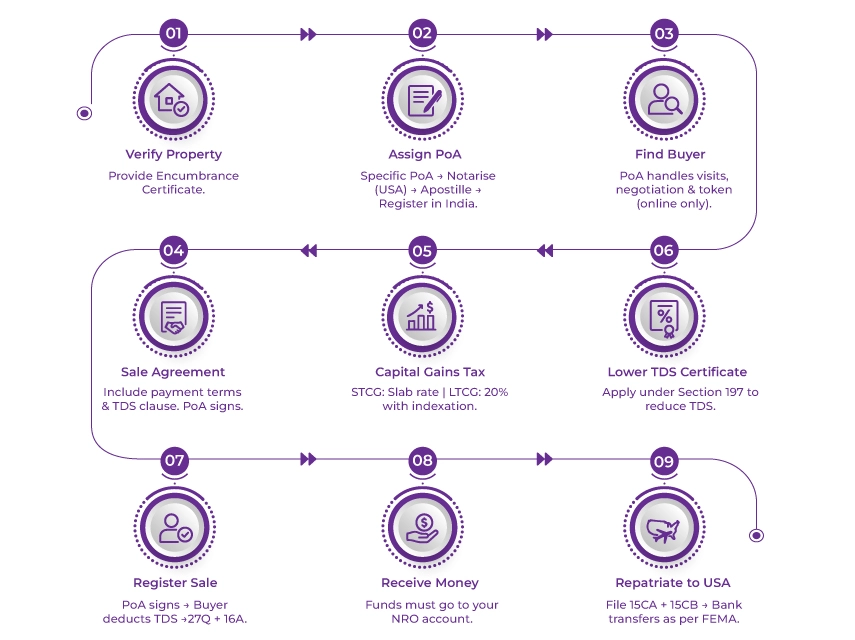

Step-by-Step Process Of NRI Selling Property In India From The USA

For NRIs, the following is the only process you'll ever need to understand to know "how to sell property in India from the USA", all while complying with FEMA regulations.

Step 1: Property Ownership And Background Verification

As an NRI selling property in India from USA, you will provide an encumbrance certificate to the buyer. This certificate will ensure that you and the buyer that the property being sold is free from legal disputes and loans.

Step 2: Appointing A Power Of Attorney (PoA) Holder

There are instances when an NRI cannot be physically present in India at the time of the property sale. This is when you can appoint a Power of Attorney holder in India.

A PoA gives the chosen individual, also known as the agent (the person to whom the power was granted), the legal authority to make decisions on behalf of the principal (the person who granted the power).

Now that the PoA holder will be acting on your behalf throughout the NRI property sale process, ensure you choose a trusted individual.

Process

- Draft an NRI PoA for a property sale deed that clearly outlines the details about the property and the powers granted to the PoA holders, such as signing documents and selling the property.

- Get the PoA for NRI property sale in India notarised by a US Notary Public, then have it apostilled.

- Send the PoA deed to India.

- Upon receiving the NRI PoA for property sale in India, it is registered or adjudicated at the local sub-registrar's office.

Please note that the general PoA is often rejected, hence use a specific PoA type only.

Step 3: Find a Buyer

To find a buyer for the property, the PoA holder in India has the authority to finalize the buying party. The holder can do so by coordinating property visits, negotiating prices among potential buyers, and collecting the token amount from the finalized buyer.

However, please ensure to get the token amount online, not in cash.

Now that you are not physically present in India, you can supervise everything through online meetings or calls.

Step 4: Draft & Sign The Sale Agreement

Once the buyer party is finalized, the next step is to draft a sale agreement. Please ensure the deed includes all key aspects such as:

- Details of the seller and the buyer

- Property details

- Payment terms

- Mandatory TDS deduction clause.

- Possession terms

- Details about taxation and related matters.

- On behalf of the seller, the PoA holder can sign the deed.

Ease filing NRI ITR by getting personalized assistance at every step of the process.

Step 5: The Calculation of Capital Gain Tax On Sale of Property By NRI

For the accurate calculation of capital gains tax on the sale of property by NRI, get yourself a Chartered accountant who has expertise in NRI taxation and cross-border real estate tax implications.

- However, in India, short-term capital gains ( property held for 24 months or less) are taxed at the individual's slab rate.

- Whereas in the long term ( property held for more than 24 months), capital gains are taxed at 20% with indexation.

The chartered accountant also checks and assesses the original cost, the improvement cost, the cost related to registration of the property, and the stamp duty. Add to that, the CA will also help you claim the eligible tax exemptions available to NRI sellers in India, such as Sections 54, 54EC, and 54F.

Step 6: Apply for a Lower TDS Certificate (Section 197)

NRIs selling property in India from USA must apply for a lower TDS certificate for NRI, also known as the Nil/Lower Deduction Certificate.

Unlike for resident Indians, TDS on the sale of property by NRI is relatively higher, as it is deducted on the entire sale value rather than the gains.

Having a lower nil TDS certificate ensures that the tax is deducted only on the estimated tax liability, and not on the entire sale value.

The default TDS for the NRI property sale can be:

- 20% + surcharge + cess (LTCG)

- 30% + surcharge + cess (STCG)

Step 7: Registration of Sale Deed

Now, on the date of registration of the property, the PoA holder signs the sale deed on behalf of the NRI, and the buyer pays the remaining amount for the property.

Once the property's amount is paid, the buyer will be obligated to deduct TDS. Hence, the buyer will file Form 27Q.

This form is a quarterly TDS (tax deducted at source) return statement. This reports the tax deduction on non-salary payments made to an NRI.

Post filing Form 27Q, the buyer will provide the seller with Form 16A. For the seller (in this case, you), this form serves as proof that the tax has been deducted from the sale proceeds and deposited with the income tax department on your behalf.

As the seller, please ensure you have kept all the forms and documents for the tax filing process.

Step 8: Receive Money in NRO Account

Ensure that the amount from property sales is credited to your NRO account. What's now allowed is receiving payment in the account of relatives, friends, or joint holders.

The following are the NRI property sale documentation that the bank may ask to validate that the payment can be:

- The sale deed.

- PAN card of the buyer.

- TDS challans,

- Your passport copy

- And the copy of PoA.

Step 9: Repatriation of Sale Proceeds to the USA

Now comes the technical part of the NRI property sale process: repatriating (transferring) your sale proceeds from your NRO account to your US bank account.

To make this repatriation happen, you need Form 15CA and Form 15CB.

Form 15CA: This is a declaration form that you will be filing with the Income Tax Department. Before processing the payment to your US bank account, the bank will ask you for a copy of this form.

Form 15CB: This is a form that a CA must sign in case of foreign remittances where TDS applies. This form ensures that any withholding tax obligation on this payment has been calculated accurately under the DTAA between India and the USA. In a nutshell, this form certifies that the taxes on the concerned taxpayers have been paid.

The bank will verify and transfer funds in accordance with FEMA's regulatory framework.

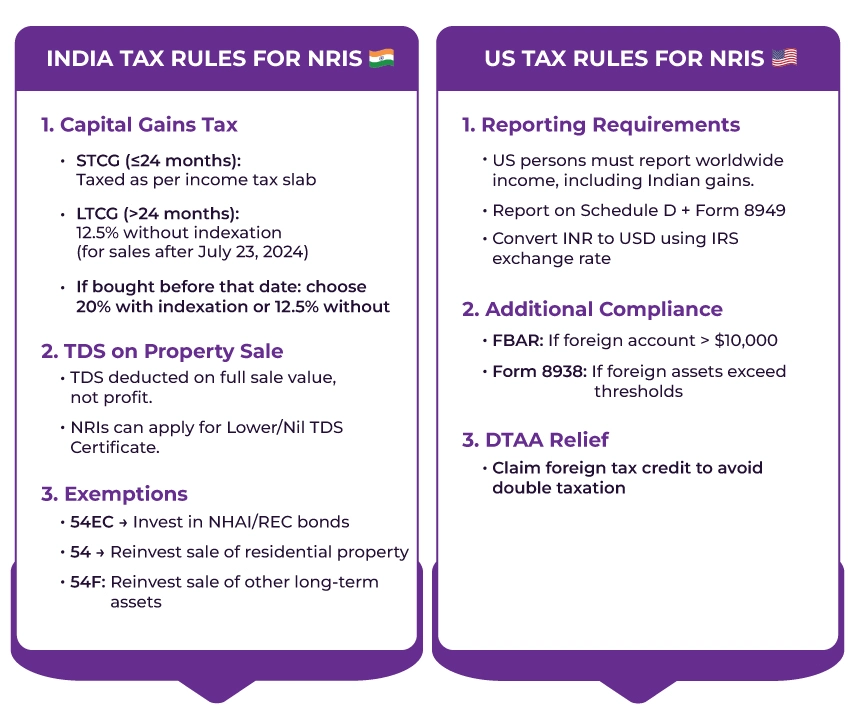

Tax Implications For NRIs in India And the USA

NRI Capital Gain Tax In India

The following is the taxation on property sale for NRIs.

Capital gains - Short-term Capital Gains & Long-Term Capital Gains

If the NRI sells the property within 24 months of its acquisition date, then the gains earned from that property are classified as short-term gains. Short-term capital gains (STCG) are taxed at your income tax bracket in India.

On the contrary, if the property is held for more than 24 months, then the gains earned are classified as long-term capital gain.

Now, for properties sold on or after July 23, 2024, the LTCG tax is applied at a rate of 12.5% without indexation.

But if the property was acquired before July 23, 2024, you can choose to be taxed under either the old regime (20% with indexation benefits) or the new regime (12.5% without indexation benefits).

The NRI TDS Rules

Under the TDS rules for NRIs, the buyer must deduct TDS on the entire sale value, not the profit.

Additionally, NRIs can apply for a Lower TDS/Nil Certificate for NRI, as mentioned above in step 6.

Exemptions Available For NRIs

NRIs can reduce their tax liability by reinvesting their sale proceeds in accordance with the following section.

Section 54EC: Invest in bonds (NHAI\REC)

Sections 54 and 54F of the Indian Income Tax Act both provide tax exemptions on long-term capital gains. To get the exemption under this section, you have to reinvest your sale proceeds in a residential property, but it applies to the sale of different original assets.

Capital gain exemption for NRI under Section 54 applies when a residential house property is sold, and Section 54F applies when any other long-term capital asset is sold, like commercial property, land, etc.

US Tax Implications on NRIs

As a US person (green card holder, resident, or citizen), you are required to report your worldwide income when filing taxes in the USA, including profits from the property sale in India.

The profits or the capital gains you have earned from the property sale have to be reported on your US Tax Return.

To report the gains, you can use Schedule D (Form 1040) and Form 8949 to detail the transactions.

Please ensure that you report the amounts in USD. To know the exact amount in USD of the gains you earned in INR, you can use the IRS-approved exchange rates for that same date on which the transaction happened.

Additionally, as an NRI living in the United States, you will need to report the sale on FBAR (FinCEN Form 114) if the account receiving the proceeds exceeds the $10,000 threshold or Form 8938 if your total foreign assets exceed a set threshold.

However, for NRIs living in the US, the India-US Tax Treaty offers great relief to American taxpayers selling property in India.

An Example: NRI Selling Property In India

Let us understand this concept of selling property in India from the USA with a simple example:

Meet Priya, an NRI living in New Jersey, who wants to sell her inherited flat in Delhi.

To start with the selling process

PoA Creation

Now that, as an NRI, she cannot be physically present in India, Priya first created a Power of Attorney for the property sale, which was notaris and apostilled, and then couriered to India. The PoA holder in the case of Priya is her brother.

Finalize The Buying Party notarised

Priya's brother finalized the buying party and kept Priya in the loop about what was happening.

Sign The Agreement

The agreement of sale has been signed by the PoA holder, Priya's brother, on her behalf.

CA Calculates The Capital Gain Tax To Be Paid

As mentioned above, the property was inherited from the father, and the original purchase cost and indexation benefits are considered.

- Cost after indexation(CII calculation by the CA): Rs 62,00,000

- New Long Term Capital Gain Tax = Rs 1,20,000 - Rs 62,00,000 = Rs 58,00,000.

Apply for the Lower TDS Certificate

Now that the capital gains tax has been calculated, the PoA holder will apply for the Lower TDS Certificate so that the tax is deducted on the actual tax liability rather than the entire value of the property.

TDS certificate issued; hence, the TDS is reduced to Rs 11,60,000.

Now, if the TDS certificate has not been issued, the TDS has been deducted from the full sale value, which would have been Rs 24,00,000.

Sale Deed Registered

The PoA holder executed the sale deed, and the buyer deducted TDS of Rs 11,60,000 as per the certificate and paid the remaining purchase amount to Priya.

Repatriation Processes

Upon receiving the sale proceeds

The CA issued Form 15CB, and Priya simultaneously filed Form 15CA online to complete the repatriation process under FEMA.

Hence, the funds were repartiated from the NRO account to Priya's New Jersey Bank account.

Tax Filing

Lastly, to stay fully compliant.

Priya filed ITR in India.

- She did so because, as the TDS of Rs 11,60,000 has already been deducted, she filed it; because if the final tax value is lower, the refund can be claimed.

In New Jersey, she filed the personal income tax return.

- The tax on capital gains was calculated in accordance with the USA rules.

- However, since she has already paid tax in India, she can claim Foreign Tax Credit for fr the taxes she paid in India and avoid double taxation.

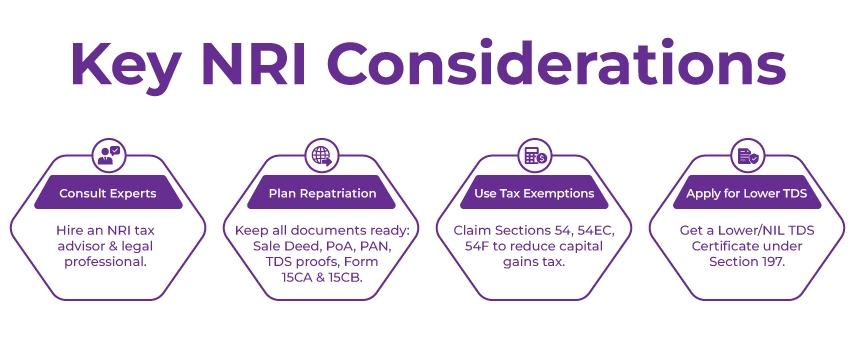

Important Considerations for NRIs

Here are a few practices that the NRIs selling property in India must consider.

Get in touch with professionals: As an NRI, the best you can do is hire an NRI tax consultant and a legal advisor. They can help you pass through the entire process smoothly.

Plan for Repatriation: For a smooth repatriation of sale proceeds to your country as an NRI, ensure you have the NRI property sale documentation and Forms, such as 15CA and 15CB, in order. Additionally, to be compliant, you can check the Repatriation rules for NRIs.

Avail Every Exemption Possible: NRIs can avail themselves of significant tax exemptions under certain sections of the Income Tax Act. Sections such as 54EC and 54F can help you minimize your capital gains tax liabilities.

Lower Deduction Certificate: Unlike resident Indians, NRIs are subject to higher TDS rates. To reduce the burden, you can apply for a lower/nil deduction certificate from the Income Tax Department.

The Bottom Line

This is not a cake walk; selling property in India as an NRI requires careful planning, proper documentation, and strict adherence to legal and taxation regulations.

As an NRI selling property in India, you need to understand the tax implications of both nations, including TDS and the FEMA guidelines. This understanding will help you throughout the process. However, to make an informed decision, NRIs should hire experienced NRI taxation and real estate professionals.

Here at Savetaxs, you get both NRI taxation and cross-border real estate orodesionde under one roof.

Our experts bring 30 years of combined experience, and we have been helping NRIs across 90+ countries for years.

The taxation and real estate professionals here will provide you with end-to-end consultation throughout the entire selling process, from drafting your PoA to repatriating your sale proceeds and filing taxes in both India and the USA. Additionally, the experts will also consult you on utilizing all available tax exemptions for NRIs as per the Income Tax Act to help you minimize your tax liability and maximize your financial benefits.

So, do not let these complex tax regulations and hectic bureaucratic processes hamper both your mind and your property sales return.

Connect with us today as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- How Should NRIs Manage US Tax On Capital Gains From India?

- Understanding Health Savings Account (HSA) For Returning NRIs

- How NRIs can e-verify IT Return From Abroad?

- How are Foreign Assets Taxed Under the Black Money Act?

- DTAA Claim Mistakes NRIs Make And How To Avoid Them

- Tax Rules for Selling Property in India as an NRI & US Tax Resident

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!