As a returning NRI, understanding the property tax implications is essential if you have investments in the Indian real estate market. From tax residency status to income earned from the property (if it's a rental), capital gains tax aspects, and repatriation rules, staying compliant with such elements is essential to avoid any legal complications.

In this blog, we will discuss the property tax implications for returning NRIs, which will help you maximize the benefits of investing in the real estate market of India.

Key Takeaways

- The change in your residential status affects your property tax implications in India.

- As a returning NRI, the rental income is taxed at the applicable slab rates. However, you can claim a 30% standard deduction at the net annual value of the property for maintenance and repair expenses.

- If you sell a property within two years of purchase, the gains are considered short-term capital gains and are taxed at your income tax slab rates. Whereas selling after more than two years, the gains are long-term and are taxed at a rate of 20% with indexation benefits.

- NRIs are eligible for certain tax exemptions and deductions on capital gains tax.

- From April 1, 2015, the wealth tax has been abolished in India.

Residential Status and Tax Liability

As an NRI returning to India, your residential status plays a significant role in determining your tax liability in India. As a non-resident Indian, you are chosen as a non-resident for tax purposes if you meet the following conditions:

- You have been outside India for 182 days or more in a financial year or

- You have stayed outside India for 365 days or more during the four preceding financial years and 60 days or more in the current financial year.

When you no longer meet these criteria, you become a resident for taxation purposes. The change in your residential status also impacts the property tax implications.

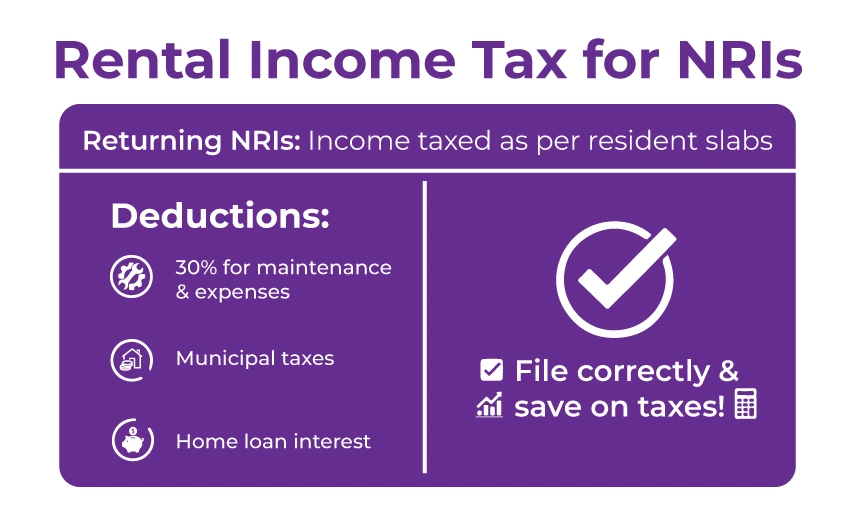

Taxation of Rental Income

As an NRI while living abroad, if you have been earning rental income from your property in India, you must report this income and pay your taxes accordingly. However, as a returning NRI, your rental income will be taxed according to the applicable tax slab rates.

Now that you will be considered a resident for taxation purposes, you are eligible to claim a standard deduction for expenses and maintenance of 30% on the net annual value of the property.

You are also eligible to claim deductions on municipal taxes and interest paid on the home loan that is related to the property.

Capital Gains Tax

Anyone who sells property in India is accountable for capital gains tax. The capital gains tax depends on the holding period of the property before its sale.

If the property is sold within two years of purchase, the gain is considered a short-term capital gain. Whereas, if you sell the property after two years, then the gains are taxed as long-term capital gains (LTCG). LTCG is taxed at a rate of 20%, along with the indexation benefits.

The indexation allows you to adjust the property’s purchase price for inflation, thereby reducing your total tax liability. Additionally, as an NRI returning to India, you may be eligible for tax deductions and exemptions on capital gains tax.

Tax Deducted At Source (TDS)

According to Section 195 of the Income Tax Act, TDS is mandatory on payments made to non-residents. It can include non-resident Indians (NRIs) and foreign companies. Now, if the seller is an NRI, the TDS rates would be much higher, depending on the capital gains. Unlike the flat 1% TDS on the sale price for resident Indians, the TDS for NRIs applies to the capital gains. The capital gains rates are:

- Long-Term Capital Gains (LTCG): 20% + surcharge + cess.

- Short-Term Capital Gains (STCG): According to the applicable income tax slab rate (can rise to 30% + surcharge + cess).

Additionally, there is no minimum threshold limit for TDS, as it applies even if the value of the property is under Rs. 50 lakhs. The buyer is responsible for deducting the TDS, be they are a resident or an NRI. Furthermore, TDS applies to the entire sale consideration instead of only to the gains.

Lower TDS Deduction

An NRI selling a property in India is allowed to apply for a lower or Nil TDS certificate from the Income Tax Department. This is possible if your actual tax liability is below the standard TDS rate of 20%-30% Upon receiving the approval, the buyer will deduct TDS according to the reduced or zero rate as specified.

To steps to apply for a lower or Nil TDS certificate include:

- Applying under Section 197 by filing Form 13 through the TRACES portal.

- Providing supporting documents like the sale agreement, PAN, property details, etc.

- Obtaining a certificate from the tax department.

- Submit the certificate to the buyer to apply the lower rate of TDS.

In case an NRI is not able to acquire a lower TDS certificate and the TDS is deducted at a higher rate. It might result in a deduction of TDS more than the actual tax liability. So, the NRI can claim the excess deduction as a refund when filing the ITR.

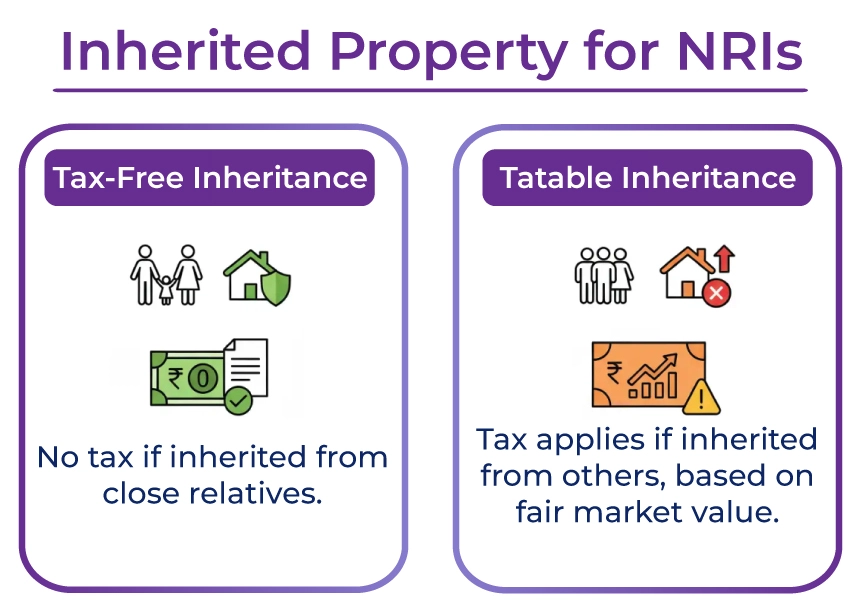

Inherited Property

As a non-resident Indian (NRI), if you have inherited a property, then understanding the tax implications associated with such a type of property is essential. If the property is inherited from a close relative, such as a parent, sibling, or spouse, then there will be no tax liability against the inherited property.

Except for close relatives, if the property is inherited from someone else, you will be liable for the tax implications associated with it. The tax is based on the fair market value of he property as of the date on which it was inherited.

Wealth Tax

The tax implications of the wealth tax are now nullified, as the wealth tax was abolished in India as of April 1, 2015.

The Bottom Line

As an NRI returning to India, understanding the property tax implications of India is essential if you have made property investments. From rental income taxation to TDS provisions and capital gains tax, understanding these aspects will help you make a more informed decision. We hope that this real estate investment guide for returning NRIs is helpful.

However, it is advisable to seek help from a qualified tax expert to ensure compliance. A tax expert can guide you through the hefty taxation rules, forms, and more, and will also help you get the exemptions and deductions you deserve.

Savetaxs is one such expert that helps returning NRIs sort out their property-related tax responsibilities in India. Our experts will assist you with an end-to-end consultation on your queries related to property tax and more.

Additionally, the experts will provide you with capital gains tax advisory services, assistance with repatriating funds, hassle-free documentation, and ensure legal compliance.

Connect with us and get expert guidance on property taxation for returning NRIs.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- A Complete Guide for NRIs Returning to India from the USA

- US Social Security Taxation for NRIs Returning to India

- USA Rental Income Tax for RORs in India

- Returning to India from Malaysia - A Guide for NRIs

- A Guide for NRIs Returning to India from UAE

- NRIs Returning from Canada to India- A Comprehensive Guide

- A Guide for NRIs Returning to India from the UK

- Best Cities to Settle After Returning to India

- 529 Plan For NRIs Returning Back To India - Is It Still Worth It?

- A Complete Guide for NRIs Returning to India from Australia

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1753429421.webp)

_1758631896.webp)