- Can NRIs File Form 10F Without A PAN?

- Why Banks And Financial Institutions Still Ask For PAN?

- Documents Required For Form 10F Filing Without PAN

- How NRIs Can File Form 10F Without PAN (Step-by-step)

- What Happens If You Do Not Submit Form 10F?

- Should NRIs Apply For A PAN Card Or Continue Without It?

- Final Thoughts

For non-resident Indians, Form 10F is a key document that allows NRIs and other non-resident individuals to claim benefits under DTAA. This form ensures that NRIs don't face higher TDS or double taxation on their Indian income.

Back then, when NRIs used to file Form 10F on the income tax portal, it required a PAN Card, which caused many hurdles for NRIs who didn't have one. Over time, the Central Board of Direct Taxes (CBDT) recognized this issue and introduced a relief allowing NRIs to file Form 10F without a PAN card, now electronically.

In this blog, we will discuss how NRIs can file Form 10F without a PAN card.

- NRIs and non-residents no longer need a PAN Card (Permanent Account Number) to file Form 10F.

- Form 10F must be filed each year to continue availing of the DTAA benefits.

- Failing to Submit Form 10F can create tax hurdles for NRIs, such as higher taxes and TDS rates, inability to claim DTAA benefits, and more.

Can NRIs File Form 10F Without A PAN?

Yes, non-residents and non-resident Indians can register on the Income Tax portal without a PAN Card. This is a major sign of relaxation for individuals and foreign companies who are new to the Indian tax system and compliance.

To file Form 10F without a PAN, the process basics involve:

(However, we will discuss the entire process later in the blog)

- Registering on the income tax e-filing portal as a non-PAN user.

- Upload all relevant documents, including your TRC, ID, and address proof, for identity verification.

- Post this, you will receive a unique user ID to access the portal and submit Form 10F of the Income Tax Act.

- Also, ensure you authenticate your Form submission with a DSC (Digital Signature Certificate) or another e-verification method.

This change to the system simplified compliance, ensuring easy access to DTAA (Double Taxation Avoidance Agreement) and eliminating delays caused by PAN card requirements for NRIs.

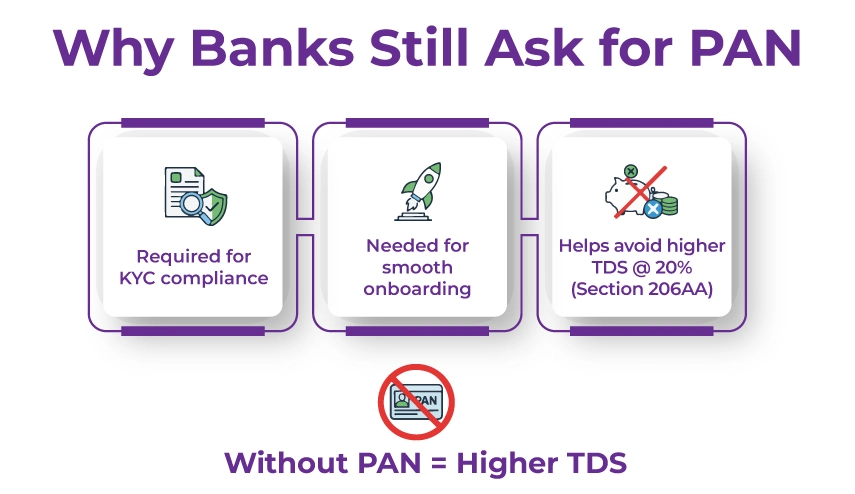

Why Banks And Financial Institutions Still Ask For PAN?

Despite the new e-filing systems that allow NRIs to submit Form 10F without a PAN, many financial institutions and banks still require a PAN card.

The reason could be as follows:

- To meet the KYC and regulatory compliance requirements.

- To ensure a smooth onboarding for NRI customers.

- And lastly, to avoid a higher TDS deduction under Section 206AA.

Please note that if you did not provide a PAN to the payer, TDS may be deducted at a higher rate, even if you are eligible to claim tax treaty benefits.

Documents Required For Form 10F Filing Without PAN

For NRIs who wish to submit Form 10F without a PAN Card, a list of required documents is needed to verify the individual's identity and tax residency. Such as:

- TRC: The tax residency certificate is issued by the foregin tax authority.

- Proof of Identity: This can be your government-issued ID or a passport.

- Proof of address: Could be your bank statements, utility bills, etc.

- DSC: Digital Signature Certificate. This is required to authenticate online form submissions.

- Other details: This could include contact information or the nature of the income.

How NRIs Can File Form 10F Without PAN (Step-by-step)

Before getting into the details of how to file Form 10F without a PAN, let us first understand the process for NRIs to register on the Income Tax Portal without a PAN Card.

- As a non-resident, you are required to register under the "Other" option on the income tax e-filing portal.

- Under the "Other" tab, select "Non-residents not holding and not required to have PAN".

- Both individuals and other than individuals, meaning companies or eneises, can register under this category.

- Non-resident individuals are required to provide the following information to register on the portal.

- Name of the individual

- Date of Birth

- TIN: Tax identification number (of the country of residence).

- Country of Residence.

- Mobile Number and email ID.

- Address

- Mobile number and the email address provided will be verified via OTP.

- Upload all the documents asked for.

- Now, upon completing the registration process, the IT portal will generate a User ID for you to log in to the income tax portal, which you can use instead of logging in with the PAN number.

You are just a call away from stress-free ITR Filing.

Post Registration: Filing of Form 10F For NRIs

Log in to the income tax e-filing portal with the user ID that was provided to you upon completion of the registration phase and the password you chose at the time of creating the profile.

The following is the path to Form 10F:

e-file > Income Tax Forms > File Income Tax Forms

As a non-resident, you are required to provide the following information when filing Form 10F.

- Assessment Year

- Status of non-resident, that is, individual, company, etc. However, it will auto-populate based on the details you have provided at the time of registration. 3:

- Country of registration or incorporation.

- TIN

- Address of the assessee in the country or any territory outside India.

- TRC needs to be attached to Form 10F.

- Now, once all the steps are complete, submit the Form.

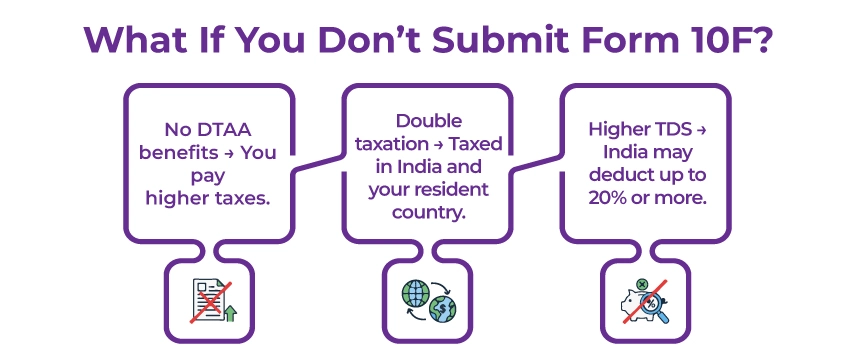

What Happens If You Do Not Submit Form 10F?

Failing to file Form 10F creates tax hurdles for NRIs. Such as:

Higher Taxes

Without an NRI Form 10F filing, you won't be able to claim any tax treaty relief.

Double Taxation

No relief under DTAA tax treatment means that your income will be subject to income tax in both India and your country of residence. And this can really add up to your tax load.

Higher Tax Deduction At Source

Your income in India, such as dividends, royalties, and interest, will be subject to higher domestic Indian tax rates for NRIs, which can be as high as 20%, rather than potentially lower DTAA rates.

Our experts are here to simplify your taxes and maximize your return.

Should NRIs Apply For A PAN Card Or Continue Without It?

However, the choice is subjective; but a non-resident Indian should apply for a PAN Card if they have any financial activities, investments, or income in India.

However, doing so is not mandatory, but along the way, having a PAN card in India lets you avoid significant restrictions, higher TDS as an NRI, and other penalties.

Final Thoughts

For NRIs seeking to claim DTAA benefits, having Form 10F and a TRC is a non-negotiable requirement. If you don't have them, you can't claim the benefits.

With the changes made by the CBDT, NRIs no longer need a PAN card to apply for Form 10F. Hence, this is a leap of relaxation for non-residents who don't have a PAN card.

Hence, if you need professional guidance on filing Form 10F without a PAN card, Savetaxs is here for you. We have been helping NRIs for the last decade with NRI taxation and compliance.

Connect with us today as we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with current regulations and can help you make accurate decisions and maintain accuracy throughout the process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- TDS on Sale of Property by NRIs in India

- Section 80C of Income Tax Act - 80C Deduction List

- Penalty for Late Filing of Income Tax Return for NRIs

- What is Section 54 and Section 54F for NRIs?

- Section 9 Of The Income Tax Act

- How to Claim TDS Refund for an NRI?

- NRI Selling Property in India

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- What is ITR-U (Updated Income Tax Return) for NRIs?

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!