A Health Savings Account (HSA) is a U.S.-based tax-advantaged account designed specifically for individuals who are enrolled under high-deductible health plans (HDHPs). These accounts help them save funds for qualified medical expenses and offer triple tax benefits to the account holder.

You can invest funds over time to make contributions to the HSA account, which can later be used to pay for qualified medical expenses. An NRI returning to India can hold and use the account, but they are not permitted to make new contributions. In this blog, we will cover everything you need to know about an HSA account as an NRI returning to India.

- An HSA is a U.S.-based tax-advantaged account that is used for healthcare expenses. An NRI can hold an HSA account even after moving back to India.

- HSA accounts offer a triple tax advantage: contributions are tax-free, money can be invested and grow tax-free, and withdrawals are not taxed if used for qualified medical expenses.

- After the age of 65, withdrawals can be made from an HSA account for any purpose without paying any penalties.

- During the NRI or RNOR status, earnings remain tax-free in India.

What is an HSA (Health Savings Account) for NRIs?

A Health Savings Account (HSA) is a tax-advantaged savings account that can be opened by individuals enrolled in a High Deductible Health Plan (HDHP). Contributions can be made to the account by the individual or their employer over time to save for qualified medical expenses.

HSA accounts offer a triple tax advantage to the account holder, such as:

- Contributions made to these accounts are free from tax.

- You can invest money, and it will grow tax-free.

- If withdrawals from these accounts are used for qualified medical expenses, they won't be taxed.

You can withdraw money from your HSA account for any purpose after the age of 65 without paying any penalties. For returning NRIs, HSA accounts can be a valuable asset for covering unexpected medical expenses in India.

Can an NRI Keep Their HSA After Moving Back to India?

Yes, an NRI can keep their U.S. Health Savings Account (HSA) after returning to India. However, once you are no longer a U.S. resident, the tax treatment and usage rules change accordingly.

You can continue to hold and use the HSA funds for qualified medical expenses in the U.S., and the account remains valid under your name. Nevertheless, after you no longer have a U.S.-based high-deductible health plan (HDHP) or lose U.S. tax residency, you are not permitted to make new contributions.

From the Indian tax perspective, when you become a resident and an ordinarily resident (ROR), earnings and balances in the HSA account may be treated as foreign assets and income. It means it will become taxable and reportable in India on your ITR under Schedule FA.

Additionally, withdrawals made for medical purposes also could be taxed as income in India. So, although you can continue holding your HSA, you must use it wisely. Ensure to maintain records and avoid making new contributions.

How India Taxes Your Earnings and Withdrawals in an HSA Account?

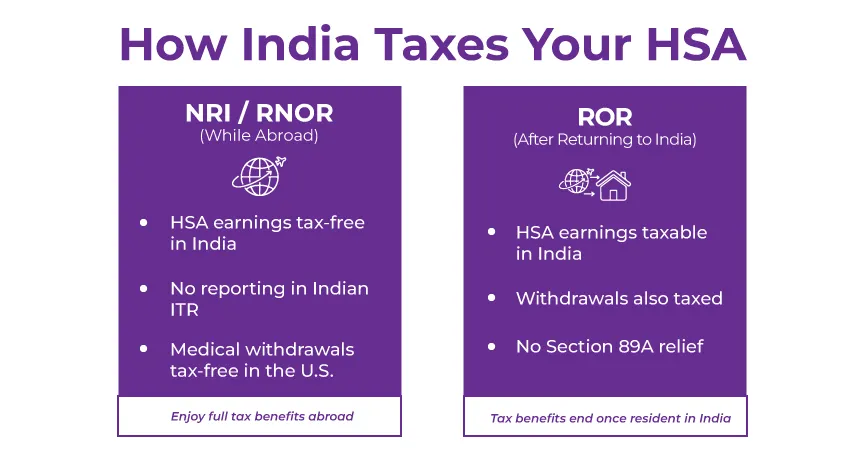

India taxes the earnings and withdrawals in an HSA account based on their residential status, with different rules for an NRI or RNOR status compared to a ROR status. Here are the tax implications for returning NRIs based on their residential status:

During the NRI (Non-Resident Indian) or RNOR (Resident but Not Ordinarily Resident) Status

- If you get the NRI or RNOR status in India, earnings in an HSA will stay tax-free in India.

- HSA accounts need not be reported in your Indian tax returns.

- Withdrawals made for medical expenses are tax-exempt in the U.S.

Upon Becoming a Resident and Ordinarily Resident (ROR)

The tax treatment for HSA changes majorly when you become an Indian tax resident (ROR):

- Interest, dividends, and capital gains are subject to taxation in India.

- Withdrawals are taxed in India, even if made to use for medical expenses.

- Unlike 401 (k) or IRA accounts, you get no Section 89A relief in HSA accounts.

For Example, suppose your HSA grows by $4,000 annually; that entire income will be subject to taxation in India, even if you don't withdraw it.

Accurate Filing, Expert Guidance & Hassle-Free Compliance

What is the Reporting and Compliance Requirement for HSA Accounts?

According to the Black Money Act, 2015, you need to report all your foreign assets and income in your ITR, including HSA accounts. in the designated schedules. Such as you can use Schedule FA of your ITR to disclose foreign assets like a bank account, real estate, HSA accounts, etc.

Under the Black Money Act, you will attract hefty penalties of up to Rs. 10 lakhs if you fail to disclose all your foreign assets and income in the Indian tax returns. It might also revoke your right to claim benefits under the DTAA (Double-Taxation Avoidance Agreement) for your foreign income.

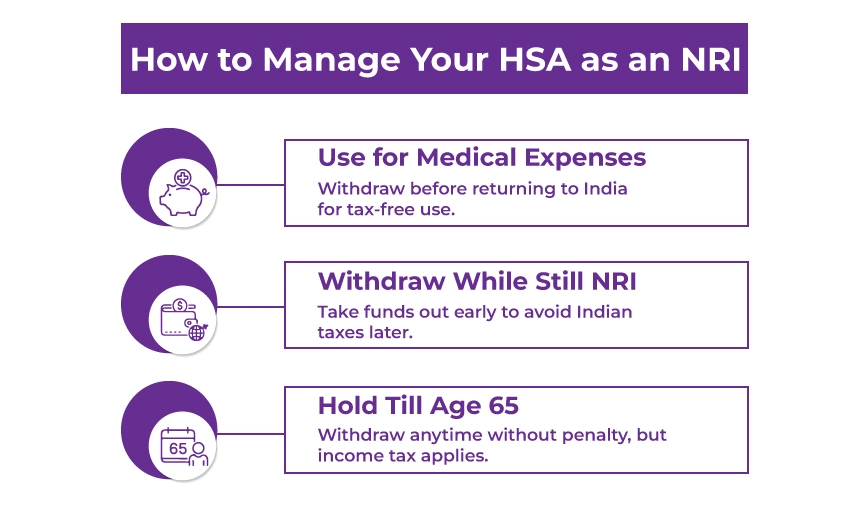

How to Manage an HSA Account as an NRI?

An NRI must consider the following options to handle their HSA account:

- Before returning to India, use the funds for medical expenses to enjoy tax-free withdrawals.

- Withdraw funds when you have a non-resident status to prevent being taxed significantly upon becoming an Indian resident.

- Hold the account till the age of 65 and withdraw after that for any purpose without attracting the 20% penalty. However, you will still pay income tax.

The Bottom Line

Having an HSA account is beneficial if you wish to stay in the US for the long term. When you plan to return to India, you must avoid making new contributions to the account and withdraw the funds strategically. HSAs can be beneficial, but the tax rules are different for NRIs in the US and India. You need to take care of everything properly; if not, you may incur unnecessary expenses.

To get the best assistance with NRI taxation and understand everything about an HSA account, contact Savetaxs. Our team of experts will help you understand all your tax obligations to ensure you stay compliant while returning to India. Contact us right away to avoid all your confusion regarding an HSA account as an NRI moving back to India. We are working 24*7 across all time zones to ensure all issues are addressed without any delays.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Can NRI Hold a Savings Account in India?

- Rules for Tax on Gifting in India for NRI: Everything You Need to Know

- NRI Income Tax Refund Delayed Because Of PAN Name Mismatch? Know What To Do

- Tax Implications of Investing in US Stocks for NRIs and Indian Residents

- When Do NRIs Need to Disclose Their Foreign Assets in India?

- What are the Aadhar Enrollment and Update Rules for NRIs?

- Tax Rules for Selling Property in India as an NRI & US Tax Resident

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766644785.png)

_1767696432.webp)