- What is TDS, and When is it Deducted?

- Why TDS is Not Your Actual Tax?

- What are Some Examples of TDS?

- Why TDS May Be Higher Than Necessary for NRIs?

- Why the Government Uses TDS as a Collection System?

- How is Final Income Tax Calculated After Deducting the TDS?

- Why Filing ITR is Still Necessary Even if TDS is Deducted?

- Final Thoughts

Many taxpayers in India, especially NRIs (Non-Resident Indians), mistakenly believe that their tax obligations are fulfilled once TDS (Tax Deducted at Source) is deducted from their income. Since TDS appears on payslips, bank statements, and Form 26AS as "tax deducted". It's easy to assume that this reflects the overall tax due.

However, TDS is only an upfront deduction meant to ensure the government receives some tax in advance, rather than a final payment. Your actual tax liability is computed based on your total annual income, deductions, exemptions, and several other things. As a result, TDS from your income may not correlate with your actual tax obligation. In this blog, we will explore the concept that TDS is not the final tax and discuss all aspects associated with it.

- TDS is a system where tax is deducted at the source of income to ensure advance tax collection rather than serve as the final tax liability.

- Your final tax liability is determined based on your total annual income, including all income sources, deductions, and exemptions, not just the TDS deducted at the source.

- Many taxpayers, including NRIs, mistakenly believe that TDS covers their entire tax obligation. This misconception leads to missed refunds and potential penalties for underreporting income.

- If excess TDS is deducted, the only way to claim a refund is through filing an Income Tax Return (ITR).

- Failing to file an ITR, despite TDS being deducted, can lead to financial losses and legal issues, especially when tax liabilities are estimated incorrectly.

What is TDS, and When is it Deducted?

TDS (Tax Deducted at Source) is a system under the Income Tax Act where the person making some specified payments is responsible for deducting taxes. It includes salary, rent, interest, commission, or professional fees.

The person who is responsible for deducting tax is called the deductor, and the person receiving the payment is known as the deductee. When the amount is deducted as TDS, the deductor is required to deposit the amount with the Income Tax Department against the deductee's PAN.

The net payment is received by the deductee (after TDS), and the gross income is used to calculate the overall tax liability. The deducted TDS is then credited against the final tax payable. Additionally, if the total TDS exceeds the actual tax liability, the excess amount is processed as a refund after the ITR (income tax return) is filed.

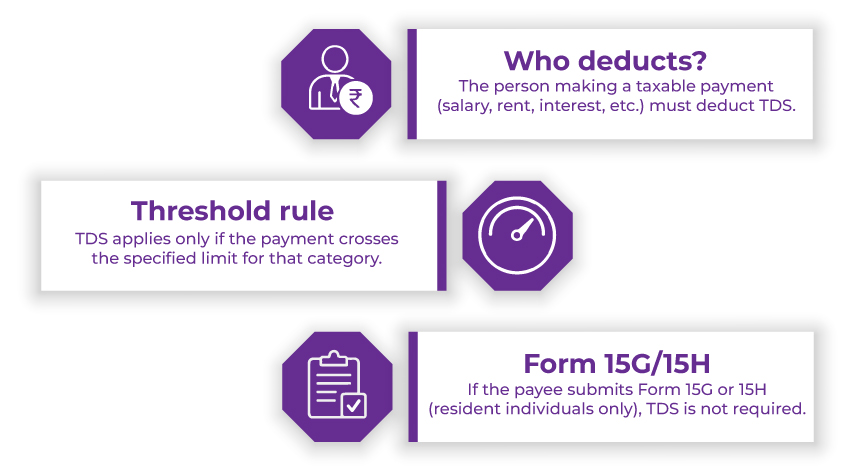

When and by Whom Should TDS Be Deducted?

An individual needs to deduct TDS under the following circumstances:

- A person making certain payments as specified under the Income Tax Act needs to deduct TDS when making such payments.

- TDS provisions involve specific threshold limits for various payment types. You don't need to deduct TDS if the total payment made doesn't exceed the threshold limit during the financial year.

- No need to deduct TDS if the payee reports for 15G or 15H, mentioning that their taxable income would fall under the taxable limits.

Why TDS is Not Your Actual Tax?

The main reason why TDS is not your actual tax is that it is deducted from individual payments, while your actual tax is calculated based on your overall income for the entire year.

Suppose you are receiving a salary, FD interest, renting a property, and also doing some small freelance work. Then, TDS will be deducted only on some parts of your income where it must be deducted, and the remaining amount may or may not be taxed at source.

Your final tax liability will be calculated by adding everything together and then applying the tax slabs. Let's understand this in detail with the help of some examples.

Make informed decisions and manage your finances effectively with a TDS calculator.

What are Some Examples of TDS?

Here are some TDS examples to get a better understanding of how it works:

Example 1: When TDS is More Than the Actual Tax

Assume there is a student named Priya who does a part-time job from which she earns Rs. 2,40,000 a year, which is below the taxable limit. However, she also holds a small FD from which she earns an interest of Rs. 40,000. The bank deducts 10% of TDS from this interest, which is Rs. 4,000.

Now, when she calculates her overall income at the end of the year:

- Total Income: Rs. 2,80,000.

- Overall Due Tax: Rs. 0 as her income is below the threshold.

However, the amount of TDS deducted is Rs. 4,000. Since TDS was only a prepaid amount and Priya's actual tax liability is zero. So, she can claim back the entire amount of deducted TDS (Rs. 4,000) as a refund. It means if TDS were actually a "tax", she wouldn't be allowed to claim any refund.

Example 2: When TDS is Less Than Actual Tax

Now, imagine a guy named Jay who is a working professional, and his employer deducts TDS from his salary. However, apart from the salary, Jay also receives rental income and interest from a large fixed deposit.

The employer is not aware of Jay's other income sources; the bank deducts TDS only at 10% on interest, and his tenants may not deduct TDS if they are Indian residents.

At the end of the year, Jay's total income falls under a higher tax bracket. While filing his ITR, he discovers that:

- TDS deducted by the employer and bank = Rs. 55,000.

- Actual due tax after adding all incomes = Rs. 78,000.

He is now liable to pay the remaining amount of Rs. 23,000 as self-assessment tax. This situation proves that TDS is only a part of the payment and not the final tax.

Example 3: For Non-Resident Indians

When it comes to TDS for NRIs, the situation becomes even more confusing as an NRI often faces very high TDS. It can sometimes be as high as 30% on NRO interest on property rental income.

Let's assume an NRI named Harshit residing in Dubai. He earns:

- Interest from NRO account = Rs. 1,00,000.

- Banks deduct TDS = Rs. 30,000.

However, when he computed his final tax as per Indian residential rules, his overall Indian income was only Rs. 1 lakh. He may qualify for rebates, or when combined with deductions, he may fall below the minimum taxable limits. His actual tax liability may be much lower, sometimes even zero.

It means the Rs. 30,000 taken earlier as TDS was not the actual tax; it was only an adjustable amount. Furthermore, he can claim back the entire money by filing an ITR.

Why TDS May Be Higher Than Necessary for NRIs?

When you sell a property or receive large sums of interest, there are times when the payer might end up deducting excess tax than your actual liability. The reason behind this is the unawareness of the deducor about your full tax profile. Consider the following steps to manage the same:

Apply for a Lower Deduction Certificate (Form 13)

NRIs have the option to apply for a certificate to the Income Tax Department under Section 197 if they think their actual tax liability is lower than the default TDS rate.

If the certificate gets issued, the payer (buyer or bank) can deduct tax at the reduced rate as specified in the certificate.

*Tip: Try to apply for Form 13 in advance of receiving large amounts, such as proceeds received from the sale of a property. It is because the processing time may vary and can take time.

File Your Tax Return to Claim a TDS Refund

In case excess TDS has already been deducted, the only way you can claim the amount back is by filing an ITR (Income Tax Return) in India. When your return is processed, you will receive a TDS refund of the overpaid amount from the income tax department within 3-6 months of filing.

Why the Government Uses TDS as a Collection System?

The government uses TDS as a collection system due to two reasons, which are:

- To avoid tax evasion: Not necessarily everyone reports their income voluntarily to ensure that at least some amount of tax is collected upfront, TDS is collected.

- To keep a steady flow of revenue: It avoids the 12-month waiting period to collect the taxes, and the government keeps receiving money throughout the year.

However, remember that this doesn't mean that TDS is similar to tax. The only purpose of TDS is to ensure compliance and transparency.

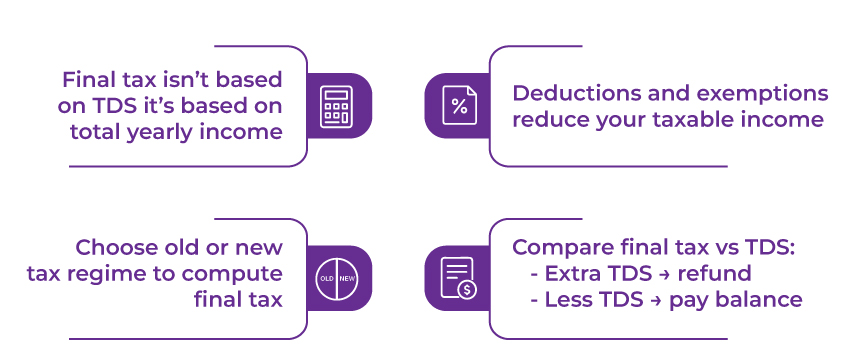

How is Final Income Tax Calculated After Deducting the TDS?

It is vital to keep in mind that your final tax is never calculated based on the TDS deducted during the year. It is computed only after considering your overall income and all the tax benefits you are eligible to claim.

The process starts by adding all your annual income, like salary, rent, FD interest, capital gains, business income, or any other earnings. The combination of amounts is called your gross total income.

From this calculation, various tax deductions are subtracted, like 80C, 80D, 80G, and 80TTA, and the deductions result in reducing your taxable income. Additionally, you need to consider exemptions as well, like HR, LTA, and other allowances (if you opt for the old tax regime).

After that, you select either the old or the new tax regime as per your choice. Your choice will significantly affect your final payable tax. Next, items like capital gains, rent paid, home loan interest, and the standard deduction are accounted for.

All these adjustments help you calculate your final taxable income, on which the actual tax is computed as per the slab rates. After this entire calculation, you compare your final tax with the TDS already deducted. So,

- If TDS is deducted in excess of your final tax, you will receive a refund.

- If TDS is less, you need to pay the remaining amount as additional tax.

It basically proves that TDS is only a part of the payment, and your real tax is calculated after applying all deductions, exemptions, capital gain rules, and tax regime selection.

Avoid the stress of receiving notices or incurring penalties with the help of experts.

Why Filing ITR is Still Necessary Even if TDS is Deducted?

Individuals, especially salaried individuals and NRIs, often end up making a mistake, which is assuming that their responsibility is completed once TDS has been deducted. However, this misconception can attract serious financial consequences.

The main problem would be losing money that rightfully belongs to you. Numerous people qualify for large tax refunds because their employer or bank deducts excess TDS than what they owe

However, since the only option to claim a refund is by filing an ITR, a lot of people lose this excess tax forever due to not filing the returns. Thousands of taxpayers miss out on refunds every year as they believe "TDS already covered everything".

Another issue that arises when the TDS deducted is actually less than your final tax liability. TDS is computed on individual payments and not on your total income. So, in case you have multiple income sources, your final tax may be much higher than the actual TDS deducted, like rent, freelance income, stock gains, or FD interest.

If you skip filing an ITR, the Income Tax Department may later find this mismatch, which will result in notices, penalties, and interest. This situation gets more complex for NRIs as they often face very high flat-rate TDS, especially on NRO account interest, property rental income, and property sale proceeds.

This higher rate of TDS may not match their actual tax liability. An NRI is not allowed to correct these mismatches or claim refunds without filing an ITR. As a result, you may end up attracting unnecessary tax losses or compliance issues.

In short, assuming that tax is paid as TDS was deducted, and not filing an ITR because of that, can cost you money, incur legal issues, and complicate tax records. NRIS need to file a return annually regardless of TDS.

Final Thoughts

You may think that TDS deduction means tax is already taken care of. However, it's important to understand that TDS is only a preliminary deduction. This misunderstanding can lead to significant financial losses for NRIs, especially when high TDS rates apply to NRO interest, rental, or property transactions. Filing an ITR is the only option to ensure accuracy, claim refunds, and avoid compliance issues.

Additionally, for NRIs who need assistance and expert consultation around TDS deduction and NRI taxation/financial planning, Savetaxs is the best choice. Connect with our team and get expert guidance with everything related to NRI taxation.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Form 27Q Simplified For NRIs- TDS Return on Payments

- TDS Deduction on Rental Property Owned by NRI

- How to Claim TDS Refund for an NRI?

- TDS on purchase of property by NRI: Tax Rules and Penalties

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Section 194I - TDS on Rent

- A Guide on the Types of TDS (Tax Deducted at Source) in India

- TDS on Sale of Property by NRIs in India

- What is a Tax Residency Certificate (TRC) and How to Get It?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767170479.png)

_1768807342.webp)

_1768633699.png)

_1767955810.png)

_1767696432.webp)