While managing their tax returns in India, NRIs often face challenges. These challenges can be due to double taxation, tax deductions at source (TDS), residential statutes, reporting of foreign assets, and more.

If left unresolved, such challenges can lead to financial losses and penalties.

In this blog, we will explore the best NRI tax planning tips that are also CA-certified and will help you manage the taxes effectively and efficiently in India.

- NRIs can claim the Tax Deduction at Source (TDS) credit if their total tax is lower than the deducted amount.

- Under Section 10(13A), NRIs can claim HRA exemptions, provided they meet certain conditions and provide proof of rent paid.

- NRIs cannot open new PPF accounts, but they definitely can invest in their existing accounts. PPFs offer tax-free interest until maturity.

- NRIs must seek professional advice from an NRI tax expert when claiming the available capital gains tax exemption, as the varied regulations between residents of Indian and NRIs can confuse them.

- The basic exemption limit for NRIs in India is 2.5 lakhs, meaning income earned below this threshold is not taxable.

Know Your Residential Status

For effective tax planning, as an NRI, understanding your NRI residential status is the first and most essential step. This is because in India, your tax obligations largely depend on your resident status.

According to the Income Tax Act, individuals are divided into three categories: residents, Non-Resident Indians (NRIs), and residents not ordinarily resident (RNOR).

Who qualifies as an NRI?

You will be considered as an NRI for the particular financial year if.

- You stayed in India for less than 182 days during the financial year. Or

- You have stayed in India for less than 365 days in the last four years and less than 60 days in the current year.

Understanding the residency requirements is essential because, unlike Indian residents, who are obligated to pay taxes on their worldwide income, non-resident individuals are only required to pay taxes on income earned in India. In the context of taxation, investment, and other legal matters, NRIs enjoy certain privileges and face certain restrictions.

Whereas RNORs fall in between and are taxed within the limited taxability.

In a nutshell, for accurate tax planning, you need to correctly determine your NRI residential status and plan accordingly.

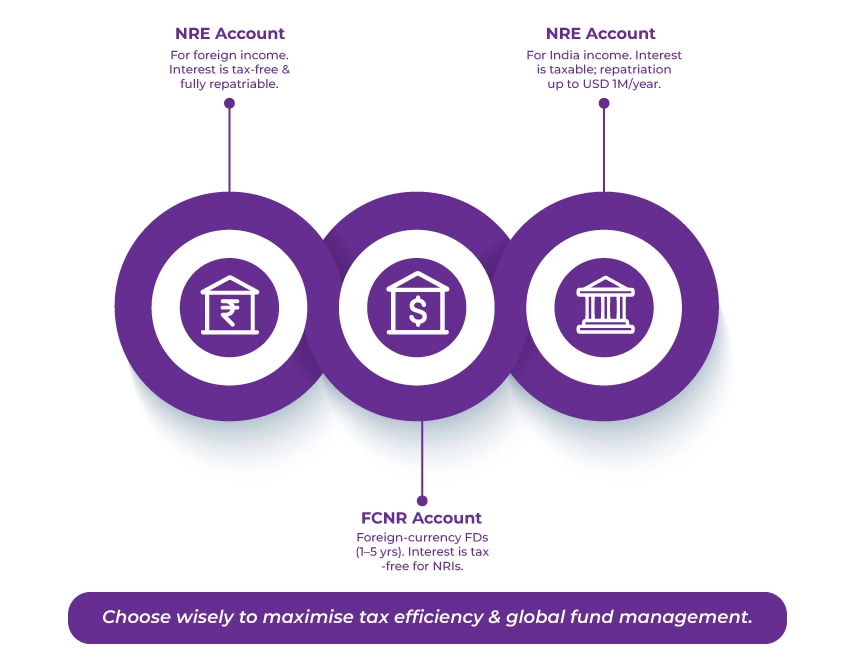

Choose The Right NRE, NRO, & FCNR Account For Tax Efficiency

Your bank account also impacts your taxes in India. However, choosing the correct NRI-designated account for tax efficiency depends on your current income and retirement needs.

- Non-Resident External Account ( NRE Account): Interest earned on this account is exempt from taxes in India, and the funds are fully repatriated. The purpose of this account is to deposit foreign earnings into India in INR.

- Non-Resident Ordinary Account (NRO Account): This account is suitable for depositing earnings from India, such as pension, dividends, or rent. The interest earned on this account is not exempt from taxes. Additionally, the repatriation limit for this account is up to USD 1 million per financial year, after taxes.

- Foreign Currency Non-Resident Account (FCNR Account): This account allows non-resident Indians (NRIs) to hold a fixed deposit in India for 1 to 5 years. Here, the deposits are held in foreign currency.

Interest on FCNR accounts is tax-free for NRIs in India.

Selecting the right bank account will help you optimize your post-tax return and manage your funds globally.

Leverage The Benefits Of DTAA

India has signed double tax avoidance agreements with more than 90 countries. This DTAA will prevent NRIs from being taxed twice in India and their country of residence on the same income source.

For example, you are receiving income in India by investing in India, renting out your properties, or in some other way. This income will definitely be taxed in India, but your country of residence may also have the right to tax it.

Now this is where the DTAA comes to the rescue and helps you avoid such financial burden.

As an NRI, there are certain documents that you must keep handy to leverage the benefits of DTAA.

For the DTAA application, you are required to file a

- Tax residency certificate (TRC): This is a non-negotiable if you wish to claim DTAA benefits.

- Form 10F: This is a self-declaration tax form for which NRIs need to claim benefits under the Indian Double Taxation Avoidance Agreement.

- Along with other supporting documents.

Here's a tip: please ensure you get your TRC well before your ITR filing due date, as processing their certificate takes time

Now, ensure that the suitable time to submit the TRC and Form 10F is to validate the lower TDS rates for NRIs and other exemptions under DTAA before filing your Income Tax Return.

Invest In Tax-Efficient NRI Investments In India

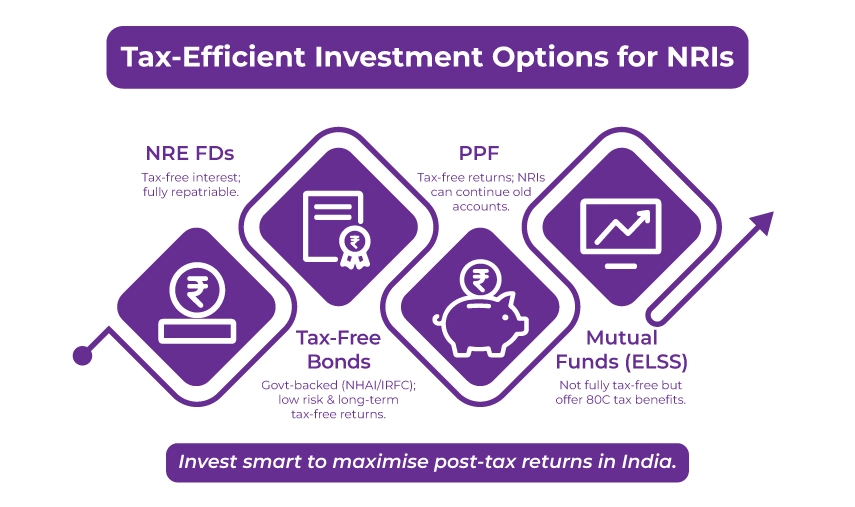

Another integral part of NRI tax planning in India is investing your money in tax-efficient investment options. Thankfully, India offers several tax-free investment options for NRIs that help them maximize returns.

Such NRI investments in India options are:

- NRE Fixed Deposits: This investment option is ready to become popular among NRIs. The Non-Resident External Fixed Deposits allow NRIs to invest their foreign earnings in India and enjoy tax exemptions on the interest earned from these FDs.

Only NRIs can easily repatriate the principal and interest amounts from here. - Tax-Free Bonds: One of the best tax-saving strategies for NRIs. NRIs can invest in certain government-backed tax-free bonds. The National Highways Authority of India (NHAI) and the India Railways Finance Corporation (IRFC) are government-backed institutions, and these bonds are suitable for risk-averse NRI investors seeking long-term income.

According to FEMA regulations, these bonds are tax-exempt, low-risk, and have a 10-20-year tenure. - Public Provident Fund (PPF): For NRIs, PPFs are also a tax-efficient investment option. The key benefits of this investment are tax-free returns, a fixed interest rate, and a long-term maturity.

However, please note that NRIs cannot open a new PPF account; they can, however, continue to contribute to their existing PPF account opened while they were an Indian resident. - Investing in Mutual Funds Through NRE Accounts: Certain mutual fund investments in India for NRIs are also tax-efficient. However, they are not entirely tax-free; but if the investments are made through an equity-linked savings scheme (ELSS), they offer greater NRI tax deductions under Section 80C of the Income Tax Act.

NRIs Can Claim The Eligible Tax Deduction And Exemption

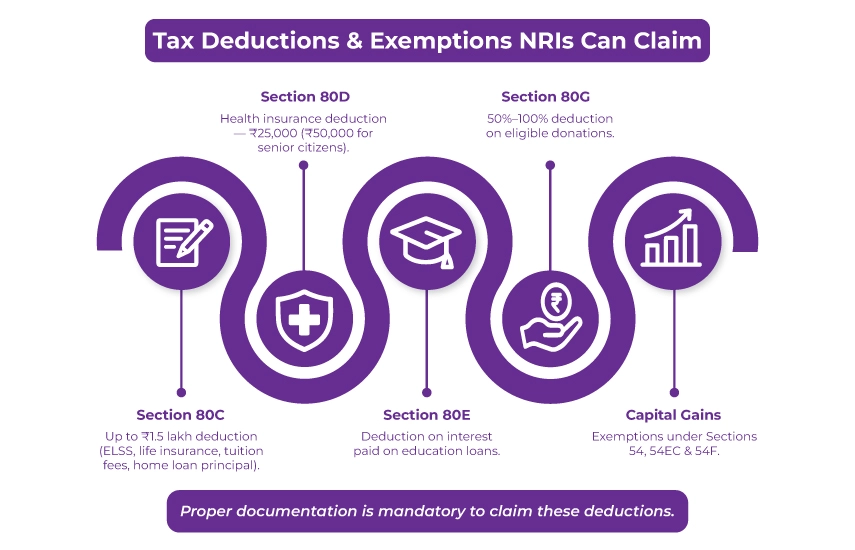

NRIs can legally reduce their tax liability in India by claiming various deductions available to them. Such deductions include Section 80C, 80D, 80E, 80G, and 24(b) of the Income Tax Act.

To validate deductions under these sections, you need proper documentation, and compliance is mandatory. Documents such as your PAN/TAN for trustees, instance certificates, loan interest statements, and other supporting documents are required for claiming deductions.

Section 80C: This section allows NRIs to claim available NRI tax exemptions of up to Rs 1.5 lakh per year on the eligible investments or expenses made from their taxable income in India.

Eligible tax investments/expenses include the life insurance premiums paid, tuition fees, home loan principal repayment, and so on.

For example, Mr Suresh invested Rs 70,000 in an ELSS and paid Rs 50,000 in life insurance premiums, allowing him a total deduction of Rs 1,20,000 under section 80C.

Section 80D: Under this section, NRIs can claim a deduction of up to Rs 25,000 on the medical insurance premium, contributions made to government health schemes, and preventive health care. Senior citizens can claim the deduction of Rs 50,000.

Section 80E: Under this section of the Income Tax Act, NRIs can claim a tax deduction on the interest paid for an education loan. However, to claim their deduction, you need to have a table income in India and also meet certain conditions.

Section 80G: Under this section, the NRI taxpayer can claim a deduction for the donations made to specified charitable trusts, institutions, or funds in India. The tax deduction limit can be somewhere from 50% to 100% of the donated amount.

Section 80E: Under this section, NRIs can claim a deduction of the interest paid on the education loan, provided they meet specific criteria.

Additionally, NRIs can avail capital gains tax exemption under Sections 54, 54EC, and 54F of the Indian Income Tax Act.

Additional NRI Tax Planning Tips To Take Into Account

The following are some additional tax saving strategies for NRIs you must consider for effective tax planning:

Proper Documentation

As an NRI, for a smooth tax planning experience, you must maintain

-

Proof of your residential status.

- Details of foreign income and taxes paid abroad.

- Certificates and Forms such as 15CA, 15CB, and related forms for the repatriation of funds.

In a nutshell, properly documenting everything eliminates the risk of last-minute tax and compliance issues.

Invest Mindfully

As an NRI in India, you have a wide range of investment options such as mutual funds, fixed deposits, real estate, the Indian stock market, and so on. These investment options may seem lucrative, but understanding their tax implications is crucial.

Hence, before investing, check its tax implications for NRIs, or for a better understanding, seek advice from an NRI taxation expert. Such experts will help you structure your investment for maximum tax efficiency and returns.

Stay Updated

One of the most low-key tax saving strategies for NRIs is simply staying updated, because, as they say, information is essential.

Indian taxation laws are often subject to change. As an NRI managing cross-border finances and taxes, you need to stay up to date with the recent tax reform changes to stay compliant.

Seek Professional Advice

Please do not think that seeking professional advice from an NRI taxation expert is a waste of money; rather, it is an investment. Experts will help you with tailored advice, ensure timely filings of your taxes, and handle all the documentation on your behalf.

The Bottom Line

These were the NRI tax planning tips to help you plan your taxes effectively in India.

Now, when it comes to accurate and efficient planning for NRIs, no one does it better than Savetaxs. We have been helping NRIs from over 90 countries with their cross-border taxation complications.

With years of experience as a leading NRI tax expert in India, Savetaxs has been the NRI's best partner.

Our experts will help you with:

- NRI tax advisory and NRI income tax filing.

- Exert backed consultation on Property Sale.

- Investment Consultation Services and so much more.

Connect with us today as we serve our clients 24/7 across all time zones.

**Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- Section 80EEB of IT Act - Electric Vehicle Tax Deduction

- Section 80CCD Of Income Tax Act: NRIs Tax Savings Guide

- Donations Under Section 80G and 80GGA Of The Income Tax Act

- Estate Planning For NRIs Via Trusts: Protect Your Wealth For Future

- Section 54EC of Income Tax Act: Capital Gain Exemption

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Section 80EE Of the IT Act: Home Loan Interest Deduction

- Advance Tax Planning For NRIs (Non-Resident Indians)

- DTAA Claim Mistakes NRIs Make And How To Avoid Them

- Section 80GG: Claim Tax Deductions on Rent Paid for Indian and NRIs?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!