NRIs are often stressed about how to e-verify ITR for NRIs from abroad. The stress is mainly because the ITR verification process requires a one-time password (OTP), which cannot be delivered abroad.

But there are solutions to this problem. NRIs can file their income tax return online from anywhere, and verification can be done via net banking, a pre-validated bank account, a demat account to generate an EVC (electronic verification code), or a DSC (digital signature certificate).

In this blog, we will discuss every possible and legitimate method NRIs can use to e-verify their income tax returns from abroad.

- NRI income tax return must be e-verified within 30 days of filing. If not, the return will be treated as invalid.

- Net baking e-verification is usually one of the smoothest verification methods for NRIs. This method has no dependence on the Indian mobile number OTP.

- E-verification is mandatory for NRIs; without it, your filed ITR will be considered invalid.

- If any of the e-verification methods for NRI tax return do not work, you can print, sign, and mail the ITR-V form to CPC Bangalore. NRIs usually keep this method of e-verification as a last resort.

Why is E-verification Important For NRI Tax Returns

E-verification is a mandatory step in the filing process for income tax returns in India. Without e-verification, the filed ITR isn't considered valid, which leads to penalties, delayed tax refunds, and other non-compliance issues.

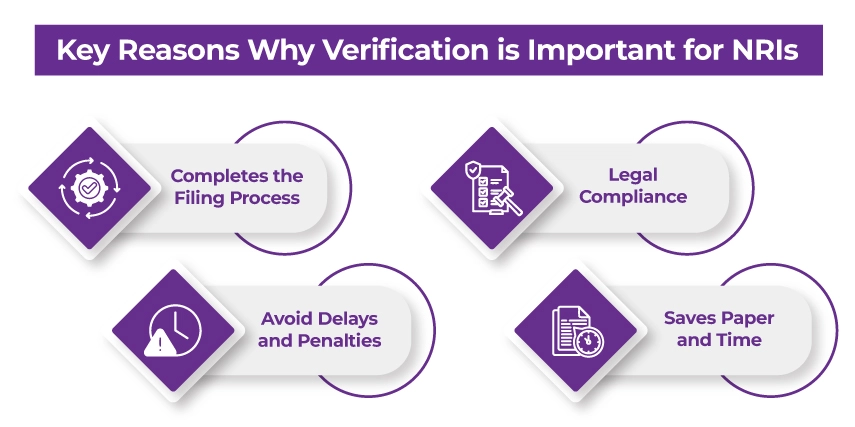

The following are the key reasons why verification is important for NRIs.

- Completes the Filing Process: Merely filing the ITR is only half of the entire process; the ITR filing process is only completed when verification is done.

- Legal Compliance: E-verification has been mandatory under the Indian Income Tax Act. Every individual or entity filing the ITR, including NRIs, must verify their ITR.

- Avoid Delays and Penalties: An unverified income tax return is treated as a return never filed; hence, you will be liable for an additional filing fee and other penalties.

- Saves Paper and Time: E-verification is a convenient electronic process, which is way more suitable than the traditional method of physically printing, signing, and mailing the ITR-V form to the centralized processing center (CPC), Bangalore. This manual paperwork process wasn't beneficial for NRIs living abroad; as a result, the verification process takes time and involves a lot of paperwork.

How Can NRIs e-Verify IT Return From Abroad?

The following are the legitimate online methods NRIs can use to e-verify their IT return from anywhere in the world. ,

Method 1: ITR e-Verification Using Net Banking

This method is one of the most convenient ones for NRIs living abroad, as this approach does not rely on OTP sent to the Indian mobile number during the verification step.

Requirement: Your PAN card must be linked to your bank account, and the net banking for the same must be enabled.

Process:

- Log in to the e-filing portal through your bank's net banking website. Doing so will redirect and automatically log you in to the official income tax website.

- On the e-filing dashboard, go to the "e-Verify Return" section,

- Select the relevant assessment year

- And complete the verification.

Method 2: ITR e-verification Using Digital Signature Certificate (DSC)

Non-resident Indians (NRIs) with a valid and active digital signature certificate can use this method to e-verify their ITR.

Requirement: A valid digital signature certificate must have been procured from a certifying authority, and the EMSigner utility must be installed and running on your device.

Process:

- Plug in your DSC token.

- Open the e-Verify ITR page.

- Enter PAN + Assessment Year.

- Authenticate via emSigner.

Savetaxs offers a full range of NRI Taxation compliance with expert guidance.

Method 3: Via A Pre-validated Indian Bank Account (EVC)

You can generate an electronic verification code (EVC) for your Indian Bank account, but only if it is verified on the e-filing portal.

Requirement: Your Indian Bank account must be pre-validated on the Income Tax Department portal. However, please ensure that your PAN is linked to your Indian bank account and that the bank verifies your mobile number and email ID, as the electronic verification code will be sent to those numbers.

Process:

- Log in to the e-filing portal.

- Under the "Service" tab, select "Generate EVC" and then choose "Through Bank account".

- Enter the EVC received via SMS/email on the e-filing portal to complete the process of e-verification.

Method 4: ITR e-verification by sending ITR-V physically

This method is your last resort for NRIs. If all the online e-verification methods fail, you can print, sign, and mail the ITR-V acknowledgment form to the CPC (Centralized Processing Centre) in Bangalore, India.

Process:

- Download ITR-V from your email

- Print it on A4 white paper.

- Sign in blue ink.

- Send via speed post/ordinary post to

CPC (Centralized Process Center)

Address: Post Box No. 1.

Electronic City Post Office,

Bangalore-560100, Karnataka.

However, please note that this method may delay tax refunds.

Which e-verification Method Should NRIs use?

Below is a clear table of NRI situations and the best verification method for each.

| NRI Situation | Best ITR e-verification method for NRIs |

|---|---|

| No Aadhaar Card | Net Banking/DSC |

| Indian mobile number not working abroad | Net Banking |

| Wants the fastest e-verification | Net Banking |

| Filing with CA/DSC | DSC |

| All online methods failed | ITR-V Acknowledgment Form by Post. |

Personalize NRI Taxation Plan Is Just A Call Away.

The Bottom Line

Filing ITR for NRIs is itself a complicated process, and to top it all off, there's a little more stress with e-verification for NRIs. However, in this blog post, we have discussed four methods NRIs can use to verify their returns from abroad easily.

However, even though these methods are pretty simple, NRIs still face many issues. And hence, Savetaxs is here to rescue them from the dilemma by providing the best income tax consultation for NRIs.

Our experts will help you not just file your Income tax return but also e-verify it within the time frame, so you don't face any last-minute hassles.

Connect with us today as we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Understanding Health Savings Account (HSA) For Returning NRIs

- Section 115BAC New Tax Regime 2025: Slabs, Benefits, Exemptions & Deductions

- Tax Rules for Selling Property in India as an NRI & US Tax Resident

- Section 147 of the Income-tax Act, 1961 (ITA) Demystified

- Understanding TDS Certificate and How To Download It Online

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- A Comprehensive Guide on the DTAA between India and the USA?

- How to Claim TDS Refund for an NRI?

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS Deduction on Rental Property Owned by NRI

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

The primary e-verification methods available to NRIs are:

- Net Banking

- EVC via pre-validated bank account.

- EVC via pre-validated Demat account.

- Digital Signature Certificate (DSC)

- Physical ITR-V posting (if e-verification is not done)

-in-the-USA_1762862398.webp)