- Why is it Important for NRIs and Indian Americans to Understand US Taxation of Indian Mutual Funds?

- What is a Passive Foreign Investment Company (PFIC)?

- Why are Indian Mutual Funds in the US Classified Under PFIC?

- How are Indian Mutual Funds Taxed in the US?

- How to Report PFIC Investments in the US?

- Final Thoughts

For Indian investors and NRIs residing in the US, investing in mutual funds is one of the most effective ways to grow their wealth. Additionally, it also helps them participate in the financial market of India. However, it is vital to know about several tax regulations and obligations that are imposed on these investments. One such requirement is knowing about the rules of a Passive Foreign Investment Company (PFIC).

To help you out, here is the complete blog on how Indian mutual funds of NRIs and Indian Americans are taxed in the US. So, read on and gather all the information about it.

- In the US, the Indian mutual funds are classified under the PFIC rules.

- A Passive Foreign Investment Company or PFIC is a foreign corporation that generates passive income.

- The Mark-to-Market Election is the best method to opt for Indian mutual fund taxation in the US. It offers you the best outcomes and reduces your tax burden.

- Do not use the default taxation method, as it leads to interest, penalties, and backdated taxes.

- To report the PFIC investments, fill out Form 8621 during your annual IRS filing.

Why is it Important for NRIs and Indian Americans to Understand US Taxation of Indian Mutual Funds?

NRIs and Indian Americans need to understand the US taxation of Indian mutual funds because of the Passive Foreign Investment Company (PFIC) rules. Additionally, compared to Indian taxes, the tax treatment of Indian mutual funds is different. In India:

- No tax is imposed on dividends (in the hands of the investor)

- On equity funds, long-term capital gains are either taxed lightly or tax-free

However, for tax purposes, you are a US person, including a US citizen, a green card holder, and a tax resident. In this scenario, your global income becomes taxable in the US. It also includes the capital gains you receive from your Indian mutual funds.

Additionally, in the US, as per the tax laws of the country, the Indian mutual funds are considered PFICs. These have complex compliance requirements and have punitive tax treatment.

So, here is why NRIs and Indian Americans need to understand the US taxation of Indian mutual funds. Moving ahead, let's know what PFIC is.

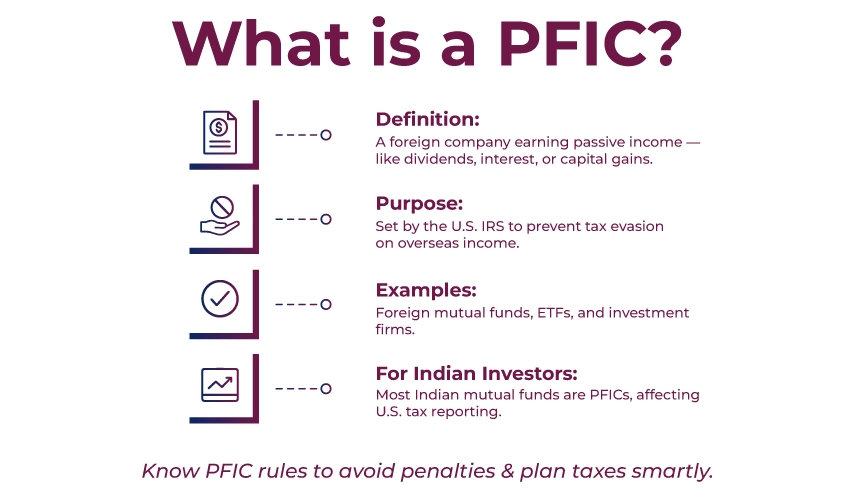

What is a Passive Foreign Investment Company (PFIC)?

A Passive Foreign Investment Company, or PFIC, is a foreign corporation in the US that generates passive income. It includes capital gains, interest, or dividends. Additionally, it also includes certain types of foreign mutual funds, making it vital for Indian investors living in the US to know their tax implications. The US Internal Revenue Service (IRS) implements the PFIC rules. It prevents the US taxpayers from tax evasion on the passive income they earn through investments.

This was all about PFIC. Moving further, let's know why Indian mutual funds are classified under PFIC.

Why are Indian Mutual Funds in the US Classified Under PFIC?

The IRS imposes the PFIC classification to know the US taxpayers who invest in offshore funds that do not provide regular income. The Indian mutual funds generally meet this criterion of a passive foreign investment company in the US. This is why the PFIC rules apply to the Indian mutual funds. Under this:

- 75% or more of the income of an Indian investor is passive

- 50% or more of the assets of Indian investors provide passive income.

Further, mostly the Indian mutual funds are stated as PFICs. So, while living in the US, if you have invested in the Indian mutual funds, then report them in PFIC.

So, here is how the PFIC rules for Indian mutual funds in the US. Moving ahead, let's know how the Indian mutual funds are taxed in the US.

How are Indian Mutual Funds Taxed in the US?

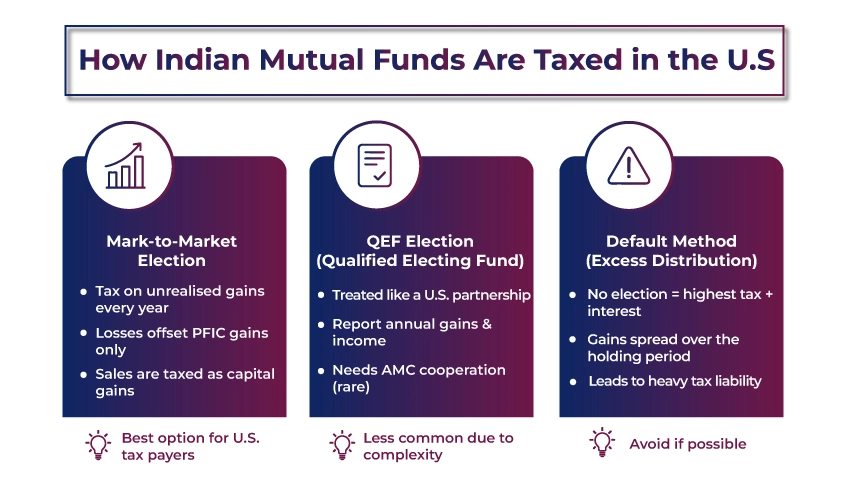

There are three ways in which mutual funds are taxed in the US. These are as follows:

Mark-to-Market Election

Mark-to-Market election is the most used tax deduction method for Indian mutual funds in the US. In this, every year, as ordinary income, your report notional (unrealized) gains, even if they are not sold. Additionally, you can offset the losses against your PFIC gains. However, they cannot be offset with other sources of income. Further, at the time of final sale, if you have previously unrecognized gains, they will be taxed as capital gains.

Key Benefit: This taxation method helps in avoiding the default method and spreading your tax burden over time. If you are a US tax resident, this is the best taxation method for your Indian mutual funds. However, for favorable tax treatment, use this method in your first tax return.

Qualified Electing Fund (QEF) Election

This taxation method treats your Indian mutual funds as a US partnership. Considering this, in this method, each year you mention your share of capital gains and earnings.

However, from the Indian fund house, cooperation is also necessary. For this, you need to provide annual bank statements showing your income from Indian mutual funds. Since the online platforms of many Indian Asset Management Companies (AMC) do not offer QEF, this method is rarely used.

Default Taxation (Excess Distribution Method)

If you do not opt for any of the above taxation methods, then the IRS imposes default taxation on your Indian mutual funds. In this method, your entire capital gain from the mutual fund is spread over the holding period. Additionally, every year, at the highest possible rate, your share is taxed. Further, on the late tax payment for those years, interest is imposed.

Confused, how does this taxation method work? Let's better understand this with an example.

For instance, for 10 years, you held Indian mutual funds, and after that, you sold those funds at a $100 gain. In the US, the IRS will treat this capital gain as $10/year gain. Considering this, at the top rates, it will tax each year and charge interest on the unpaid taxes. It further creates a massive tax obligation on you.

These are the three different methods that Indian investors can opt for to pay tax on their Indian mutual funds in the US. Moving further, let's know how to report PFIC investments.

How to Report PFIC Investments in the US?

To report PFIC investments in the US, during your annual tax return, you need to fill out Form 8621. This form offers details information about your PFIC investments. It includes annual capital gains, cost basis, and distribution of income. Further, you need to fill out this form correctly with the right information. It helps you avoid the tax penalties and ensure you comply with the IRS tax requirements.

However, if you are staying in the US temporarily and do not have any plans to redeem your Indian mutual funds. In this scenario, you do not need to fill out Form 8621.

So, this is how using Form 8621, you can report your Indian mutual funds in the US.

Final Thoughts

Lastly, being an Indian investor in the US, it is vital to understand the PFIC investments. It helps in complying with the US tax regulations and avoiding penalties. Considering this, on mostly Indian mutual funds, the PFIC rules are imposed. Additionally, using the Form 8621, it is vital to report your PFIC investments during your annual tax filing.

Further, the reporting process of PFIC investments is complicated and time-consuming. However, at Savetaxs, we ease down the whole process by guiding you throughout the process and online, providing you with the required documents. So, connect with us today, and manage your Indian mutual funds smoothly in the US.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Indian ESOP Taxation in the USA for NRIs & US Residents

- 25 Popular Tax Deductions (Tax Write-offs) and Tax Breaks for 2025

- Are Medical Expenses Tax Deductible in the US?

- All You Need to Know About 401(k) Plan

- FBAR vs Form 8938 - A Difference Every US Based NRI Must Know

- IRS Tax Credit vs Tax Deduction

- Traditional IRA Tax Deduction and Contribution Limits

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!