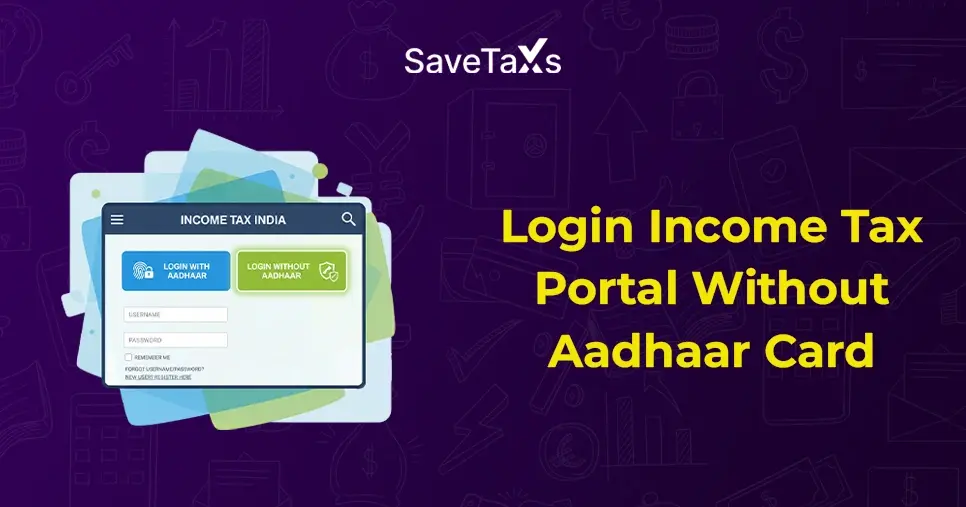

For Non-Resident Indian (NRIs), accessing the Income Tax e-filing portals from their country of residence can be tedious due to the mandatory Aadhaar-PAN ink requirement. Now that Aadhaar cards are not compulsory for NRIs, and many are not eligible for Aadhaar, logging in or completing tax-related tasks can be confusing.

But not anymore, because NRIs can now log in to the income tax portal without an Aadhaar card. They can do so by using alternative methods permitted under Indian tax laws.

In this blog, we will discuss how NRIs can log in without Aadhaar, alternative login methods, and the respective solutions if their accounts become inaccessible.

- Aadhaar card is not a legal requirement; hence, they are legally exempt from linking PAN and Aadhaar.

- Without Aadhaar authentication, NRIs can log in to the income tax e-filing portal using PAN + password.

- Net Banking Logging is one of the easiest and most commonly used logging methods for NRIs.

- At times, an NRI PAN card may appear inoperative because their residential status has not been correctly updated with the Income Tax portal; however, NRIs can reactivate it by submitting NRI documents, such as a passport, OCI card, or a valid visa.

- NRIs can complete their e-verification for ITR via DSC, net banking, or email OTP.

- By understanding the relevant methods, NRIs can easily access the income tax portal from abroad without requiring Aadhaar.

Why Aadhar Is Not Mandatory For NRIs

Aadhaar is not mandatory for NRIs as the Aadhaar Act defines "resident" for the purpose of having an Aadhaar number. Now, a resident is someone who has resided in India for 182 days or more in the last financial year.

Since many NRIs do not meet this residency criterion, they are not eligible for an Aadhaar card; hence, NRIs don't need one.

Ways Through which NRIs Can Login To Income Tax Portal Without An Aadhaar Card.

There are four legitimate ways for NRIs to log in to the Income Tax portal without an Aadhaar Card.

Method 1: Login Using PAN and Password

NRIs can log into the income tax portal using their PAN as the User ID

Steps:

- Visit the income tax e-filing website

- Click on Login

- Enter your PAN (Permanent Account Number)

- Enter your password

- Complete OTP validation (email or mobile)

Please note that OTP is sent to your registered email ID and the Indian mobile number.

Now, if your Indian mobile number is inactive, please update it. This is one of the standard, simplest income tax login without an Aadhaar method for NRIs.

Method 2: Login Using Mobile OTP / Email OTP

This is how the mobile/email OTP login works:

Steps:

Go to the login and then click Forgot Password.

- Enter the PAN number.

- Choose Resent via OTP

- The OPT will be sent to your registered mobile number and email.

- Reset the password.

- Log in using your PAN and a new password.

Method 3: Login Using Digital Signature Certificate (DSC)

This method is ideal for NRIs who use DSC for tax filings.

Steps:

- Log in to the income tax portal.

- Select Login with DSC.

- Upload the signature file.

- Enter the PIN

- And login.

Method 4: Login Using Net Banking (If Linked)

To log in using the net banking, the supported banks are SBI, ICICI, HDFC, Axis, Kotak, IDBI, etc.

Steps:

- Visit the Income Tax e-filing portal.

- Click Login and continue to net banking.

- Choose your bank and log in to net banking.

- Click on the income tax e-filing option inside your bank portal.

- You will be redirected and automatically logged in.

Experience a seamless NRI ITR Filing with Savetaxs.

What If Your Aadhaar Is Incorrectly Linked Or Showing As Mandatory?

While logging in to the income tax portal, NRIs encounter errors such as "Your Aadhaar is not linked with PAN", "Login Failed: Aadhaar authentication required", and "Your PAN is operative due to not linking with Aadhaar".

This happens because, as an NRI, your PAN card hasn't been validated as an NRI, meaning you haven't updated your residential status on the PAN card to NRI.

A simple solution to these problems is:

NRIs can reactivate PAN by submitting:

- Passport Copy

- Overseas address proof

- Latest visa/residence permit

- OCI/PIO Card (optional).

Now, this can be done via:

Income Tax e-filing portal (PAN services section) or through NSDL or UTIITSL PAN service portal.

Once the PAN is validated as NRI status, Aadhaar linking is no longer required, and you won't encounter the login failures mentioned above.

How To Log In After PAN Reactivation

Upon updating your NRI status in the PAN Card, you have to.

- Log in normally with PAN+ Password.

- OTP will be sent to the email/updated mobile number.

- Aadhar linking messages will no longer pop up.

- And that's how your PAN becomes fully operative.

Can NRIs File ITR Without Aadhaar?

Yes, NRIs can file ITRs without Aadhaar, as Aadhaar is required only for residents; for NRIs, only having PAN is sufficient.

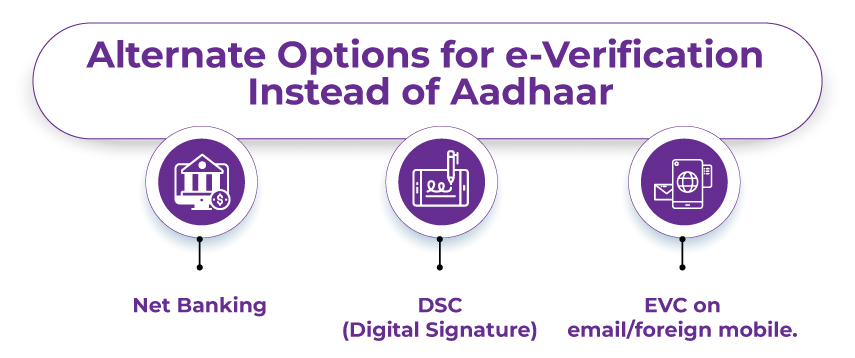

For the process of e-verification, NRIs can do it using:

- Net Banking

- DSC (Digital Signature)

- EVC on email/foreign mobile.

This makes the entire tax filing process for NRIs accessible from anywhere in the world.

Tips For NRIs For A Smooth Login Experience

The following are a few tips for NRIs to ensure a smooth login experience.

- Keep your Details Updated: NRIs, please ensure that your mobile number and email on the portal are accurate.

- Use the Correct Password Format: Ensure your password includes an uppercase letter, a lowercase letter, numbers, and special characters.

- Bookmark the Official Portal: This prevents your form from accidentally visiting the websites.

- Avoid Public Wi-Fi: While logging in, please use secure networks rather than public ones to reduce the risk of hacking.

- Clear the Browser Cache: At times, the login fails; it's usually because outdated cookies are being accumulated. Clear the browser cache once.

We do what we say. NRI, your stress-free taxation journey starts here.

The Bottom Line

Yes, NRIs do not need an Aadhaar card to log into the Income Tax Portal. As an NRI, you can easily log in using your PAN, email OTP, or Net Banking. If your PAN is temporarily inactive due to Aadhar mismatch, you can reactivate it by updating your NRI status.

Now, if you want to skip these time-consuming and tedious processes and have someone handle your income tax filing professionally, you are at the right page. Savetaxs have been helping NRIs with their taxation and finances for years.

Our experts will ensure that all your logins are set up and that you file your ITR on time. Savetaxs wants every NRI to have smooth access to any tax services from anywhere in the world, which is why we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Section 195 of Income Tax Act - TDS Applicability for NRI

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- A Comprehensive Guide on the DTAA between India and the USA?

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- TDS on Sale of Property by NRIs in India

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- What is a Tax Residency Certificate (TRC) and How to Get It?

- TDS Deduction on Rental Property Owned by NRI

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)