NRIs invest in the Indian stock market for strong potential returns, portfolio diversification, tax benefits, and more. India is the third-largest investor base worldwide, and its steady growth makes it a lucrative opportunity for non-resident investors.

To invest in the Indian stock market, residents need to open a demat or trading account and start trading. However, this is not the case for Non-resident investors, as their process differs and is regulated by FEMA and RBI guidelines.

In this guide, we will break down the entire process of NRI investment in the Indian stock market into simple, actionable steps. In addition, the guide will cover everything from understanding the regulations to setting up an investment account for NRIs and more.

- NRIs can invest in the Indian stock market in accordance with the regulations set by the RBI and FEMA.

- Popular NRI investment options in India include mutual funds, equities, real estate, and other international equity funds.

- Tax implications for NRIs and repatriation rules may vary depending on the type of investment and the location.

- NRIs are considering investing in India due to high GDP growth, strong equity market returns, and favourable exchange rates for EUR, USD, and GBP.

Can NRIs Invest in the Indian Stock Market?

Yes, non-resident Indians are allowed to invest in the Indian stock market, as per regulations under the Foreign Exchange Management Act (FEMA) and the Reserve Bank of India (RBI). India, altogether, has an encouraging attitude towards NRI investments.

However, please note that NRIs cannot use their regular resident trading accounts to invest in the Indian stock market. They can only do so by opening a specific bank account and a demat account that comply with RBI and FEMA regulations.

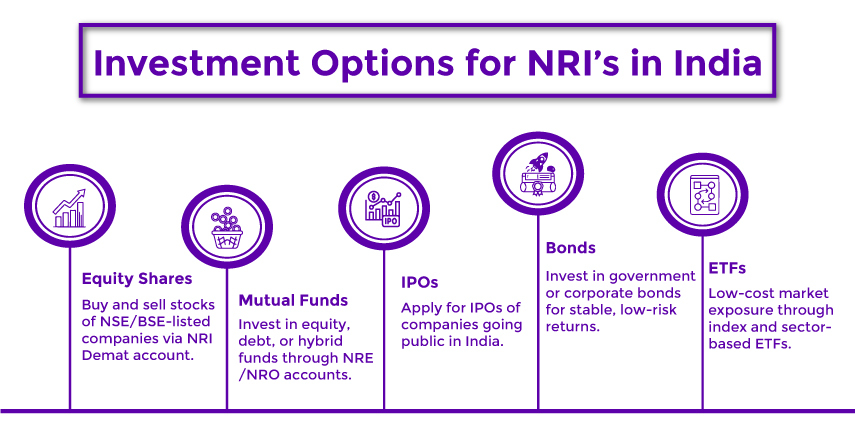

Investment Options For NRIs In The Indian Stock Market

The following are the investment opportunities for NRIs in the Indian stock market:

Equity Shares (in NSE/BSE-listed companies)

NRIs are allowed to buy and sell shares of companies listed on Indian stock exchanges through a registered broker.

Mutual Funds (via NRE/NRO account)

NRIs are allowed to invest in various mutual fund schemes, including debt, equity, and hybrid, using NRE or NRO bank accounts.

IPOs (Initial Public Offerings)

NRIs can participate in and invest in IPOs and subscribe to the shares of companies going public in India.

Bonds and Debentures

NRIs can invest in both government and corporate bonds. This is a safe, low-risk investment option backed by the government of India.

Exchange Traded Funds (ETFs)

Investing in ETFs is an excellent way for NRIs to gain diversified market exposure.

Savetaxs brings you investment plans that deliver high returns with low stress.

Step-by-Step Process For NRIs to Start Investing

The following is a step-by-step guide on investing in the Indian stock market for NRIs.

Know The Regulations

NRI investment in India is governed by the regulations set by the Foreign Exchange Management Act (FEMA) and the Reserve Bank of India (RBI). As per their regulations, NRIs need a specific bank account to invest in the Indian stock markets and also an RBI approval through the Portfolio Investment Scheme (PIS) to open a demat account in India to start trading.

Open an NRI Bank Account

Now, one of the integral steps for NRIs is to open an NRI bank account, as without one, you cannot invest in the Indian stock market. There are two types of accounts to choose from: Non-Resident Ordinary (NRO) and Non-Resident External (NRE).

- The NRO account holds income earned in India and is not fully repatriable.

- The NRE account holds and manages the foreign-earned income in India, and the funds are fully repatriable.

Before you think about why there is a need to have two accounts, know that the type of investment you want to make influences the account you need.

For example, an NRO or NRE account with PIS approval is needed if you want to trade in equities, an NRE/NRO account for mutual funds and IPOs, an NRO account for derivatives, and so on.

Get The PIS Approval For NRIs

Before investing in the Indian stock market, NRIs need to obtain RBI PIS approval. PIS, or the Portfolio Investment Scheme, was launched by the RBI to encourage NRIs to invest in the Indian stock market.

This approval can be routed through the RBI-designated banks.

Why A PIS Approval Is Needed:

(Here is an overview of why a PIS approval is needed; however, we will be discussing the importance of PIS in detail in the latter part of the blog.)

NRIs live outside India, and the RBI needs to track their investments in the Indian stock market. PIS is an official way to do so.

Hence, whenever an NRI sells or buys a share, the bank will report it to the RBI through the PIS account. Therefore, without PIS approval, an NRI cannot use funds in their NRI bank account to buy stocks.

Open NRI Demat Account

Once you have been granted all the approvals, now is the time to open an NRI trading account and start investing in the Indian stock market.

Please note that an NRI must open an NRI Demat account to hold securities electronically and an NRI trading account to buy and sell securities. These accounts of yours will be linked to the NRE or NRO account and are managed by SEBI-registered brokers.

To invest in Indian equities and mutual funds as an NRI, you will need a separate NRI trading account.

File accurate income tax for NRIs with an expert approach.

The Route Of Investment

NRIs can invest in the Indian stock market via two routes:

Direct Equity Investment: NRIs are permitted to buy or sell the shares listed on the Indian exchanges (NSE or BSE) under the PIS. However, an NRI can collectively hold only up to 10% of a company's capital.

Mutual Funds: NRIs are permitted to invest in mutual funds without using the PIS route.

However, please note:

- NRI trading restrictions include a prohibition on short-selling in India. This means trading of securities without taking a delivery in your NRI demat account.

- NRIs are not permitted to invest in specific public sectors in India, such as the railways, atomic energy, or the military.

- Lastly, as an NRI trading in the Indian stock market, it is a non-negotiable requirement that you comply with all Indian tax rules for NRI stock market investments.

Tax Implications for NRI Investors

Just like an Indian resident, an NRI is also liable to pay taxes on investments held in the Indian stock market.

Here is the breakdown of it:

| The source of capital gains | Tax On NRI Stock Gains |

|---|---|

| BSE or NSE-listed equity shares | Short-term capital gain tax on NRI stock gains is 20% with applicable cess and surcharge. Long-term capital gain tax is 12.5% levied on capital gains above the threshold of INR 1.25 lakh. |

|

Mutual Funds (Debt-oriented) |

NRI invests in mutual funds: Short-term capital gains tax is calculated according to the individual's tax slab. |

| Mutual Funds bought after April 1, 2023, with an underlying fund that is more than 65% debt. | Applicable as per the tax slabs |

| Mutual Funds purchased after April 1, 2023, with an equity ETF whose underlying fund is 90% or more. | The short-term capital gains tax, with applicable cess and surcharge, is 20%. Long-term capital gains tax of 12.5% is imposed on gains above the threshold of INR 1.25 lakh. |

| Dividends and interests |

As per the individual's applicable tax slab rate. |

Repatriation Of Funds

With regard to repatriation of funds, if invested through an NRE account, repatriation is allowed in full. Whereas for Investmedes made via the NRO account, repatriation is allowed, but only up to $1 million per financial year.

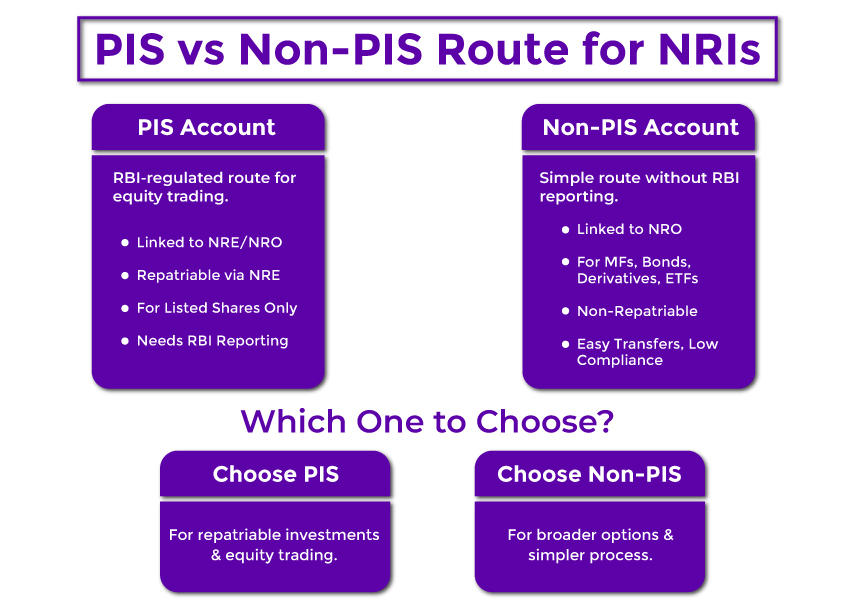

PIS vs Non-PIS Route For NRIs - Which One Should An NRI Choose?

Before getting into the conclusion about which route is better for NRIs to invest in the Indian stock market? Let us first understand what a PIS and a Non-PIS account mean.

What is a PIS Account?

A PIS account is a specialized facility account governed by the Reserve Bank of India. This account allows NRIs and OCIs to buy or sell shares and bonds of Indian companies listed on the Indian Stock Exchange.

Here is an overview of a PIS account:

- This account can be linked to an NRO and NRE account.

- Investments made through an NRE PIS account are fully repatriable, while those made through an NRO PIS account are subject to a repatriation limit.

- PIS accounts are explicitly used for trading in equity shares listed on the Indian exchange.

What is a Non-PIS Account?

A non-PIS account lets NRIs invest in India without the regulatory reporting requirements associated with PIS accounts. NRIs often like this investment route for the flexibility and simplicity it offers.

Overview of a non-PIS account:

- Such an account is usually linked to an NRO account for non-repatriable investments.

- Using a non-PIS account, you can invest in derivatives, mutual funds, commodities, and bonds.

- A Non-PIS account enables direct fund transfers from your NRO account to your trading account without delay.

Which is better: PIS or Non-PIS?

The answer depends entirely on an individual's financial circumstances and investment goals.

Choose PIS Account:

- If you want to invest your foreign earnings in India on a repatriable basis.

- As an NRI, your preference is direct investments in equity shares listed on Indian stock exchanges.

- You need RBI complaint reporting for your transactions.

Choose Non-PIS Account:

- If you plan to invest the income earned in India via your NRO account.

- If you want to explore a broader range of financial instruments, such as derivatives and mutual funds.

- Go with a Non-PIS account if you prefer a simple process with no additional regulatory compliance costs.

The Bottom Line

The process of NRI investing in India's stock market becomes easier once you understand the entire process and the tax implications; however, before making any investment, consider your financial goals and risk tolerance.

If you need expert guidance to analyze your financial goals better and help you with the best investment options as an NRI, reach out to Savetaxs.

We have been helping NRIs from 90+ countries to manage their investments in India. Contact us today, and be rest assured that your investment journey will be hassle-free and compliant.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- NRI Investment in SGrBs Through IFSC

- A Complete Guide to Investing in Gold for NRI in India

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- NRI Succession Certificate: A Guide to Inheriting Property

- Sending Money to India from Abroad: A Complete Guide for NRIs

- Investing in REITs as an NRI in India- Complete Guide

- Registering a Will in India: Key Tips for NRIs

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

Want to read more? Explore Blogs

_1763555884.webp)

_1753429421.webp)

_1756729655.webp)

_1767339016.png)

_1767429506.webp)

_1758631896.webp)

-plan_1761282887.webp)