To boost foreign investment in derivatives, the Reserve Bank of India (RBI) has recently made certain changes in the Foreign Exchange Management Act (FEMA) regulations. The new regulations facilitate margin management for trading in permitted derivatives. It will be applicable for transactions made in or outside India. Further, these changes aim to increase the foreign investment opportunities in India by attracting NRIs and foreign individuals to invest in the country.

Want to know the changes in FEAM regulations for derivatives. Additionally, how these changes are beneficial for NRIs and foreign investors. Read on the blog and get your answers.

- Indian Authorized Dealers (ADs) can now collect and post margin globally for permitted derivative contracts signed with NRIs and foreign individuals.

- NRIs can now open and maintain a margin account in foreign or Indian currencies.

- The changes in FEMA regulations ensure the handling of funds efficiently related to permitted derivative contracts. It further provides smooth transactions for NRI and foreign investors.

- With changes in FEMA regulations, RBI aims to mitigate the exposure risks for all stakeholders, whether residents or NRIs involved in derivative trading.

- To stay compliant with the FEMA regulations and tax laws, before investing in India, NRIs and foreign investors should consult a tax advisor.

What Are Derivatives and Why Are They Important?

In simple words, derivatives are financial contracts, and their value is calculated by the underlying assets or a set of assets. It is a type of financial security signed between two or more parties. Bonds, commodities, stocks, currencies, and market indices are all common assets.

Through derivatives, investors efficiently hedge risks, manage exposures, and speculate on future movements. This is the reason why investors from all over the world heavily rely on them. For instance:

- Through a stock option, an investor sells or buys shares at a pre-decided cost later.

- With a currency forward, for a future date, a company today fixes an exchange rate.

- Further, with an interest rate swap, companies manage the risk of fluctuating interest rates.

Considering the above examples, the main idea of signing derivative contracts is to get the benefit of the underlying asset by betting on its future value. Believing that the market price of an equity share will increase or decrease.

Further, through a derivative contract, you can generate gains by having an appropriate bet. Additionally, you can also protect yourself from losses in the market, where the trading of stock is done.

This was all about derivatives and why it is important for investors. Moving ahead, let's know the changes made by the RBI under FEMA regulations.

What Has RBI Changed Under FEMA Regulations?

The recent changes made by the RBI under FEMA regulations for trading aim to facilitate margin management in permitted derivatives both in and outside India. Considering this, now, for foreign investors and NRIs, investing in derivative instruments will be easier following the FEMA regulations.

Now, let's know the key highlights of the new rules.

Key Highlights of the New Rules

Here are the highlights of the new rules:

- Authorized Dealers (ADs) can now post and collect margin globally for permitted derivative contracts signed with NRIs or entities. Additionally, they can also they can engage in derivative transactions with the International Financial Services Centre Banking Units and overseas branches. It further in this domain increase foreign investment.

- Under the new regulations, ADs enable NRIs to open and maintain interest-bearing accounts in foreign or Indian currency. Through this provision, margin obligations are expedited. Additionally, now NRIs can accrue interest on the funds held in these accounts rather than remain idle.

- Further, through these changes, NRIs participating in derivative contracts now have a more streamlined avenue to fulfill the margin requirements.

- This dedicated account mechanism certifies the handling of funds efficiently associated with permitted derivative contracts. Considering this, for foreign investors, it provides smoother transactions.

For instance, suppose Mr. A is an NRI living in the US. He has made investments in India and earns dividends or rent in INR. In case the value of the rupee drops, Mr. A loses value when converting the income into dollars. However, this happened in the past.

Now, with the new FEMA regulations, he can open a margin account in dollars or INR. Additionally, signed a currency forward contract to fix the exchange rate. This further helps in getting the appropriate profit value during a currency fluctuation situation.

These were the changes made by the RBI that eased FEMA regulations for derivatives. Moving further, let's know why the RBI eased the FEMA rules.

Why Did the RBI Ease FEMA Rules?

The RBI eased the FEMA rules because it aims to mitigate the exposure of risk for all stakeholders who are involved in derivative trading. Considering this, the margin money of outstanding positions constitutes a specific percentage value. It further for both stock exchanges and investors serves as a vital tool of risk management.

Now, with simple FEMA regulations for derivatives, the regulatory landscape has become more conducive. Additionally, foreign investors can explore the derivative investment opportunities confidently in India. This makes India an attractive destination for investments for NRIs and foreign individuals.

So, from the above information, it is clear why the RBI eased the FEMA rules for derivatives. Moving ahead, let's know how NRIs can invest in India under the new guidelines.

How NRIs or Foreign Investors Make Investments in India?

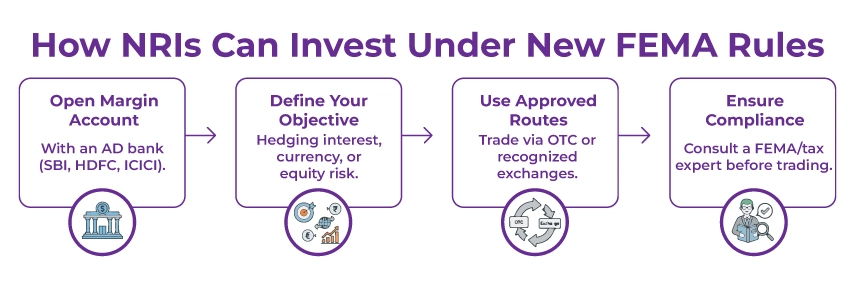

Here is how, under the new FEMA regulations for derivatives, NRIs or foreign investors can invest in India:

- For opening a permitted margin account, contact an Authorized Dealer (AD) bank in India, such as ICICI, SBI, or HDFC Bank.

- Understand what your hedging or investment goal is. For instance, interest rate risk, currency risk, or equity exposure.

- Further, through over-the-counter (OTC) or recognized exchanges routes signed permitted derivative contracts.

Additionally, for full compliance before starting trading, it is advisable to consult a FEMA or tax advisor.

Final Thoughts

Lastly, the proactive measures of the RBI made towards FEMA regulations for derivatives show its commitment to increasing foreign investment opportunities in India. Considering this, the country makes its position strong as an investment place. Further, these regulatory amendments serve as a tool of unwavering commitment of India towards financial inclusivity and economic growth.

Furthermore, if you are still confused about the foreign investment rules for NRIs in India, connect with Savetaxs. Our experts will solve all your queries about it and help you make the correct investment decision.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766129179.png)

_1764137986.webp)

_1767604193.webp)

_1767333184.png)