Section 10 of the Income Tax Act states an array of tax deductions and exemptions to reduce the overall tax liability of salaried individuals. Incomes like house rent, travel allowance, interest on the PF, gratuity, and more are exempted, meaning such income will not be included while calculating the taxable income of the individual.

Such tax exemptions will help individuals reduce their overall tax burden. However, they should be aware that Section 10 is divided into various subjects like Section 10(5), Section 10(3A), and Section 10(26), each offering a different exemption that can be claimed if an individual is eligible.

In this blog, we will explore Section 10 of the Income Tax Act, including its sub-sections, and explain how to claim exemptions under this section.

What is Section 10 of the Income Tax Act?

Income Tax Act 1961 section 10 states a list of various types of income sources of a salaried individual that are not taxable. Some of these commonly claimed tax exemptions include house rent allowance, children's education, leave travel allowance, and many others. Moreover, Section 10 also includes a life insurance policy tax-free maturity benefit that falls under Section 10(10D).

By offering such tax exemptions, the government aims to promote tax savings, responsible financial planning, and smart investments for the salaried professionals. Not just this for a person working on a fixed salary, these exemptions result in a higher take-home salary, which ultimately improves the lifestyle of individuals.

In a nutshell, Section 10 of the income tax balances both the personal and the economic growth of an individual.

Who Can Claim an Income Tax Exemption Under Section 10?

Section 10 benefits individuals earning a salary. The table below outlines the maximum tax exemption limit for each age group under Section 10.

| Age Group | Tax Exemption Maximum Limit |

|---|---|

| Up to 60 Years | Rs 2.5 Lakhs |

| 60-80 Years | Rs 3 Lakhs |

| 80 years and above | Rs 5 lakhs. |

However, please note that Section 10 income tax exemptions are not available under the new tax regime. Only the individuals who have opted for the old tax regime can benefit from these exemptions.

What Are the Available Tax Exemptions Under Section 10?

Following is a list of all the tax exemptions that are stated under section 10 of the Income Tax Act.

Section 10(13A) - House Rent Allowance

This section covers the house rent allowance for a taxpayer. Meaning whatever part of your salary you received to cover the rent and accommodation expenses is exempt from income tax.

But there are a few exceptions which should be considered in Section 10(13A) Rule 2A. The exemption is given for the least of the following amounts:

- Actual HRA received

- 50% of the basic salary + DA: this is for the ones who are living in Mumbai, Chennai, Kolkata, Delhi, or

- 40% of the basic salary + DA: this is for those living in other cities.

- Actual rent paid (-) 10% of the basic salary + DA.

According to Section 10(13A), the following expenses are taken into consideration under the house rent allowance exemption from income tax.

- The actual rent paid for the accommodation.

- Commission to the brokerage paid to the broker or the real estate agent.

- Maintenance charges paid for the rented accommodation, including society fees and other expenses.

- Cost paid for preparing and registering the lease agreement.

Section 10(5) - Leave Travel Allowance

The leave travel allowance falls undwe section 10(5). It is applicable for all employees with domestic travel expenses, such as train, bus, and airfare. Additional expenses, including transportation to destinations, hotel accommodations, sightseeing, food, etc, are not covered under this policy. Ensure that the leave travel allowance exemptions are limited to the LTA exemption provided in your CTC by your employer.

For instance, an employee is given an LTA of Rs 30,000, and he incurs travel expenses of Rs 20,000. The amount spent on travel is exempt from taxes, and the remaining Rs 10,000 is calculated under taxable income.

Section 10(14)(ii) - Children Education Allowance

Under this section, taxpayers with children's education allowances can claim an exemption of Rs 100 per year for two children.

Section 10(11) - Tax Exemptions on Payments Made to the Sukanaya Samriddhi Account and Provident Fund.

Under section 10(11), an individual is eligible to get tax exemptions for interest from a provident fund upon retirement or resignation.

Note: From April 2021, the exemptions under this section are not being applied to interest income that accrues during the last year on contributions exceeding the threshold of Rs 2,50,000 made by an employee to those funds.

Section 10(10) - Gratuity

Any income received from the government as a gratuity is exempted. For employment in the private sector, the exemption depends on whether you are covered under the Payment of Gratuity Act or not.

Section 10(10AA) - Enhancement of Paid Leaves

Every employee is permitted a certain number of leaves in the company, which they can take as per their convenience. If the employee does not use their leave, they either lapse by the end of the year or can be carried forward to the future. Alternatively, it can be encashed upon retirement or resignation, as per the company's policy.

So, if the employee wishes to encash their leaves during their tenure of service, then it is fully taxable. In contrast, if an employee encashes their leaves during retirement or resignation, the leave encashment amount is fully exempt from income tax.

However, the government employees' leave encashment is fully exempted.

Section 10(10A) - Commuted Pension

Under this section, a taxpayer receives tax benefits on the money they get from the accumulated pensions; the taxpayer must be a government employee.

Section 10(1) of Income Tax Act

This section aims to provide tax exemption on the agricultural income earned by a Hindu Undivided Family (HUF) or an individual. However, taxpayers must be aware that the exemption under section 10(1) only applies to income earned through agricultural activities, and not animal husbandry activities such as dairy, poultry, farming, and more.

Here, the term "agriculture" refers to the income from agricultural land in India, which includes:

- Any rent or revenue received from a land that is used for agricultural purposes.

- Any income generated from agricultural operations, such as processing, raising, and maintaining agricultural produce, and more.

Section 10(10B) - Retrenchment Compensation

Amount paid during the time of closing down of an industrial undertaking or transfer of an employee is called reterenchment compensation. Any individual who receives such compensation can claim it as an exemption under section 10(10B) of the Income Tax Act. Tax exemption can be claimed for the lower of the following:

- Compensation received

- Rs 5,00,000

- Lastly: 15 days average pay * number of completed years of service.

Section 10(10C) - Voluntary Retairment

If an employee receives money on termination or voluntary retirement, it is exempt from income tax. Now, if a government employee receives money during their voluntary retirement or termination, the limit of tax exemption is capped at Rs 5 lakh.

Section 10(10D) - Life Insurance Policy Tax Exemption

Under section 10(10D) of the Income Tax Act, if an individual receives income from an insurance policy or bonus, it is exempt from income tax. But in the case of the below-mentioned insurance policies, the taxpayer is not eligible to claim the exemptions.

- A life insurance policy is taken out for a dependent family member who is specially-abled.

- Key man insurance policy.

- The insurance policy has a premium amount exceeding 10% of the sum assured.

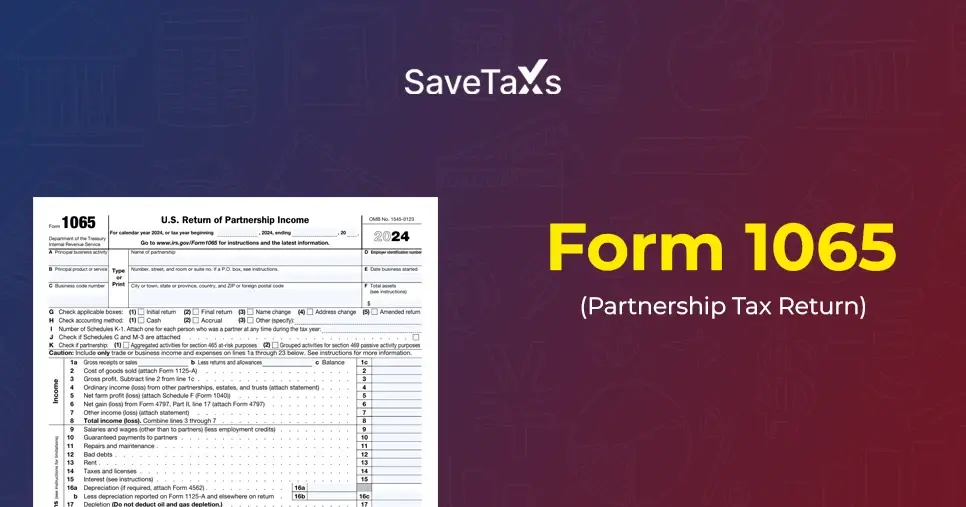

Section 10(2A) - A Partner's Share in Profits

Section 10(2A) of the Income Tax Act states that any partner's profit share in the firm or an LLP (limited liability partnership) is fully exempted from tax.

Section 10(14) - Special Allowance Tax Exemption

Under this section of the Income Tax Act, tax exemption on special allowances is given, including a tax exemption of Rs 26,400 for food annually.

The internet allowance that your employer provides is also exempt from taxation.

In a nutshell, the section offers tax exemption from expenses like conveyance, research allowance, travelling, and more incurred because of the taxpayer's employer's business.

Section 10(15) - Interest on Savings Certificate

Section 10(15) of the IT Act offers an exemption from income tax on interest income earned from specific investments.

| Investment Type | Eligible Entities | Interest Exemption |

|---|---|---|

| Savings certificates | Indidviduals | Fully exempted |

| Debentures and bonds | NRIs, specified entities | Varies, up to full exemption. |

| Deposits under NSSF | Any entity | Exempted fully |

| NRI Accounts | Non-resident Indians | Exempted fully on certain accounts. |

Section 10(23C) - Exemption from taxes for medical and educational institutions.

Under this section, those medical and educational institutions whose annual receipts aggregate do not exceed the threshold of Rs 5 crore are eligible for exemption.

Section 10(26) Exemption for Scheduled Tribe Members in North-eastern States.

Members of scheduled tribes in Tripura, Nagaland, Mizoram, Arunachal Pradesh, and Manipur receive tax exemptions on any income that has been earned in the states mentioned or through interest or dividends on securities under Section 10(26).

Section 10(26AAA) - Tax Exemption for Skikkimese Individuals.

Under section 10(26AAA), if you are a Sikkimese who has earned income from any source in Sikkim or through securities dividends or interests, then such income will be exempt from taxes.

Section 10(34) - Exemption on Dividends

Section 10(34) talks about the exemption on the dividend income that you have received by investing in an Indian company. However, this ensures that the list of exemptions is capped at Rs 10,000. If the limit exceeds, the rest will be taxable.

Please note that this exemption is only applicable for dividends received up to March 31, 2020.

Section 10(34A) - Exemption on Buy-Back of Shares.

Under section 10(34A), before October 1, 2024, the amount a taxpayer receives on the shares bought back by a domestic company is entirely exempt from taxes.

Section 10(35) - Tax Exemption on Income from Specified Mutual Funds.

Under section 10(35), any income a taxpayer earns from the sale of a specified mutual fund unit is exempted from the Income Tax. However, this is applicable for the income earned till March 31, 2020.

Section 10(37) - Exemption on Capital Gains from compulsory acquisition of agricultural land in an urban area.

Under this section, a taxpayer is eligible for tax exemption on capital gains due to the compulsory acquisition of agricultural land in an urban area.

However, to get an exemption, one needs to fulfill the conditions mentioned below.

- The land must only be used for agricultural purposes for two years before its date of sale.

- The RBI or the central government of India must have approved the compulsory acquisition scheme.

Section 10(38)- Long-term capital gains from the sale of equity shares and equity-oriented mutual funds are tax-exempt.

When a taxpayer gets long-term capital gain through a sale of either equity shares or equity-oriented mutual funds, it is entirely exempt from income tax calculation. However, ensure that the securities transactions tax is paid.

Note that this exemption on long-term capital gains applies only to longer-term capital gains earned up to March 31, 2018. Additionally, the long-term gain generated from the sale of listed securities that exceed the threshold of Rs 1 lakh will be taxable at the 10% rate under Section 112A (terms and conditions apply).

Key Tax Exemptions for NRIs under Section 10 of the Income Tax Act

Below are some of the key tax exemptions for NRIs under Section 10 of the Income Tax Act.

Section 10(4)(ii) - Interest on an NRE Account

For non-resident Indians, one of the most important tax benefits is the exemption on interest earned from NRE bank accounts. The interests earned from these accounts are fully tax exempt in India; hence, NRE accounts are a preferred space for NRIs to park their funds.

However, the taxpayer must ensure that these exemptions are only available as long as they qualify as a person resident outside India under FEMA. Once the residential status of the taxpayer changes, the tax exemptions will no longer be applicable.

Section 10(15)(iv)(fa) Interest on an FCNR Account

The interest earned on a foreign currency non-resident account (FCNR) is also fully exempted from taxes in India under section 10 (15)(iv)(fa) of the Income Tax Act.

Another good part about this section is that these benefits of tax exemption on FCNR account interest are not limited only to the non-resident Indian(NRIs) but also to the person classified as "Resident but not ordinarily Resident" (RNOR).

Section 10(6)(iv) - Remuneration to Foreign Citizens.

However, the provision under this section is not specifically for NRIs, but it is somehow relevant for foreign nationals working in India for a short duration.

The section states that if a foreign citizen comes to India for employment and the period of their stay remains within the timeframe of 90 days in a financial year, the remuneration they get is exempt from income tax in India, provided certain conditions are met.

Get Expert NRI Tax Filing Assistance In A Click

NRIs, the tax filing session for the financial year 2024-25 is ongoing, and the last date to file your ITR is September 15th, 2025. If you earn a salary from an income source in India, you can file your taxes accurately and with utmost precision with Savetaxs.

We have been helping NRIs for decades with filing their taxes, and our satisfied client base speaks volumes. With over 30 years of NRI tax filing expertise, our experts are going to help you just right, which is to minimize your tax liabilities and maximize your tax refunds.

We serve our clients 24/7 across all time zones. File now and save on taxes with Savetaxs.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Income Tax Surcharge Rate & Marginal Relief for AY 2025-26

- Securities Transaction Tax: What It Is and How It Is Levied?

- New Tax Laws 2025: Tax Brackets and Deductions

- Short Term Capital Gain on Shares (Section 111A of Income Tax Act) - STCG Tax Rate and Calculation

- Section 112 of the Income Tax Act: Tax on Long Term Capital Gains

- Section 115F: Unlocking Tax Benefits for NRIs in India

- Section 115BAC New Tax Regime 2025: Slabs, Benefits, Exemptions & Deductions

- Section 80IA of the Income Tax Act: Everything You Need to Know

- All You Need to Know About Section 22 of the Income Tax Act

- Home Loan Tax Benefits Under Section 24(b)

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

Section 10(13A) of the Income Tax Act provides an exemption related to HRA. The amount that is eligible for exemption is the least of the following limits:

- The actual house rent allowance received.

- 40% of the salary in the non-metro city and 50% in the metro city.

_1759750925.webp)

_1752921287.webp)

_1760618042.webp)