Owning agricultural land in India is a common dream of many NRIs (Non-Resident Indians) to connect with their roots. However, an NRI must navigate the legal complexities of acquiring agricultural land. The main legislation that governs such transactions is the FEMA Act 1999.

Under the FEMA Act, an OCI cardholder and an NRI are not allowed to purchase agricultural land, plantation property, or farmhouses in India. This rule aims to safeguard agricultural resources and avoid speculative buying.

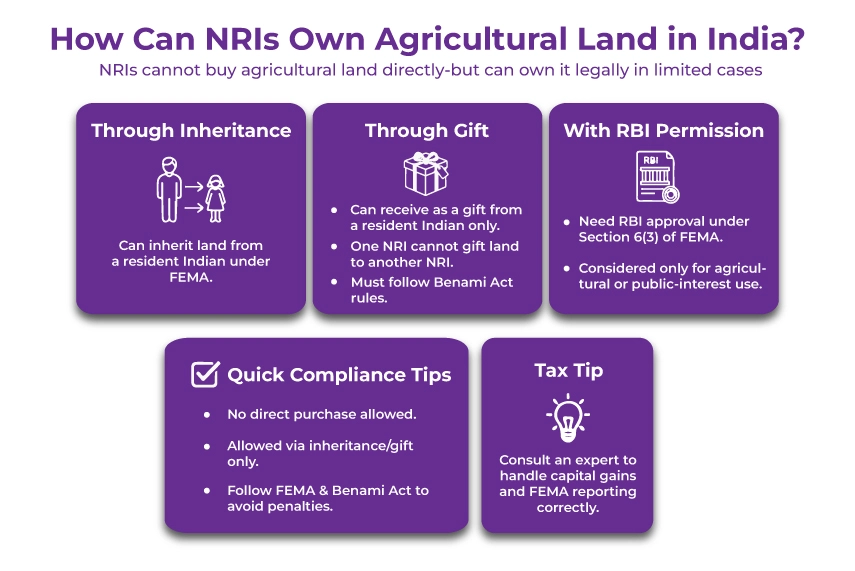

However, NRIs can inherit agricultural land from relatives if they comply with Indian inheritance laws and regulations. Additionally, they can receive the land as a gift from a resident Indian. Violating the rules by buying agricultural land directly as an NRI can lead to severe penalties.

In this blog, we will discuss the legalities and compliance requirements for an NRI seeking to purchase agricultural land in India.

- NRIs and OCIs are prohibited from buying agricultural land, plantation property, or farmhouses in India.

- The only way for NRIs to own agricultural land is through inheritance from an Indian resident or by receiving it as a gift from an Indian resident.

- If they wish to inherit the land, they can only sell it to a resident Indian.

- Violating the FEMA rules can lead to hefty penalties, including property confiscation, fines of up to three times the amount involved, imprisonment, etc., as the transaction will be considered void.

Can an NRI Buy Agricultural Land in India?

No, an NRI cannot buy agricultural land in India. Under the FEMA (Foreign Exchange Management Act) and the RBI (Reserve Bank of India), NRIs, PIOs, and OCIs are generally legally restricted from purchasing agricultural land*, plantation property*, or farmhouses* in India. It applies unless they get special permission from the RBI. This policy is intended to protect agricultural resources from speculative, offshore investment.

If you do so, the FEMA authorities will send you a notice, and your land could be confiscated by the government. Additionally, they can even impose a hefty fine. However, NRIs can inherit agricultural land or receive it as a gift under certain situations. This will let you maintain a connection to your heritage and take part in agricultural activities.

- Agricultural land: A land that is used to cultivate crops, including vegetables, fruits, and grains.

- Farmhouse: It is a house situated on agricultural land. The value and purpose of this house are essentially associated with that land.

- Plantation Property: Estates used to grow certain commercial crops such as tea, coffee, rubber, or cardamom.

How Can NRIs Own Agricultural Land?

The law allows an NRI to own agricultural land under certain circumstances. However, these exceptions apply only to passive acquisition. It means the NRI is not allowed to actively go and purchase the land. They can only own it either through inheritance or as a gift under very specific situations.

Acquiring Land Through Inheritance

An NRI or a PIO is allowed legally to acquire agricultural land, farmhouse, or plantation property in India through inheritance from an individual who was an Indian resident. It means if a resident Indian relative willingly passes on their agricultural land to an NRI. Then, the NRI will become the owner of the land legally.

The main requirement for this condition is that the person who is inheriting the property must have been an Indian resident as per the FEMA definitions.

Receiving Land As A Gift

An NRI can also receive agricultural land as a gift. However, there is an exception to this condition: the gift can only be received from an Indian resident.

For instance, a parent who is an Indian resident gifting their agricultural property to their NRI child. One important thing to keep in mind is that one NRI cannot gift agricultural land to another NRI. This is to ensure that the land is transferred from within the country only. Furthermore, it's not a way to avoid the purchase restrictions for non-residents. Also, you must consider the Benami Act** while gifting the property.

**Benami Act: The Benami Transactions (Prohibition) Amendment Act, 2016, restricts NRIs from buying a property in somebody else's name. This act intends to avoid money laundering and ensure transparency. The exceptions could include property bought for immediate family members under certain situations. Not following the rule can lead to hefty penalties, including property confiscation and imprisonment.

Special Permission from RBI

NRIs who wish to buy agricultural land must get special permission from the RBI by following the process mentioned below:

- Application to RBI: Firstly, you need to submit a formal request under Section 6(3) of FEMA. You need to state the acquisition purpose and its intended use.

- Consultation with the State Government: RBI may seek the state government's opinion on whether the acquisition should be allowed, as the land is a state subject.

- Public Interest: In case the purchase is associated with agricultural development, research, or any initiative that benefits the farmers. Then, the RBI may consider approving.

- Decision by the RBI: You must report the transaction under FEMA compliance norms in case you receive approval from the RBI. This is to ensure that you are not violating foreign exchange rules.

Holding and Selling Inherited/ Gifted Land

Now, once you have legally acquired the land either via inheritance or as a gift. The next question that arises is, what can I do with it? So, here are the two things that you can do with the agricultural land:

Hold the Property

An NRI can retain holding the gifted or inherited agricultural land. They can manage it, cultivate it, and earn income from it. The derived income would be credited to their NRO account and taxed under Indian income tax laws.

Sell the Property

Although an NRI can sell the inherited/gifted property but they can only sell it to someone who is an Indian resident. They are not allowed to sell the land to another NRI, PIO, OCI, or any other foreign national. This will ensure that an Indian resident holds the land's ultimate ownership upon sale.

How State-Wise Rules Differ?

Although FEMA is responsible for setting the national policy and rules. The land ownership rules are a state subject in India. It means the rules may differ by state, making some more NRI-friendly than others. The table below shows the rules as per different states:

| State | Direct Purchase Permitted | Key Exceptions and Conditions | Inheritance/Gifting |

|---|---|---|---|

| Karnataka | Yes (Conditional) | Must fulfill requirements related to income and land ceiling | Permitted |

| Rajasthan | No | Leasing is allowed; some zones may permit tourism/industrial use. | Permitted |

| Kerala | No | Plantation - specific rules (rubber, cardamom, etc. ) | Permitted |

| Punjab and Haryana | No | Leasing: invest through agribusiness companies owning land | Permitted |

| Gujarat | No | Land must be converted to non-agricultural use. | Permitted |

| Tamil Nadu | No | Strict land ceiling acts: leasing is also an option. | Permitted |

| Maharasthra | No | NRIs who held land while being residents can retain it. | Permitted |

| Uttar Pradesh and Bihar | No | Strict protections because of high agricultural density | Permitted |

Documents Required for NRIs Acquiring Agricultural Land

An NRI needs several documents when acquiring agricultural land either through purchase (with RBI approval) or inheritance. The documents include:

- Compliance with FEMA Guideline: Proof of the source of funds for the purchase must be submitted.

- Proof of Ownership: Sale deeds or inheritance papers to confirm rightful ownership.

- Agricultural Use: Documents must prove that the land is used for agricultural purposes and intended for such purposes only.

Tax Implications on Agricultural Land Transactions for NRIs

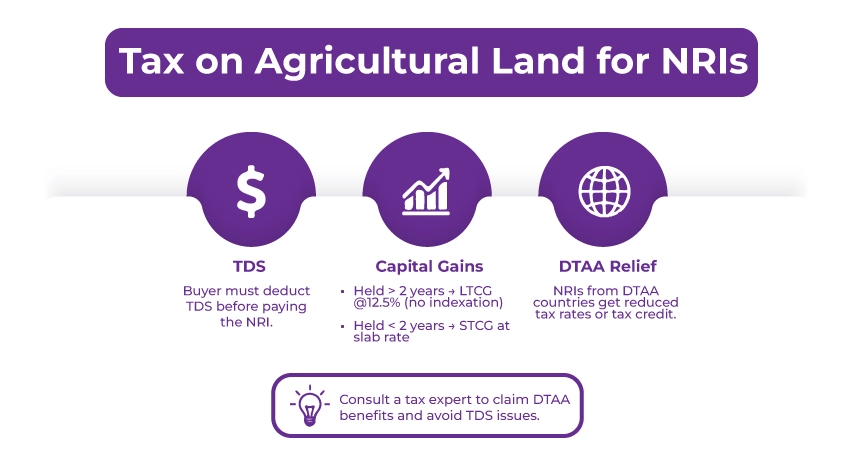

When an NRI sells agricultural land received through inheritance or as a gift, they must comply with the associated Indian tax laws:

- TDS (Tax Deducted at Source): Before making a payment to an NRI, the buyer must deduct TDS.

- Capital Gains Tax: If the land has been held for more than 2 years, it is taxed under long-term capital gains (LTCG). The current LTCG is 12.5% without any indexation benefits.

- DTAA Benefits: If the NRI is from a country with a DTAA with India, they may qualify for reduced tax rates.

To Conclude

An NRI cannot legally buy agricultural land, unless acquired via inheritance or gifting. You may incur penalties if you try to violate the rules through proxy ownership, benami transactions, or unauthorized purchases. The penalties could include confiscation and legal action under FEMA, RBI, and the Benami Transactions Act.

Given the legal complexities, you should seek help from a professional NRI tax consultancy before making any transaction that involves agricultural land. One such consultancy is Savetaxs. We have a team of experts carrying more than 30 years of expertise and knowledge

They will ensure you stay compliant with the rules related to NRI buying agricultural land in India and guide you throughout. We are working 24*7 across all time zones, so contact us right away.

**Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- A Comprehensive Guide to the Annual Information Statement

- A Guide for NRI Buying Agricultural Land in India

- How NRIs Can File Form 10F Without a PAN Card (Claiming DTAA Benefits)

- What is House Rent Allowance: HRA Exemption, Tax Deduction, Rules & Regulations

- Complete Guide On What is ITR, Documents Required, ITR Forms & Why To File

- Section 194N- TDS on Cash Withdrawal

- Income Tax Surcharge Rate & Marginal Relief for AY 2025-26

- Understanding Section 10 of the Income Tax Act

- All You Need to Know About Section 22 of the Income Tax Act

- Intimation Under Section 143(1) of Income Tax Act – ITR Intimation Password

- 5 Common Mistakes NRIs Make The Lead To Tax Notices

- Section 143(2) Notice Meaning & How to Respond

- Short Term Capital Gain on Shares (Section 111A of Income Tax Act) - STCG Tax Rate and Calculation

- Section 115F: Unlocking Tax Benefits for NRIs in India

- How Much Gold NRI Can Bring to India in 2025?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!