Do you know that interest is often tax-deductible when it comes to mortgages and taxes? This is true if the loan fulfills the IRS mortgage rules, helping you reduce your taxable income. You might get the option to deduct interest paid on your mortgage and any local or state property taxes you have paid during the year.

The deductible amount of mortgage interest is reported annually by the mortgage company on Form 1098. If you also wish to maximize your savings, keep reading this blog. We will find out if you qualify for the deduction and also learn how to claim the mortgage tax deduction.

Key Takeaways

- You can subtract the interest from your payments when you repay a mortgage loan. This applies if the loan fulfills the IRS mortgage rules.

- You can generally deduct mortgage interest on your tax return. However, the loan must be secured by your home. It is vital to use the loan proceeds for buying, building, or improving your primary home. Also, it can be used for one other home you own and use for personal purposes.

- Mortgage interest for a rental home usually doesn't qualify as an itemized deduction on your tax return. However, it qualifies as a rental expense deduction.

- You can deduct mortgage interest from new loans for your main residence on your tax return. However, there is a limit to this deduction of the first $750,000 of the loan.

What is the Mortgage Interest Deduction?

While repaying a mortgage loan, do you know that the payments are mostly interest? Yes, it's true in the first few years. Even after that, the loan's interest part can be an important portion of your payments. However, if the loan fulfills the IRS mortgage requirements, you can deduct the interest paid by you.

The mortgage company reports the amount of deductible mortgage interest on Form 1098. It is then sent to the homeowners. The federal government offers this tax benefit to homeowners, which is designed to make homeownership more affordable. However, to claim the mortgage tax deduction, you must itemize deductions.

A non-resident alien (NRA) in the US will qualify to claim a mortgage interest deduction based on whether the income from he property is “effectively connected” with a U.S. trade or business. They must itemize on Form 1040-NR to claim a deduction and are not allowed to take the standard deduction.

What are the Requirements for a Mortgage Loan?

When you file a tax return, you get the option to deduct interest from your mortgage payments. However, this option only applies if the loan is secured by your home. Additionally, you must utilize the loan proceeds for the specified purpose. It means the proceeds must have been used to buy, build, or improve your main residence.

Furthermore, it can be used for your other home you own and for personal reasons. Now, renting out your second home to a tenant doesn't count as a personal purpose. Therefore, it doesn't qualify for the mortgage interest deduction on your tax return. However, if you use the rental home as a residence for 15 days or more every year. Also, use it as a residence for over 10% of the days you rent it to tenants. Then, the rental home will qualify for the mortgage interest deduction.

What is the Limit for the Mortgage Interest Tax Deduction?

The IRS puts forward numerous limits on the interest amount that you can deduct annually on your tax return. Here are the limits for the mortgage tax deduction:

- For the tax year before 2018, if you itemize on your tax return. Then, you can deduct the interest paid on up to $1 million of acquisition debt. Also, if specific requirements are fulfilled, the interest on an additional $100,000 of debt can be deductible.

- Beginning in 2018, the deductible interest for new loans is limited to the main amount of $750,000. The loans from before December 16, 2017, or under a contract that closes before April 1, 2018, adhere to the old rules for tax years before 2018.

- The limitation is cut in half if you are married and filing separately. These limits are progressive for all your mortgage debt on both residences. For instance, if you are single and hold an $800,000 mortgage on your primary residence. Also, have a $400,000 mortgage on your summer residence. Then, you could subtract only the interest on the first $1 million. For tax years before 2018, both loans individually fall under the $1,000,000 limit.

What are Mortgage Discount Points?

Mortgage discount points, also known as prepaid interest, are fees that you pay during closing to acquire a lower mortgage rate. Generally, these costs can be deducted in the year you purchase the home. If not, you can subtract them pro rata over the repayment period.

For instance, if you pay $3,000 in points to acquire a lower mortgage rate. Then, you can increase your mortgage interest deduction by $3,000 in the tax year you close on the home.

How Can I Claim the Home Mortgage Interest Deduction?

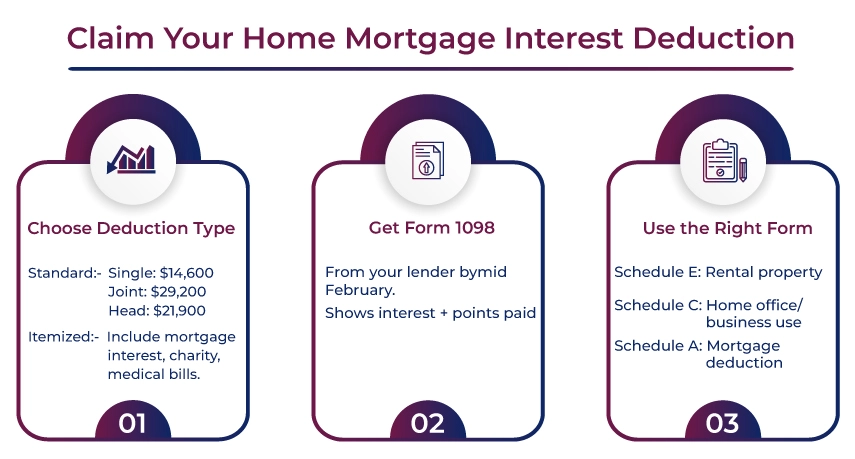

Follow the steps below to claim your home mortgage interest deduction:

- Choose Between the Standard Deduction and Itemized Deductions: Opting for the standard deduction means fewer forms. You are also not required to prove your deductions. It provides a predetermined amount, which may differ according to the filing status. The amounts for the tax year 2024 are as follows:

- For individuals filing as single or married filing separately: $14,600

- For married filing jointly: $29,200

- For filing as heads of household: $21,900.

You can pick from numerous deductions if you opt for an itemized deduction. It includes charitable donations and medical expenses. You must fill out additional forms to choose this option. Additionally, you must provide evidence for each deduction. Both types of deduction will reduce your taxability:

- Get Form 1098 from your Mortgage Lender: Form 1098 is crucial to claim your mortgage tax deduction. You will receive Form 1098 from either your mortgage lender or service provider. It specifies the mortgage interest you paid and points for the year. Contact your lender in case you don't receive this form by mid-February, and also for any assistance.

- Choose the relevant tax forms: To claim the mortgage interest deduction, you need to list it on Schedule A (Form 1040). You need to itemize your deductions to do the same. You require a different form for income from your home, such as rental or business use.

- Schedule E (Form 1040): Form 1040 can be used for deducting interest on rental properties.

- Schedule C (Form 1040 or 1040-SR for those aged 65 or above): Use this if a part of your home is a home office or if your business is funded by your mortgage.

Example of mortgage interest deduction decision-making

The decision of opting between the itemizing and the standard deduction depends on which offers more savings. Consider opting for a single filer with the following deductions:

- Mortgage interest: $9,500

- Charitable contributions: $2,500

The total of these two is $12,000. In this example, opting for the $14,600 standard deduction (2024) would be better. It cuts taxable income by an additional $2,600. However, if the mortgage interest was $13,000 and the charitable contributions $3,000, which makes a total of $16,000.

In such a case, choosing itemized deductions would be beneficial. It would lower your taxability by an additional $1,400 over the standard deduction.

To Conclude

The mortgage tax deduction allows homeowners to reduce their taxable income. Under the Tax Cuts and Jobs Act of 2017, the limits for the mortgage interest deduction were reduced from $1 million to $750,000. It means you can now claim the deduction on the first $750,000 of the mortgage instead of the first $1 million.

Remember, it is not a mandatory deduction. However, not deducting your mortgage interest can lead to a higher tax liability as you can lose out on a valuable tax benefit. Also, the financial repercussions depend wholly on whether itemizing their deductions saves them more money.

Furthermore, if you need assistance with your mortgage interest deduction, contact an expert. When talking about experts, Savetaxs tops the list. We have been helping individuals with their tax-related queries for over a decade now. We assure that your queries will be handled with utmost precision. Our team of experts is working 24*7 across all time zones. So, connect with us right away to avoid considering deduction claiming as a stressful thing.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Vikram brings in more than ten years of experience in US Taxation. He is also an EA mentor and instructor. The expertise of Mr. Agrawal includes accounting, bookkeeping, Tax preparation, small business tax, personal tax planning, income tax, financial advisory services, and retirement planning.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

Below is the limit of mortgage debt that qualifies for the deduction:

- Mortgage taken out on or after December 16, 2017: You can deduct interest on the first $750,000 of qualifying mortgage debt (or $375,000 if married filing separately).

- Mortgage that began before December 16, 2017: Old limits still apply- up to $1,000,000 (or $500,000 for married filing separately).

Yes, there are several restrictions and special conditions, which are as follows:

- The loan must be secured by the home

- The home must include standard living facilities

- There might be additional occupancy rules if the home is a second home and rented part of the time.

The Tax Cuts and Jobs Act made changes like:

- Reduced the limit of mortgage debt for new loans to $750,000 for most filers.

- Increased the standard deduction so that only a few people benefit from itemizing.

_1758631896.webp)

_1766559165.png)

_1763555884.webp)

_1767080655.webp)