To build long-term wealth in India, millions of NRIs prefer investing in mutual funds. However, they end up facing the biggest challenge, which is double taxation. Double taxation is a situation in which a person is taxed twice on the same income in two different nations.

The government deducts TDS (Tax Deducted at Source) on capital gains when an NRI redeems mutual fund units in India. Simultaneously, a lot of foreign countries, specifically those following a worldwide income taxation system, require residents to report and pay taxes on their global income, including mutual fund gains from India. It means they pay capital gain tax TDS in India, pay additional tax, and report the same gains in their country of residence.

Several countries like the USA, Australia, and Canada enforce global taxation, resulting in NRIs being taxed twice. This is when DTAA comes into the picture, which is an agreement that ensures NRIs are not taxed twice on the same income.

In this blog, we will learn how an NRI can avoid double taxation on mutual fund gains. We will also discuss how the DTAA tax treaty works and how it applies specifically to mutual fund gains for NRIs.

- The DTAA agreement helps NRIs to prevent double taxation on the same income in two countries.

- NRIs need to pay TDS as per the specific TDS rate based on the scheme type and fund holding period when redeeming mutual funds.

- Mutual funds are a type of investment, while share represents ownership in a company.

- TRC and Form 10F are important documents required to claim a tax refund and the benefits to the DTAA provision.

What Tax Benefits Do NRIs Get on Mutual Fund Gains Under DTAA?

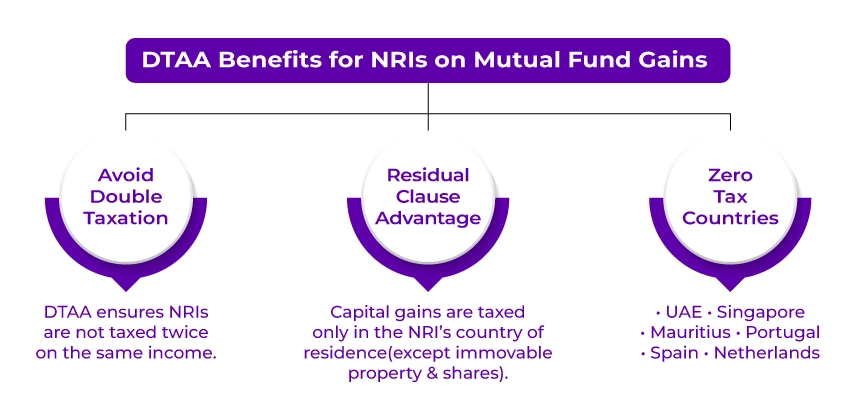

India has signed a DTAA (Double Taxation Avoidance Agreement) with several countries. It allows NRIs to avoid paying tax twice on the same income, once in India and again in their country of residence.

The main provision that permits this tax provision is called the 'residual clause' in Article 13 of certain DTAAs. As per the residual clause, capital gains are subject to taxation only in the country of residency of the seller. It doesn't include those received from immovable property and shares.

In short, if you are a tax resident of a country like Singapore, the UAE, Mauritius, Portugal, Spain, or the Netherlands, you might qualify to enjoy zero tax liability on mutual fund gains in India.

How are Mutual Fund Gains Taxed in India for NRIs?

Consider the following tax implications if you are an NRI seeking to invest in mutual funds in India:

Tax Deducted at Source (TDS)

When redeeming mutual funds, NRIs are liable to pay TDS at the specific TDS rate determined by the scheme type (equity or non-equity) and the duration of fund holding.

- Short-Term Capital Gains: Profits acquired from the sale of mutual funds that have a holding period of one year or less.

- Long-Term Capital Gains: Profits earned from the sale of a mutual fund having a holding period of more than one year.

| Particulars | TDS on Short-Term Capital Gains | TDS on Long-Term Capital Gains | TDS on Distributed Income Under IDCW Option |

|---|---|---|---|

| Equity Mutual Funds | 15% | 10% | 20% |

| Other Than Equity-Oriented Fund | 30% |

Listed - 20% with indexation. Unlisted - 10% without indexation. |

20% |

The TDS is levied at the highest applicable rate. The NRI will qualify to claim a refund when filing their returns, provided they fall in a lower tax slab.

Capital Gains Tax

Capital gains taxation on mutual funds depends on the holding period and the type of scheme.

| Particulars | Tax on Short-Term Capital Gains | Tax on Long-Term Capital Gains |

|---|---|---|

| Equity Mutual Funds | 15% | Gains that go beyond Rs. 1 lakh - 10% without indexation benefit |

| Other than the Equity-Oriented Fund | Taxed based on the income tax bracket |

Listed - 20% with indexation. Unlisted - 10% without indexation. |

When filing taxes, an NRI can claim a refund if they have paid higher TDS than their lower tax slab. TDS deducts income tax at the highest rate, so if an NRI's tax slab is lower, then they can claim the extra tax paid through refunds.

Tax Return of Income

If an NRI's total income includes only investment income or long-term capital gains with appropriate TDS deductions, they don't need to file a return of income.

Filing returns in India also has its own advantages. When filing returns, you will be eligible to claim a refund on the TDS deduction if your income falls under a lower tax slab.

Dividend Taxation

Dividends acquired from dividend schemes, equity, and non-equity will be deemed as income of the year and will be taxed according to the applicable tax slab rate.

Ease filing NRI ITR by getting personalized assistance at every step of the process.

Why are Mutual Funds Units Not Considered as "Shares Under DTAA"?

Mutual fund units had been treated as shares of companies by the Income Tax Department. Under that classification, capital gains would be subject to taxation in India for most NRIs. However, according to the ITAT (Income Tax Appellate Tribunal), it is clarified as:

In India, mutual funds are set up as trusts in accordance with SEBI regulations. When you invest in a mutual fund, you are actually buying units of a trust, not shares of a company.

Share represents ownership in a company registered under the Companies Act, while mutual fund units are a different type of investment. This distinction is essential because most DTAA specifically state that only "shares of a company deriving value from Indian assets are taxable in India.

Since mutual fund units are not mentioned in these agreements, they fall under the residual clause that usually allows the taxing rights to go to your country of residence. This means that, for capital gains from mutual fund investments, your home country typically has the right to tax those gains rather than India.

What are the Steps to Avoid Double Taxation for NRIs?

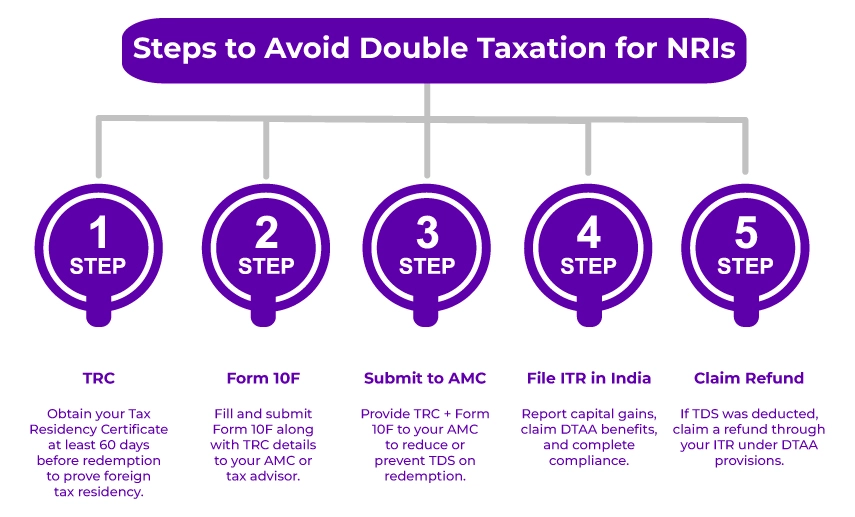

Understanding your eligibility for DTAA is one thing; claiming the benefits of the treaty is another. Follow these steps to avail yourself of all the benefits under the DTAA tax treaty and avoid double taxation on mutual fund gains:

Step 1: Obtain a TRC (Tax Residency Certificate)

You need to obtain a TRC (Tax Residency Certificate). TRC is used to prove your tax residency status in a country and is one of the most important documents.

Ensure that you apply for a TRC at least 60 days before you plan to redeem your mutual funds, as processing times may vary by country.

Step 2: Complete Form 10F

Fill out Form 10F, which is an Indian tax form that includes details from your TRC. After filling it out, it is typically submitted to your mutual fund house or through your tax advisor when filing returns.

Step 3: Submit Documents to Your AMC

Many AMC (Asset Management Companies) offer the option to submit your TRC and Form 10F before the redemption. It will help you avoid or lower TDS deduction at source.

However, remember that not all AMCs follow this process consistently. Many AMCs will still deduct TDS and require you to claim a refund later.

Step 4: File Your Income Tax Return in India

You need to file an ITR in India even if your gains are exempt under DTAA. It is required to:

- Report the capital gains

- Claim the DTAA exemption under Section 90/91

- Receive a refund of the TDS deducted (if there is any)

Step 5: Claim a Tax Refund (if TDS was Deducted)

You can claim a refund, provided your AMC deducted TDS before you submitted your TRC.

You can do this through the ITR filing process. The Income Tax Department will process your refund when you file and claim the exemption under the DTAA (Double Taxation Avoidance Agreement).

Final Thoughts

Double taxation can't be avoided. You can legally reduce or avoid tax on mutual fund gains with proper planning under the DTAA provisions. With the help of this blog, you will get an idea of double taxation on mutual fund gains for NRIs and a way to avoid it.

Furthermore, to accurately claim the exemption and avoid any mistakes, contact an expert. When it comes to experts, Savetaxs tops the list. We have a team of professionals carrying years of experience in this field. They have been helping NRIs manage their tax obligations and plan their finances. We will ensure you follow everything accurately and help you reduce your tax burden. Contact us anytime you want, as we are working 24*7 around the globe.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Advance Investment Options for NRIs: AIFs, REITs & Bonds

- NRI Purchasing Property In India From The USA - A Complete Guide

- What are the Top ELSS Tax Saving Funds for NRIs?

- Understanding Thematic Mutual Funds for NRIs

- Small Cap Funds for NRIs: All You Need to Know About

- Mistakes NRIs Make While Investing in India

- Tax-Free Investment Options For NRIs In India

- Dividend Stocks in India for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

NRIs can invest securely in mutual funds via:

NRE/NRO accounts

Online KYC process

Reputed fund houses or registered platforms.

An NRI can reduce tax on mutual fund gains by using:

DTAA benefits to avoid double taxation.

Long-term holding for lower capital gains tax.

ELSS funds under Section 80C (If subject to taxation in India).

Investing in equity funds that attract lower tax than debt funds.

_1767099354.png)

_1767696432.webp)