Both FCNR (Foreign Currency Non-Resident) and NRE (Non-Resident External) accounts are designed to fulfill the banking requirements of the NRIs. However, both accounts serve different purposes. Considering this, the process of transferring funds from an FCNR account to an NRE account is simple. For this, you need to contact your bank with a written application containing details of both accounts and requesting a fund transfer from FCNR to the NRE account.

Additionally, you must follow the underlying rules and procedures before transferring funds from one account to another. Want to know all about this in detail? Read the blog and clear understanding of the complete fund transfer process.

- The process of transferring funds from FCNR to an NRE account is managed primarily through banks. You need to fill out an application form and request your bank for the transfer process.

- The Reserve Bank of India (RBI) permits the transfer of funds from an FCNR account to an NRE account.

- The FCNR accounts manage your earnings in your desired foreign currency available in the Indian bank.

- Before the transfer process begins, the funds are first converted from foreign currency to INR and then transferred to the NRE account.

- No tax is imposed on the earned interest in both accounts. Additionally, the funds in both accounts are freely and fully repartiable without any amount restriction.

What Are FCNR and NRE Accounts?

Before moving to the transfer process, first let's understand what an FCNR and NRE account actually are.

- FCNR Account: A Foreign Currency Non-Resident or FCNR account is a fixed deposit account that allows you to maintain your deposits in foreign currencies. Additionally, you do not need to pay tax in India on the earned interest in an FCNR account. Apart from this, the principal amount is also free from currency exchange risk, as the deposits are made in a foreign currency.

- NRE Account: A Non-Resident External or NRE account is generally used by NRIs to deposit their foreign income. The money in this account is maintained in INR. Additionally, the principal and interest amounts are also tax-free in India. Further, in terms of both principal and interest, the NRE account provides easy fund repatriation to your resident country.

This was all about FCNR and NRE accounts. The fund transfer process from FCNR to NRE account is done under the guidelines of the Reserve Bank of India. Moving ahead, now let's know why to transfer funds from FCNR to an NRE account.

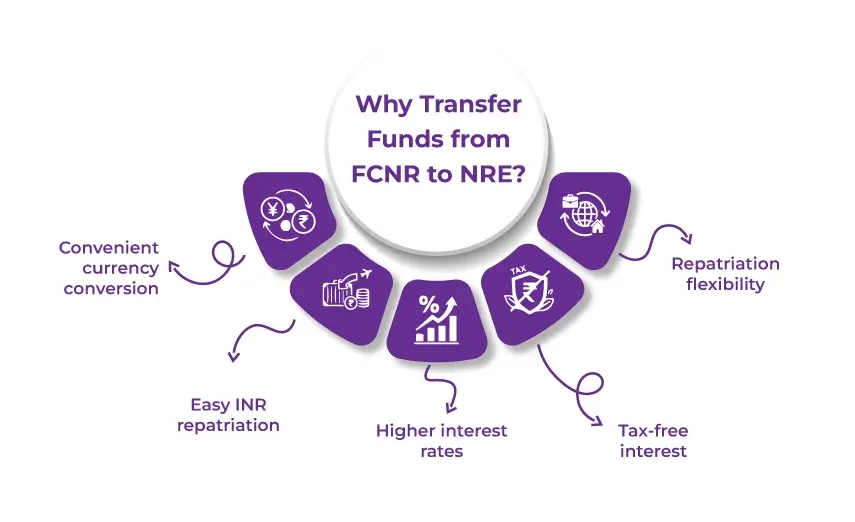

Why Transfer Funds from FCNR to NRE?

You need to transfer funds from FCNR to an NRE account because of the following reasons:

- After the maturity of your FCNR account, you want to convert foreign currency to INR. An NRE account serves as a convenient option for currency conversion.

- Unlike an FCNR account, based on foreign currency and often needs conversion to INR, an NRE account provides easy fund repatriation to your resident country.

- Depending on the current interest rates in India, to earn interest, rather than keeping in foreign currency, you may want to transfer funds to your NRE account.

- In terms of repatriation and tax flexibility, the NRE account is a good option for fund repatriation from FCNR accounts. It is because it offers easy repatriation and tax-free interest.

These were the key reasons why an NRI transfers funds from FCNR to an NRE Account. Moving further, let's know the transfer process in detail.

How to Transfer Funds from FCNR to NRE Account?

The process of transferring funds from FCNR to an NRE account is simple. However, you do need to understand the process. Here is how you can do so:

- Step 1: Request a Fund Transfer to Your Bank

- Visit the bank where you have an FCNR account. Request your bank to transfer funds from your FCNR account to your NRE account.

- Some banks for transferring funds may also ask you for a written request. For this, you need to fill out a form and mention the details of both accounts.

- Further, the following are the details that you need to provide:

- FCNR account details, including account number, branch, and more.

- NRE account details, including account number, branch, etc.

- Your desired amount that you want to transfer.

- Step 2: Account Type Considerations

- If your FCNR accounts hold foreign currencies such as AUD, USD, and more, as per the current currency exchange rate, the bank will convert the foreign currency to INR.

- It is vital to check the currency exchange rate, as it can impact the fund value you get in your NRE account. For this, you can inquire with your bank and ask them about the charges or additional fees related to currency conversion.

- Step 3: Request for Fund Transfer from FCNR Account

- The bank will move forward with your request, and first, they will convert the foreign currency to INR (if applicable). After that, transfer your funds from your FCNR account to your NRE account.

- The fund transfer processed will be an inter-account transfer that is generally done via electronic banking methods. It includes RTGS/ NEFT, depending on the policies of the bank and the amount.

- Step 4: Check Transfer Completion

- Once the fund transfer process begins, either via SMS, email, or online banking platform, you will receive confirmation from the bank.

- After the conversion, to ensure the process has completed accurately, check the amount that was credited to your NRE bank account.

So, this is how you can transfer your funds from your FCNR account to an NRE account. Moving ahead, let's know the things you need to consider when transferring your funds.

With the expert guidance of Savetaxs, simply file your ITR as an NRI and maximize your tax refunds.

Important Considerations When Transferring Funds from FCNR to NRE Account

Here are the following things that you should consider when transferring funds from FCNR to an NRE account:

- Tax Implications

- Both FCNR and NRE account offers tax-free interest in India. Considering this, after the transfer, the funds will continue to earn tax-free interest.

- Any capital gain or loss arising from the foreign currency conversion to INR is generally not taxed in India. However, depending on the tax regulations of your current country, you can be taxed there.

- Currency Conversion Risk

- It is well-known to everyone that foreign currency and INR always fluctuate. So if you transfer a large amount, it is vital to consider the exchange rate at the time of fund transfer. It is because the exchange rate volatility impacts the amount credited to your NRE account.

- Fund Repatriation

- One of the advantages of transferring funds to an NRE account is that it provides fund repatriation to your resident country. So, once your amount is credited to your NRE account, you can freely repatriate it either partially or entirely.

- When transferring funds back to your resident country, ensure you have all the vital documents by your side as per the RBI guidelines and your bank.

- Transfer Limitation

- Ensure that your NRE bank account is active and in a good position before starting the fund transfer.

- In both the accounts, i.e., FCNR and NRE accounts, there are no specific limitations on transferring the amount. However, for large transfers, banks may impose their own documentation requirements and procedures.

These were some of the things that you need to consider before transferring funds from FCNR to an NRE account. Moving further, let's know whether funds can be transferred or not during the tenure of the FCNR deposit.

Can I Transfer from FCNR to NRE During the Tenure of the FCNR Deposit?

Yes, during the tenure of the FCNR deposit, you can transfer funds from the FCNR to the NRE account. However, you need to consider the following things:

- If you transfer or withdraw the funds before their maturity date, the bank charges a penalty for premature withdrawal or closure.

- Additionally, the fund transfer from the FCNR account to the NRE account is considered a withdrawal. Also, at that time, with the applicable currency exchange rate, the funds will be converted to INR.

Further, if your FCNR deposit has matured, automatically your funds will be converted to INR and, without any penalty, transferred to your NRE account.

Get financial experts to approve NRI banking services tailored to your financial and investment goals in India.

Final Thoughts

Lastly, the process of transferring funds from FCNR to an NRE account is straightforward. For NRIs, it is a good way to manage their foreign earnings. It provides NRIs with easy INR conversion and flexibility for repatriation. However, it is vital to understand the fees and conversion rates included in it. Additionally, before starting the transfer process, consider any currency fluctuations and tax implications imposed on it.

Further, if you are still confused and looking for reliable NRI banking services, contact Savetaxs. Our financial experts will help you easily transfer your funds from FCNR to an NRE account. Additionally, if you want, they can also assist you with the repatriation process.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Everything You Need to Know About UPI for NRI

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- What is an RFC Account for NRIs Returning to India?

- Why Should an NRI Convert Their Resident Savings Account to an NRO Account?

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- Everything You Need to Know About FCNR (B) Account

- Overseas Bank Account for NRIs

- How To Transfer Money From NRO Account to NRE Account

- A Guide to NRO (Non-Resident Ordinary) Accounts

- Top 5 NRI Banks for NRE account in India for 2026

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756816946.webp)

_1768807342.webp)