With recent updates, UPI for NRIs has simplified making payments, investments, and receiving money with people in India. Through NRE or NRO accounts, the National Payments Corporation of India (NPCI) has enabled NRIs to access UPI in India. Considering this, NRIs need to link their international mobile numbers to their bank accounts to obtain UPI access.

Want to know more about UPI for NRI? This blog will solve your doubts about how to use it, its eligibility criteria, and more. So read on and get all your answers.

- NRIs can make UPI payments in India by linking their NRO/ NRE accounts with an international mobile number.

- Through UPI, you can receive and send money, make payments to merchants in India, and pay utility bills without any additional costs.

- UPI transactions are safe, secure, and easy to use.

- To access the UPI facility, NRIs need to link their international mobile number to an NRE/NRO bank account.

- UPI transactions can only be made in Indian currency as it does not support the transfer of foreign currency.

What is UPI and Why Does it Matter for NRIs?

UPI stands for the Unified Payments Interface. With the introduction of UPI digital payments in India, it has revolutionised. It has made the transactions seamless, instant, and hassle-free. Previously, UPI was accessible only to Indian residents. However, with recent digital advancements, NRIs can also use UPI for various transactions.

Specifically, assisting NRIs, overseas businesses, and students studying abroad with efficient payment handling in India. Whether it is paying bills, sending money to family, or making online purchases, UPI eliminates the costly remittance services and cumbersome bank details. NRIs can also experience this ecosystem of digital payment by linking their NRE or NRO account to UPI.

This was all about UPI and why it matters for NRIs. Moving ahead, let's know the eligibility criteria for NRIs to use UPI.

Eligibility Criteria for NRIs to Use UPI

As an NRI to use UPI, you need to fulfill certain eligibility requirements set by NPCI and your bank. Here are some eligibility requirements for it:

- Should have an NRO or NRE bank account in India.

- Mobile number, whether international or Indian, should be linked to your bank account.

- Bank should provide UPI access and support to international mobile numbers.

- Additionally, NRIs need to register using a UPI-enabled app that supports the onboarding of NRIs. For instance, PhonePe, Paytm, Google Pay, or BHIM.

These are some of the eligibility criteria that NRIs need to fulfill to use UPI in India. Moving further, how NRIs can activate UPI.

How NRIs Can Activate UPI?

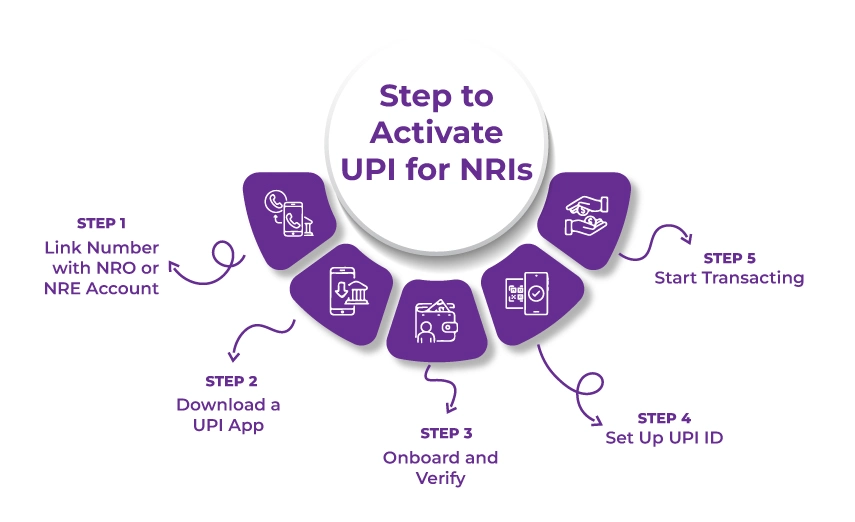

Here is a step-by-step how NRIs can activate UPI with their international mobile number:

- Link the International Number with NRO or NRE Account: Connect your international mobile number with your Indian bank account.

- Download a UPI-Compatible App: Opt for a UPI app that provides support to international mobile numbers. For example, ICICI Bank's iMobile, BHIM, or FedMobile of Federal Bank.

- Onboard and Verify: Follow the instructions available on the app for onboarding. Through this, you will verify your account.

- Set Up UPI ID: Create a unique UPI ID and link it with your selected bank.

- Start Transacting: Once the verification is done, via UPI, you can transfer money, pay for services, and more.

This is how NRIs can activate UPI in India. Moving ahead, let's know what NRIs can do with UPI.

What NRIs Can Do with UPI?

Using UPI, NRIs can do the following things:

- Instantly making payments to Indian individuals and merchants.

- Compared to traditional remittance methods, NRIs can enjoy secure, cost-effective, and fast transactions with UPI.

- Pay bills, subscriptions, and other recurring payments in India without intermediary requirements.

- Use UPI IDs and QR codes for seamless digital transactions.

Previously, NRIs relied on net banking, remittance services, or credit/debit cards for making payments in India. However, with the introduction of UPI, transactions become easy and are without the requirement of any additional costs or delays.

Now, moving further, let's know the benefits of UPI for NRIs.

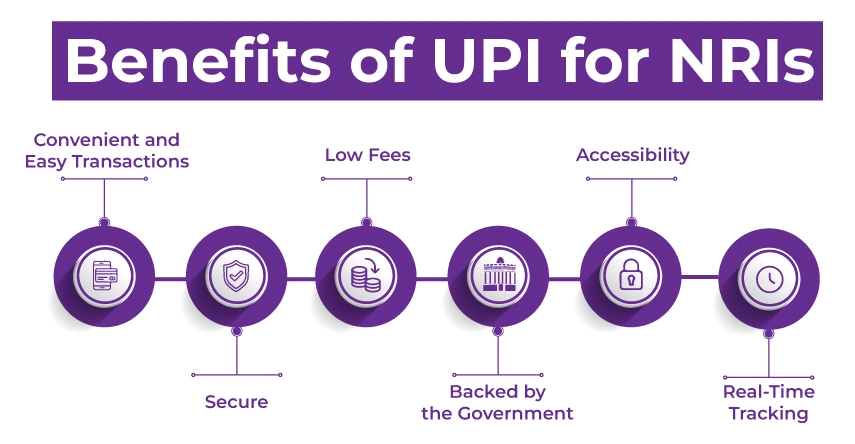

Benefits of UPI for NRIs

Here are the following benefits offered by UPI for NRIs:

- Convenient and Easy Transactions: Through UPIs, the payments to India have become faster and easier. You can pay from anywhere to anyone in India, within a few minutes, without facing any issues.

- Security: To protect users and their transaction data, advanced encryption technology is used by the UPI apps. Therefore, it is safe and secure to use.

- Lower Fees: In comparison to the existing remittance methods, using UPIs for sending money is very cost-effective, as the fees are either zero or low.

- Backed by the Government: The Indian government backs the UPI. Considering this, it provides ongoing development and support to the UPI apps to ensure they work successfully.

- Accessibility: In India, UPI payments are widely accepted. This makes it very easy to send money easy to send money to family and friends.

- Real-Time Tracking: In UPI, you can track your transactions in real-time. This simplifies the monitoring of your payments and receipts.

These were some of the benefits that UPIs offer to NRIs. Moving ahead, let's know the limitations of using UPI for NRIs.

Limitations of Using UPI for NRIs

While UPI offers several benefits for NRIs, they also face some limitations. These are as follows:

- Using UPI, NRIs can make transactions only in INR, as UPI does not support the transfer of foreign currency.

- Like Indian residents, NRIs cannot link multiple bank accounts with the same UPI ID.

- Additionally, you cannot transfer funds from your NRO account to an NRE account.

- Further, only primary account holders are eligible to have a UPI ID. For joint account holders, the UPI feature is not available.

These were some of the limitations of using UPI for NRIs. Moving further, let's know the name of the top banks and apps that supports UPI for NRIs.

For smooth ITR filing, streamline your tax process with the online consultation services of Savetaxs.

Top Banks & Apps Supporting UPI for NRIs

Top Indian banks and apps supporting UPI for NRIs are as follows:

Banks supporting UPI for NRIs

Here is the list of the following banks in India that allow connecting of international mobile numbers for UPI for NRIs:

| Sr. No. | Name of the Indian Bank |

|---|---|

| 1. | Canara Bank |

| 2. | AU Small Finance Bank |

| 3. | City Union Bank |

| 4. | Axis Bank |

| 5. | HDFC Bank |

| 6. | DBS Bank Ltd |

| 7. | Federal Bank |

| 8. | Equitas Small Finance Bank |

| 9. | Kotak Mahindra Bank |

| 10. | ICICI Bank |

| 11. | Induslnd Bank |

| 12. | IDFC First Bank |

| 13. | Yes Bank |

| 14. | Punjab National Bank |

| 15. | State Bank of India |

| 16. | South Indian Bank |

UPI Apps Supporting International Mobile Numbers

NRI users with eligible bank accounts can use the following UPI applications for making bank transactions using their international numbers:

| Sr. No. | Name of the UPI App |

|---|---|

| 1. | PhonePe |

| 2. | Federal Bank (FedMobile) |

| 3. | AU Small Finance Bank (BHIM AU) |

| 4. | ICICI Bank (iMobile) |

| 5. | BHIM |

| 6. | South Indian Bank (SIB Mirror+) |

| 7. | Induslnd Bank (BHIM Indus Pay) |

Further, this facility is only for NRIs with NRE or NRO accounts. Additionally, the availability of UPI transactions will depend on the specific policies and compliance of the bank with regulatory guidelines.

Connect with Savetaxs and solve all your doubts about NRI taxation in India with clear explanations and solutions.

Final Thoughts

Lastly, with the introduction of UPI for NRIs in India, it has simplified the whole transaction process for NRIs. Receiving and sending to family and friends, investing, and paying bills in India have become easy. In simple words, you can say that for NRIs, UPI is revolutionizing the way of handling money in India.

Further, if you need help in opening or managing your NRE/ NRO account, connect with Savetaxs. We have a team of professionals who assist you in managing your bank account and solving all your tax-related queries.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- When Does an NRIs NRE Account Lose Tax-Free Status in India?

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- Top 5 NRI Banks for NRE account in India for 2025

- How To Transfer Money From NRO Account to NRE Account

- Everything You Need to Know About FCNR (B) Account

- A Guide to NRO (Non-Resident Ordinary) Accounts

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756729655.webp)

_1767170479.png)

_1767780160.webp)

_1763555884.webp)

_1767333184.png)