Yes, NRIs can change their tax regime while filing ITR in India. The new tax regime is the default regime under Section 115BAC, but NRIs can opt out of it and choose the old regime each year, subject to certain restrictions.

These retractions are discussed in the latter part of the blog. However, in this blog, we will understand the tax regime for NRIs, how they can switch to it every year, who is eligible to do so, and who is not.

- Annual switching is possible for non-business NRIs, meaning NRIs with only salary, NRO interests, or capital gains income can switch between the old and the new tax regimes every year via the ITR checkboxes; you don't need any Form 10-IEA.

- The new regime offers a relaxed tax slab but fewer deductions.

- The old tax regime offers tight slab rates but allows you to claim every possible deduction and tax exemption.

Understanding The Tax Regimes For NRIs

As an NRI, you are taxed only on the income you have earned in India. This includes your NRO interests, rental income, capital gains, and so on. Furthermore, NRIs use the same slabs as resident Indians but with limited deductions.

Old Tax Regime - How Does This Regime Work for NRIs

Opting for the old tax regime offers deductions and exemptions under section 80C, 80D, HRA, and the standard deduction.

- Basic Exemption: Up to Rs 2.5 lakh.

- Slab Type: The old tax regime use progressive slab rate up to 30% + surcharge/cess.

- NRI Benefit: While filing NRI income tax, opting for the old tax regime is ideal if the deductions are high, for example, home loan, EMI, NRO FD, and so on.

New Tax Regime - How Does This Regime Work for NRIs

With the new tax regime, NRIs get more relaxed tax rates with little to no deductions, except for the standard deductions. Standard deduction is available only on salary/pension income, even under the new regime.

- Basic Exemption: Up to Rs 3 Lakh.

- Slabs: Offers lower tax rates than the old tax regime.

- NRI Benefit: Ideal for a lower deductions profile.

Can NRIs Change The Tax Regime Every Year?

Yes, if you earn non-business income, NRIs can switch regimes each year directly in their ITR utility without Form 10-IEA.

However, as an NRI with Indian business income, you are restricted from switching regimes between the old and new every year. For the financial year 2025-26, the new tax regime is the default regime under section 115BAC. NRIs filing ITR-3 or ITR- 4 due to business or professional income can opt for the old regime only once.

To choose the old regime, you must file Form 10-IEA before the ITR due date. After that, you have only one chance to revert to the old tax regime, and no further changes are allowed.

This lock-in is applicable to both NRIs and Indian resident to curb repeated deductions after opting for relaxed slabs. Henceforth, plan strategically: use the old regime if you have a major deduction to claim, and, if the case is the opposite, go for the new tax regime.

NRIs, we help you file your taxes as if our life dependents on it. No errors, no hassles, and absolutely no stress with Savetaxs.

How Can NRIs Change The Tax Regime While Filing ITR?

The following are the step-by-step procedures for NRIs to change their tax regime while filing their ITRs.

Step 1: Log in to the income tax e-filing portal with your PAN card.

Step 2: Then select the assessment year, > file income tax return > ITR-2/ITR-3.

Step 3: Now, under the general information toggle, you will find a checkbox labeled "Opting For Old Regime?" Tick if you are opting for the old regime, and untick it if you wish to go with the default regime, which is the new tax regime.

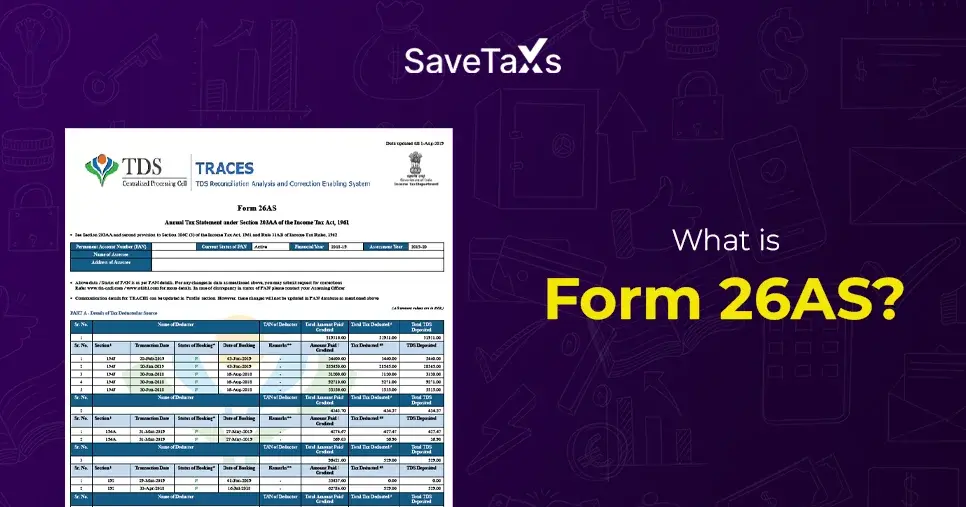

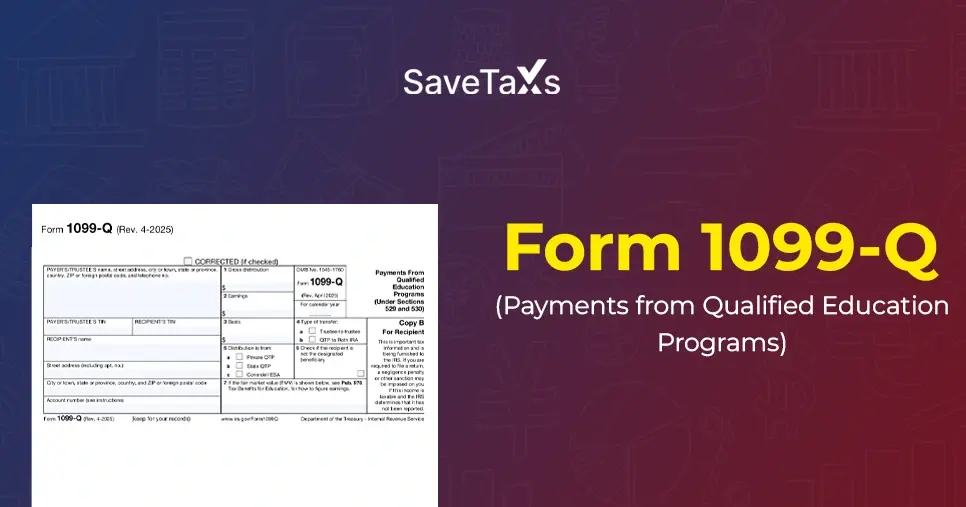

Step 4: Now the ITR will automatically pull in your income details from the Annual Information Statement and Form 26AS. However, under the old regime, you had to manually enter all eligible deductions, such as 80C (PPF, ELSS), 80D, HRA, home loan interest, and so on. Under the new tax regime, no deduction entry is needed; a standard deduction is automatically applied.

Step 5: The ITR utility will then show you a side-by-side tax comparison between both the tax regimes based on the deductions and income you entered. Choose the lower tax option, then validate all the fields, e-verify the ITR using Aadhaar OTP, net banking, or EVC.

Which Tax Regime Is Better For NRIs?

Choosing the better regime for NRIs depends on factors such as the nature of an individual's income, their investment portfolio, personal financial goals, and income level.

For salaried individuals with minimal deductions, the New Regime is more beneficial, as it offers lower tax slabs. However, if you are eligible to claim major deductions under Section 80C, 80D, HRA, or a home loan interest, then the old tax regime is suitable for you as it offers greater tax savings.

Let us Understand the Scenarios Where the Old Tax Regime is Better for NRIs:

NRIs must use the old tax regime if they have significant tax exemptions or deductions to claim. Such as:

- Investment in tax-savings instruments: If you have invested in tax savings instruments under section 80C.

- Home loan interest: If you are paying a significant home loan interest, you can benefit from tax deductions available under Section 24.

Let us Examine the Scenarios in Which the New Tax Regime is Better for NRIs:

- The new tax regime is suitable for NRIs with lower taxable income and minimal deductions to claim, specifically when your total deductions are less than Rs 1.5 lakh annually.

- Secondly, you can opt for the new tax regime if you are seeking simplicity and easy compliance while filing your ITR.

Our experts at Savetaxs strategize your taxes and finances, ensuring you unlock the maximum return potential.

The Bottom Line

In a nutshell, yes, NRIs can switch their tax regimes when filing their ITRs, subject to certain restrictions. The restriction is that NRIs with business or professional income can switch to the old tax regime and then back to the default tax regime only once in their lifetime. This case does not apply to NRIs with non-business or professional income, meaning they can switch regimes every year.

However, as an NRI, if you arelooking for professional ITR assistance in India, then Savetaxs is the name to trust. We have been helping NRIs from 90+ countries in filing their ITR in compliance with the indian tax laws. Our experts here bring extensive experience in ITR filing, ensuring your ITR is filed on time, eligible tax exemptions are claimed, and everything is done in compliance.

Connect with us as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Double Tax Avoidance Agreement (DTAA) Between India and Hong Kong

- Double Tax Avoidance Agreement (DTAA) Between India and Australia

- Income Tax Act Section 148: Assessment or Reassessment

- Income Tax Act 2025: Key Changes, Features, Provisions & Objectives Explained

- Indian Parents Receiving Money From US Kids: Key Rules

- TDS Deduction on Rental Property Owned by NRI

- How to Claim TDS Refund for an NRI?

- TDS on Sale of Property by NRIs in India

- Section 89A - Tax Relief on Income from Foreign Retirement Funds

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- NRI Selling Property in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768807342.webp)

_1754046271.webp)

_1765974748.webp)

_1759750925.webp)

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)

_1756816946.webp)