As a non-resident Indian living abroad, you may have financial assets in India. Assets such as mutual funds, shares, bank accounts, ULIPs, real estate, and more. Although these assets remain in India, the US tax authority mandates that you disclose these foreign assets entirely under two key reporting requirements.

1: FBAR (Foreign Bank Account Report - FinCEN Form 114)

2: Form 8938 (Statement of Specified Foreign Financial Assets- IRS Form)

Now, both forms relate to foreign asset reporting, but their purposes differ, and they are submitted to different authorities. Additionally, these forms have different compliance rules and thresholds.

In this blog, we will understand the FBAR vs Form 8938 differences in detail so you never confuse the two, stay compliant, and manage your cross-border NRI taxation without attracting penalties.

- Form 8939 is somewhat similar to FBAR, and many U.S.-based NRIs assume that both forms perform precisely the same. It is not the thresholds, purposes, penalties, or the submission to authorities that differ between the two forms.

- Form 8939 is used to report specific foreign financial assets with a value above a set threshold.

- FBARs are used to report a foreign financial account with $10,000 or more at any point during a calendar year.

What is FBAR (FinCEN Form 114)?

The full form of FBAR is foreign Bank Account Report (FBAR). This form is not filed with the IRS but with the FinCEN. US-based NRIs use this form to report foreign and other financial accounts if their combined value exceeds a set threshold.

Who Needs To File FBAR?

- Foreign bank account holders

- Demat or trading accounts that are outside the USA.

- Foreign mutual funds.

- Accounts that have a signatory authority. For example, the power of attorney.

FBAR Filing Requirements

The set threshold: If the aggregate value of the bank account exceeds $10,000 at any time during the financial year.

Deadline: 15 April (Automatic extension to October 15).

Filed With: FinCEN (Foreign Bank Account Report (FBAR) and not the Internal Revenue Service (IRS).

-

Up to $10,000 for non-wilful violations.

- Up to $100,000 or 50% of the account balance for willful violations.

What is Form 8938 (IRS Form 8938)?

Form 8938 is used to report your foreign financial assets and is submitted as part of the annual IRS tax return (Form 1040).

In a nutshell, IRS Form 8938 is used by US taxpayers to report their specified foreign financial assets if the total value exceeds a certain threshold.

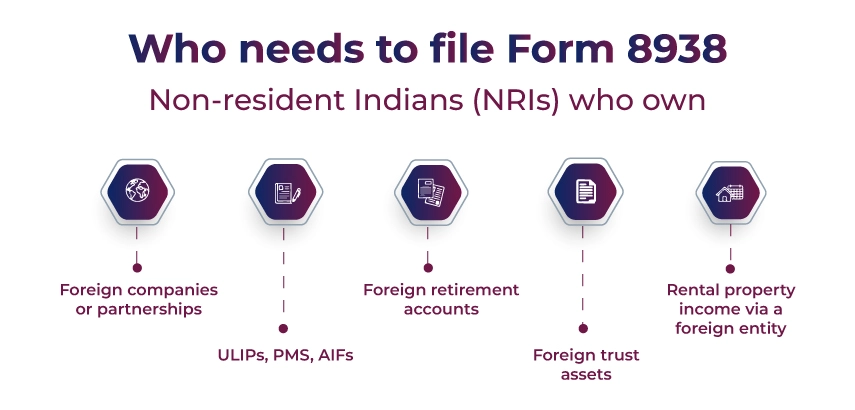

Who Needs to File Form 8938?

- Foreign companies or partnerships

- ULIPs, PMS, AIFs.

- Foreign retirement accounts

- Foreign trust assets

- Rental property income via a foreign entity.

Filing Requirements Form 8938

Thresholds Vary by Residency and Filing Status:

- Single filer in the United States:- >$50,000 (year-end) or >$75,000 (anytime).

- Married filing jointly abroad: >$400,000 (year-end) or >$600,000 (anytime).

Deadline: April 15 (extensions align with Form 1040)

Filed With: IRS

- $10,000 on each violation and up to $50,000 if violations continue.

- Potential criminal penalties

Key Differences Between FBAR and Form 8938

| Particulars | FinCEN Form 114 (FBAR) | Form 8938 |

|---|---|---|

| Reporting Threshold | The aggregate value of any financial account exceeds $10,000 at any time during a financial year. This is a cumulative balance, which means that if you have two accounts with a combined balance of more than $10,000 at any time of the year, both accounts must be reported. |

For specified individuals living in the United States. Specified domestic entities: |

| What is reported | The maximum value of the financial accounts that have been maintained by the financial institution, which was initially located in a foreign country. | The maximum value of the specified foregin financial assets. Now this can include the financial accounts located in foregin financial institutions and a few different foreign non-account investment assets. |

| When it is due | Received by April 15 (6-month automatic extension to October 15) | Form is attached to your annual return and is due on the date of that return. This includes any applicable extensions. |

| Where to file | It can be filed electronically through FinCEN's BSA E-Filing System. The FBAR is not filed with a federal tax return. | You can file this with income tax pursuant to the instructions for filing the return. |

| Penalties | The civil monetary penalties are adjusted every year for inflation. Currently, it is up to $100,000 or 50% of the account value. | The penalty is up to $50,000 per violation. |

Why Accurate Filing Of Form 8938 and FBAR Is Important For NRIs

The United States' tax authorities impose taxes on the global income of US tax residents. So, NRI, your assets and income from India have to be disclosed on designated forms, even if you have paid taxes on them in India.

Failure to do so can result in heavy criminal and civil penalties, audits, and scrutiny by the IRS or FinCEN, and loss of eligibility for tax benefits such as foreign tax credits.

Hence, as a US-based NRI with Indian assets, it is vital to understand the difference between Form 8938 and FBAR, report what's required, and remain compliant.

The Bottom Line

In a nutshell, FBAR is foreign financial accounts and signature submission, which was reported to FinCEN. Form 8938 is broader foreign assets and income interests and is reported to the IRS along with your US tax return.

To avoid last-minute tax complexities and remain compliant, it is advisable to seek professional guidance from a cross-border taxation expert. One such expert in NRI taxation is Savetaxs.

Our experts bring more than 30 years of combined experience in NRI taxation. We can provide you with high-end consultation on FBAR & Form 8938 Filing Services, NRI tax return filing in India and the United States, DTAA claims and cross-border structuring, and global mobility and asset reporting compliance.

Contact us today as we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- A Comprehensive Guide to Short Term vs. Long Term Capital Gains Taxes

- Claiming Dependents on Taxes: IRS Guidelines for Qualifying People

- Child Tax Credit - Meaning, How Does It Work And Who Qualifies

- IRA vs 401k : A Clear Difference

- Difference Between Residents And Non-Residents Aliens And Their Taxes

- What is Adjusted Gross Income (AGI)?

- Difference Between Federal and State Income Taxes

- New Tax Laws 2025: Tax Brackets and Deductions

- Self Employment Tax: Meaning & How To File It

- Difference Between Residents And Non-Residents Aliens And Their Taxes

- Know Your Tax Deadlines for 2025: When and Where to File?

- Standard Deduction vs Itemized Deduction - Which One To Choose

- 9 US States With No Income Tax

- What Is State Income Tax - Overview, How It Works And More

- What Is Earned Income & the Earned Income Credit?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

FBAR, also known as FinCEN Form 114, is filed with the Financial Crimes Enforcement Network, whereas the Form 8938 (FATCA) is filed with the Internal Revenue Service (IRS) along with your US tax return (Form 1040).

However, both forms are used for reporting foreign final assets, but the filing thresholds and agencies differ.

_1767853713.webp)

-plan_1761282887.webp)

_1767780160.webp)