The tax credit vs tax deduction has a simple difference: the tax deduction reduces your taxable income, whereas the tax credit reduces your tax bill or tax liability. Both the tax credit and the deductions are among the most rewarding parts of the entire tax return preparation process.

Both reduce your overall tax bill, just the way of doing so is different.

The Tax Credit: This directly reduces the taxable amount you owe, providing a dollar-for-dollar federal reduction on your overall tax liability. For instance, let's say you have a tax credit worth $1,000; then it will directly lower your overall tax bill by $1,000.

The Tax Deduction: The deduction reduces the amount of your income that is subject to taxes. The tax deductions lower your entire taxable income by a percentage. This percentage, however, depends on your federal income tax bracket.

Let's say there is a deduction of $1000, and you fall into a 22% tax bracket. In this case, your deduction amount will be 22% of the $1000. This means that the deduction will save you $220 (22% of the $1000) on your overall tax bill.

In this blog, we will clarify the difference between a tax credit vs tax deduction through a simple example.

Key Takeaways

- A tax credit helps to reduce your overall tax bill or liability, whereas a tax deduction helps in reducing the taxable income on which the taxes are owed.

- A tax deduction can be claimed on Form 1040 and the related schedules, which will help reduce your taxable income.

- In many cases, the tax credits have a greater impact because they directly aim at reducing the taxes you owe rather than lowering the income on which you are taxed.

Tax Credit vs Tax Deduction - An Example

We will demonstrate an example showing how a tax deduction and credit work on your overall taxable income.

| - | $10,000 Tax Deduction | $10,000 Tax Credit |

|---|---|---|

| Your AGI | $100,000 | $100,000 |

| The Tax Deduction | - | $10,000 |

| Taxable Income | $90,000 | $100,000 |

| The Tax Rate* | 25% | 25% |

| Calculated Tax | $22,500 (25% of $90,000) |

$25,000 (25% of $100,000) |

| Tax Credit | - | $10,000 |

| Your Final Tax Bill | $22,500 | $15,000 |

*Example Rate: The United States has a progressive tax system.

Now, via the example, we can see that both benefit in lowering your taxes, but how they work is totally different.

Usually, the tax credit has a greater impact because it aims directly at reducing the taxes you owe, rather than reducing the income that you will be taxed on.

For an NRI, a tax credit is more valuable than a tax deduction. The main difference is how these two reduce your tax liability.

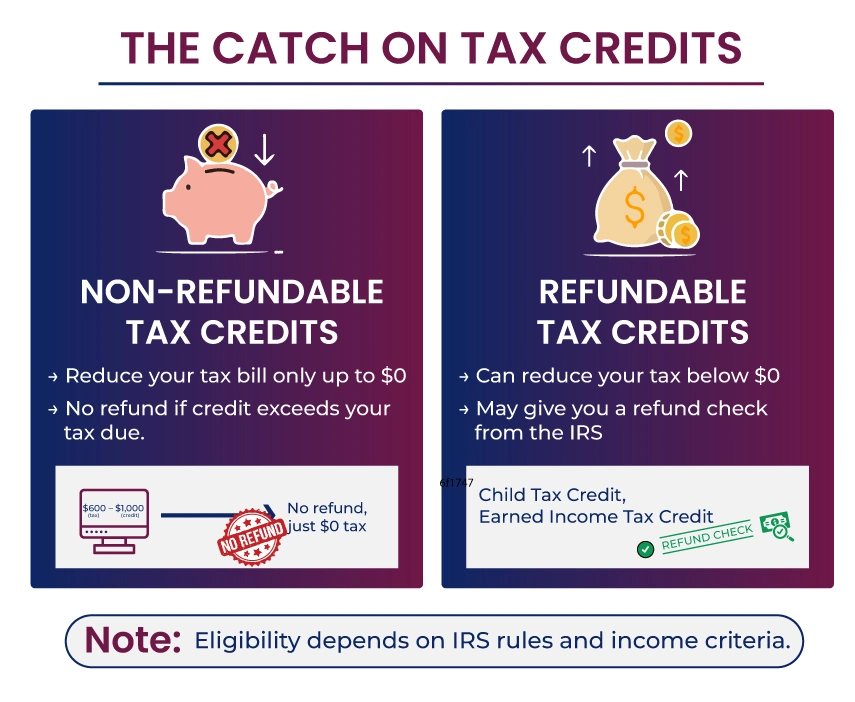

The Catch On The Tax Credits

Here are a few things to consider about the tax credits:

Non-redundant tax credits: Such Tax Credits mean that even if you owe less in taxes, you will not get the full value of the credit if it takes your federal tax bill to zero.

For example, a $600 tax bill, when combined with a $1000 non-refundable credit, does not mean that you will get a $400 tax refund check. All you will get is $0 tax bill.

Refundable tax credits: If you are qualified to take a refundable tax credit, such as the child tax credit or the earned income tax credit, then the value of these credits exceeds your tax liability and may even result in a refund check.

However, please note that the Internal Revenue Service (IRS) has specific criteria that you must meet to qualify for either nonrefundable or refundable credits.

The Tax Deduction Decision

There are two types of tax deduction methods that individuals can choose from, namely the standard deduction method and the itemized deduction method.

The Standard Deduction

This is kind of a one-size-fits-all type of decision. The IRS determines a standard and fixed deduction amount. You do not have to do anything to qualify for the Standard Deduction, nor do you have to provide any documentation.

You can claim the standard deduction on Form 1040. However, depending on your filing status, the amount will vary.

| Filing Status | Standard Deduction Amount |

|---|---|

| Single | $15,750 |

| Married Filing Separately | $15,750 |

| Head of Household | $23,626 |

| Married Filing Jointly | $31,500 |

| Surviving Spouses | $31,500 |

Itemized Deductions

The itemized deductions allow you to take advantage of various deductions, including medical expenses, charitable donations, and others. After calculating your total itemized deduction, if it exceeds the value of the standard deduction, you must choose itemizing your deduction.

Use Form 1040 and Schedule A to claim the Itemized Deductions.

Choosing between the standard deduction or itemized deduction is an either-or situation. Meaning you can choose either one of the two in a tax year, but not both.

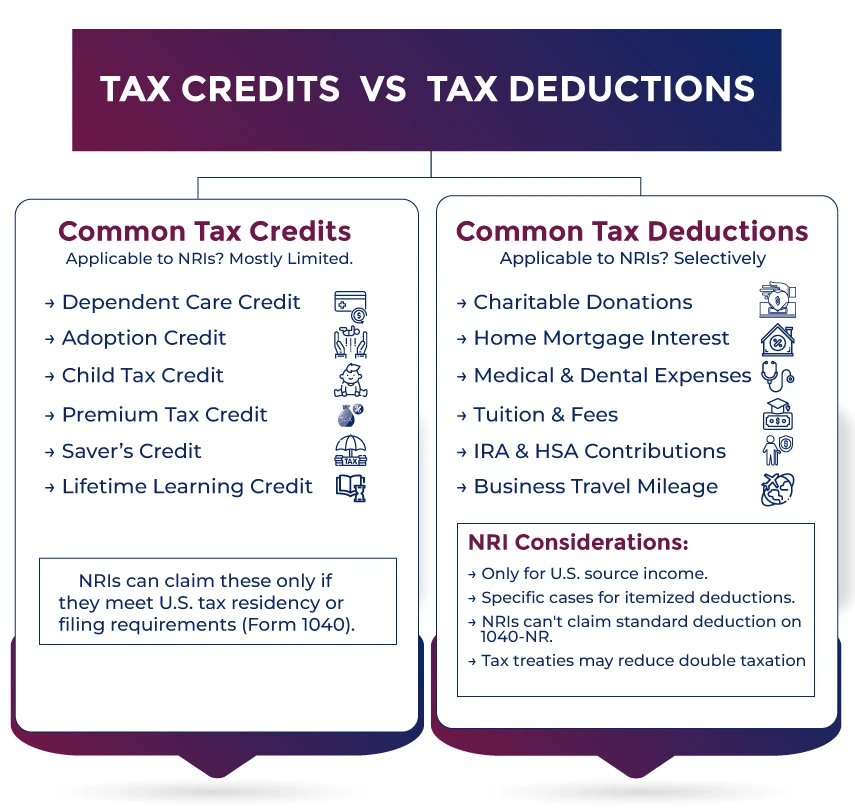

A List of Common Tax Credits and Tax Deductions

Below is a list of common tax credits and deductions that individuals must be aware of.

Common Tax Credits

- Child and Dependent Care Credit.

- Adoption Credit.

- Child Tax Credit.

- Premium Tax Credit.

- Saver's Credit.

- Lifetime Learning Credit.

To know which credit might be eligible for your situation, you must talk with an expert.

Common Tax Deductions

Here are some examples of the common tax deductions. A few of them, such as the itemized deduction, are considered above-the-line deductions, while others, like the student loan interest deduction, are not. The above-the-line deductions can be claimed as separate deductions even if you choose not to itemize your deductions.

- Charitable Donations.

- Home Mortgage interest.

- Medical and dental expenses.

- Tuition and Fees.

- Contributions to the traditional IRA.

- Contributions made to health savings accounts (HSAs).

- Mileage for business travel.

- Moving expenses to start a new job.

- Expenses related to the job search.

- Teacher educational expenses.

- Real estate and property taxes.

The Bottom Line

The tax credit vs the tax deduction both help in reducing the total amount you will have to pay in taxes, but their implementation is different. However, understanding both is crucial. The tax return preparation process was straightforward.

Be it tax deductions or tax credits, our experts will help you claim the maximum of both, ensuring your overall tax bill is reduced significantly. Savetaxs has expertise in US taxation and has helped thousands of US residents and citizens with their tax queries. We serve our clients 24/7 across all time zones, so connect with us today and reduce your overall tax bill.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- Married Filing Taxes Jointly vs. Separately

- IRS Capital Gains Tax: Short and Long-Term Rates for 2024-2025

- All You Need to Know About Mortgage Interest Deduction

- Are Medical Expenses Tax Deductible in the US?

- State And Local Tax (SALT) Deductions

- What Are The Penalties for Late Filing or Not Filing Taxes At All?

- The Full List Of 20 Tax Deductions For Self-Employed People

- Understanding Itemized Tax Deductions

- Understanding Standard Tax Deduction

- Tax-Deductible Donations: Rules for Charitable Contributions

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1754046271.webp)

_1767955810.png)