Thematic funds are a category of mutual funds that focus on specific themes or trends in the market. Unlike traditional classification methods like market capitalization or investment styles, thematic mutual funds focus on companies that are tied by a specific idea or concept.

It can include clean energy, digital India, or broader rural development themes spanning multiple sectors. These funds carry moderate to high risk based on the assets and sectors in which they invest. In this blog, we will cover everything that an NRI needs to know before investing in thematic mutual funds.

- Thematic mutual funds are a type of mutual fund that focuses on a specific theme or trend, like clean energy or technology.

- An NRI gets various options of thematic funds to choose from, including defense and security, infrastructure and construction, renewable energy, and ESG themes etc.

- There may be risks associated with investing in a thematic fund, so it's ideal to consider every factor before deciding to invest.

- Thematic mutual funds need to be monitored quarterly, as these are volatile, and weekly reviews can be stressful.

What are Thematic Mutual Funds?

Thematic mutual funds are mutual fund schemes that focus on specific themes or trends, such as clean energy or technology. It invests in companies from different sectors that are all connected by a specific theme. The investment strategy of these funds depends on factors such as economic conditions, industry outlook, and emerging market trends.

Fund managers of thematic funds monitor changes in consumer behaviour, the regulatory environment, and technological developments to align with the fund's strategy and capitalize on future growth.

Why NRIs Prefer Thematic Funds?

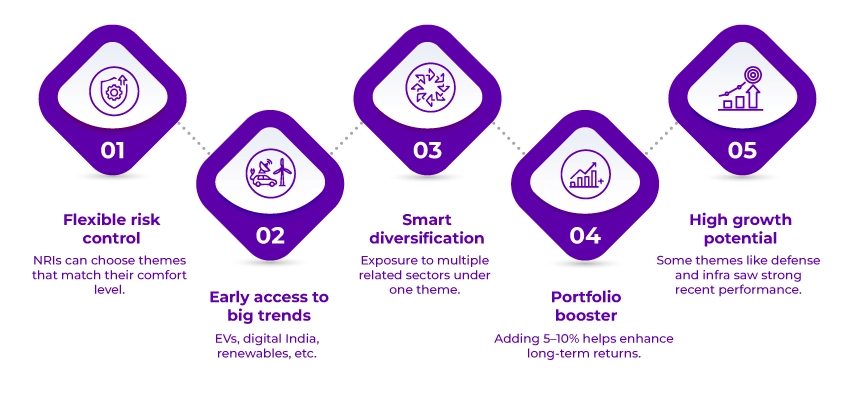

Thematic mutual funds offer several benefits that are tailored to the needs of an NRI. Here are some of the benefits of a thematic mutual fund, which makes them a preferred choice amongst NRIs:

Risk Managing Flexibility

The Investor has the option to adjust their risk exposure within the themes depending on their comfort level. It gives NRIs control over their portfolio risk within themes.

Access to Emerging Trends

These funds allow you to invest early on emerging trends before they reach mainstream adoption, like renewable energy, digital transformation, or electric vehicles. This will help you in positioning your portfolio to benefit from the developing market trends that may take several years to mature completely.

Strategic Diversification

Thematic mutual funds offer exposure to multiple related sectors, helping in reducing dependence on a single industry's performance while also providing targeted investment. A manufacturing-themed fund might include stocks from the construction, chemicals, and engineering industries.

Enhancing Portfolio

Allocating 5-10% of your portfolio to thematic funds can create better returns without risking core diversification. This allows you to maintain a core diversified approach while adding focused exposure to specific growth areas.

Higher Potential for Growth

You can enjoy exceptional returns if you opt for the right themes. Recent funds focused on defense, infrastructure, or technology have returned 60-77% every year. (Such high returns may not be consistent or guaranteed).

What are Some Popular Themes for NRI Investors?

NRIs get a variety of thematic fund options to choose from. These options are aligned with the current Indian economic priorities. Here are some of the popular thematic fund themes for NRI investors:

- Defense and Security

- Infrastructure and Construction

- Manufacturing and Engineering

- Digital innovation and Technology

- Consumption and FMCG Sectors

- Renewable Energy and ESG Themes.

Are There Any Risks Associated With Thematic Investing for NRIs?

Yes, there are risks associated with investing in thematic funds. The following are some situations where thematic investing can be a bad idea for NRIs:

- Not Able to Handle the 30-40% Volatility: A few thematic funds lost 20-25% in just three months in 2025. If you get panciked by such fluctuations, avoid investing in these funds. Risk tolerance power matters more than potential returns.

- No Time to Keep Track of Your Investments: Thematic funds must be monitored actively. You must review quarterly performance, check if the underlying theme is still the same, and also rebalance if required.

If you think you don't have sufficient time and wish to avoid such hassle, opt for hybrid mutual funds or index funds, as they require minimal attention. - Chasing Recent Performance: The most common mistake an NRI makes is chasing momentum. For example, you decide to invest because a fund gave 70% last year.

High recent returns might mean valuations are stretched, and easy gains are behind you. - Equity Investing is a New Concept for You: If you are new to equity mutual funds and have never invested before, don't start with thematic funds, as they are volatile and sensitive to time.

To start, opt for flexi-cap funds or large-cap funds that offer a broad exposure to the market. Once you have built a core portfolio, you can add thematic exposure. - Need the Money in Less than 5 Years: These funds can take several years to recover from corrections. If you are saving with the intention to use the money after 2-3 years (purchasing property, child's education), opt for safer options like fixed deposits or debt funds.

We offer expert services to ensure easy NRI ITR filing.

What are the Taxation Rules for NRIs in Thematic Funds?

Thematic funds follow equity taxation rules as they are equity-oriented funds. Here is how it is taxed:

- For equity-oriented funds (≥ 65% in domestic equity):

- Short-term capital gains (STCG) - if you sell within 12 months:

- TDS is deducted at the source by the fund house.

- Tax Rate: 20% (updated in Budget 2024, was 15% earlier)

- Applies to gains on investments sold within one year.

- Long-Term Capital Gains (LTCG) - if you hold for more than 12 months:

- You get no indexation benefit.

- First Rs. 1.25 lakh of gains per financial year is exempt from tax.

- Gains exceeding Rs. 1.25 lakh will be taxed at 12.5%.

Let's understand this clearly with the help of an example:

In January 2023, you invested Rs. 15 lakh in the Solanki Infrastructure Fund. Since it has a holding period of 26 months, by March 2026, your investment will grow to Rs. 22 lakh.

So, your long-term capital gain will be Rs. 7 lakh. If we calculate the tax,

Since the first Rs. 1.25 lakh is tax-free, the remaining Rs. 5.75 lakh will be taxed at 12.5%.

- Rs. 5.75 lakh taxed at 12.5% = Rs. 71,875 (Total Tax).

How can NRIs invest in Thematic Funds?

An NRI can invest in thematic mutual funds by following the steps mentioned below:

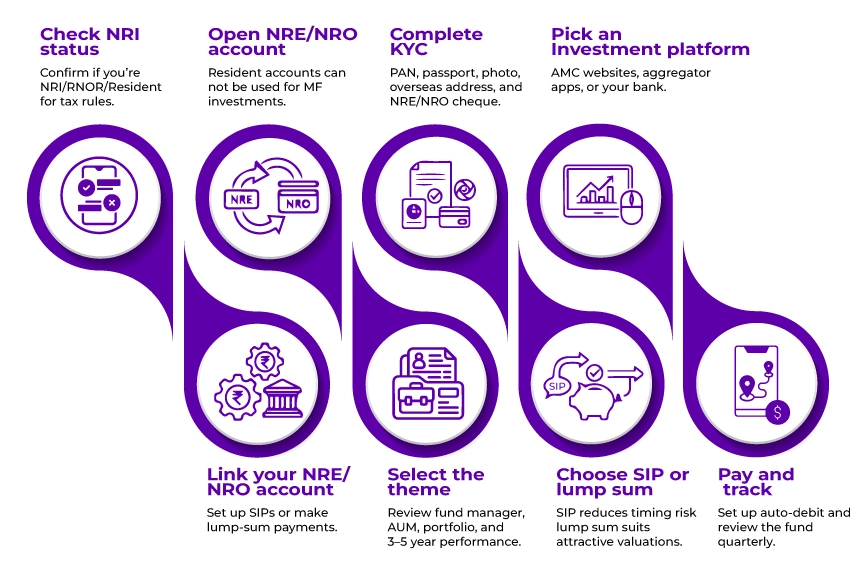

Step 1: Confirm Your NRI Status

Check your Residential Status and determine if you are classified as NRI, RNOR, or resident for tax purposes. Your residential status will affect your tax liability and ITR filing requirements.

Step 2: Open NRE or NRO Account

You need either an NRE or an NRO account, as you are not allowed to invest in thematic funds through your old resident savings account.

Step 3: Complete KYC (Know Your Customer)

For completing KYC, you will need the following documents:

- PAN Card

- Copy of passport

- Recent photograph

- Overseas address proof

- OCI Card (if applicable)

- Cancelled cheque or bank statement (NRE/NRO Account)

Step 4: Select the Platform of Investment

The following are three options that you get to invest in a thematic mutual fund, along with their benefit and drawbacks:

| Option | Where to Invest | Benefit | Drawback |

|---|---|---|---|

| Direct Fund House Website | Invest directly on AMC websites such as ICICI Prudential, HDFC, and SBI Mutual Fund by registering as an NRI investor. | Lower expense ratio (direct plans vs. regular plans). | You must manage multiple fund houses separately. |

| Aggregator Platforms | Platforms like Zerodha Coin, ET Money, INDmoney, and Groww (Groww accepts most NRIs except those in the US & Canada). | Single dashboard to manage multiple funds. | Some platforms apply FATCA-related restrictions. |

| Through Your Bank | Invest via wealth management portals of banks where you hold an NRE/NRO account—ICICI, HDFC, Axis, SBI. | Convenience of managing investments within your existing banking relationship. | May have higher charges or limited fund options. |

Step 5: Link Your Bank Account

Once you have selected the platform, the next step is to link your NRE or NRO account. You will receive a small test transaction from the platform for verification.

Upon verification, you can set up:

- One-time lump sum investments.

- SIP (Systematic Investment Plan) with auto-debit.

Step 6: Choose the Thematic Fund

You can research the best option using:

- Value Research for fund analysis.

- Moneycontrol for NAV and returns.

- Fund factsheets (available on AMC websites).

To research, check the following things:

- Fund manager expereince

- AUM (bigger funds have more stability)

- 3-5 year performance (not just one year)

- Portfolio holdings (which stocks does it hold)

- Expense Ratio (lower is better, ideally below 1%)

Ease your tax burdens and minimize deductions with the help of professionals.

Step 7: Decide Lump Sum or SIP

- Lump Sum: Choose a lump sum if you have a large amount and find valuations attractive.

- SIP (Systematic Investment Plan): Invest a fixed amount every month, like Rs. 5000, Rs. 15,000, Rs. 20,000, etc. This will reduce timing risk and average your purchase cost over time.

Step 8: Set Up Payment

Ensure to authorize an auto-debt mandate for SIPs. The funds will be transferred automatically by your bank every month.

For a lump sum, you can make the payment through:

- Net banking

- NEFT/RTGS

- UPI (If you have an Indian UPI-enabled account).

Step 9: Keep Monitoring Quarterly

You need to keep monitoring your fund every day or week, as thematic funds are volatile and daily monitoring can be stressful. Instead of keeping track every week, review it quarterly and check the following things:

- Is the chosen theme still valid?

- Are the valuations still reasonable?

- Should you continue, pause, or exit SIP?

- Is the fund performing relative to its set benchmark?

Final Thoughts

Thematic mutual funds are types of equity funds that invest in a specific theme, such as ESG investing, green investing, or infrastructure development. Thematic funds are ideal for experienced investors who can tolerate high risk and have a long-term investment goal. Additionally, to avoid any kind of confusion, it's ideal to contact the experts at Savetaxs. We have an entire team of experts who can help you understand the implications for your personal financial situation. Contact us anytime, as we are working 24*7 across the globe.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- Registering a Will in India: Key Tips for NRIs

- NRI Succession Certificate: A Guide to Inheriting Property

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- Investing in REITs as an NRI in India- Complete Guide

- Sending Money to India from Abroad: A Complete Guide for NRIs

- A Complete Guide to Investing in Gold for NRI in India

- Top 5 Problems NRI Face While Investing In India

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- NRI Investment in SGrBs Through IFSC

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1753429421.webp)

_1767955810.png)

_1768807342.webp)

_1759750925.webp)