As an NRI living in the USA, you already know the financial maze you are in. From US state laws to federal taxes, investment options, managing cross-border finances, filing taxes, and staying compliant with the FEMA regulatory framework, handling all this is overwhelming. Henceforth, having a solid financial plan will help you navigate this myriad of complexities like a pro.

Whether you are earning dollars or generating income in India, knowing how to balance both worlds will help you ensure a financially sound future. And this is what we will discuss in this blog.

Here we will see how you, as an NRI, can make a financially compliant plan that fits right in your NRI world.

- Managing money across borders is simple when you define your goals clearly, file your taxes on time, and align your India and US investments with your goals.

- While you are managing across borders, you must choose the correct bank account. In India, you can open the following types of bank accounts: NRE Account & NRO Account.

- Creating a financial plan for NRIs in the US is all about balancing the tax strategies, insurance coverage, and investments to safeguard your financial future.

- Understanding the US-India tax treaty is essential for creating a solid financial plan to avoid a double-taxation headache.

What Is A Financial Plan And Why Is It Important For NRIs?

A financial plan is a structured, systematic process for clearly defining your financial life goals. Such as purchasing a property, funding your child's education, supporting your parents living in India, and managing your retirement corpus in the USA, all while mapping your assets and liabilities in both INR and USD.

Additionally, a financial plan involves creating a roadmap for saving, making tax-efficient investments, optimizing your tax strategy, and protecting your wealth by making sound financial decisions.

For NRIs living in the USA, having a financial plan for you all is way more important than ever because you are governed by US rules and regulations on your global income while also being liable for taxes in India on the revenue generated in India. A solid financial plan will help you avoid being taxed twice on the same income source and manage your finances in both countries.

The complexities for NRIs living in the USA don't end here, as the impact of currency fluctuations, varying investment rules for NRIs, and the question of whether to settle in the USA or return to India must also be considered.

But all of these complexities can easily be resolved with a reliable financial plan. Henceforth, the importance of a financial plan for NRIs is that it helps you secure your future in India and the USA.

With Savetaxs, we help you simplify filing NRI Income Tax in India.

Setting Up A Strong Financial Foundation In the USA For NRIs

As an NRI, you balance the best of both worlds, which is the USA and India, and this duality comes with an array of financial challenges. These challenges can be cross-border taxation, fluctuating exchange rates, and regulatory compliance.

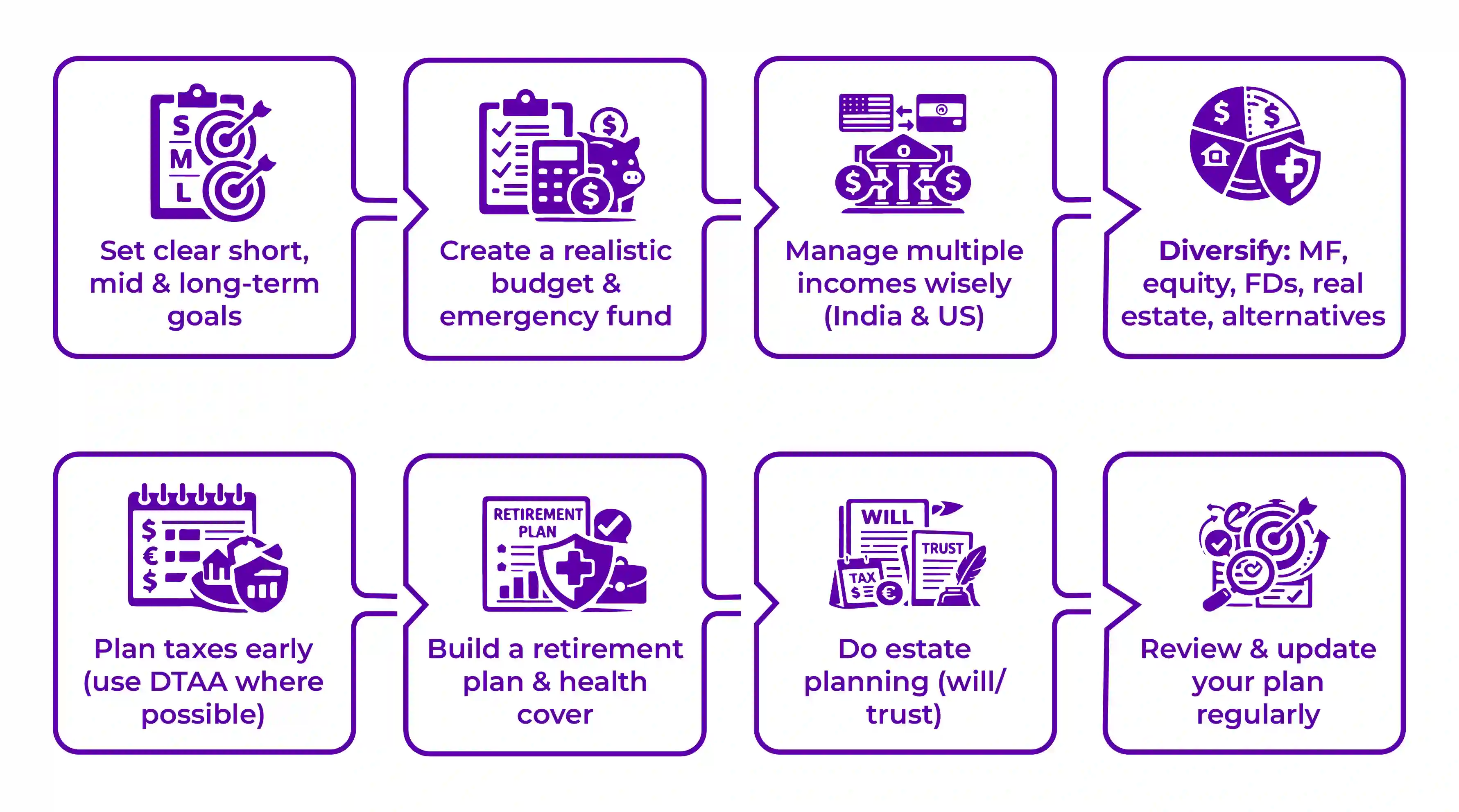

Hence, to help you navigate these economic challenges smoothly, here is a step-by-step method to tailor a financial plan that suits your needs, goals, and stability and safeguards your future wealth.

Step 1: Set Your Financial Goals Clearly.

Setting your life's financial goals clearly is the anchor of your successful financial plan. You must classify your goals into three categories:

- Short-term goals: Saving funds for vacations, home renovations, emergency funds, etc.

- Midterm Goals: Purchase a property, have a diversified investment portfolio, fund children's education, and help parents in India.

- Long-term goals: Having a good retirement corpus, succession planning, or having financial independence.

This way, you will be able to clearly segregate your goals, which will help you plan more effectively.

Step 2: Creating A Realistic Budget

Once your goals are clearly defined, you need a budget to bring those goals to life. Hence, planning your budget provides you with a clear picture of your current income, expenses, and savings capacity.

- The following steps will help you build your budget.

- Identify your income source: To know your income source, identify all the streams through which you earn, like salary, dividends, rental income, business profit, etc.

- Track Your Expenses: Monitor your expenses by categorizing them into two groups: fixed and variable. Fixed expenses can be your utility bills or mortgage, whereas variable expenses can be your entertainment or travel expenses.

- Allocate the Funds: You must now allocate funds to each expense and prioritize them. If you feel some expenses can be avoided, cut them.

- Create an emergency fund: This option is essential; it must not be avoided. NRIs' emergency don't wait, they arrive like the relative you hate, unannounced. Hence, it is advised to keep aside three to six months of expenses to cover any unforeseen events.

- Review Your Budget: Review and update your budget to reflect changes in income, goals, and lifestyle.

Step 3: Effectively Manage The Multiple Income Sources

As an NRI, you might have multiple income streams, and managing these effectively is important for optimizing your cash flow and achieving financial stability.

The following are best practices for managing your income.

- You must maintain a separate account for Indian and foreign income. This ensures clarity in your repetition and taxation.

- You must optimize your tax liabilities by understanding the DTAA double taxation avoidance agreement between your resident country and India.

- You must diversify your investments and avoid depending on a single income source.

Step 4: Diversify Your Investments For Stability

As we know, diversification is important for minimizing risk and maximizing benefits. The following are the key investment options for NRIs in India to diversify into.

- Mutual Funds: This investment type is ideal for NRIs seeking long-term wealth creation with a balanced risk profile.

- Equity Investments: This type of investment offers NRIs with high growth potential and ensures compliance with the RBI's Portfolio Investment Scheme for NRIs.

- Fixed Income Products: These include NRI fixed deposits, debentures, government bonds, and other fixed-income instruments.

- Real Estate: As an NRI, you can invest in commercial and residential properties in India for high rental yield and capital appreciation.

- Alternative Investments: If you're seeking higher returns, consider portfolio management services (PMS) or alternative investment funds (AIFs).

Step 5: Proactive Tax Planning

It's better to be proactive than be sorry. As an NRI, managing cross-border tax regulation is important to minimize your tax liabilities and remain compliant with the tax laws.

The following steps outline how to create a proactive, effective tax plan.

- Accurately determine your tax residency status under the Indian Income Tax Act ( Resident, NRI, or RNOR ).

- You must leverage the DTAAs to avoid being taxed twice on the same income source.

- Lastly, choose the tax-efficient investment instruments such as NRE accounts and other tax-saving funds.

Step 6: Planning For Retirement

Regardless of where any plan is to be, whether in India or the USA, having a sound retirement strategy is essential.

Key Components of Retirement Planning.

- You must estimate post-retirement expenses and factor in inflation and other lifestyle changes.

- Build a well-diversified portfolio that includes both Indian and global investments.

- Get yourself health insurance as soon as possible.

- For steady post-retirement income, consider SWPs (systematic withdrawal plans).

Step 7: Succession and Estate Planning

NRIs' succession and estate planning ensure that, after you, your wealth is transferred seamlessly across the border, without any legal disputes or tax complications.

For effective succession planning:

- Create a will that aligns with the inheritance laws of both India and your country of residence.

- As an NRI, you can also create a trust for an efficient asset transfer.

- You can also use joint ownership of assets to streamline the entire inheritance process.

Step 8: Insurance Planning

NRIs, you must have adequate insurance to protect you against unforeseen risks in life.

You can opt for

- Health insurance to cover medical emergencies in India and abroad.

- Life insurance provides financial security for dependents.

- Property Insurance to protect your real estate investments in India.

Step 9: Monitoring and Adapting.

Financial planning for NRIs is an ongoing process that requires you to review your plan annually to stay relevant.

- Schedule periodic reviews to assess your progress towards your goals.

- Adapt to changes in market conditions, income, and personal priorities.

- You must stay informed about local and Indian economic trends to make proactive adjustments.

Managing Taxes Across India & USA

NRI taxation is complicated because you must comply with the tax laws of two countries: India and the USA. The income you earn in India as an NRI is taxable in India. Now, under the US-India double tax avoidance agreement, you can claim relief and legitimately avoid paying tax twice on the same income source.

The India-US taxation treaty sets specific rates: dividends are taxed at 12-25%, interest at 10-15%, and so on. Hence, you must be aware of these rates before you invest. To claim the benefits of the DTAA, NRIs must submit Form 10F and a tax residence certificate from their country of residence.

When An NRI Must File Tax Returns

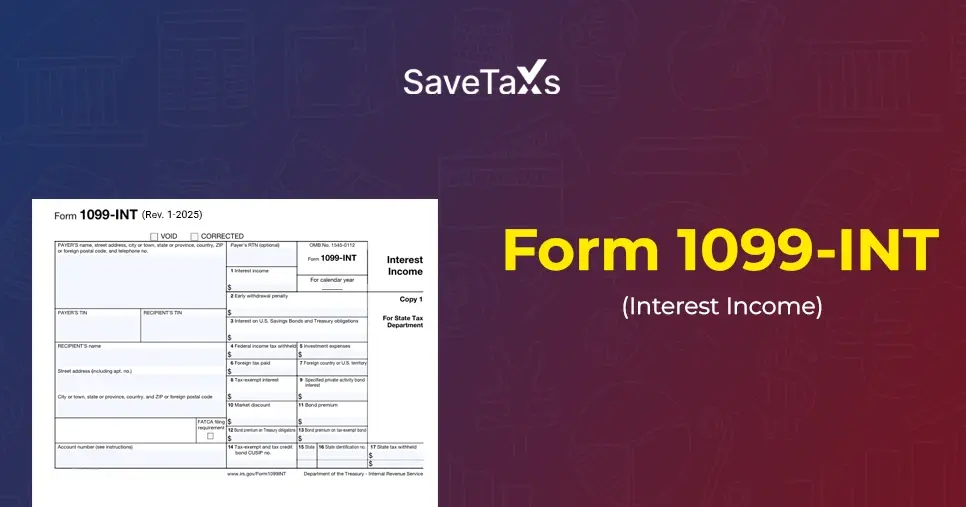

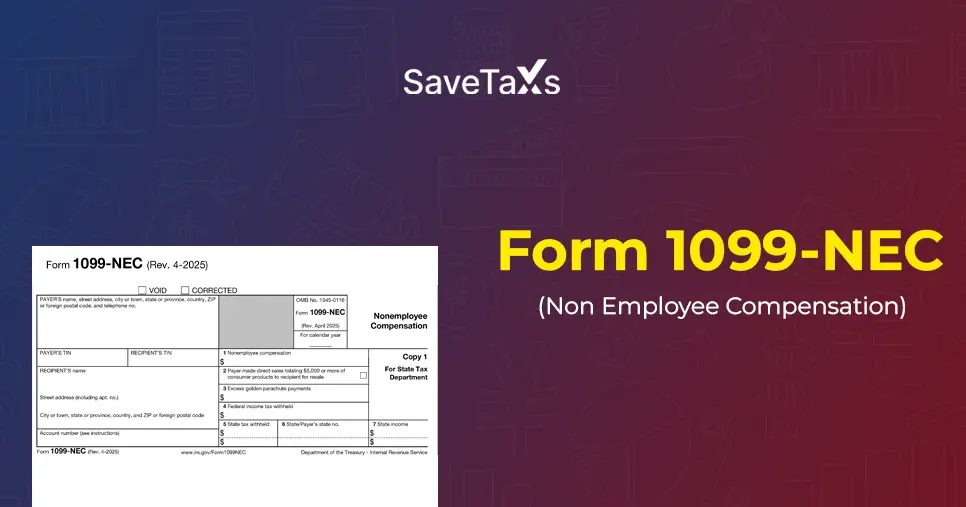

US Tax Filing: NRIs must report their worldwide income on Form 1040 if they are US tax residents, and nonresident aliens must use Form 1040-NR. For US filing, file your taxes by April 15; however, extensions vary, so don't wait until the last moment.

Indian Tax Filing: In India, how you will be taxed depends entirely on your residence status. File the wrong statutes, and you will end up serving heavy penalties. Indian tax returns are typically due by July 31st.

Also, it's important for NRIs to consult a qualified NRI financial advisor to understand the entire NRI taxation concept in compliance, so that you don't face any legal complications or end up paying more taxes than you should.

Connect with Savetaxs, get expert guidance on crypto taxation, and maximize your refunds.

How You Should Build Wealth Across the USA And India As An NRI

Wealth creation and traditional investment are two different terms because, in wealth creation, assets are distributed across countries, and future financial goals are split between the US and India.

Here, a balanced approach between the two countries is required to ensure investments are diversified and aligned with long-term objectives. In the US, where building wealth through regulated markets and retirement accounts is common, the NRI benefits from strong global economies and growth opportunities. At the same time, investments in India, be it equity, mutual funds, bonds, or property, must support emotional goals, future relocation plans, and family responsibilities.

Additionally, you must ensure that cross-border investment requires careful planning, as regulations under FEMA, tax differences, repatriation restrictions, and documentation obligations must be understood well in advance of investing.

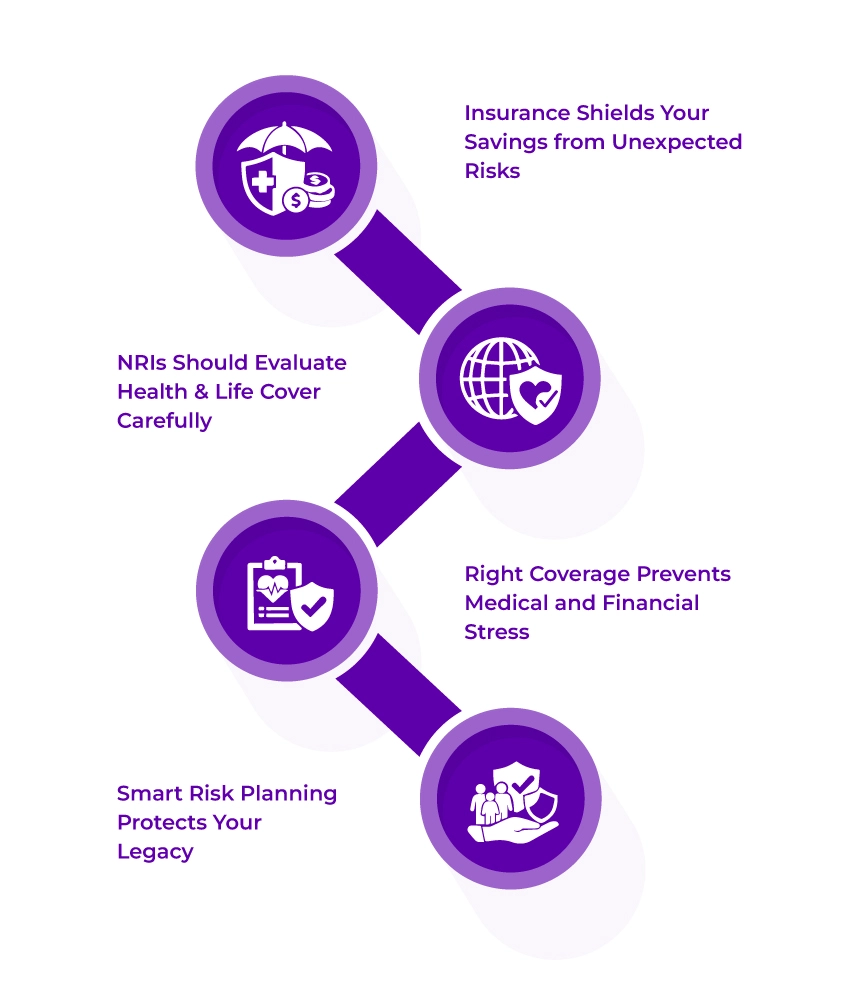

How To Protect Your Wealth: Insurance And Risk Planning

The cornerstone of financial planning is not just about growing your money, but it's also about protecting it. Having the right insurance and timely risk management ensures that unexpected events do not disrupt your years of savings. NRIs must carefully evaluate their health and life insurance needs depending on their dependents, lifestyle, and income in the United States.

Additionally, having proper medical coverage ensures you don't face financial strain from healthcare costs,

In a nutshell, risk planning and management give you peace of mind and protect your legacy from being destroyed.

The Bottom Line

Financial planning for NRIs covers all the significant aspects of your life, including personal finances, investments, taxes, retirement estate planning, and more. The importance of having a financial plan for NRIs cannot be understated.

For NRIs, your taxation, investment, repatriation of funds, and inheritance regulations are governed by one or two countries, and having a good NRI compliance financial plan is essential.

However, as an NRI, if you are looking for an expert to strategize your finances for the current financial year, Savetaxs is the name to trust. We have been helping NRIs strategize and curate financial plans to maximize wealth creation, minimize tax liabilities, and ensure economic security for them and their families.

Start your financial planning for NRIs in the USA journey with Savetaxs as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- NRI Selling Property In USA : Process & Tax Implication

- How can NRIs Invest in Alternative Investment Funds in India?

- Normal Demat Account Status After Becoming an NRI

- Normal Demat Account Vs NRI Demat Account - Key Differences

- Virtual Digital Assets and Their Taxation for NRIs

- How to Convert an NRI Demat Account to a Resident Demat Account?

- Advantages and Disadvantages of Cryptocurrency for NRIs

- Pravasi Pension Scheme for NRIs: Eligibility and Application Procedure

- What are the Crypto Tax Rates in Various Countries?

- How Can NRIs Open A Joint Demat Account

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)

_1766059659.webp)

_1766396437.webp)

_1759750925.webp)

_1756816946.webp)