Mutual funds offer diversified portfolio options to NRIs, whereas real estate is a safe investment option for NRIs in India. While both investment options have their different benefits, understanding their details is vital for making the correct investment choice as per your preferences.

Considering this, to help you out, in this blog, we have done a mutual fund vs real estate comparison. It will help you know about the mutual funds and real estate individually, their benefits, and limits. So, read on and choose the right investment option as per your financial goals and preferences.

- Choosing between mutual funds and real estate depends on your risk tolerance, financial goals, and available capital.

- Mutual funds provide professional management with low entry fees and have high liquidity.

- Real estate offers a tangible asset with potential rental income and long-term appreciation. However, consists of low liquidity and high costs.

- When investing, consider liquidity, time, and risk horizon.

- Investing in both real estate and mutual funds can provide you with a balanced investment portfolio. You can use mutual funds for growth and liquidity, while real estate is for wealth preservation and long-term stability.

Mutual Funds for NRIs

Mutual funds help NRIs to diversify their investment portfolio by providing the flexibility of choosing across investments from multiple industries and regions. It includes debt, equities, and money market instruments. These investments provide an effective and easy way to invest as per your preferences in several asset classes. Also, these are managed by professionals.

Further, NRIs with some restrictions can invest in most mutual fund categories in India. Considering this, to invest in mutual funds, NRIs need to have an NRE account or an NRO account. Now, let's know the popular investment options available in these funds.

- Equity Funds: Large-cap, mid-cap, small-cap, and flexi-cap

- Hybrid Funds: Balanced advantage, conservative hybrid, aggressive hybrid.

- Debt Funds: Corporate bond funds, dynamic bond funds, gilt funds.

- Index Funds and ETFs: Sectoral indices, Nifty, Sensex

- Gold Funds: Gold mutual funds, Gold ETFs

Moreover, some AMCs, due to FATCA compliance requirements, do not allow investments from Canada and U.S.-based NRIs. So before investing in these schemes, it is advisable to check the documents.

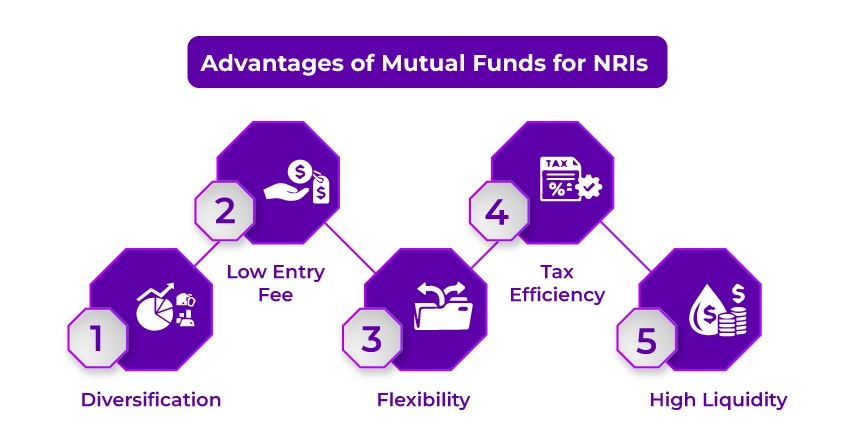

Advantages of Mutual Funds for NRIs

Here is the list of benefits NRIs get when investing in mutual funds:

- Diversification: Investing in different assets helps you diversify your investment portfolio. Additionally, compared to single-asset investments like real estate, mutual funds have reduced risk.

- Low Entry Fee: The entry of mutual funds is very low. Considering this, you can start investing in these funds with INR 500 and, over time, increase your investment.

- Flexibility: Mutual funds are good investment options to serve the different investment goals of people, from short-term to mid-term or long-term growth.

- Tax Efficiency: Long-term capital gains (LTCG) from equity funds are moderately taxed. Additionally, many mutual funds also provide indexation benefits.

- High Liquidity: With open-ended mutual funds, you can sell your units anytime. It makes these funds more liquid and offers flexibility.

Drawbacks of Mutual Funds

Unlike any investments, mutual funds do have some drawbacks. These are as follows:

- Market Risks: It is well-known to everyone that mutual fund investments are subject to market risk. Additionally, in these investments, there is no guarantee of returns.

- Expense Ratios: Investors need to consider expense ratios and management fees. Considering this, it can be higher and can impact your investment returns.

So, this was all about mutual funds for NRIs. Now, let's know real estate for NRIs.

Real Estate for NRIs

With the emotional connection of having a property in their own country, real estate investments always remain a safe investment choice among NRIs. For generations, it has remained a favorable investment option.

However, when people hear "real estate," most of them imagine a house, rent it out, or later sell it for profit. Correct? But it is not so. There are different types of real estate properties in which NRIs can and cannot invest. Confused? Under the Foreign Exchange Management Act (FEMA), NRIs are allowed and not allowed to invest in the following properties in India:

- Allowed

- Residential Properties: It includes villas, apartments, flats, and independent houses in unlimited numbers.

- Commercial Properties: Shops, office spaces, warehouses, and more.

- Not Allowed:

- Farmhouses: Any structure on agricultural land.

- Agricultural Land: Plantation property, farms (only exceptions for inherited property)

Further, let's know the advantages and disadvantages of investing in real estate for NRIs.

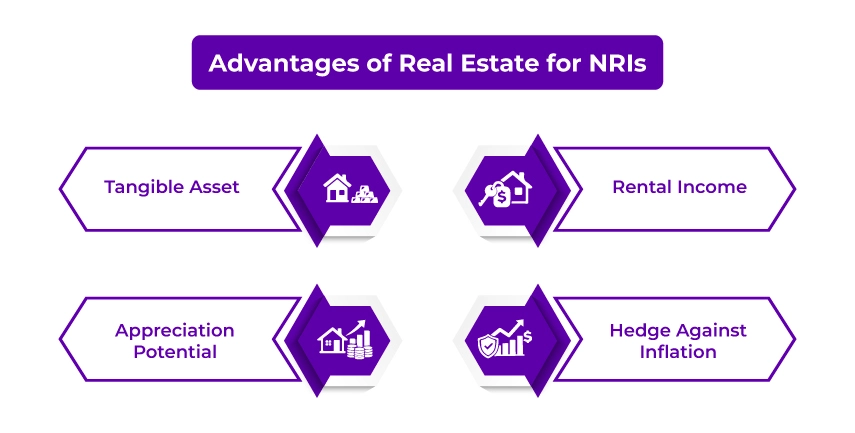

Advantages of Real Estate for NRIs

Here is the list of benefits real estate offers to NRIs:

- Tangible Asset: It is well-known to everyone that real estate is a visible, physical asset. Since it is tangible, many investors are comfortable investing in it.

- Rental Income: Through rentals, real estate offers a steady stream of income. Further, it is an appealing investment choice for NRIs.

- Appreciation Potential: Properties, specifically located in emerging markets or growing cities, can, over time, significantly increase the value.

- Hedge Against Inflation: With inflation, generally, the value of property rises. It further preserves the buying power of investors.

Drawbacks of Real Estate

The drawbacks of investing in real estate are as follows:

- Low Liquidity: Selling a property takes effort and time. Further, compared to other assets, real estate has low liquidity.

- High Initial Investment: Real estate has a large upfront investment and charges. It includes the price of the property, registration fees, stamp duty, and maintenance costs.

- Management Efforts: Maintaining property, managing tenants, and legal processes can be hectic and time-consuming.

- Market Risks: Property markets are generally volatile. It is because the property prices fluctuate due to regulatory changes, economic conditions, and oversupply.

This was all about real estate investments for NRIs. Now, when you have an understanding of both the funds, let's compare mutual funds vs real estate. It will provide you with an idea of which investment is the best for you.

File your taxes online without any markup and increase your refunds.

Mutual Funds vs. Real Estate: Key Differences for NRIs

Here is the table below that states the key difference between mutual funds and real estate. Read on, clear all your doubts about these investments:

| Basis | Mutual Funds | Real Estate |

|---|---|---|

| Initial Investment Required | The initial investment requirement is very low. Through SIPs generally start with INR 100 | The initial investment requirement is very high. Generally, traditional property costs INR 10,00,000 +, REITs cost as low as INR 100 to INR 500 via the stock exchange. |

| Ease of Entry | Simple, you can invest online via AMC websites or apps in a few minutes. | Traditional property investments require detailed paperwork, whereas REIT investments are easy to invest in online, like stocks. |

| Liquidity | You can redeem the mutual funds partially or fully at any time except for ELSS. | Selling property consumes both effort and time. |

| Returns | Historically, for equity funds, market-linked 10-15% annually. | Dependent on location, generally 7-12% but can vary widely. |

| Risk Level | The risk in mutual fund investments ranges from moderate to high, depending on the fund type, i.e., debt, equity, hybrid, and more. | The investment risk in real estate is high as it consists of regulatory risk, market cycles, and location dependency. |

| Management Effort | Zero effort, as mutual funds are managed by financial experts | Have high management efforts as it needs personal involvement in tenants, maintenance, and legal issues. |

| Diversification | Easy, one SIP provides you the exposure to several bonds and stocks. | Difficult as one property in a single location ties up a large amount. |

| Tax on Short-Term Capital For equity Gains | A 20% tax is imposed on equity funds if sold before 12 months, and debt is taxed as per the income slab rate. | If the property is sold within 2 years of purchase, tax is imposed as per the income tax slab rate. |

| Tax on Long-Term Capital Gains | For equity funds above INR 1,25,000: 12.5% | If the property is sold after 2 years, a 20% tax is imposed with indexation benefits. |

| Regular Income Possibility | Yes, through Systematic Withdrawal Plan (SWP) or dividend plans, regular income is possible. | Yes, through rental income, regular income is possible. |

| Transparency | Very high- regular NAV updates, SEBI-regulated, and portfolio disclosure. | Not always is the low cost transparent. Additionally, black money is still prevalent. |

| Control Over Asset | Low- you do not control specific bonds/ stocks. | High as physical assets are owned and managed by you. |

| Inflation Protection | Against inflation, equity funds provide a good hedge. | Generally, property appreciates with inflation. |

| Leverage (Loan Possibility) | Limited, as getting a loan against mutual funds is possible, however, it is limited in value. | High, as you can use property to get large loans. |

| Ownership Cost | Minimal with an expense ratio between 0.1% to 2.5% exit load if any. | High as it includes stamp duty, property tax, broker fees, registration, and maintenance. |

| Time Commitment | Minimal, as it is managed by professionals. So set and forget with SIPs. | High- from legal matters to tenant issues, have heavy time engagement. |

| Regulatory Oversight | Strong- SEBI-regulated, high transparency, and audited funds | Less robust- regulation is improved by RERA, however, not as centralised. |

| Best Suited For | Beginners, passive investors, and salaried individuals. | HNIs, experienced investors, and people seeking ownership of tangible assets. |

| Ideal for Short-Term Goals | Yes, mutual funds are ideal via liquid or debt funds for short-term capital goals. | Not ideal due to high entry/exit costs and low liquidity. |

| Ideal for Long-Term Goals | Yes, specifically for equity mutual funds for wealth creation. | Yes, if held for several years, specifically in developing areas. |

| Emotional Satisfaction | Low as it is purely a financial product. | High as physical ownership gives emotional security. |

| Legacy and Inheritance Value | Simple to transfer with a demat account or a nominee. | Strong as property has high inheritance and sentimental value in Indian homes. |

This was all about mutual funds vs real estate. Moving ahead, let's know which among the two is the best investment option for NRIs.

Which Investment Option Is Better for NRIs?

When it comes to mutual funds vs real estate, there is no one-size-fits-all answer. Your investment choice depends on your personal connection to India, financial goals, and risk tolerance.

- Opt for Mutual Funds If:

- Prefer high liquidity and quick access to your funds.

- Seeking short to mid-term investment returns.

- Comfortable with market fluctuations and risks.

- You want a hands-off investment that needs low maintenance.

- Go for Real Estate If:

- With capital appreciation, you want a long-term, stable asset.

- Planning for retirement, future relocation, or family visits.

- You are emotionally connected to having a property in India.

- With potential rental income, you prefer tangible investments.

Further, for many NRIs, a combination of both mutual funds and real estate fits better. It is because real estate offers them emotional fulfillment and long-term security. On the other hand, mutual funds provide quick growth and flexibility.

Choose the best investment option as per your financial goals and risk.

Final Thoughts

Lastly, the mutual funds vs real estate debate will always come down to your financial goals and personal preferences. Additionally, selecting between these two investment options is not about choosing a winner; it is about knowing what aligns with your lifestyle and financial goals.

Furthermore, if you are confused and looking for financial advice, connect with Savetaxs. We have a team of financial advisors who can assist you in selecting the right investment options as per your financial goals and risk appetite.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- Investing in REITs as an NRI in India- Complete Guide

- PIS vs. Non-PIS: The Best Stock Investment Options for NRIs in India

- How Can NRIs Invest In Indian Stock Market

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- Sending Money to India from Abroad: A Complete Guide for NRIs

- NRI Investment in SGrBs Through IFSC

- Top 5 Problems NRI Face While Investing In India

- NRI Succession Certificate: A Guide to Inheriting Property

- A Complete Guide to Investing in Gold for NRI in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

There is no single best investment option for an NRI in India, as it totally depends on your financial goals, risk, and tax rules in your resident country. Considering this, popular investment options for NRIs include:

- NRE Fixed Deposits

- Equity Mutual Funds

- NPS (for eligible NRIs)

- Sovereign Gold Bonds

The golden rules of mutual funds are:

- Use SIPs

- Stay invested for a minimum of 5 to 10 years

- Choose funds as per your financial goals and risk tolerance

- During market falls, avoid selling funds in panic

_1767604193.webp)

_1767080655.webp)