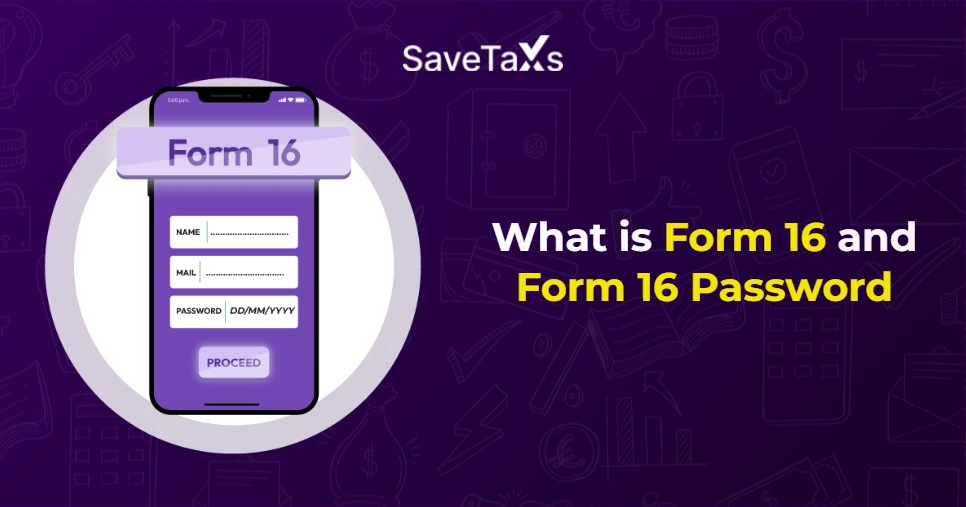

Form 16 is a crucial document issued by employers to salaried employees, containing various sensitive financial information. It includes PAN information, salary details, TDS deducted, and more. To protect this confidential data, employers usually issue Form 16 in a password-protected PDF. The password to this PDF is easy, generated using the employee's basic details. Generally, it is a combination of the first 5 characters of your PAN number in capital letters and your date of birth in the DDMMYYYY format.

For example, the password for PAN number ABCDE6789F and birth date is 11/01/2003, would be ABCDE11012003. However, the password format for Form 16 may vary from one organization/employer to another. In this blog, we will discuss what Form 16 is and how to open the Form 16 password.

- Form 16 contains sensitive personal and financial information, like your salary details, PAN, TAN, etc., and hence it comes in a password-protected file.

- The Form 16 password is usually the first five letters of your PAN number + date of birth in the DDMMYYYY format. However, this format may vary from one organization to another.

- Ensure to enter the password in the correct case (uppercase or lowercase) as specified or instructed by your employer.

- You can create an unprotected copy by removing the password for personal use by using the 'Print' function and choosing the 'Save as PDF' option.

What is Form 16 and Form 16 Password?

Form 16 is a significant document that includes all the information regarding your income, like salary, tax deductions based on investment declaration made to the employer, and TDS deducted on it. It comes in two parts, Part A and Part B, and is an important document for a salaried individual. Although not legally mandatory, Form 16 can simplify the ITR (Income Tax Return) filing process as it contains all the information required to file your ITR (Income Tax Return) accurately.

Since Form 16 contains crucial financial data related to the employee, it comes in a password-protected PDF file. Form 16 password is the first 5 letters of your PAN in either lowercase or uppercase and your date of birth in DDMMYYYY format. For example, if your PAN number is ABCDE9876F and your date of birth is 04/10/2003, then your Form 16 password would be ABCDE04102003/ abcde04102003.

However, keep in mind that the Form 16 password can vary from one organisation to another. Hence, you must check your email for the correct password format to open your Form 16 PDF.

File your ITR accurately and optimize your tax savings with experts.

What are Some Form 16 Password Examples?

Form 16 password format varies based on the employer's organization. You can use several combinations of passwords to open Form 16. The table below contains some of the possible Form 16 password formats:

| Form 16 Password Format | Format Example | Explanation |

|---|---|---|

| First 5 letters of PAN + date of birth | ABCDE01052003 | The password can combine the first five letters of your PAN number in uppercase or lowercase and your date of birth in the DDMMYYYY format |

| Last 4 digits of your PAN + date of birth | 1234_15051996 | Some employers may use the last four digits of your PAN and yourdate of birth. |

| PAN number | EIXHG4578B | The password can be the PAN number of the employee in uppercase or lowercase. |

| Full name + date of birth | AjayGupta12071999 | Full name in either uppercase or lowercase and date of birth in the DDMMYYYY format. |

| Last name + PAN number | GuptaABCDE7891F | A combination of your last name in uppercase or lowercase and your PAN number |

How to Remove the Form 16 Password?

You will need to enter a password every time you wish to access Form 16 since it is password-protected. To avoid this, you can remove the password by following the steps below:

- Right-click on the PDF file and open the file using Google Chrome.

- Enter the password in the specified format and click on the 'Submit' button

- In the upper right corner, the screen printer option will appear; click on it or press Ctrl + P.

- After that, the print window will appear, providing you with an option to change the destination.

- Change the destination to 'Save as PDF' and click on the 'Save' button below.

- Select the desired location to save the PDF, and the password will be removed now.

Keep in mind that removing the Form 16 password using the above-mentioned steps might change the format of the file, and the PDF might not be readable by other software.

Note:- The password should be removed only for personal use and stored securely, as Form 16 contains sensitive financial information.

NRIs journey to stress-free taxation starts at Savetaxs.

Final Thoughts

Form 16 password is easy to understand yet unique to each employee, generated using an employee's PAN and date of birth details. Understanding its password can be crucial for salaried individuals as Form 16 may be required while filing ITR. Additionally, the password for Form 16 can be removed for easier access and personal use.

Furthermore, if you need more details or assistance with any issues regarding Form 16 or any other financial or tax issues, Savetaxs is the name to trust. We have a team of professionals who can resolve all your queries and help you gain confidence regarding your financial planning and tax obligations. So, avoid the stress and contact us right away.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Section 89A - Tax Relief on Income from Foreign Retirement Funds

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- NRI Selling Property in India

- How to Claim TDS Refund for an NRI?

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- Section 195 of Income Tax Act - TDS Applicability for NRI

- TDS Deduction on Rental Property Owned by NRI

- What is a Tax Residency Certificate (TRC) and How to Get It?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767099354.png)

_1766644785.png)

_1765974748.webp)