Are you an NRI seeking the best investment options in India? Foreign Currency Non-Resident Account deposits are a perfect choice for you. With FCNR deposits, you can simply hold your savings in foreign currencies. Additionally, can also enjoy great tax benefits and interest rates.

To know more about the FCNR deposits, their pros and cons in detail? Read the given blog and clear all your doubts about it.

- FCNR deposits allow you to hold money in a foreign currency, preserving your savings from INR depreciation.

- Interest earned on FCNR deposits is exempt from all taxes in India. It significantly provides effective returns.

- If the withdrawal is made before the completion of one year, no interest is paid. Additionally, after one year, premature withdrawals also incur a reduced interest rate or penalties.

- Generally, FCNR deposits have a maximum tenure of 5 years. Retirement planning spans decades, needing a strategy for long-term investments that alone FCNR cannot provide.

- Although FCNR deposits are not a bad option for retirement for NRIs, they are not sufficient alone. So, along with them, consider other investment options also.

What Are FCNR Deposits?

FCNR (Foreign Currency Non-Resident) deposit is a fixed deposit in which you can park foreign currency, such as GBP, AUD, USD, CAD, JPY, or EUR, with an Indian bank. Over a 1- to 5-year term, your money stays in that currency. Additionally, with zero currency conversion risk, the interest on it is tax-free in India. Also, principal and interest amounts are fully repatriable.

Further, FCNR deposit accounts are a good option for NRIs who want to retain their money in foreign currencies. Since, in this account, your deposited money will be in a foreign currency, you are saved from exchange rate variability risk. This account also provides good and risk-free returns. Moreover, if you are confused about where to save or invest your earnings, FCNR deposits are the right option.

This was all about FCNR deposits. Moving ahead, let's know how these deposits are attracting the retiring NRIs.

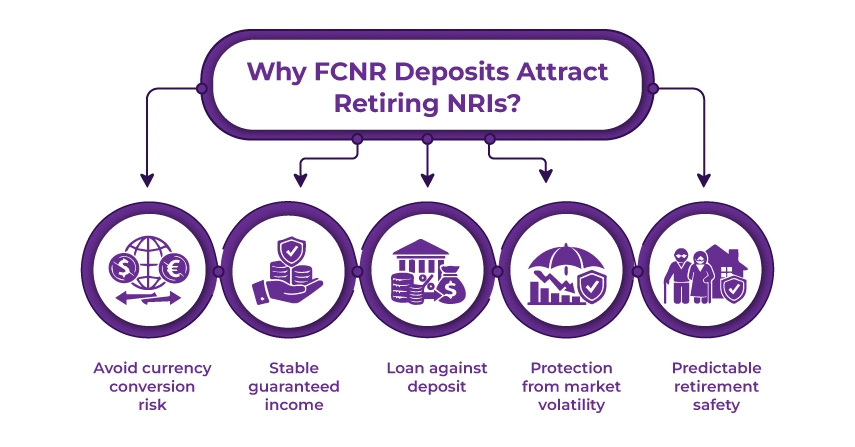

Why FCNR Deposits Attract Retiring NRIs?

For retiring NRIs, FCNR deposits perform well in specific situations:

- If you are retiring outside India, such as London, Dubai, or somewhere else where you have a permanent home. In this scenario, having money in your earning currency helps in avoiding conversion losses.

- It provides you with a stable and guaranteed income portion. Investing 20-3-% of your retirement corpus in FCNR provides you with a predictable safety net. Further, the rest grows in alternative investments or equities.

- If you are within 5 years of retirement, short-term parking in FCNR deposits saves your corpus from market volatility before you require it.

- You can also use your FCNR deposit as loan collateral. Most banks provide loans of up to 70% to 90% of FCNR deposit value. It is helpful during emergencies when you do not need to break your FD.

So this is why FCNR deposits are attracting retiring NRIs. Moving further, let's know the benefits of having FCNR deposits for retirement.

Advantages of FCNR Deposits for Retirement

Here are some of the key advantages of the FCNR deposits for retirement that make it one of the good options to save, manage, and invest funds in India for NRIs:

- These accounts protect NRIs from the risk of forex rates, as they are managed in a foreign currency. In simple words, the principal and interest amount is transferred in the foreign currency in which the account is maintained, sans any exchange loss.

- Since FCNR deposits are managed in foreign currency, these are proposed against the risk of currency exchange.

- Several foreign currencies like USD, AUD, GBP, and more denominate the FCNR deposit accounts.

- Additionally, interest from these accounts is exempt from all taxes in India.

- These accounts also provide provision for joint account ownership. It means that you have 2 or more NRI joint account holders in your FCNR deposits. However, a resident Indian cannot be a joint account holder in an FCNR deposit account.

- Both principal and interest amount are repatriable on a free basis without restrictions to the country of residence of the account holder.

- After the end of the first year, the lock-in period of the FCNR account is payable.

- The FCNR account holders get benefits from the compounded interest, which, after the first year, is determined on a half-yearly basis.

- FCNR account holders for any investment in India that can be repaid from the maturity benefits are also entitled to rupee loans. Further, loans for foreign currency outside India are permissible, and repayment can be done from the maturity payouts. Additionally, against the security of FCNR accounts, some banks also provide a loan facility.

- All authorized banks in India that provide the facility of FCNR deposit accounts within the upper limits as stated by the RBI fix the interest rates.

- Additionally, an FCNR deposit account also provides the facility of overdraft.

- Apart from all these benefits, the principal amount and earned interest in the FCNR deposit accounts are fully repatriable. It means that they are fully transferable without amount restrictions.

These were some of the advantages of having an FCNR deposit for retirement. Now, let's look at the drawbacks of this investment for retirement.

Get professional NRI Taxation services with Savetaxs as per your investment goals, risk appetite, and time horizon.

Disadvantages of FNCR Deposits for Retirement

Like any other investment, FCNR deposits do have some drawbacks. These are as follows:

- If with a weak bank, FCNR deposits are registered, then upon maturity, you may not be able to get a payout. In India, on a credit guarantee, the upper limit is approximately INR 1,00,000 or USD 16000, which is low. Considering this, during a financial crunch or bankruptcy, the deposit security can be at risk. Therefore, many financial experts believe that in India, deposit insurance almost does not exist. It further creates concern for FCNR account holders.

- FCNR deposit accounts are term deposits, so if they are withdrawn before a year, no interest is paid.

- At the time of fund transfer, banks might apply a charge for swapping prices.

- Additionally, if you make premature withdrawals from your FCNR deposit accounts, you are liable to pay penalties.

- In India, only the account holders against the FCNR deposit account can take foreign currency loans.

- The interest earned on the FCNR deposit account is exempt from Indian taxes. However, it is taxable in the resident country of the NRIs.

- FCNR account deposits are only available for term deposits, not for current, savings, and recurring accounts.

- After the maturity time, in 14 days, you can renew the FCNR deposit account. However, if you fail to do so, the authorized bank on renewal will fix the interest rate. Further, before a fixed period, if the renewed accounts are withdrawn, banks have the right to take back the paid interest.

- Apart from this, if you plan to return to India permanently and your NRI status changes to resident India, the interest on it becomes taxable in India.

So, these were the disadvantages of FCNR deposits for retirement NRIs. Moving ahead, let's know among FCNR, NRE FDs, and mutual funds which one is the best for NRIs.

FCNR vs NRE FD vs Mutual Funds

The table below showcases the comparison between FCNR and other investment options available for NRIs in India:

| Basis | FCNR Deposit | NRE FD | Mutual Funds |

|---|---|---|---|

| Currency | USD/ EUR/ GBP | INR | INR |

| Return (Approx.) | 3.5 to 5% | 6.5 to 7.5% | 10 to 12% (equity) |

| Tax in India | Tax-free | Tax-free | Taxable |

| Currency Risk | None | High | High |

| Liquidity | Low (1 to 5 year lock-in period) | Medium | High |

| Maximum Tenure | 5 years | 10 years | No limit |

This was all about the comparison of FCNR deposits with other investment options in India. Although investing in an FCNR deposit is not a bad idea. However, there are other investment options that, within less time, provide you with more investment income. Before making a choice, consider your financial goals, time horizon, and risk appetite, then choose the investment.

Get NRI banking consultation From anywhere at any time with the savetaxs financial experts.

Final Thoughts

Lastly, FCNR deposits for retirement are a good idea for NRIs who are seeking to keep their foreign earnings in India and want to have stable returns at low risk. However, they are not sufficient alone. There are several investment options also such as mutual funds, NRE FDs, and more, that NRIs should consider. So, based on your investment goals and risk appetite, choose the investment that matches your financial goals.

Further, if you are still struggling to choose the right investment available for NRIs in India, connect with Savetaxs. We have a team of financial experts who assist you in selecting the correct investment as per your investment goals and risk appetite.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- A Guide to NRO (Non-Resident Ordinary) Accounts

- Overseas Bank Account for NRIs

- Top 5 NRI Banks for NRE account in India for 2026

- Everything You Need to Know About UPI for NRI

- How To Transfer Money From NRO Account to NRE Account

- Why Should an NRI Convert Their Resident Savings Account to an NRO Account?

- When Does an NRIs NRE Account Lose Tax-Free Status in India?

- What is an RFC Account for NRIs Returning to India?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

The key FCNR deposits features for NRIs include:

- Provides multiple currency options such as CAD, AUD, USD, GBP, EUR, or JPY.

- Varied tenure choices, generally 1 to 5 years.

- The interest earned from the FCNR account is tax-free in India.

- The capital and interest are fully repartiable without any restrictions.

- Can claim insurance of up to INR 5,00,000 DICGC cover.

_1768474831.webp)

_1759750925.webp)