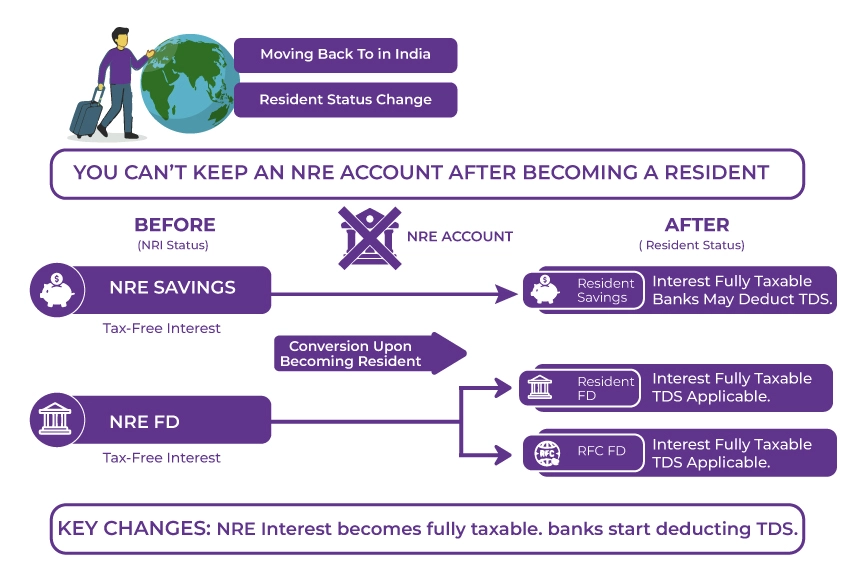

Once an NRI's residential status changes to an Indian resident, their NRE account loses its tax-free status in India. Under the provisions of FEMA (Foreign Exchange Management Act), a person is considered an Indian resident when they move back to India with the intent to reside permanently.

Upon this change in your residency, you immediately need to inform your bank and convert your NRE account into a resident rupee account or a resident foreign currency (RFC) account. In this blog, we will discuss whether the NRE account interest is tax-free and when it loses its tax-free status.

- An NRE account is designed specifically for NRIs to manage their foreign earnings in India.

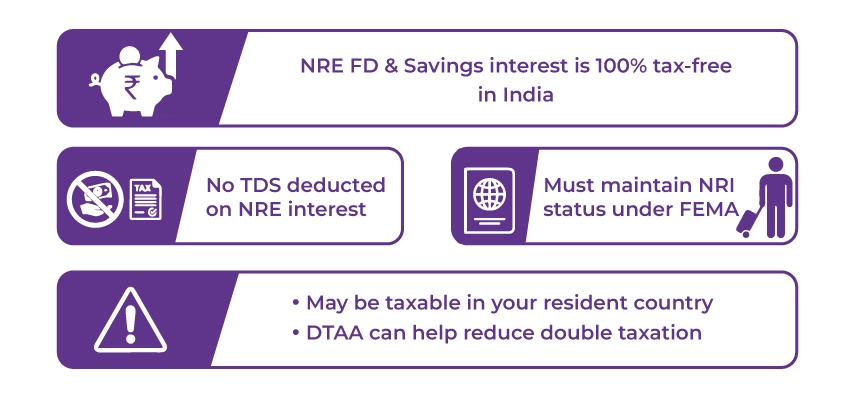

- The interest earned from NRE fixed deposit and savings account is fully tax-exempt in India. However, it may be subject to taxation in your residence country.

- The NRE account loses its tax-free status when the account holder's residential status changes from NRI to an Indian resident.

- You must convert your NRE savings account to a resident savings account upon becoming an Indian resident.

What is an NRE Account for NRIs?

An NRE (Non-Resident External) account is a bank account specifically for NRIs that permits them to manage their foreign earnings in Indian Rupees. An NRE account is ideal if you wish to send money earned abroad to India.

The primary benefit of an NRE account is that both the principal and interest amount can be sent back abroad without any restrictions. It means that there are no limits on repatriation in an NRE account.

An NRE account can be opened as savings, current, recurring, or fixed deposits. NRE Fixed Deposits (NRE FD) accounts are fixed deposits that are funded by an NRI through their NRE accounts using foreign income. Unlike standard savings accounts, NRE accounts offer higher returns, making them the most popular investment choices for NRIs.

Is NRE Interest Taxable in India for NRIs?

According to the Indian tax laws, NRIs are taxed only on income earned in India. This means that the funds in your NRE (Non-Resident External) account, which are foreign earnings, are not taxable in India.

The interest earned from both NRE fixed deposits and NRE savings accounts is entirely exempt from taxes in India, and no tax is deducted at the source for this interest.

To take advantage of these tax benefits, it's important to be recognized as a Non-Resident Indian (NRI) under the Foreign Exchange Management Act (FEMA). Keeping your NRI status active is important to enjoy the tax-free perks associated with NRE accounts.

While the interest from NRE FDs and savings accounts is tax-exempt in India, it may be subject to taxation in your current country of residence. India has established Double Taxation Avoidance Agreements (DTAA) with several nations, aiming to prevent double taxation. If such an agreement is in place between India and the country where you live, you may be eligible for tax exemptions or reduced tax rates on the interest earned from your NRE deposits.

When is an NRE Account Interest Taxable?

Interest earned on an NRE account is tax-exempt as long as you remain an NRI. However, upon your permanent return to India, you are classified as a resident under FEMA from the moment you arrive, making it non-compliant to keep your NRE account active.

You will need to either convert your NRE account into a resident account or transfer the funds to a Resident Foreign Currency (RFC) account. Interest on these accounts remains tax-free only while you maintain the RNOR status (Resident but Not Ordinarily Resident), which is valid for up to three years after your return. After the RNOR period ends and you become a regular resident, all income, including interest, will be subject to full taxation in India.

Avoid errors and enjoy fast and accurate tax filing assistance by experts.

How Do Banks Verify Your NRI Status?

The banks will frequently review your residency by checking your:

- Overseas Address Proof

- Periodic re-KYC updates

- Visa/Work Permit/Green Card

- PAN status (resident or NRI)

- Passport (entry/exit stamps)

- FATCA and CRS self-declaration

If they find any mismatch in the documents, like your PAN shows "resident". Then, the banks may:

- Deduct TDS

- Reclassify your account

- Ask for updated documents

What Happens to an NRE Account When You Move Back to India?

When you move back to India to reside permanently, or your residential status changes from Non-resident Indian (NRI) to resident. Then, you are not allowed to legally operate your NRE account in its original form because, as per the rules of FEMA, NRE accounts are specifically meant for NRIs. Upon becoming a resident, you should:

Convert NRE Savings Account to a Resident Savings Account

Banks are legally required to re-designate your NRE savings account into a regular resident savings account as:

- A resident is not allowed to hold an NRE account legally.

- FEMA guidelines mandate reclassification based on residential status.

- The interest earned on an NRE account becomes fully taxable.

NRE Fixed Deposits Will Be Converted to Resident FD or RFC FD

If you hold NRE fixed deposits (FDs), you are not allowed to continue in NRE status. Your bank will convert them into:

- Resident FD(Fixed Deposits): Interest becomes taxable under the Indian tax slab.

- RFC FD (Resident Foreign Currency Fixed Deposits): Allows holding foreign currency legally and may have tax benefits for a certain period.

Interest Starts Becoming Taxable

Once your status changes to a resident Indian:

- NRE interest exemption ends immediately

- Banks may start deducting TDS on the interest

- Interest on converted resident FDs becomes fully taxable.

Get complete NRI tax solutions under one platform

To Conclude

An NRE account offers a tax-efficient way for NRIs to manage their foreign income in India. The interest earned on both NRE savings and fixed deposits is exempt from taxation, making them an attractive choice. It is essential to understand the taxation and compliance requirements for an NRE account.

To handle this transition smoothly, it's advised to consult an expert from the Savetaxs team. We have a team of experts who can help you understand the complexities of this status transition, as well as your associated tax obligations. Contact us anytime, as we are available 24*7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- NEFT, RTGS, IMPS and UPI to Transfer Funds From NRO to NRE Account

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- Why Should an NRI Convert Their Resident Savings Account to an NRO Account?

- Everything You Need to Know About FCNR (B) Account

- Everything You Need to Know About UPI for NRI

- When Does an NRIs NRE Account Lose Tax-Free Status in India?

- What Is Re-KYC For NRI Accounts - A Guide For NRIs

- Top 5 NRI Banks for NRE account in India for 2026

- PoA For NRIs To Manage Indian Banking Needs

- A Guide to NRO (Non-Resident Ordinary) Accounts

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1764137986.webp)