An OCI (Overseas Citizen of India) card is a golden ticket for NRIs of Indian Origin as it helps them maintain a strong lifetime connection with India. The purpose of an OCI card is to permit foreign citizens of Indian origin to live and work in India for an indefinite period without needing a visa. It serves as a lifelong visa that offers some significant benefits and allows you to study, invest, own a house, or travel within India without facing any issues.

However, it's vital to note that, unlike Indian residents, an OCI cardholder is not allowed to enjoy certain political rights, such as the right to cast a vote or be elected to offices like the Lok Sabha, Rajya Sabha, Legislative Assembly, or Council. In this blog, we will cover everything you need to know about an OCI card and also discuss how to apply for an OCI card outside India.

- An OCI card is a special permit given to people of Indian origin who have foreign citizenship, allowing them to live and work in India for as long as they want.

- The card provides several benefits to its holder, including seeking employment in most sectors, running a business, admitting their children to Indian educational institutions, etc.

- An individual needs to meet some OCI card eligibility requirements to qualify to apply for an OCI card outside India, including being an Indian citizen on or after January 26th, 1950.

- The OCI card processing time may vary, so it's best to apply well in advance before your travel to prevent potential delays.

What is an OCI Card?

OCI (Overseas Citizenship of India) is a special status given to people with a foreign citizenship, which allows them to live and work in India indefinitely. It allows them to seek employment in most sectors, set up a business, and also practice several professions.

This scheme was introduced by the Indian government in 2005 in response to fulfill the demands for dual citizenship by the Indian diaspora. However, the OCI card must not be misunderstood as Indian citizenship.

Although you can avail yourself of certain rights, you don't have equivalent rights to those of an Indian citizen. Such as, you cannot cast a vote in elections, work in government sectors, hold constitutional posts, etc. An OCI card is an excellent way for an NRI to maintain strong ties with India while holding their foreign citizenship.

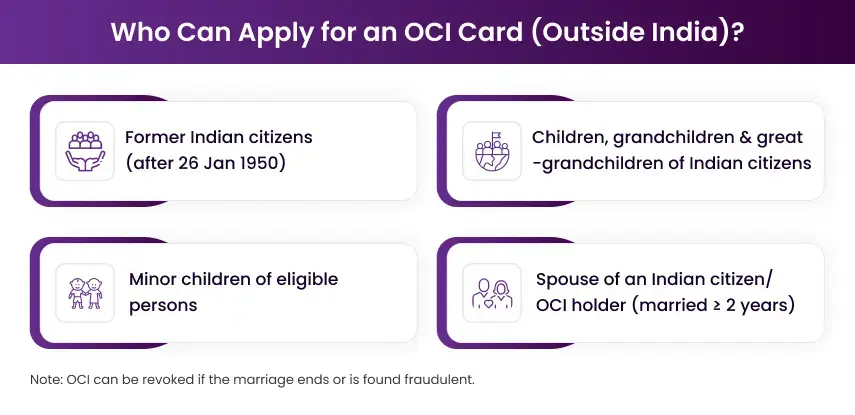

Who Can Apply for an OCI Card Outside India?

Although an OCI card provides several benefits to its holder, there are some restrictions on who can apply for an OCI card outside India. Here are the eligibility criteria that you need to fulfil:

Eligibility Based on Ancestry

You can apply for an OCI (Overseas Citizen of India) Card if you meet at least one of the following requirements:

- You are (or were) an Indian citizen on or after the 26th of January, 1950.

- You are the child, grandchild, or great-grandchild of someone who was an Indian citizen on or after that date.

- You are a minor child of the aforementioned person.

- You will be considered eligible if your parent or grandparent held Indian citizenship after India became a republic in 1950.

Eligibility Based on Spouse

If you are a spouse of an Indian citizen or an existing OCI cardholder, you will qualify to apply for an OCI card, provided that:

- The marriage has lasted at least two years and has been legally registered when application.

- Your partner currently holds an Indian citizenship or has an OCI card.

The government has the authority to revoke your OCI status if your marriage is dissolved by divorce or found to be fraudulent.

Maximize your refund and minimize stress by hiring a tax professional.

What are the Benefits of Applying for an OCI from Abroad?

Apart from offering a lifelong multiple-entry visa, an OCI card provides numerous other benefits to its holder. Here are some of the benefits of having the OCI (Overseas Citizen of India) status:

- Visa-Free Entry: An OCI cardholder can travel and enter India multiple times throughout their life without the need to apply for a visa each time.

- Duration of Stay: There are no restrictions on the number of days for which you can stay in India.

- Be Exempt from Registering: You don't need to register yourself with the FRRO (Foreign Regional Registration Office) or local authorities for any duration of stay.

- Seek Employment: An OCI cardholder is allowed to seek employment in most sectors, run a business, and even practice certain professions like medicine, law, accountancy, etc.

- Education: The cardholder's children can take admission to Indian educational institutions under the NRI quota. They can even appear for competitive exams like NEET, JEE (Mains), etc.

What are the Documents Required to Apply for OCI Outside India?

You need to submit some documents to prove your eligibility and provide the necessary information to the authorities. Below is a checklist of the documents that you need to provide:

- Birth certificate.

- Previous Indian passport.

- Four passport-sized photographs.

- Completed OCI card application form.

- Citizenship proof in the current country (passport and local address proof).

- Nativity certificate (for applicants who don't have a passport)

- If applying based on your parents or grandparents' citizenship, submit proof of relationship.

Where to Apply for OCI Outside India?

OCI applications outside India are processed by:

- VFS Global: USA, UK, Europe, Australia, etc.

- BLS International: UAE, Singapore, Canada, Malaysia, etc.

- Indian Embassy or Consulate

Point to Note: Every NRI needs to submit documents both online (government portal) and offline (VFS/BLS).

The OCI application process involves two parts, which are.

Part A: Apply Online on the Official OCI Government Portal

Follow these steps to apply for OCI (Overseas Citizen of India) online:

- Step 1: Complete Part A of the form

- Step 2: Upload photo and signature

- Step 3: Upload required documents

- Step 4: Generate final form

- Step 5: Take a printout of the form and sign it.

Part B: Submit Documents to VFS/BLS

The next step is to visit either VFS Global or BLS International, where you need to:

- Step 1: Create an account

- Step 2: Fill out VFS/BLS form

- Step 3: Pay service and courier fees

- Step 4: Book an appointment or choose postal submission

- Step 5: Submit documents as well as your original passport (if required).

What is the OCI Card Processing Time and Fees Outside India?

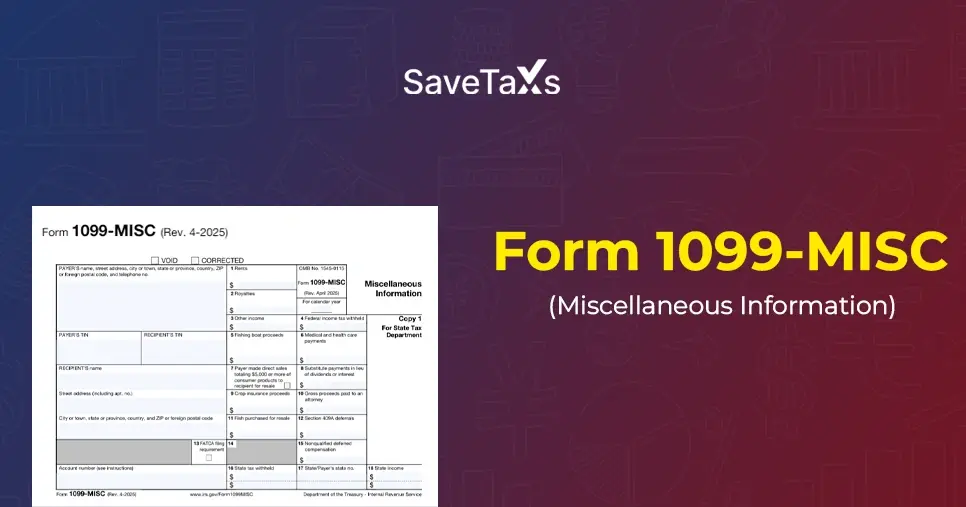

The table below shows the OCI card fees and processing time outside India based on the type of application as of 2025:

| OCI Application Type | Fee in USD | Estimated Processing Time |

|---|---|---|

| New OCI Card (from abroad) | $275 | 6-8 weeks |

| New OCI (from India) | $175 | 4-6 weeks |

| PIO to OCI Conversion | $100 | 6-8 weeks |

| Lost/Damaged OCI Card Replacement | $100 | 2-4 weeks |

Tip: Apply well in advance of your planned travel date to ensure sufficient processing time, as there may be delays. Although it's possible to expedite in some missions but there are no assured rush services.

Get end-to-end support at every step of the application process from the experts.

To Conclude

An OCI card provides a simple and effective way for individuals of Indian origin who wish to maintain strong ties with the country. It saves you from the stressful process of applying for a visa and helps you get a smooth entry into the country. Applying for an OCI card from abroad can be a straightforward process if you follow the correct steps. Ensure to be well-prepared before starting the process to avoid missing out on any important information and prevent potential delays.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- How to Apply for an OCI Card from the USA?

- Why NRI Need A PAN Card Even If They Don't Pay Tax In India?

- Aadhaar Card For NRIs In India

- PAN Card Form 49A: How to Fill Pan Card Form 49A and 49AA?

- PAN Card 2.0: Features, Process, Benefits and More

- What is the Importance of Aadhaar and PAN Card for NRIs?

- PAN vs TAN: Key Difference You Should Know

- PAN Card Surrender For NRIs and Indian Residents

- Duplicate PAN Card Application Process For NRIs and Indian Citizens

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766129179.png)

_1767339016.png)