The Income Tax Law offers several tax-saving options to India. In this, the HUF or the Hindu Undivided Family comes as one of the most effective ways of saving on taxes. It is used for wealth management and income splitting. Additionally, as a separate taxable entity, it can also earn income and claim tax deductions like Section 80C, 80D, and capital gains tax exemptions.

Want to know more about HUF and how it works? Read on the blog and get all the information related to it, from its meaning, benefits, to how it helps in reducing tax.

- Under the Income Tax Act, 1961, HUF is a legal separate entity.

- You can legally split and show the HUF members' income in the HUF's income, offering more tax benefits.

- Under the old tax regime, HUF enjoys the basic tax exemption limit of INR 2,50,000, and under the new tax regime, it enjoys the tax benefit of INR 4,00,000.

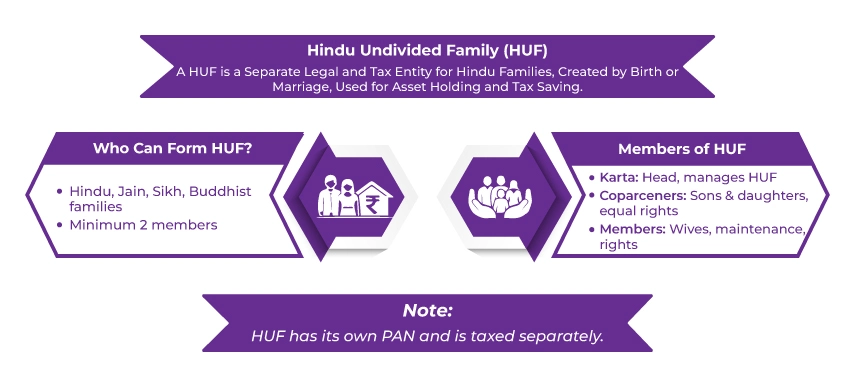

What Is an HUF?

A Hindu Undivided Family (HUF) is a unique legal entity in India designed for Hindu families to save on taxes. HUF is based on the joint family concept that includes all the members of the family across all generations. In general, the eldest male/female member of the family acts as the "Karta" or head of the family, while other family members are coparceners. It is one of the legally tax-saving strategies available to joint families.

Additionally, an HUF can own property, earn income, and independently claim tax benefits of its members. Further, by legally splitting the income, it helps the members in reducing their overall tax liability.

So, this was all about a Hindu Undivided Family (HUF). Moving ahead, let's know who can form an HUF in India.

Who Can Form HUF?

Here is the list of individuals who can form an HUF:

- Apart from Hindu families, Buddhist, Jain, and Sikh families are also stated under the ambit of HUF.

- One person cannot create an HUF. Considering this, a minimum of two persons are required to form an HUF.

- A family with lineal ascendants and descendants is needed to form an HUF.

- Additionally, you can also create an HUF upon marriage.

This was all about who can form an HUF. Moving further, let's know about the members of an HUF.

Who Are the Members of HUF?

As stated above, the HUF members have a common ancestor and all lineal descendants. It also includes their wives and unmarried daughters. Considering this, the members of HUF include:

Karta: Karta is considered the head of the HUF. Generally, he/she is the senior-most family member, who manages all the affairs of the family and has unlimited liability.

Coparceners: All male and female lineal children of a common ancestor, including daughters, who have equal rights in the property of HUF are coparceners. Additionally, they can also demand a partition of the HUF property.

Other Members: After marriage, wives of coparceners become members of HUF. However, they are not considered coparceners themselves. Considering this, they only have maintenance rights but cannot claim partition of the property.

Moreover, only coparceners have the right to claim partition of HUF. Additionally, as stated above, the Karta of a HUF has unlimited liability for its dues. It also includes the tax obligations on HUF.

Further, these are the members included in HUF. Now, moving ahead, let's know how an HUF is formed.

How to Form an HUF- A Step-by-Step Guide

You can form an HUF in three simple steps. It includes creating an HUF deed, applying for an HUF PAN card, opening a bank account, and starting operations for the HUF. Further, let's know about this process in detail.

Step 1: Create an HUF Deed

- An HUF deed is the first -

- step to forming an HUF.

- Considering this, the HUF deed should have the name of the Karta, coparceners, their personal details, formation date, amount, and sources of HUF corpus, and other details as per the circumstances.

Step 2: Obtain a PAN Card

- You can apply for an HUF PAN card online.

- For this, Karta needs to fill out the Form 49A along with other vital declarations.

- Generally, the digital PAN or PAN card number is generated within 48 hours of the HUF PAN application.

Step 3: Open an HUF Bank Account

- Once you get your HUF PAN card, you can now open a bank account in the name of HUF to undertake all the transactions under the name of HUF.

- Additionally, to open an HUF bank account, you need to submit an HUF deed, an HUF PAN card, and other KYC documents.

Step 4: Transfer the Common Assets to HUF

- Transfer all the assets, including liquid cash, properties, deposits, and more, that you intended to be used under the HUF name.

So, by following the above-mentioned steps, you can simply form an HUF. Moving further, let's know the tax implications of an HUF.

Tax Implications of HUF

According to the income tax laws, both resident and non-resident Indians (NRIs) have permission to form an HUF. Considering this, the tax implications of an HUF depend on the residential status of an individual and whether it is controlled from India or not. This is as follows:

Resident HUF: An HUF is considered a Resident in India if, during the previous year, it is managed and controlled from India. Additionally, partial control is under India's control. Further, if the Karta of an HUF is resident and ordinarily resident (ROR) in India, in this scenario, the HUF is also treated as ROR.

Non-Resident HUF: An HUF is considered non-resident if it was completely managed and controlled outside India during the previous year.

Resident and Ordinarily Resident or Resident but Not Ordinarily Resident: An HUF is considered a resident HUF; any of the following conditions are satisfied by the Karta:

- Karta has been living in India for a minimum of 2 or more years out of the 10 years preceding the previous year.

- Karta, during the period of 7 years preceding the previous year, has been in India for 730 or more days.

In the Karta, it does not fulfill either of the two conditions; the HUF will be considered as a resident but not an ordinarily resident in India.

Additionally, if a resident HUF is liable to pay tax on its global income in India. On the other hand, a non-resident HUF is only liable to pay tax on the income that arises/ accrues/ deemed to arise or accrue in India and income received or deemed to be received in India.

Further, if the income of an HUF is taxable in both India as well as in foreign country. In this scenario, through the Double Taxation Avoidance Agreement (DTAA), they can claim a foreign tax credit for such income.

So, this was all about the tax implications of HUF. Now, moving ahead, let's know the HUF tax slabs in India.

HUF Tax Slabs

The income tax slabs of HUF and individual are the same, under both the old and new tax regimes, irrespective of whether the HUF is resident or not.

New Tax Regime Slabs for Financial Year 2025-26

Under the new tax regime, for the financial year 2025-26, the tax slabs for HUF are as follows:

| Income Tax Slabs | Income Tax Rates |

|---|---|

| Up to INR 4,00,000 | Nil |

| INR 4,00,000 to INR 8,00,000 | 5% |

| INR 8,00,000 to INR 12,00,000 | 10% |

| INR 12,00,000 to INR 16,00,000 | 15% |

| INR 16,00,000 to INR 20,00,000 | 20% |

| INR 20,00,000 to INR 24,00,000 | 25% |

| Above INR 24,00,000 | 30% |

Old Tax Regime Slabs

The tax slab rates, under the old tax regime for HUF, are as follows:

| Income Tax Slabs | Income Tax Rates |

|---|---|

| Up to INR 2,50,000 | Nil |

| INR 2,50,000 - INR 5,00,000 | 5% |

| INR 5,00,000 - INR 10,00,000 | 20% |

| Above INR 10,00,000 | 30% |

These were the HUF tax slabs available under the new and old tax regimes. However, for HUF, relaxed slab rates are not applicable, unlike they are for resident senior and super senior citizens. Additionally, surcharges and cesses are also applicable to taxes.

Now, moving further, let's now the rebate and tax benefits available on HUF.

Rebate

It is stated that if the taxable income of HUF is less than INR 7,00,000 under the new tax regime and below INR 5,00,000 under the old tax regime, then a rebate is available for HUF. However, it is not true. Rebate is not available for HUFs. Only the resident individuals can claim it. However, there are several tax benefits available for HUFs. These are as follows:

HUF Tax Benefits

HUFs and individuals have the same income tax slabs, with a basic tax exemption of INR 4,00,000 in the new tax regime and INR 2,50,000 in the old tax regime. As mentioned at the start, HUF for tax purposes is treated as a separate entity. Hence, apart from the members of HUF, the tax deduction limit, income tax slabs for HUFs are different. Additionally, as appropriate, a part of the income can be taken from the HUF members and stated as HUF income, reducing the overall tax obligation.

Further, key tax benefits available for HUF include:

Section 80C: Up to INR 1,50,000 tax deduction available on life insurance, ELSS, PPF, and more.

Section 80D: Tax deduction available for health insurance premiums paid for the members of HUF.

Section 80G: Tax deductions available on eligible donations made by HUF.

Home Loan: Tax deductions on paid interest on a housing loan.

Capital Gains: Tax exemptions available under Sections 54, 54F, and 54EC on reinvesting the long-term capital gains.

This was all about the rebate and tax benefits available on HUF. Moving ahead, let's know how forming an HUF helps you in saving taxes.

How to Save Taxes by Forming an HUF?

Here is how HUF helps you in saving taxes:

- An HUF has its own PAN number and files a separate tax return in India.

- With a different entity from its members, a separate joint Hindu family business is made.

- Under section 80 and other applicable tax exemptions, on the income tax return of HUF, you can claim a tax deduction.

- Additionally, the Hindu Undivided Family can have insurance policies for the benefit of its members.

- HUF pays salaries to its members, which are then deducted from the income of the HUF.

- Investments can be made from the income of the HUF, and the returns on those investments in the hands of the HUF are taxable.

- Further, the same tax rates apply to the HUF as to individual taxpayers in India.

Let's understand how an HUF is taxed with an example.

For instance, Mr. A decided to start an HUF with his wife, daughter, and son as members. He holds a property that provides him with an annual rent of INR 15,00,000. He had transferred that property to the HUF. Additionally, he also had an income of INR 20,00,000.

Further, here is how Mr. A has saved taxes under the new tax regime for FY 2025-26 through creating an HUF.

| Income from Several Sources | Tax Return of an Individual | Tax Return of HUF | |

| Income of Mr. A before the formation of HUF | Income of Mr. A after the formation of HUF | Income of HUF | |

| A) Salary | INR 20,00,000 | INR 20,00,000 | - |

| B) House Property Rent | INR 15,00,000 | - | INR 15,00,000 |

| C) Standard Deduction on House Property (30% of 15 Lakhs) | (INR 4,50,000) | - | (INR 4,50,000) |

| D) Income from House Property (B-C) | INR 10,50,000 | - | INR 10,50,000 |

| Total Taxable Income (A+D) | INR 30,50,000 | INR 20,00,000 | INR 10,50,000 |

| (-) Standard Deduction | (INR 75,000) | (INR 75,000) | - |

| Net Taxable Income | INR 29,75,000 | INR 19,25,000 | INR 10,50,000 |

| Payable Tax | INR 4,91,400 | INR 1,92,400 | INR 46,800 |

Now, let's do the tax comparison with and without dividing the income to the HUF:

| Comparison | |

| Total Tax Paid by Mr. A | INR 4,91,400 |

| Total Tax Paid by Mr. A & HUF | INR 2,39,200 |

| Tax Saving Due to Forming an HUF | INR 2,52,200 |

Further, with HUF, Mr. A has saved INR 2,52,200 in taxes. However, under section 87A, in the absence of a rebate, the HUF needs to pay INR 46,800 tax on the rental income.

So, this was all about how HUF helps in saving taxes. Moving further, let's know the risks and challenges associated with it.

Risks and Challenges of an HUF

Though HUF helps you in saving tax, it also has some risks and challenges associated with it. These are as follows:

- Partition disputes

- Limited applicability

- Complex compliance

- Not allowed to get a salary.

These were some of the risks and challenges associated with an HUF. Moving ahead, let's see how an HUF gets dissolved.

Dissolution of an HUF

The dissolution of an HUF can be done through partition, in which the assets are distributed among all coparceners. Here is how partition can be done:

- Total Partition: All assets mentioned in the HUF deed are divided, and the HUF ceases to exist.

- Partial Partition: Only the distribution of some assets is completed, and the HUF continues for the remaining assets.

For the HUF partition to be valid under law, a partition deed must be made, stamped, and registered. Additionally, to complete the dissolution process, the HUF's PAN card should also be surrendered to the tax officials.

Final Thoughts

Lastly, the Hindu Undivided Family offers a structured way for individuals to manage family wealth and leverage more tax benefits. Under Indian tax law, it has a separate legal entity that allows people to manage the ancestral assets, pool resources, and minimize their tax obligations.

Further, being an NRI, if you are looking for an individualised, flexible, and goal-oriented way to save on taxes, connect with Savetaxs. Our tax officials, with years of experience, provide you with the best tax-saving options to maximize your refunds and minimize your tax obligations.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- Section 80C of Income Tax Act - 80C Deduction List

- Section 80EE Of the IT Act: Home Loan Interest Deduction

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- Section 197 Certificate or Lower Deduction Certificate for NRIs and Indians?

- Section 80CCC: Deduction on Pension Fund Contributions

- TDS Deduction on Rental Property Owned by NRI

- Section 80GG: Claim Tax Deductions on Rent Paid for Indian and NRIs?

- Section 80TTA of Income Tax Act – All about Claiming Deduction on Interest

- Section 195 of Income Tax Act - TDS Applicability for NRI

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756729655.webp)

_1768304909.webp)

_1767077669.webp)