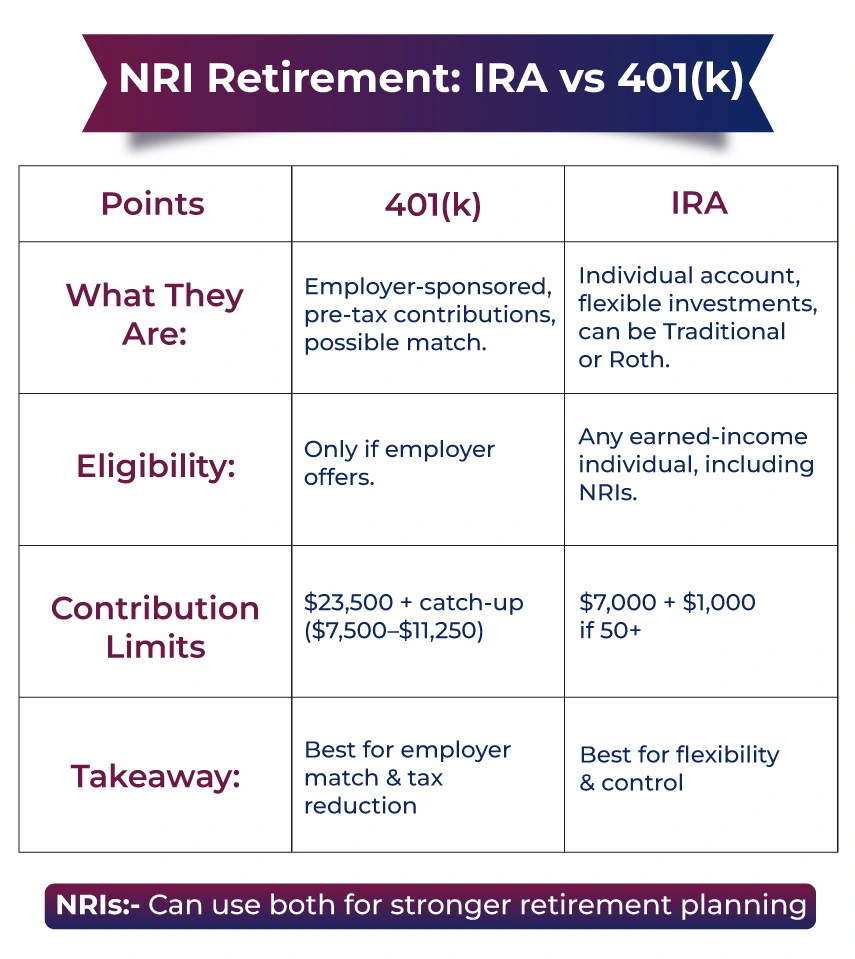

IRAs vs 401(k) plans: Both are tax-advantaged retirement savings accounts. A 401(k) is a type of employer-sponsored retirement plan, while an IRA is an individual retirement plan that you open with a bank or a financial institution.

A non-resident Indian can open an individual IRA account, contribute to an employer-sponsored 401(k) plan, or even have both. If the employer-sponsored 401(k) plan is terminated, it can be rolled over into an IRA. Hence, it will be helpful to understand how the two differ in terms of contribution limits, withdrawals, and more.

- 401(k)s and IRAs are both tax-advantaged retirement savings accounts.

- While anyone can open an IRA account themselves, you only get a 401(k) plan if your employer offers one.

- 401(k)s have higher annual contribution limits in comparison to IRAs.

- Many employers offer an employer match, which can then help you build your retirement savings plan quickly.

IRA vs 401(k) Meaning

401(k) is an employer-sponsored defined contribution plan. Such a plan provides employees with a tax-advantaged way to save for retirement.

Employer-sponsored plan types include 401(k)s, 403(b) s, and 457. Depending on your workplace employer's response, you can also have access to a Roth 401(k).

An IRA is a long-term, tax-advantaged individual retirement account that individuals with earned income can utilize to save for their retirement.

An IRA is generally designed for self-employed individuals who do not have access to employer-sponsored plans such as 401(k)s. However, even though you have an employer-sponsored plan, you can also have an IRA.

The types of IRA available include Roth IRAs, traditional IRAs, and additional types for small business owners and self-employed individuals.

IRA vs 401(k) Contributions and Investment Selections

There is a significant difference in how you fund your 401(k)s and IRAs, as well as the investment options available.

The following table provides a clear difference between the two.

| - | 401(k) | Roth 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|---|

| Eligibility | In certain workplaces, the employers have a set of qualifications that you must meet to be a part of their 401(k) retirement savings plan. For example, one must be at least 21 years of age and have been employed with the organization for more than a year. | Depends on the availability within the employer's plan. | Any individual with earned income is eligible to open and contribute to a traditional IRA. | The eligibility for a Roth IRA is based on income level. |

| Details about the contribution | The contributions made under 401(k) are directly withdrawn from your paycheck with pre-tax dollars. | Contributions to a Roth 401(k) are made with after-tax dollars. | Traditional IRAs can be funded either as tax-deductible contributions or after-tax dollars. | Roth IRA contributions are funded with after-tax dollars. |

| Contribution Limit Annually | 2025 Annual combined limit for 401(k) is $23,500. If you are in the age group of 50 to 59 or 64 and older, you are allowed to contribute an additional $7,500. If you are in the 60-63 age group, you are allowed to contribute an additional $11,250. | 2025 Annual combined limit for Roth 401(k) is $23,500. If you are in the age group of 50 to 59 or 64 and older, you are allowed to contribute an additional $7,500. If you are in the 60-63 age group, you are allowed to contribute an additional $11,250. | For the tax year 2024-2024, the combined annual limit for traditional and Roth IRAs is $ 7,000. If you are 50 or older, you are eligible to contribute an additional $ 1,000. |

For the tax year 2024-2025, the combined annual limit for traditional and Roth IRAs is $7000. Now, if you are 50 years or older, you can contribute an additional $1000. |

| Employer Match | Yes, varies by employer, with an average match of 4.6% of the income. | Yes, varies by the employer. Your employer will be allocating any contributions to a pre-tax account. | None | None |

| Investment Selection | The employer usually makes this choice, and more than one type of portfolio may be offered. | This employer usually makes the choice, and more than one type of portfolio may be offered. | You can choose the investments for your portfolio. | You can choose the investments for your portfolio. |

IRA vs 401(k) Taxes and Withdrawals

Traditional IRAs and traditional 401(k)s have quite a lot in common when it comes to tax benefits, withdrawal requirements, and distributions. Both are considered tax-advantage investment accounts, and the contributions are either tax-deductible or pre-tax.

The Roth IRAs and Roth 401(k)s are both considered tax-free investment accounts, as the qualified withdrawals and distributions are not taxed.

| - | Traditional 401(k)s + traditional IRA | Roth 401(k) + Roth IRA |

|---|---|---|

| Tax implications | Tax-deductible or pre-tax contributions. Such contributions grow tax deferred, and the withdrawals are taxed just like ordinary income. | Tax-deferred growth and non-deductible contributions. There are tax-free withdrawals on contributions, tax-free withdrawals on earnings if you are older than 59 and a half, and have owned the account for at least five years. |

| Tax Penalties for early withdrawal | If the money is withdrawn before the age of 59 and a half, then the penalty tax would be 10%. | If the earnings are withdrawn before the age of 59 and a half, then they will be subjected to a 10% penalty tax. |

IRA vs 401(k): Which is better for your needs?

The following pointers might help NRIs make an informed decision.

You must consider a 401(k) if your employer is offering a company match. Additionally, contributions to a traditional 401(k) help lower your adjusted gross income (AGI) since it is made with pre-tax dollars. However, please make sure that they are not added back when determining your modified adjusted gross income (MAGI).

If flexibility is important to you, a traditional IRA or a Roth IRA allows you to choose your investments. But please ensure to consider the sales charges, transaction fees, maintenance, and expenses in your decision.

You can open a Roth IRA or a traditional IRA account for your nonworking spouse to reap the benefits of both retirement plans.

If your priority is to lower your overall taxable income, a traditional 401(k) or a traditional IRA can be the best fit. Whatever amount you contribute to these accounts, your taxable income will be reduced by that. However, the contribution limits of the IRA are significantly lower than those of 401(k)s.

If your priority is access to funds, you should consider a Roth IRA, which lets you withdraw your contributions at any time. If you plan to withdraw earnings, they might be subjected to penalties and taxes.

The Bottom Line

Both IRAs and 401(k)s are different investing tools with different pros and cons. You can have both retirement accounts and multiple accounts of each type. However, it is essential to consider the common segments and other aspects of both before depositing funds.

With that being said, if you are an NRI seeking expert assistance and consultation on which retirement account would reap you the most benefits and the strategy to operate your account smartly, Savetaxs is your place.

Our experts bring more than 30 years of combined experience, providing you with the right and updated guidance. Get your tailored retirement investment plan here at Savetaxs, because we don't just aim to make your present better, but also your future.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- Tax-Deductible Donations: Rules for Charitable Contributions

- State And Local Tax (SALT) Deductions

- The Full List Of 20 Tax Deductions For Self-Employed People

- Understanding Standard Tax Deduction

- Understanding Itemized Tax Deductions

- IRS Capital Gains Tax: Short and Long-Term Rates for 2024-2025

- 2025 Roth IRA Income and Contribution Limits

- Tax Credit: What It Is, How to Claim It, and Types

- All You Need to Know About Mortgage Interest Deduction

- Married Filing Taxes Jointly vs. Separately

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766561266.webp)

_1766129179.png)

_1760618042.webp)

_1767003468.png)